About Dolomite

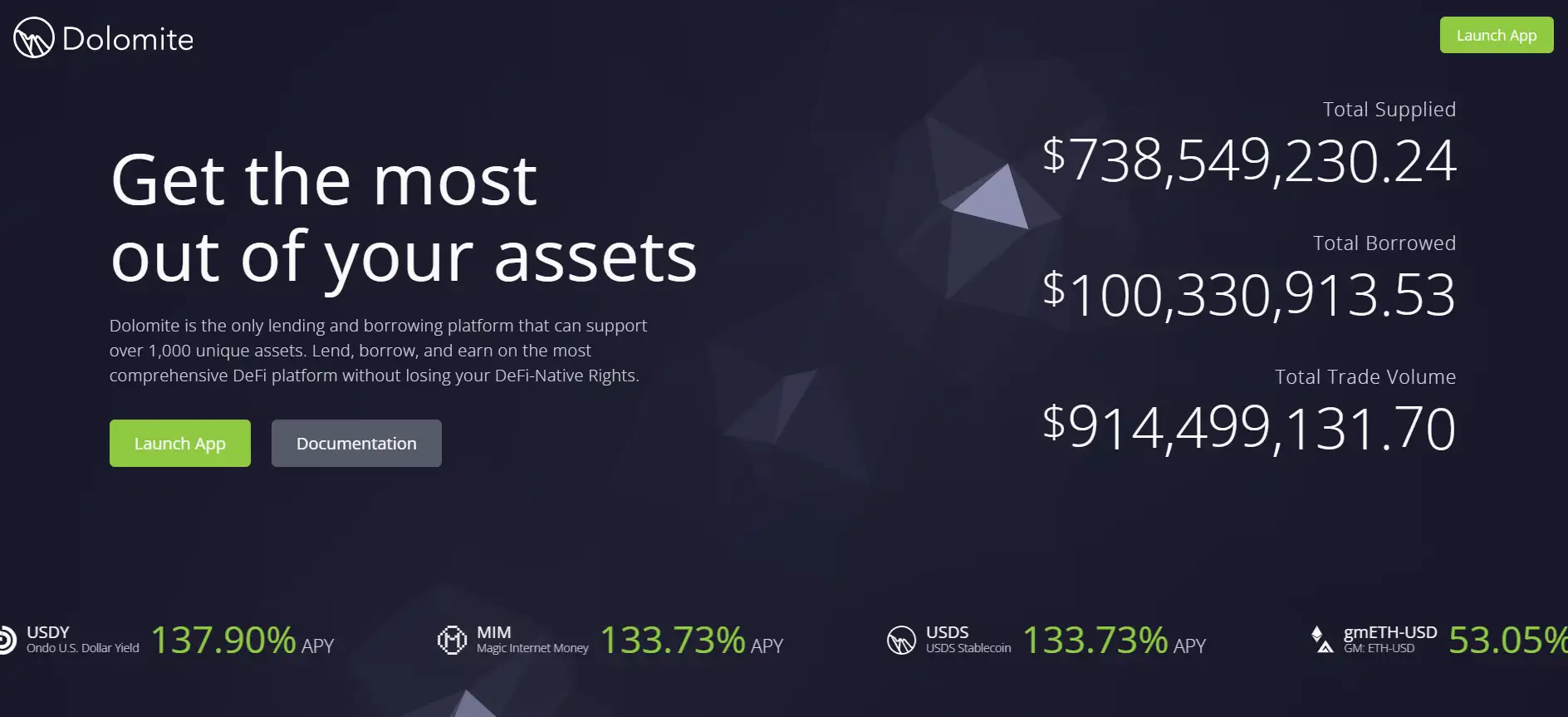

Dolomite is a next-generation lending, borrowing, and margin trading protocol built on Ethereum Layer 2 chains. It stands out by supporting over 1,000 unique digital assets and maintaining DeFi-native rights for users. Whether you're trading, earning yield, or deploying complex DeFi strategies, Dolomite ensures full control of your assets without sacrificing security, transparency, or utility.

Via its intuitive design and decentralized infrastructure, Dolomite enables anyone to lend, borrow, or margin trade directly from their crypto wallet. Unlike other platforms, it preserves key rights such as governance, staking rewards, and token utility while funds are deployed. This empowers both casual DeFi users and advanced traders to get the most out of their portfolios.

