About ENKI Protocol

ENKI Protocol is a next-generation liquid staking platform designed specifically for the Metis decentralized sequencer ecosystem. Built to address the complexities of sequencer node operation, ENKI Protocol enables users to stake Metis tokens without technical barriers while still participating in the network’s yield generation model. By transforming Metis into eMetis and seMetis, ENKI allows users to retain liquidity and earn sequencer rewards without locking up assets.

This dual-token design empowers stakers with the freedom to use their tokens in DeFi applications while accumulating passive income. The project stands out through its frictionless staking experience, non-custodial design, and focus on creating DeFi composability for staked assets. As part of the Metis Layer2 ecosystem, ENKI lowers the entry barrier to sequencer node participation, thereby democratizing access to validator-level rewards for the broader crypto community.

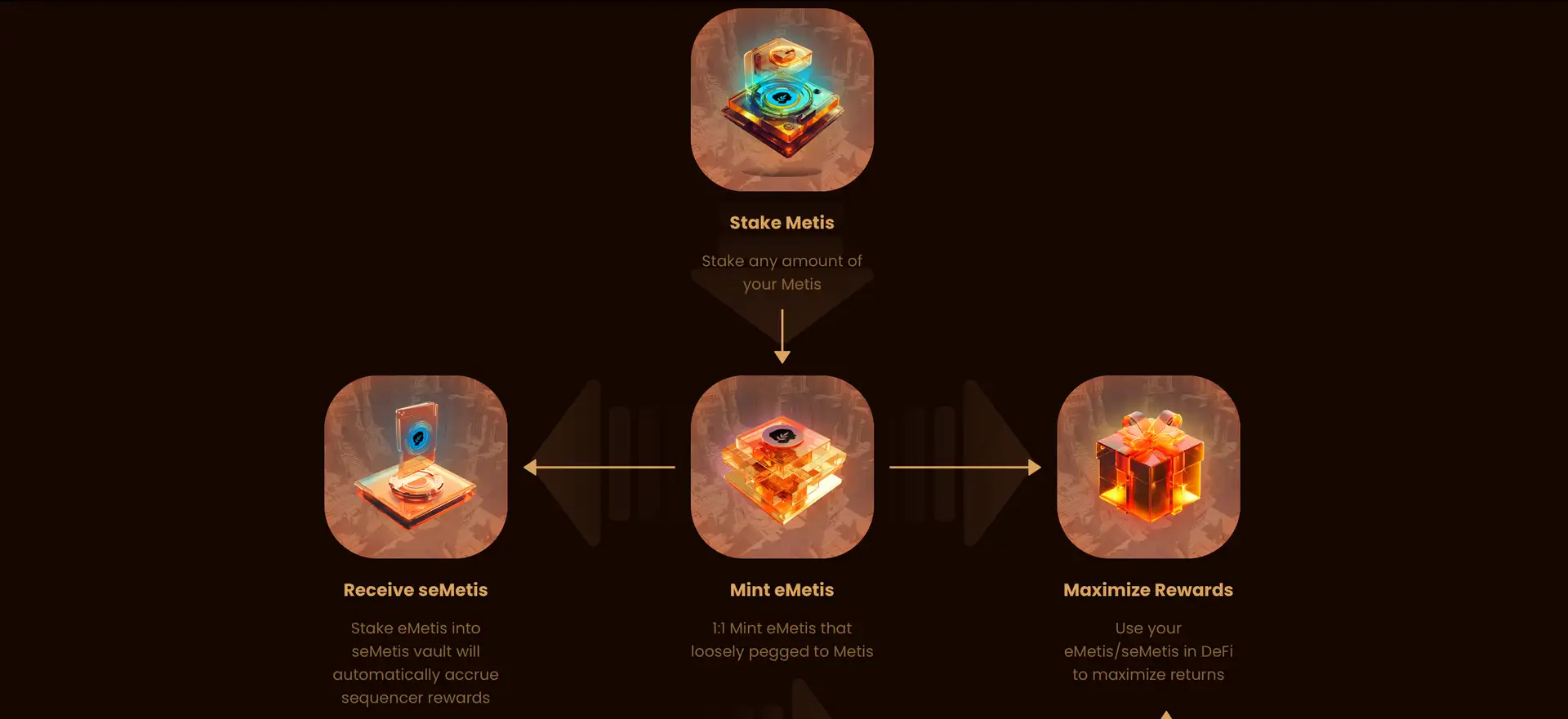

ENKI Protocol is revolutionizing the Metis staking landscape by introducing an innovative liquid staking derivative model purpose-built for Metis Sequencer Nodes. Traditionally, operating a sequencer node requires significant technical infrastructure and a large Metis deposit — challenges that alienate the average DeFi user. ENKI addresses this by offering an accessible, non-custodial staking interface where any amount of Metis can be staked, and users receive eMetis tokens in return.

eMetis acts as a liquid representation of staked Metis and is freely usable across multiple DeFi protocols. When eMetis is staked into the seMetis vault, it accrues sequencer rewards — providing an elegant yield-generating instrument. Users may later redeem their seMetis for eMetis, with a portion of the yield directed into a vesting contract, incentivizing longer-term commitment via ENKI token staking. This mechanism balances short-term usability with long-term protocol sustainability.

