About dHEDGE

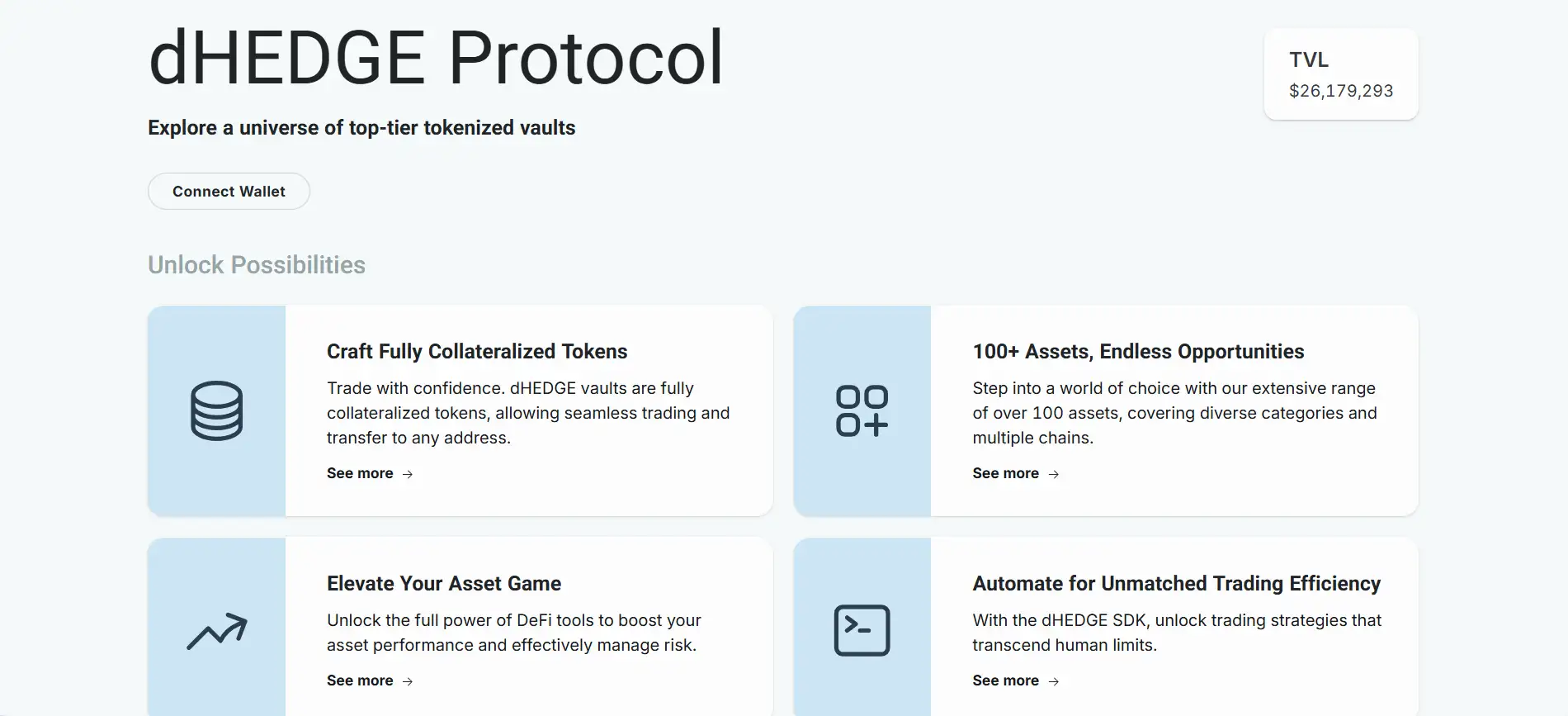

dHEDGE is a decentralized, non-custodial asset management protocol that empowers users to explore and invest in top-performing tokenized vaults across multiple Ethereum Layer 2 chains. The platform enables permissionless creation and participation in fully collateralized vaults, allowing investors to access advanced DeFi strategies without relinquishing control over their assets.

