About Dirac Finance

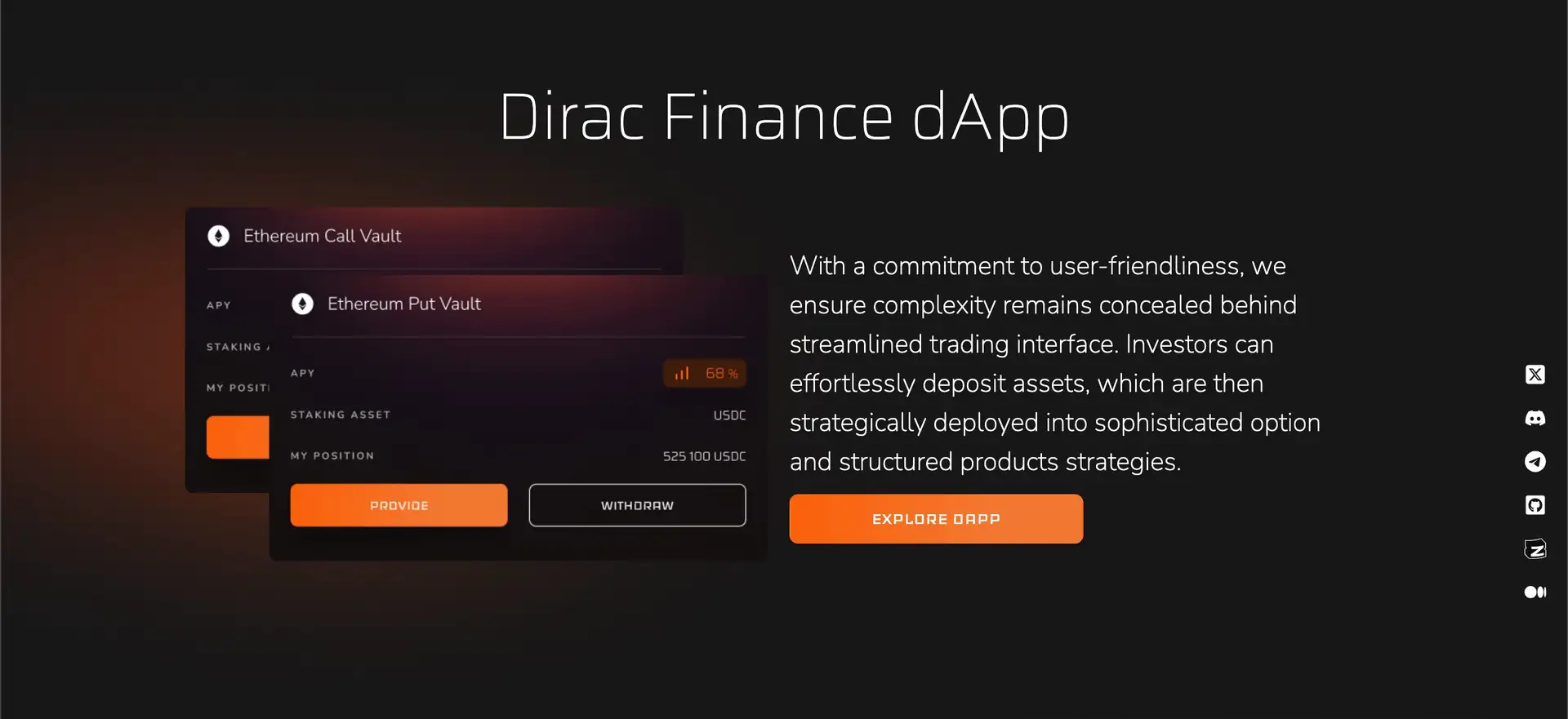

Dirac Finance is a pioneering platform in the decentralized finance (DeFi) space, offering a range of innovative derivatives protocols designed to generate organic and sustainable yields for investors. The platform’s vaults utilize sophisticated strategies, including structured products and principal-protected notes, to provide investors with secure exposure to cryptocurrency volatility. Through a unique combination of advanced algorithms and intelligent decision-making, Dirac Finance aims to optimize returns while prioritizing capital preservation.

The core of Dirac Finance lies in its commitment to risk management and yield optimization. Each vault is designed to ensure maximum security and efficiency, using advanced hedging techniques that protect the principal invested. By integrating robust financial strategies, the platform enables investors to navigate the complexities of the DeFi market with confidence. This focus on safety and sustainability positions Dirac Finance as a standout player in the evolving world of digital finance.

The vision of Dirac Finance is to democratize access to sophisticated financial instruments, bridging the gap between traditional finance (TradFi) and DeFi. Inspired by conventional financial systems, Dirac Finance aims to provide users with advanced investment opportunities typically reserved for institutional investors. By doing so, the platform empowers retail investors to participate in high-yield strategies that were previously out of reach, reshaping the way they interact with financial markets.

The creative inspiration behind Dirac Finance stems from the need to make complex financial products accessible, secure, and sustainable. The platform’s algorithms are crafted to deliver optimized yields while mitigating risks, catering to a broad range of investors from newcomers to seasoned professionals. This inclusivity is core to Dirac Finance’s mission, driving the platform’s commitment to transparency, security, and financial empowerment.

Dirac Finance is dedicated to building a resilient ecosystem that redefines investor expectations. By prioritizing innovative product development and rigorous security protocols, the platform aspires to set new standards in the DeFi industry. The result is a user-centric experience that not only meets but exceeds the demands of a dynamic and fast-paced market.

