About EigenPhi

EigenPhi is a powerful on-chain analytics platform specializing in real-time and historical analysis of MEV (Maximal Extractable Value). Built for researchers, traders, protocols, and DeFi stakeholders, EigenPhi offers unmatched insights into arbitrage, sandwich attacks, flash loans, and liquidations—providing critical data to interpret, avoid, and even capitalize on complex blockchain behaviors.

Whether you are a DeFi developer, protocol strategist, or on-chain analyst, EigenPhi is designed to help you understand how MEV impacts liquidity, risk, and revenue. The platform aggregates and contextualizes data across multiple MEV types and presents it through intuitive dashboards and visualizations. By offering precision analytics, EigenPhi is enabling the next generation of decentralized finance intelligence.

EigenPhi fills a vital gap in the DeFi analytics landscape by focusing on the economic consequences of MEV extraction on Ethereum. As MEV becomes increasingly sophisticated—often involving multiple contracts, assets, and chains within a single atomic transaction—traditional analytics tools fall short in visibility and detail. EigenPhi was designed specifically to address this challenge, empowering users to quantify profit, identify patterns, and understand which addresses are driving or suffering from MEV dynamics.

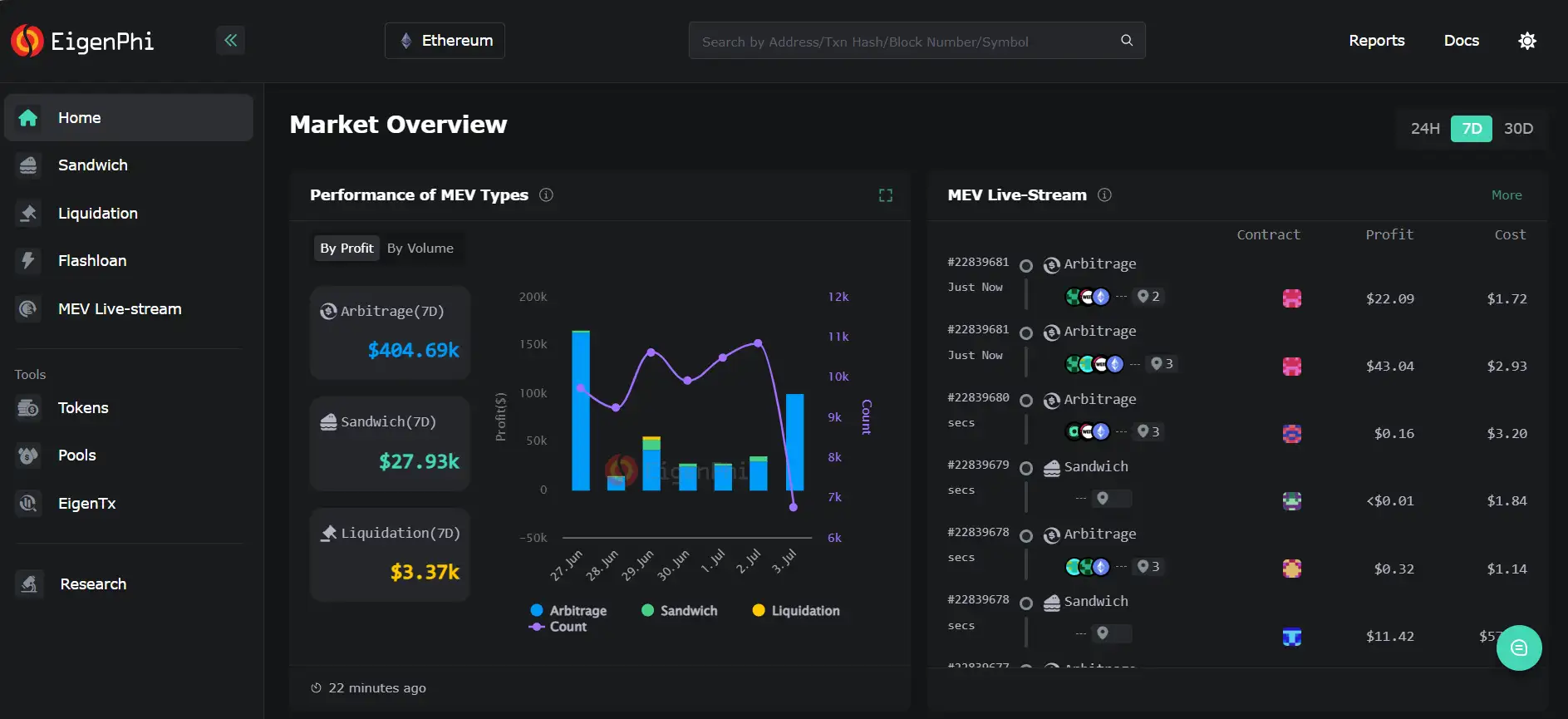

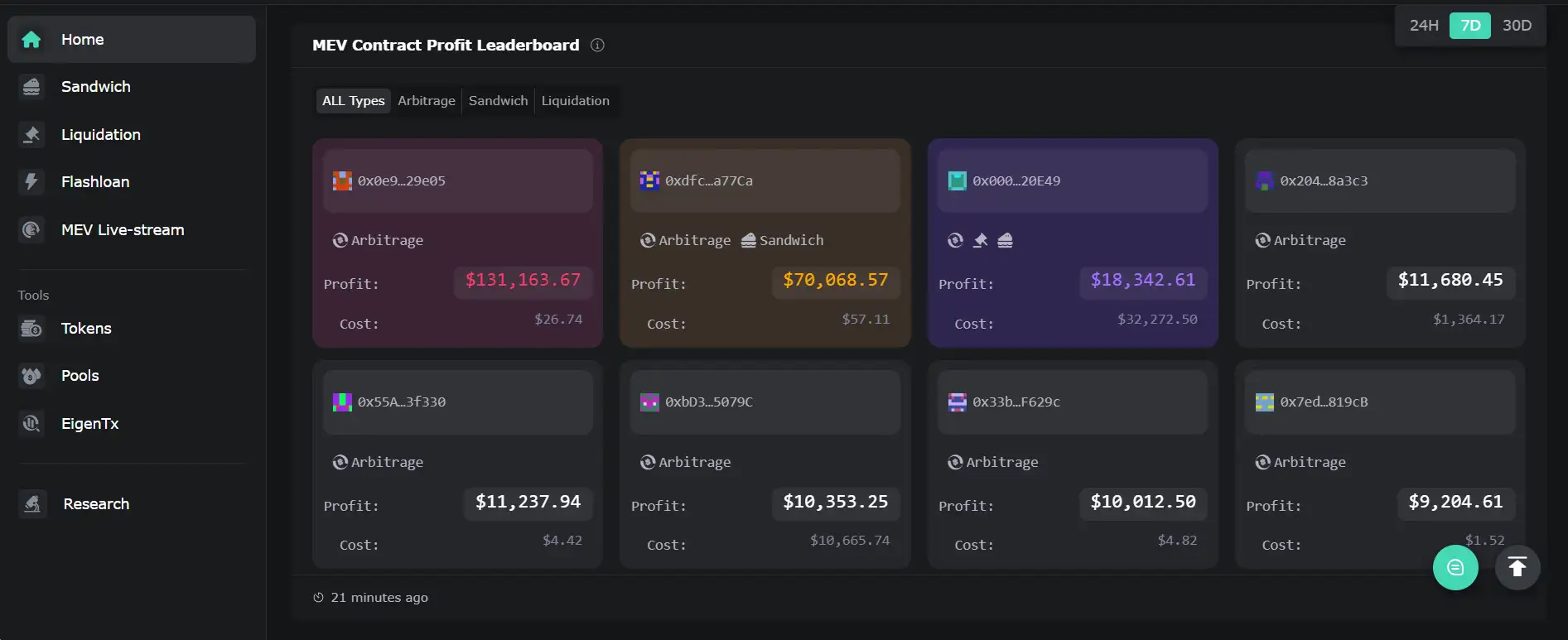

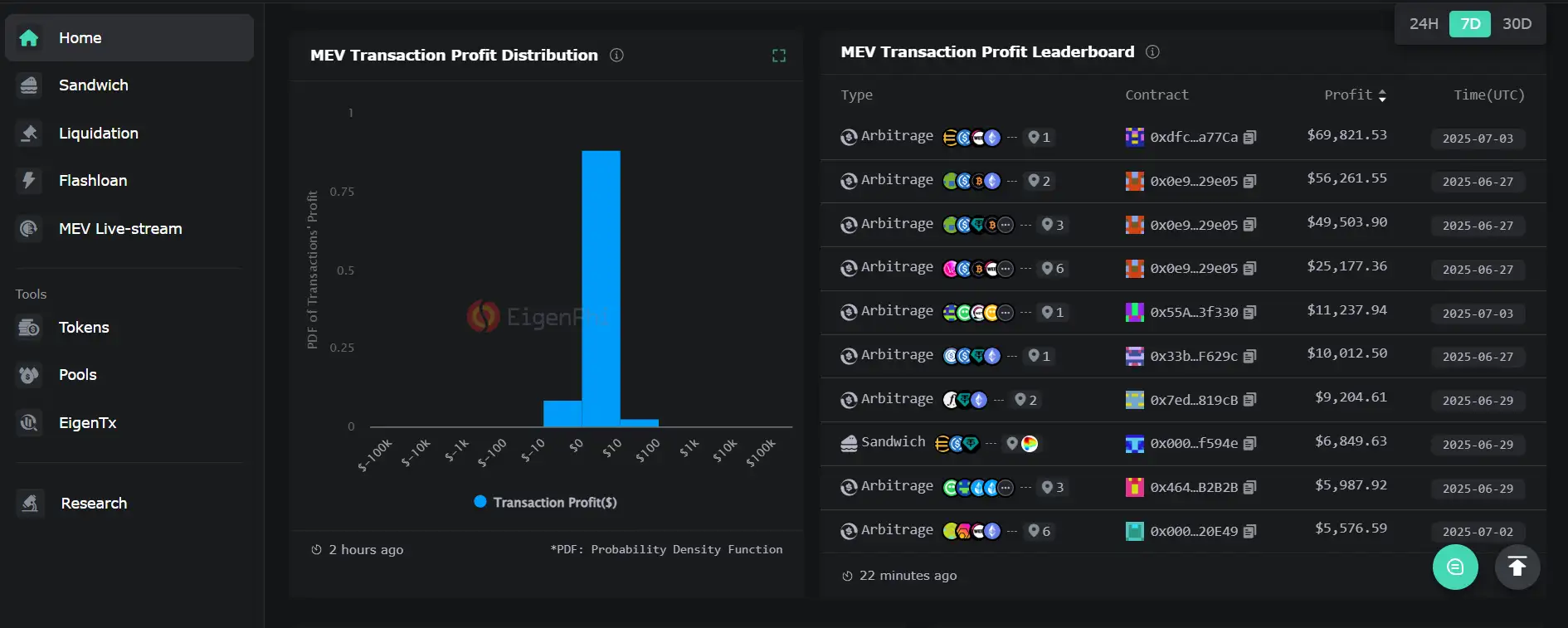

The platform breaks down MEV into its core categories—Arbitrage, Sandwich attacks, Liquidations, and Flashloans. Through modules like MEV Live-Stream and the Contract Profit Leaderboard, users can observe real-time trades and outcomes, including profits, costs, victims, and attackers. Retail investors can use this data to avoid costly slippage and track malicious tokens, while searchers can monitor exploitable patterns and liquidity hotspots.

Each MEV type has its own dashboard. For example, the Sandwich section includes summary statistics, exploited contract data, and interactive leaderboards for victims and attackers. The Tx Profit tab displays transaction-level profitability, allowing users to drill into the specifics of each attack. The platform also enables sorting by profit, cost, and revenue, and provides click-through access to token flow and behavior charts.