Through its cutting-edge infrastructure and transparent smart contracts, dHEDGE enables fund managers to build, automate, and scale on-chain investment strategies while maintaining immutability, visibility, and security. With support for over 100 assets and integrations with key DeFi protocols, dHEDGE is redefining what decentralized, permissionless investing can be.

dHEDGE is a leading protocol in the decentralized asset management space, built on Ethereum Layer 2 blockchains like Optimism, Polygon, and Base. The protocol allows users to allocate capital to non-custodial tokenized vaults that are managed by experienced DeFi strategists or through automated algorithms using the dHEDGE SDK. These vaults support seamless entry and exit with no lock-up periods, enabling full flexibility and user control.

The ecosystem is structured around vault contracts—each managed independently by a designated wallet with restricted permissions. Vault managers can execute trades, configure fees, and interact with whitelisted DeFi protocols to implement advanced strategies. Investors retain ownership of their vault tokens at all times and can withdraw their proportional share of assets at the current Net Asset Value (NAV). Withdrawal methods include both single-asset or underlying asset distributions, preserving vault balance integrity.

One of the most compelling aspects of dHEDGE is its performance-based staking mechanism for the DHT token. Users who stake DHT alongside vault tokens (DHVT) receive governance power (vDHT) and are rewarded based on factors like duration, vault performance, and staking ratio. Governance is fully on-chain, using NFT-based staking positions and Snapshot for proposals and voting.

