About Enzyme

Enzyme is a powerful on-chain asset management protocol tailored to help builders and asset managers develop, scale, and operate tokenized finance solutions with efficiency and confidence. Built with transparency and modularity in mind, Enzyme empowers users with a fully auditable infrastructure that streamlines fund administration, vault creation, and investment operations.

Launched in 2017, Enzyme has evolved into a comprehensive platform offering institutional-grade tools and services. These include white-labeled front-end solutions, API and SDK support, advanced risk management, and regulatory compliance tools. Whether you're a DAO, DeFi protocol, exchange, or traditional financial manager, Enzyme makes it easy to build, customize, and manage vaults with complete flexibility.

Enzyme has positioned itself as a robust and flexible infrastructure for building on-chain asset management products since its inception in 2017. Designed to serve a wide array of use cases, it enables users to create and manage customizable vaults, deploy investment strategies, and leverage a wide selection of DeFi protocols—all through a non-custodial and auditable environment. The protocol supports more than 200 tokens and integrates with popular DeFi primitives like lending, borrowing, liquidity provision, derivatives, and staking, offering vast opportunities for customization and innovation.

At the core of Enzyme is the Vault-as-a-Service model, particularly highlighted by its flagship product, Enzyme.Blue. Users can launch vaults with tailored features such as management and performance fees, slippage settings, role-based permissions, and whitelist controls. The protocol's configuration tools allow precise rule-setting and automation, making it ideal for DAOs, asset managers, and financial institutions looking to create sophisticated investment products with minimal engineering overhead. The Enzyme Admin platform further enhances fund operations by offering automated NAV calculations, fee distributions, and permission control through a user-friendly dashboard.

Additional tools such as Enzyme.Myso for covered options trading and Enzyme Liquid for pre-launch TVL accumulation extend the platform’s capabilities. These services support both institutional and retail applications, with custom front-end and white-labeled integration options available. Regulatory compliance is also a core feature, with built-in CTF, AML, KYC, and KYB integrations that enable firms to operate within their jurisdiction’s legal frameworks.

Over the years, Enzyme has collaborated with projects like Swell, and Avantgarde Finance , among others. Each collaboration exemplifies its utility as an infrastructure backbone for tokenized finance. By eliminating the need for builders to develop their own complex smart contract systems, Enzyme offers a low-cost, secure, and efficient gateway to decentralized asset management.

Enzyme provides numerous benefits and features that make it a standout project in the tokenized finance infrastructure landscape:

- Vault-as-a-Service (VaaS): Enzyme.Blue allows users to deploy custom vaults with advanced configurability, including performance fees, slippage controls, and whitelists—without writing code.

- White-Labeled Integration: Projects can launch fully branded interfaces and provide their users with a seamless, native experience built on Enzyme infrastructure.

- Smart Automation: Built-in automation features enable fund managers to execute strategies efficiently and reduce manual tasks, while maintaining real-time accounting and analytics.

- Regulatory Readiness: Enzyme includes CTF & AML compliance tools such as KYC/KYB, whitelist support, and permissioned access—critical for institutional use cases.

- Security & Trust: All smart contracts undergo rigorous audits and offer non-custodial control, ensuring safety of funds and transparency for users.

- Diverse Protocol Integrations: Seamlessly integrate with lending, staking, derivatives, and DeFi tools to craft complex investment strategies across over 200+ supported tokens.

- Options Trading with Enzyme.Myso: Execute covered calls and puts using a frictionless protocol, or integrate with OTC options trading marketplaces.

- Third-Party Support: Expand capability with partners like Gorilla Funds, 31Third, and Crypto Matter for IBAN banking, portfolio optimization, and AI-based analytics.

