About Folks Finance

Folks Finance is a decentralized finance (DeFi) platform built on the Algorand blockchain, offering innovative financial services such as lending, borrowing, and staking. As a non-custodial and fully decentralized protocol, Folks Finance empowers users by providing seamless access to liquidity, enabling them to earn interest on assets or borrow funds without intermediaries.

The platform stands out due to its high efficiency, low fees, and secure smart contract infrastructure. With deep liquidity pools and advanced algorithmic mechanisms, Folks Finance ensures optimal lending and borrowing rates. Its integration with the broader Algorand DeFi ecosystem makes it a key player in the decentralized financial landscape, providing users with a secure and scalable solution for asset management.

Folks Finance is a leading DeFi platform designed to maximize financial opportunities on the Algorand blockchain. It provides a comprehensive suite of services, including lending, borrowing, staking, and liquidity provision. As the Algorand ecosystem continues to grow, Folks Finance plays a crucial role in enhancing decentralized financial services through automation, efficiency, and security.

At its core, Folks Finance enables users to lend their assets and earn interest or borrow funds against collateralized holdings. Unlike traditional financial institutions, it operates without intermediaries, reducing costs and enhancing accessibility. The platform is fully decentralized, utilizing Algorand’s Pure Proof-of-Stake (PPoS) consensus to ensure security and transparency. Users maintain full control over their funds while benefiting from high-speed transactions and near-zero fees.

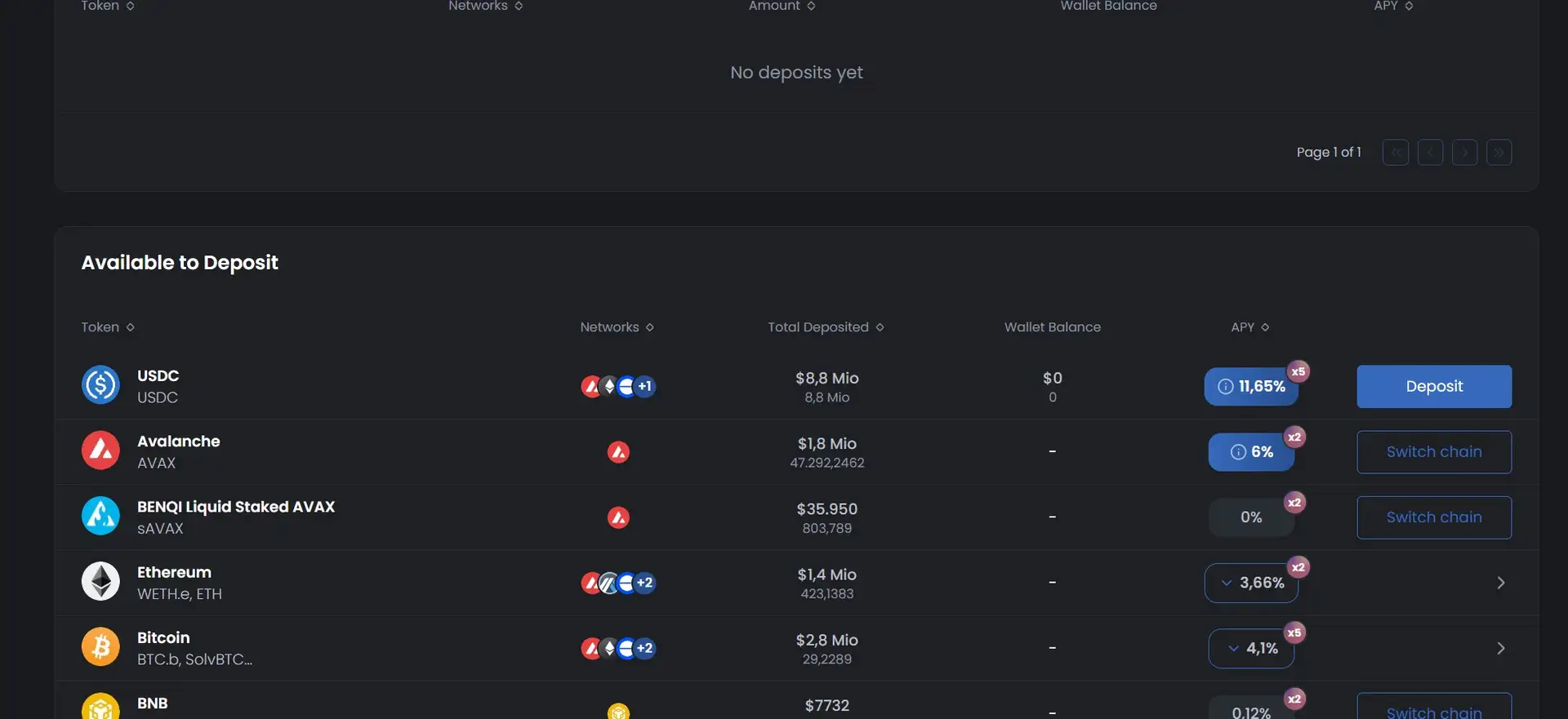

A key component of the platform is the Folks Finance Liquidity Pools, which facilitate efficient capital utilization. These pools allow users to deposit assets, providing liquidity for borrowers while earning passive income. The smart contracts automatically adjust interest rates based on supply and demand, optimizing returns for lenders and affordability for borrowers.