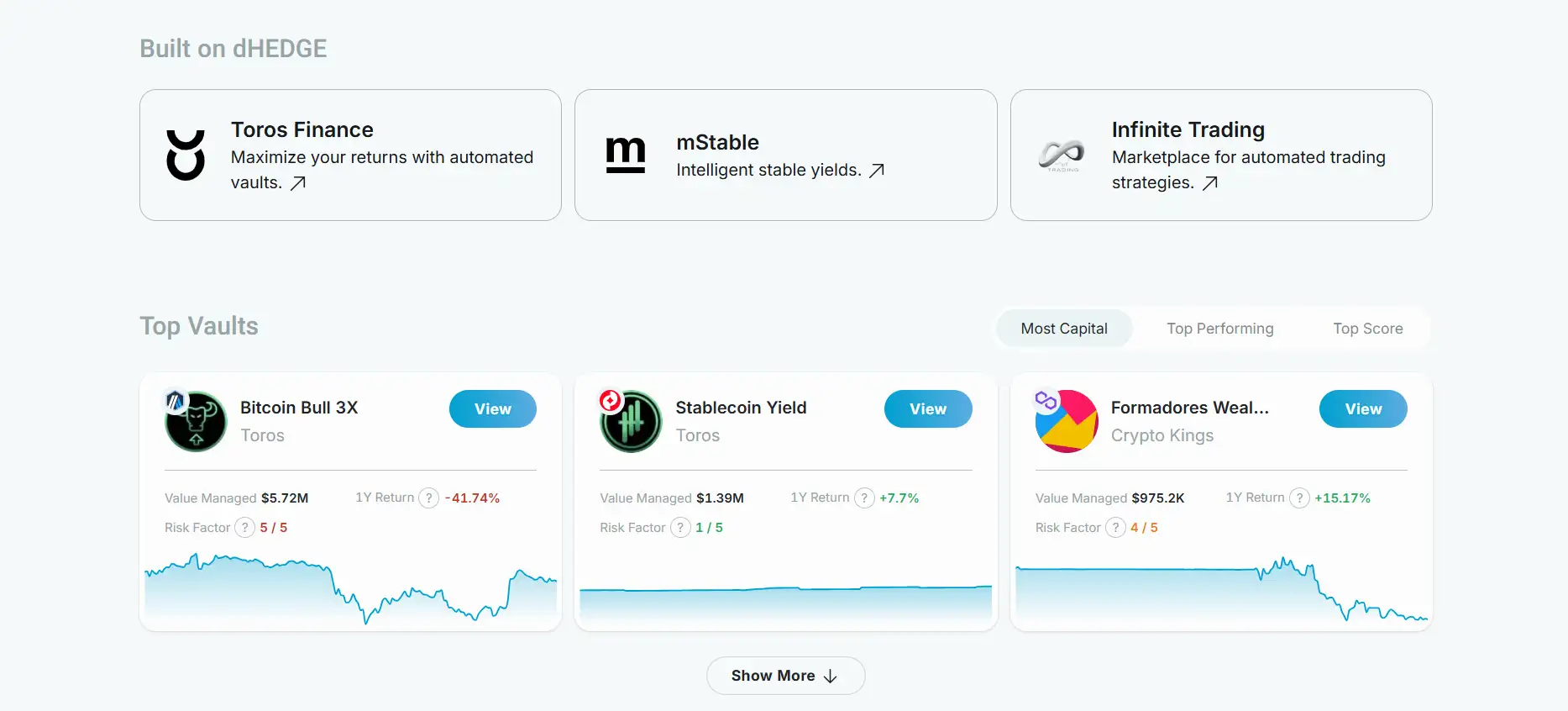

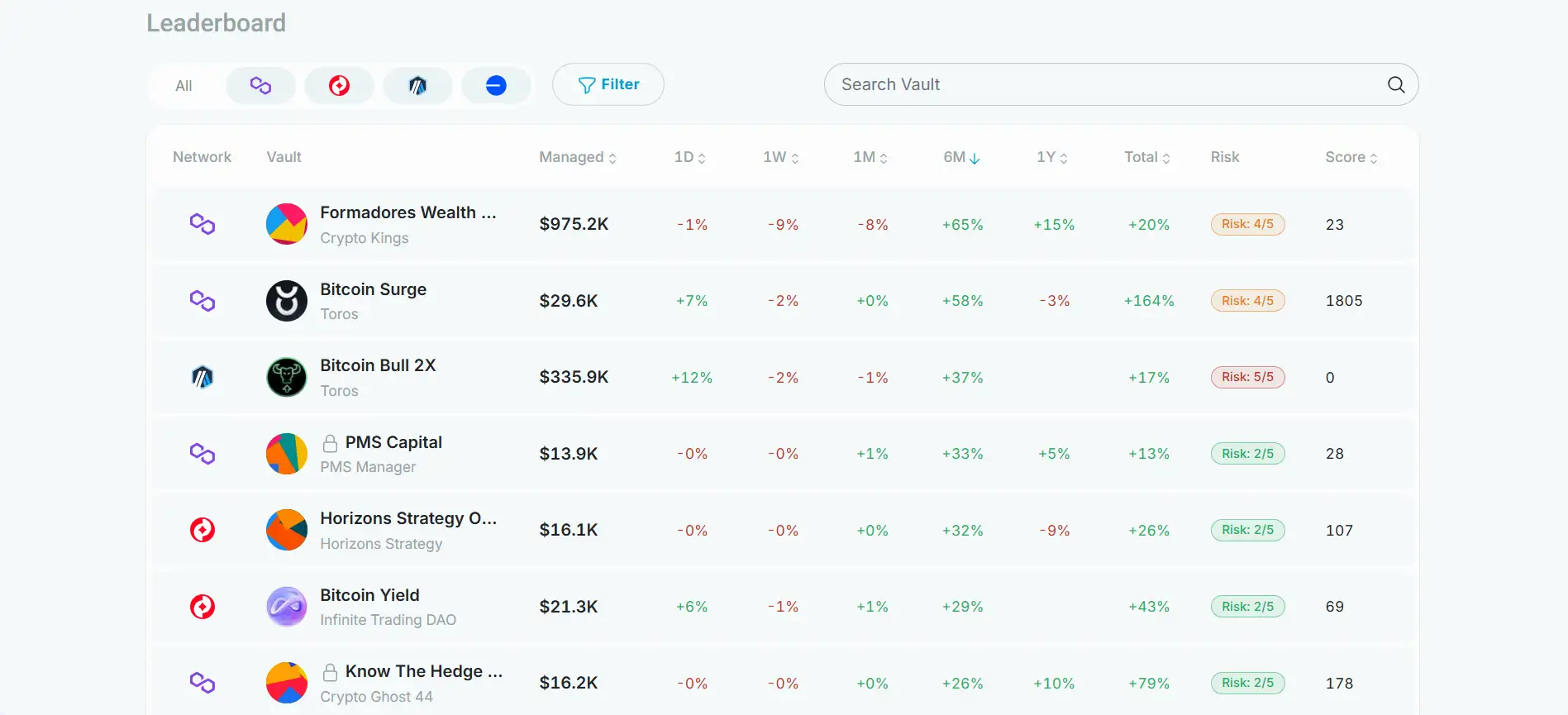

The protocol boasts a diverse range of vault types, including leveraged strategies like BTCBULL3X, stablecoin yield strategies such as USDy, and high-performing discretionary portfolios like Formadores Wealth Growth. Investors can monitor performance, risk factors, and manager transparency via the built-in leaderboard.

