About EOS Microloan

EOS Microloan is a transformative blockchain-based platform that bridges the gap between decentralized finance (DeFi) and traditional microfinance systems. Its primary mission is to provide financial accessibility to underserved communities through microloans powered by the fast, secure, and scalable EOS blockchain. By eliminating intermediaries and leveraging smart contracts, the platform offers borrowers quick, cost-effective loans while enabling lenders to earn secure returns on their investments. The innovative approach of EOS Microloan makes it a leader in driving financial inclusion worldwide.

Focused on democratizing financial opportunities, EOS Microloan empowers users to access resources for small business ventures, personal emergencies, and other needs in regions where banking infrastructure is limited. Unlike traditional systems that are often inefficient and costly, the platform uses the strengths of blockchain technology—such as transparency, immutability, and automation—to create a streamlined, user-friendly, and trustless lending ecosystem. Its vision is to reduce systemic financial barriers, enabling people across the globe to achieve their goals while supporting the adoption of blockchain technology.

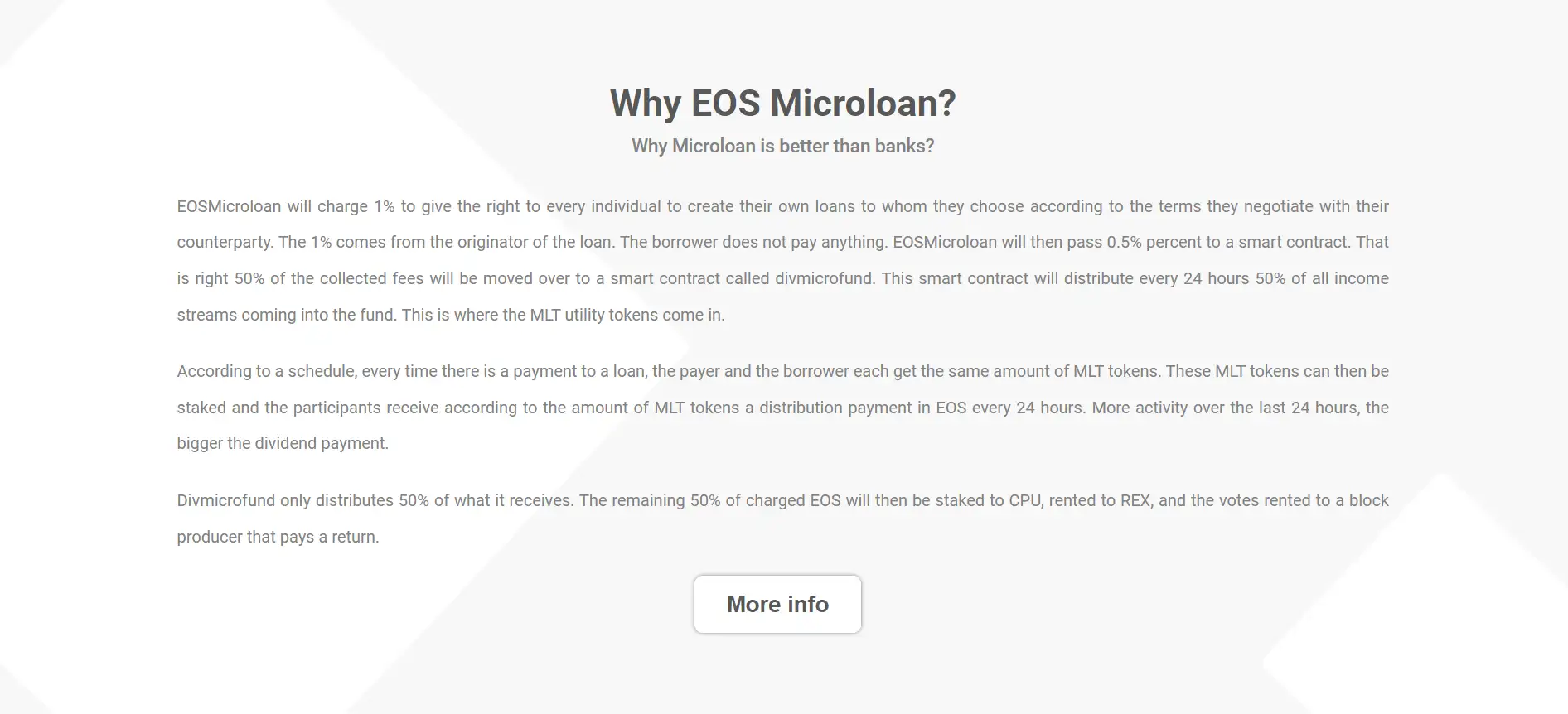

EOS Microloan is a decentralized lending platform designed to address the financial needs of underserved individuals and small businesses worldwide. Built on the EOS blockchain, it leverages the chain’s high-speed transactions, scalability, and low fees to provide accessible and affordable microloans. The platform was developed to disrupt traditional microfinance institutions (MFIs), which are often hindered by high operational costs, limited scalability, and lack of transparency. By using blockchain technology, EOS Microloan minimizes intermediaries, improves efficiency, and empowers both borrowers and lenders with a secure, transparent system.