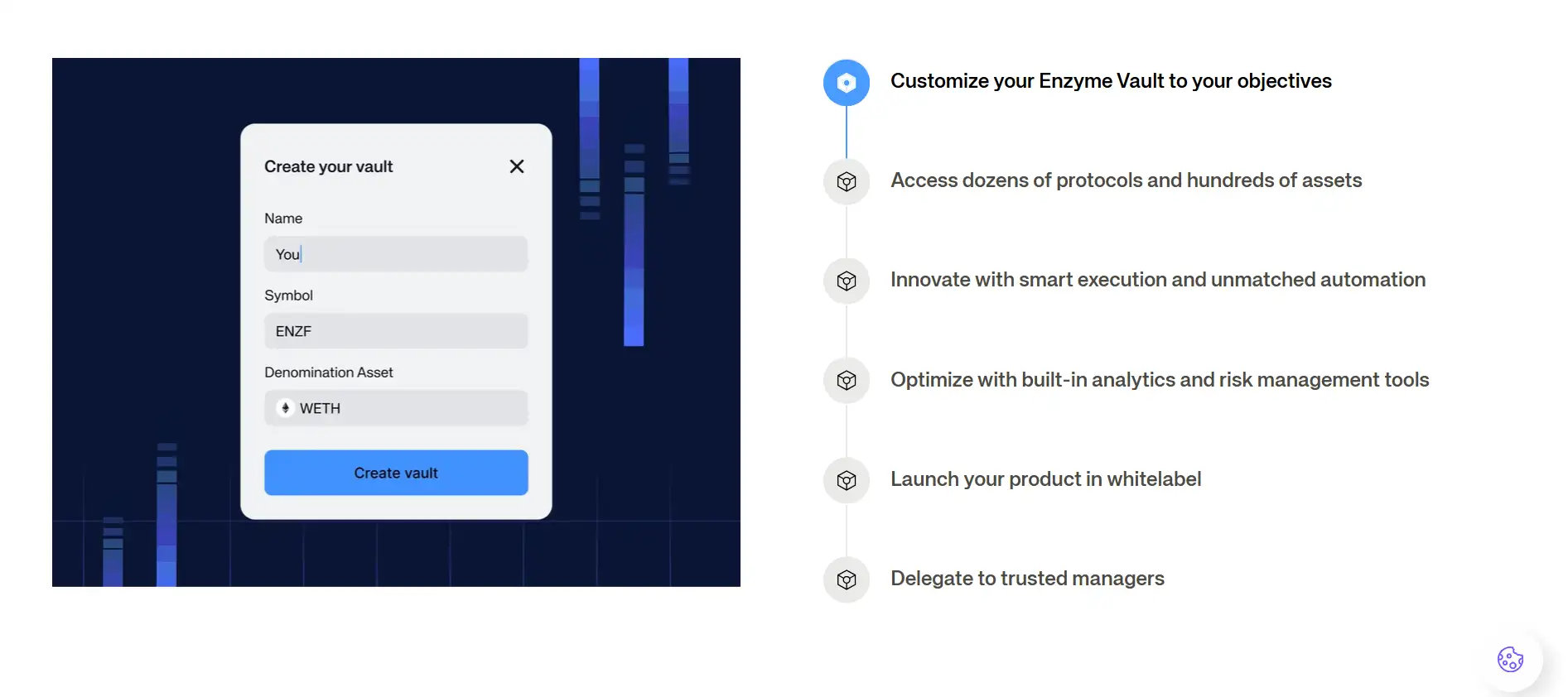

Enzyme makes it simple for users and organizations to start building, managing, and scaling on-chain asset strategies. Here's a step-by-step guide to get started with Enzyme:

- Set Up an Account (Optional): While not required, creating an account lets you receive updates, view all vaults you manage in one place, and enables multi-vault aggregation.

- Create a Vault: Click the "+" button on the platform to launch the vault creation wizard. Customize vault name, symbol, fee structures, token settings, and whitelists through an intuitive UI.

- Define Roles & Permissions: Configure trading rights, access levels, and risk settings such as slippage limits or stop-loss conditions. These parameters can be tailored to each team member or automated bot.

- Start Trading: Once configured, your vault can execute DeFi-native strategies using supported protocols. Trades are recorded on-chain and automatically calculated into NAV.

- Use Enzyme Admin: Set up the Enzyme Admin dashboard to manage fund activity, automate fee calculations, and provide real-time performance insights.

- Explore APIs & SDKs: Developers can access APIs in TypeScript and Python for advanced integrations. SDKs and subgraphs are available for customizing front-ends and dashboards.

- Access Documentation: For in-depth walkthroughs and technical references, visit the official Enzyme documentation.

- Get Support: Enzyme offers advisory, development, and community support via email at [email protected].

Enzyme FAQ

Yes, Enzyme enables DAOs to tokenize their treasuries while maintaining full control through non-custodial vaults that are governed by smart contracts. Vault owners can be DAOs, multisigs, or individual addresses, and permissions can be finely tuned using on-chain rules for deposits, trading access, and asset management. With Enzyme, no interaction occurs without explicit smart contract approval, ensuring complete control and transparency.

Enzyme integrates real-time risk management directly into its vault architecture, allowing you to set parameters such as slippage tolerance, stop-loss triggers, protocol allowlists, and trading limits. These settings are encoded on-chain and enforced automatically, ensuring risk-controlled execution without requiring centralized oversight. Everything is processed through decentralized smart contracts on Enzyme, preserving trustless operations.

Yes, Enzyme supports multi-level vault customization that allows you to create differentiated access conditions for institutional and retail users within the same infrastructure. By configuring permissions like wallet whitelisting, investment limits, and share transferability rules, fund managers can operate multiple strategies with distinct investor profiles using a unified system on Enzyme.

Enzyme vaults operate with programmable role-based access, meaning fund creators can specify exactly who can trade, what they can trade, and under which constraints. Changes to vault configuration can be subject to multisig approval or DAO governance, with optional timelocks for added safety. This setup ensures that no single manager can unilaterally withdraw or reallocate funds maliciously. Learn more at Enzyme.

Enzyme Liquid allows DeFi projects to secure pre-launch TVL by using smart vaults to hold and transparently manage pledged assets, instead of offering speculative tokens. This method builds user trust through non-custodial deposits and on-chain visibility. Unlike token presales, funds in Enzyme Liquid are only deployed post-launch, and can even be programmed as governance tokens, aligning investors with long-term project success. Explore it at Enzyme.

You Might Also Like