Dolomite is an advanced composable protocol that integrates spot and margin trading with lending and liquidity provisioning, built entirely on-chain. Operating on networks like Arbitrum, Mantle, Polygon zkEVM, and X Layer, it brings high-throughput performance and ultra-low gas costs to DeFi participants without compromising decentralization. The platform is governed by a suite of immutable smart contracts that ensure trustless interaction and complete auditability.

Users can lend or borrow assets in overcollateralized, isolated positions — each independently secured, which means one loan does not risk others in the wallet. With Chainlink oracles ensuring real-time pricing and liquidation thresholds set at 115%, Dolomite protects lender liquidity and borrower positions. Additionally, the protocol supports dynamic interest rate models based on asset utilization, ensuring market-driven yields and capital efficiency.

A standout feature of Dolomite is its ability to preserve DeFi-native rights when assets are lent out. This means users continue earning staking rewards or governance rights even while their tokens are used as collateral or liquidity. The platform also integrates a flexible AMM system based on Uniswap v2 (with upgrades), enabling interest-accruing liquidity pools that enhance protocol earnings and capital efficiency.

Dolomite is built for composability and future-proofing. Developers can build on top of it using its robust SDK and API, and the smart contracts have undergone security audits by firms like Zeppelin Solutions, Bramah Systems, SECBIT Labs, and Cyfrin. A progressive transition to a DAO model is underway, which will eventually hand protocol ownership and fee accrual to the community. Competitors in the space include Aave, Compound, and Instadapp, but Dolomite’s unmatched asset support and DeFi-native rights retention set it apart.

Dolomite delivers a powerful suite of DeFi features and protocol-level advantages for asset managers, traders, and developers:

- Over 1,000 supported assets: The most comprehensive list in DeFi for lending, borrowing, and margin trading.

- DeFi-native rights retention: Lend without losing access to staking rewards, governance participation, or yield-bearing capabilities.

- Flexible collateralization: Open multiple isolated borrow positions using 30+ assets per position.

- Composable smart contracts: Built to support integrations and fully audited for security.

- Integrated AMM pools: Interest-accruing liquidity pools enable deeper trading pairs and protocol revenue.

- Permissionless liquidations: Community-powered, reward-based liquidation system ensures decentralized risk management.

- Mobile-native trading: Full functionality across mobile devices — from DEX margin trading to wallet management.

Getting started with Dolomite is easy, whether you're a casual user or DeFi veteran:

- Visit the Dolomite website and click Launch App.

- Connect your Web3 wallet (e.g. MetaMask) and select a supported network like Arbitrum or Mantle.

- Browse supported markets and supply assets to begin earning yields—assets like USDY, MIM, and gmBTC offer up to 137% APY.

- Use the margin trading interface to long or short assets with leverage, paired against stablecoins or other tokens.

- Explore advanced DeFi tools like AMM-integrated liquidity, staking strategies, and virtual liquidity markets.

- Read the Dolomite documentation or dive into the GitHub repo for technical setup and integrations.

- Join the community via Discord, Twitter, or read updates on Medium.

Dolomite FAQ

Dolomite introduces a groundbreaking lending model where users retain their DeFi-native rights even while lending assets. This means you don’t lose access to staking rewards, governance power, or yield-bearing functions just because your tokens are deployed. Unlike other protocols that strip away utility when assets are locked, Dolomite allows your tokens to keep working for you in multiple ways simultaneously. Explore this at Dolomite.

Dolomite implements a system of isolated collateral positions. This means each borrow position you open is secured by a separate set of collateral assets, so a liquidation in one position does not affect your others. This isolation reduces systemic risk, especially during volatile market events, and gives borrowers a much higher degree of capital efficiency and safety.

Yes, unlike many platforms limited to ETH and BTC margin pairs, Dolomite supports margin trading across a wide range of DeFi-native assets. You can open leveraged positions between USDC, MAGIC, GMX, PENDLE and more. This opens up new strategic trading opportunities and supports a more diverse set of DeFi users. Try margin trading now at Dolomite.io.

Dolomite has undergone rigorous audits from top firms like Zeppelin Solutions, Bramah Systems, SECBIT Labs, and Cyfrin. Additionally, all smart contracts have 100% line, branch, and statement coverage. The protocol is deployed on secure Layer 2 networks and will eventually be governed by a DAO to further decentralize oversight and reduce risk of centralized control.

Dolomite has integrated automated market maker (AMM) pools as a core part of its margin protocol. These pools not only provide liquidity for spot and margin trades but also accrue interest from borrowers, giving liquidity providers additional yield beyond just swap fees. Traders can also borrow against their LP tokens or speculate on impermanent loss, making AMMs a yield source and a tradable asset class on their own.

You Might Also Like