In addition to data dashboards, EigenPhi Research offers bespoke analysis and intelligence reports for protocols and trading desks. These insights help optimize liquidity, reduce MEV exposure, and uncover new opportunities in on-chain finance. While competitors like Dune, Flipside, and Nansen offer broader analytics, EigenPhi stands out with its laser-focus on MEV and its financial impact.

EigenPhi provides numerous benefits and features that make it a go-to platform for MEV intelligence:

- MEV Live-Stream: Real-time tracking of arbitrage, sandwich, and liquidation events—complete with profit and cost per transaction.

- Advanced Leaderboards: Interactive rankings for top MEV attackers and victims, sortable by profit, volume, or frequency.

- Detailed Transaction Analysis: Click into any MEV event to visualize token flows, costs, and protocol interactions within a block.

- Research Integration: Access bespoke institutional-grade reports to evaluate your protocol’s exposure and market positioning.

- Retail & Searcher Tools: Features like Hot Tokens, Malicious Token alerts, and LP performance tracking allow users to spot threats and arbitrage opportunities.

- Protocol Optimization: Helps DeFi builders identify vulnerabilities and revenue loss from MEV to optimize liquidity and reduce slippage.

EigenPhi is a web-based analytics platform requiring no downloads or installations. Getting started is simple and immediate:

- Visit the Platform: Go to eigenphi.io to access the full suite of MEV dashboards.

- Explore MEV Types: Use the top navigation to examine Arbitrage, Sandwich, Liquidation, and Flashloan dashboards.

- Use Live Tools: Open MEV Live-Stream to track events as they occur across the Ethereum network.

- Monitor Leaderboards: Head to the MEV Contract Profit Leaderboard or Tx Profit Rankings to identify top-performing searchers or active exploits.

- Download Reports: Leverage expert research and historical datasets to dive deeper into MEV trends affecting your projects or investments.

- Stay Updated: Bookmark the Research section for the latest analysis, metrics, and DeFi commentary.

EigenPhi FAQ

EigenPhi leverages a custom-built MEV detection engine that monitors Ethereum blocks as they are created. The MEV Live-Stream shows real-time arbitrage, sandwich, flashloan, and liquidation events, displaying each transaction’s profit, cost, and affected contracts. This allows users to observe complex on-chain behavior as it happens, and click into each tx hash to explore full token flow and execution details.

Yes. EigenPhi has dedicated tools for identifying and monitoring sandwich MEV activity. The Sandwich dashboard provides summaries of recent attacks, a list of top exploited contracts, and even a Victim Leaderboard where users can analyze who was targeted and when. Retail users can use this data to avoid vulnerable tokens or liquidity pools and recognize patterns in timing or attack vectors.

EigenPhi plays a strategic role for institutional DeFi stakeholders by offering bespoke research and analytics on how MEV impacts protocol revenue and liquidity flow. Institutions use EigenPhi’s data to detect lost MEV capture opportunities, analyze who is exploiting their systems, and redesign incentive models for better security and performance. For protocols seeking to optimize capital efficiency and MEV resistance, EigenPhi is an essential analytics partner.

Yes, EigenPhi monitors malicious token deployment in the context of MEV exploitation. The system can flag tokens involved in sandwich attacks or rug-pull-style behaviors, helping users and searchers avoid or track high-risk smart contracts. These tools are especially valuable to retail investors and searchers looking to avoid getting caught in slippage-heavy or manipulated trading environments.

EigenPhi offers a detailed Attacker Leaderboard for MEV events, especially in the Sandwich module. Users can sort by total profit, cost, frequency, and attack style, and then click an address to reveal the attacker’s historical patterns, behavior charts, and top victim lists. This makes it possible to study how specific wallets operate, which pools or tokens they target, and how frequently they deploy MEV strategies. Access it at eigenphi.io.

You Might Also Like