The architecture integrates the ENKI Metis Minter, which allows seamless minting of eMetis at a 1:1 ratio with deposited Metis. Rewards from sequencer nodes are converted back into eMetis, and 90% are funneled into the seMetis vault, while the remaining 10% serves as protocol revenue — supporting treasury growth and community incentives. The protocol's internal logic accommodates Ethereum Layer1 settlement delays, handling the Metis bridge's 7-day challenge periods transparently for the user.

Unlike many single-token liquid staking platforms, ENKI implements a dual-token system — solving rebasing issues in DeFi and boosting composability. The team has proactively addressed liquidity and security through extensive audits and is building integrations with other Metis DeFi protocols to deepen eMetis/seMetis utility. While withdrawals from the Metis Sequencer Pool are not yet supported, ENKI enables secondary market redemption, with plans underway to improve liquidity on DEXs.

In contrast to other liquid staking projects like Lido or Stader, which focus on Ethereum or general PoS chains, ENKI uniquely targets the Metis Layer2 infrastructure. This specialization allows ENKI to capture niche validator yield and integrate directly with Metis-native incentives. The platform is also committed to a fair launch model — no tokens are reserved for the team, and the entire token supply is allocated to the community and protocol utility.

ENKI Protocol provides numerous benefits and features that make it a standout project in the Metis ecosystem:

- Liquid Staking for All: Stake any amount of Metis and receive eMetis with no whitelist or technical barrier.

- DeFi Composability: Use eMetis and seMetis across DeFi apps to maximize earnings and maintain liquidity.

- Dual-Token Architecture: Solves rebasing issues and enhances compatibility with external protocols.

- Non-Custodial & Secure: Fully audited with a treasury-backed system and layered security framework.

- Reward Boosting Mechanism: Stake ENKI tokens to unlock the full potential of your staking rewards via vesting contracts.

- Fair Launch Model: No team allocation, no private funding — 100% of the supply is for the community and protocol.

Getting started with ENKI Protocol is straightforward and doesn’t require advanced technical knowledge:

- Visit the Platform: Navigate to the official ENKI website and connect your Metis-compatible wallet.

- Stake Metis: Choose the “Stake Metis” option to mint eMetis at a 1:1 ratio.

- Stake eMetis: Deposit your eMetis into the seMetis vault to start accruing sequencer rewards.

- Claim & Boost Rewards: When you unstake, claim up to 70% immediately and stake ENKI tokens to unlock the rest over time.

- Use in DeFi: Deploy your eMetis or seMetis in DeFi protocols to earn more.

- Track Performance: View your staking points, TVL, and reward rates directly on the dashboard.

- Stay Updated: Follow audit updates, roadmap releases, and new integrations via the ENKI site.

ENKI Protocol Reviews by Real Users

ENKI Protocol FAQ

ENKI Protocol utilizes a dual-token model — eMetis and seMetis — to resolve rebasing issues in DeFi protocols. Rebasing tokens often break DeFi integrations due to fluctuating balances. By separating the representation of staked Metis (eMetis) from the yield-accruing version (seMetis), ENKI ensures maximum compatibility across protocols. Users can choose between liquidity (eMetis) or compounding yield (seMetis), offering flexibility without compromising functionality. Explore more at ENKI.

Metis staking rewards are subject to a 7-day challenge window due to Layer1 bridge mechanics. ENKI abstracts this by synchronizing weekly rewards with the protocol’s internal vault schedule. Each 7-day cycle, ENKI converts accumulated sequencer rewards to eMetis and distributes 90% to seMetis vault participants. Users don’t need to wait or manage these bridge delays manually — ENKI Protocol automates the process.

Upon unstaking seMetis, 30% of your yield is moved into a vesting contract. If you do not stake ENKI tokens, that portion remains locked and inaccessible. There’s no penalty — the funds stay secure — but staking ENKI unlocks access over 90 days. This model encourages long-term protocol commitment while leaving full control to the user. Learn how to boost your staking efficiency on ENKI.

Yes, eMetis is designed to be freely tradeable on secondary markets. Even if direct redemption back to Metis is paused due to sequencer node withdrawal limitations, you can swap eMetis on DEXes or use it as collateral in DeFi protocols. ENKI is actively working to improve market liquidity and enable stable redemption processes. Track updates at ENKI Protocol.

ENKI Protocol operates on a fair launch model — no tokens are reserved for the team, advisors, or early investors. Of the total 10 million ENKI tokens, 1 million are for community and marketing initiatives, and 9 million are reserved strictly for liquidity mining and staking incentives. There was no fundraising round, and all minting beyond the initial cap is gated by governance votes and a 28-day timelock, ensuring transparency and decentralization. View full tokenomics on ENKI.

You Might Also Like