In terms of industry relevance, dHEDGE aligns closely with platforms like Enzyme, Toros Finance, and Yearn Finance—but differentiates itself by combining vault transparency, automated SDK strategies, and a uniquely gamified staking system. Its rigorous fee mechanics and trust-minimized architecture make it one of the most technically advanced DeFi investment platforms available.

dHEDGE provides numerous benefits and features that make it a standout in decentralized asset management:

- Non-Custodial Vaults: Investors always retain full control of their funds—vault managers can never withdraw investor capital.

- Cross-Chain Deployment: Operates on Optimism, Polygon, Ethereum, and Base for maximum accessibility.

- Advanced Strategy Execution: Managers can build complex DeFi strategies including lending, borrowing, staking, LPing, and more via whitelisted protocols.

- Transparent Performance Tracking: All vault activity is recorded on-chain and easily accessible through contract explorers.

- Staking for Governance: Stake DHT tokens and vault tokens to earn vDHT, unlocking voting power and reward amplification.

- Dynamic Fee Structure: Vaults support management, performance, entry, and exit fees—all visible and updated on-chain.

- Automated SDK Strategies: Vault managers and developers can integrate automated strategies with the dHEDGE SDK to optimize performance beyond human capabilities.

dHEDGE is designed for both investors and fund managers to get started quickly and securely. Here's how to begin:

- Go to the dHEDGE website and connect your Web3 wallet (MetaMask or WalletConnect) to the platform.

- Browse the Vault Leaderboard and choose a vault to invest in. Evaluate risk scores, returns, and strategy types before making a deposit.

- Once selected, deposit your assets into the vault and receive vault tokens representing your stake.

- To create your own vault, click “Create Vault” and follow the guided setup process. Choose your tradable assets and DeFi integrations.

- Stake DHT tokens via the staking interface to gain vDHT and participate in governance. Stake positions are issued as ERC-721 NFTs.

- Need help? Join the dHEDGE Discord or explore GitBook documentation for advanced tutorials and management features.

dHEDGE FAQ

dHEDGE is a fully non-custodial protocol, meaning vault managers do not have access to user capital. Vaults are smart contracts deployed on-chain, and while managers can trade and configure strategy settings, they cannot withdraw or move user funds. All user deposits remain in the vault contract, and any withdrawals are executed directly by the depositor. This ensures 100% fund security and trustless interaction.

Yes, dHEDGE offers an advanced SDK (Software Development Kit) that lets managers and developers automate vault strategies with precision—no need to write low-level smart contracts. This SDK enables you to build algorithmic trading systems, set parameters for automation, and deploy across supported chains. It’s ideal for those looking to scale and experiment with non-human-managed DeFi strategies. Explore the SDK via dHEDGE’s platform.

When you stake DHT tokens with vault tokens (DHVT), you create a staked position that earns vDHT (voting power) and potential DHT rewards. This staked position is returned to you as an ERC-721 NFT. Rewards depend on vault performance, stake duration, and your staking ratio. The better your vault performs, the more rewards you can unlock. It’s a powerful way to earn, govern, and support the protocol. Learn more at dhedge.org.

dHEDGE vault fees are fully transparent and configured by each vault manager. There are four types: entry fee, exit fee, performance fee, and management fee. These fees are charged proportionally across all users, and are minted as new vault tokens when applicable. Performance fees only apply if the vault surpasses its high-water mark. All fees go directly to the vault manager’s wallet, and changes are announced with a 14-day delay for transparency.

Users have two withdrawal methods: underlying asset withdrawal and single asset withdrawal. The underlying asset option gives you your share of each token in the vault (e.g., ETH and BTC). The single asset option automatically liquidates all positions and gives you one token of your choice. Both are processed at the vault’s Net Asset Value (NAV). A 24-hour hold applies to new deposits to prevent flash loan exploits. Learn more on the dHEDGE app.

You Might Also Like