One of the key innovations of EOS Microloan is its use of smart contracts, which automate loan agreements between users. Borrowers can quickly access small, short-term loans without the lengthy processes typical of traditional finance systems. Meanwhile, lenders can fund loans directly, benefiting from blockchain's security and earning interest on their investments. This approach creates a win-win environment where users on both sides of the transaction are rewarded. Additionally, the platform’s global accessibility ensures it reaches populations in developing regions, furthering its mission of financial inclusion.

Compared to traditional microfinance competitors like Kiva which rely on centralized infrastructure, EOS Microloan leverages decentralized blockchain technology to lower costs and enhance transparency. By eliminating intermediaries and offering near-instant transactions, it sets itself apart as an innovative and efficient solution for modern financial challenges. Moreover, the platform competes with blockchain-based lending services by focusing specifically on microloans, carving out a unique niche within the decentralized finance (DeFi) sector.

In its development journey, EOS Microloan has achieved several milestones, such as integrating advanced smart contracts, enhancing platform security, and building a user-friendly interface. These features have allowed it to attract a growing community of borrowers and lenders who value transparency, speed, and efficiency. By continuing to innovate and refine its offerings, the platform is poised to expand its impact and become a vital part of the global decentralized finance landscape.

EOS Microloan delivers significant advantages to both borrowers and lenders, making it a standout platform in the decentralized finance space. Below are its key benefits and features:

- Decentralized Lending: The platform uses blockchain technology to eliminate the need for intermediaries, ensuring direct and cost-effective transactions between borrowers and lenders.

- Transparent Operations: Transactions and loan agreements are recorded on the immutable EOS blockchain, ensuring full transparency and accountability.

- Low Transaction Fees: Operating on the highly efficient EOS blockchain keeps transaction costs minimal, making it affordable for users globally.

- High-Speed Transactions: The platform leverages EOS’s fast block times to enable instant loan approvals and fund transfers.

- Global Reach: EOS Microloan is available to users worldwide, helping to promote financial inclusion in regions with limited banking access.

- Smart Contracts: Automated, tamper-proof contracts ensure secure and trustless loan agreements without manual oversight.

- Impactful Lending: Lenders not only earn returns but also contribute to meaningful causes, helping borrowers meet their goals and improve their lives.

- User-Friendly Interface: The intuitive design makes the platform accessible to users regardless of their experience with blockchain technology.

Starting with EOS Microloan is easy and designed to accommodate beginners and experienced users alike. Follow these steps to begin:

- Sign Up: Visit the EOS Microloan website and create an account by entering your details and verifying your email address.

- Set Up an EOS Wallet: Choose an EOS-compatible wallet like Anchor Wallet or Scatter Wallet to store your funds securely.

- Add Funds: Fund your wallet with EOS tokens by purchasing them from exchanges such as Binance or Coinbase.

- Choose Your Role: Decide whether you want to borrow or lend. Borrowers can apply for a loan by entering their requirements, while lenders can review loan requests and choose which ones to fund.

- Track Your Progress: Use the dashboard to monitor loans, repayments, and earnings in real time.

EOS Microloan FAQ

EOS Microloan uses blockchain’s transparent and immutable nature to prevent fraud. All transactions are recorded on the EOS blockchain, making them tamper-proof and verifiable by all parties. Additionally, EOS Microloan incorporates identity verification processes and algorithms that monitor unusual borrowing or lending patterns. Smart contracts also ensure funds are only released when all predefined conditions are met, significantly reducing fraudulent activities.

Yes, EOS Microloan allows lenders to browse loan requests and choose which ones to fund. Loan requests can be filtered based on borrower details, loan amount, and purpose. Additionally, the platform uses an algorithm to prioritize requests from borrowers with a higher repayment history or pressing financial needs, helping lenders make informed decisions while supporting impactful lending.

EOS Microloan ensures fair interest rates by eliminating intermediaries and connecting borrowers directly with lenders. By reducing overhead costs, the platform allows competitive rates to be set through free-market dynamics. Lenders and borrowers can negotiate terms transparently using smart contracts. To avoid predatory practices, EOS Microloan monitors interest rate trends and enforces ethical lending standards.

EOS Microloan does not rely on traditional credit scores, which can exclude many underserved borrowers. Instead, the platform evaluates borrowers based on alternative metrics, such as repayment history on the platform, community endorsements, or blockchain activity. This approach creates opportunities for individuals without traditional banking access to qualify for loans, promoting financial inclusion globally.

Yes, EOS Microloan promotes community-driven initiatives like crowdfunding pools, where multiple lenders can collectively fund high-impact loans. The platform also incentivizes community engagement by rewarding users who refer borrowers or lenders. Through its global accessibility, EOS Microloan encourages communities to collaborate and uplift underserved individuals, strengthening its impact worldwide.

You Might Also Like