The development roadmap of Dirac Finance outlines a series of strategic milestones aimed at enhancing its product offerings and market presence. One of the primary goals is to expand the platform’s suite of vault products, which are built around sophisticated derivatives strategies designed to maximize yield while mitigating risk. Key planned upgrades include the integration of advanced risk management algorithms such as the Dirac Decision Making Algorithm (DDMA) and Dirac Global Hedging Algorithm (DGHA), which are pivotal in ensuring capital protection for investors.

Dirac Finance is also focusing on enhancing its platform security and user experience, with continuous updates planned for its DeFi interfaces. The team’s future initiatives include exploring cross-chain capabilities to broaden the platform’s reach, ensuring compatibility with multiple blockchain networks to cater to a diverse audience. These efforts align with Dirac Finance's mission to provide accessible and secure financial instruments that are robust enough to withstand market volatility.

Upcoming milestones also involve community engagement initiatives such as governance token launches and Decentralized Autonomous Organization (DAO) integration, which will empower users to have a voice in platform developments. This approach not only strengthens the Dirac community but also ensures that the platform evolves in line with user needs and market dynamics. More details on the roadmap and milestones can be found on the Dirac Finance GitBook.

Dirac Finance was co-founded by Mathias Johansson, who plays a pivotal role as the Chief Technology Officer (CTO) and Chief Product Officer. Johansson's expertise in technology and product innovation is fundamental to the platform's sophisticated derivatives protocols and risk management strategies. The leadership team is further strengthened by Anders Storm, who serves as the Chief Executive Officer (CEO), bringing a wealth of experience from both traditional finance and the emerging blockchain sector.

Other key members include Petra Stergel, Chief Human Resources Officer, who oversees team dynamics and organizational growth, and Emelie Gessner Gozzi, Chief Marketing Officer, who drives brand strategy and user engagement. Mats Oberg, the Chief Sales Officer and Chief Commercial Officer, is responsible for expanding Dirac’s market reach and strategic partnerships. This multidisciplinary team combines deep expertise in finance, technology, and blockchain, positioning Dirac Finance as a leader in the DeFi space.

On the investment front, Dirac Finance has garnered significant support from notable investors, including TIN Fonder and DIG Investment. Individual investors like Johan Sedihn have also contributed, highlighting strong confidence in Dirac's vision and innovative approach to decentralized finance. These strategic investments have fueled Dirac’s development, allowing the platform to continuously innovate and expand its offerings.

Dirac Finance also collaborates with major industry players, such as Chainlink, integrating Chainlink’s oracle solutions to enhance the reliability and security of its financial products. This partnership is a testament to Dirac’s commitment to providing institutional-grade decentralized options with advanced data connectivity and protection.

Dirac Finance offers early access opportunities through its beta program, allowing selected users to participate in testing new features and providing feedback directly to the development team. This program is crucial for refining the platform’s functionality before public release, ensuring a smooth user experience. By participating in the beta program, users get a firsthand look at the latest innovations, including new vault strategies and security upgrades.

The platform’s testnet phase serves as a critical component of the development process, enabling stress testing of the vaults under simulated market conditions. This phase helps identify potential issues, ensuring that all products meet the high standards of security and performance that Dirac Finance aims to uphold. These trials are vital for maintaining investor confidence and platform integrity, particularly in the volatile DeFi market.

Dirac Finance's commitment to transparency during the beta phase is evident in its collaborative approach, as feedback gathered from early adopters directly influences final product adjustments. This iterative process ensures that the platform is not only technically robust but also user-friendly, meeting the needs of both retail and institutional investors. For more details on how to participate, visit the Dirac Finance website.

Dirac Finance Suggestions by Real Users

Dirac Finance FAQ

Dirac Finance prioritizes security by employing advanced risk mitigation techniques across all its decentralized vaults. The platform integrates algorithms like the Dirac Decision Making Algorithm (DDMA) and Dirac Global Hedging Algorithm (DGHA) that dynamically adjust strategies to protect investor capital. These measures are supplemented with rigorous auditing processes and smart contract security checks to ensure that funds are safe and secure.

Dirac Finance distinguishes itself by combining Traditional Finance (TradFi) principles with DeFi accessibility, offering structured products and principal-protected notes typically available only to institutional investors. Unlike many DeFi protocols that rely solely on passive deposit strategies, Dirac Finance leverages sophisticated derivatives and option strategies that allow investors to benefit from cryptocurrency volatility while managing risks effectively.

Yes, Dirac Finance plans to launch a Decentralized Autonomous Organization (DAO) that will enable community members to participate in governance decisions. Through the DAO, users can vote on key platform developments, changes to vault strategies, and other critical aspects of the protocol. This democratic approach ensures that the platform evolves in a way that reflects the collective interests of its community.

Dirac Finance has integrated with Chainlink to enhance the reliability and security of its decentralized vaults. Chainlink's industry-leading oracle solutions provide secure, off-chain data integration that allows Dirac Finance to connect with real-world market data seamlessly. This partnership ensures accurate pricing, robust security, and improved operational efficiency, making Dirac's financial products more resilient and trustworthy.

Dirac Finance employs a multi-layered approach to risk management, incorporating advanced algorithms like the Dirac Decision Making Algorithm (DDMA) and Dirac Global Hedging Algorithm (DGHA). These algorithms constantly monitor market conditions and adjust strategies in real-time to minimize risk exposure. By using structured products and principal-protected notes, Dirac ensures that investors’ capital remains secure, even in volatile market conditions.

You Might Also Like