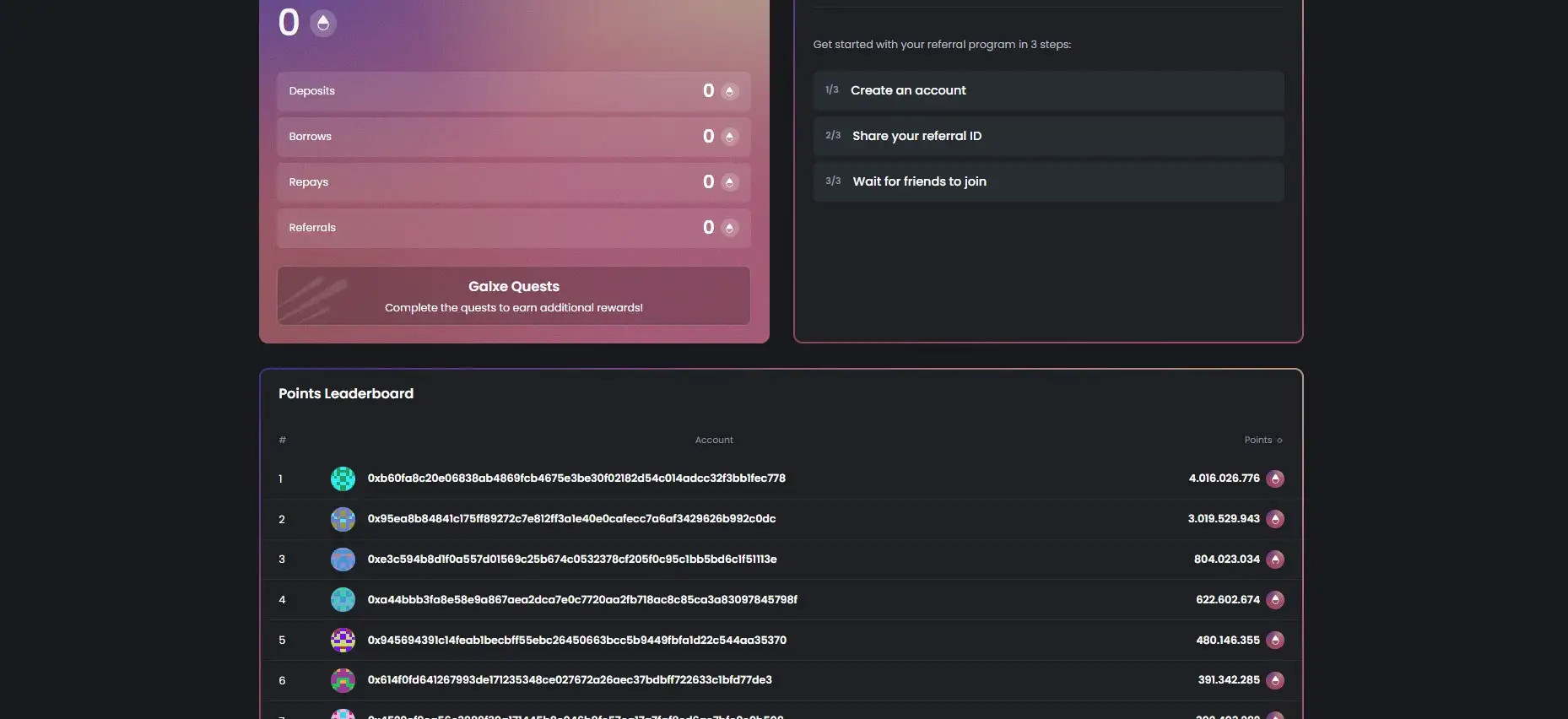

Additionally, Folks Finance offers an innovative feature called Liquid Governance. This allows users to participate in Algorand governance while maintaining liquidity for their staked assets. By tokenizing governance participation, users can stay engaged in decentralized decision-making without locking up their funds.

The platform competes with other DeFi protocols such as Aave, and Compound, but differentiates itself with Algorand-native efficiency, high security, and governance participation features. The deep integration with the Algorand ecosystem ensures a scalable and user-friendly experience for DeFi participants.

Folks Finance offers a range of features and benefits that make it a standout DeFi protocol on the Algorand blockchain:

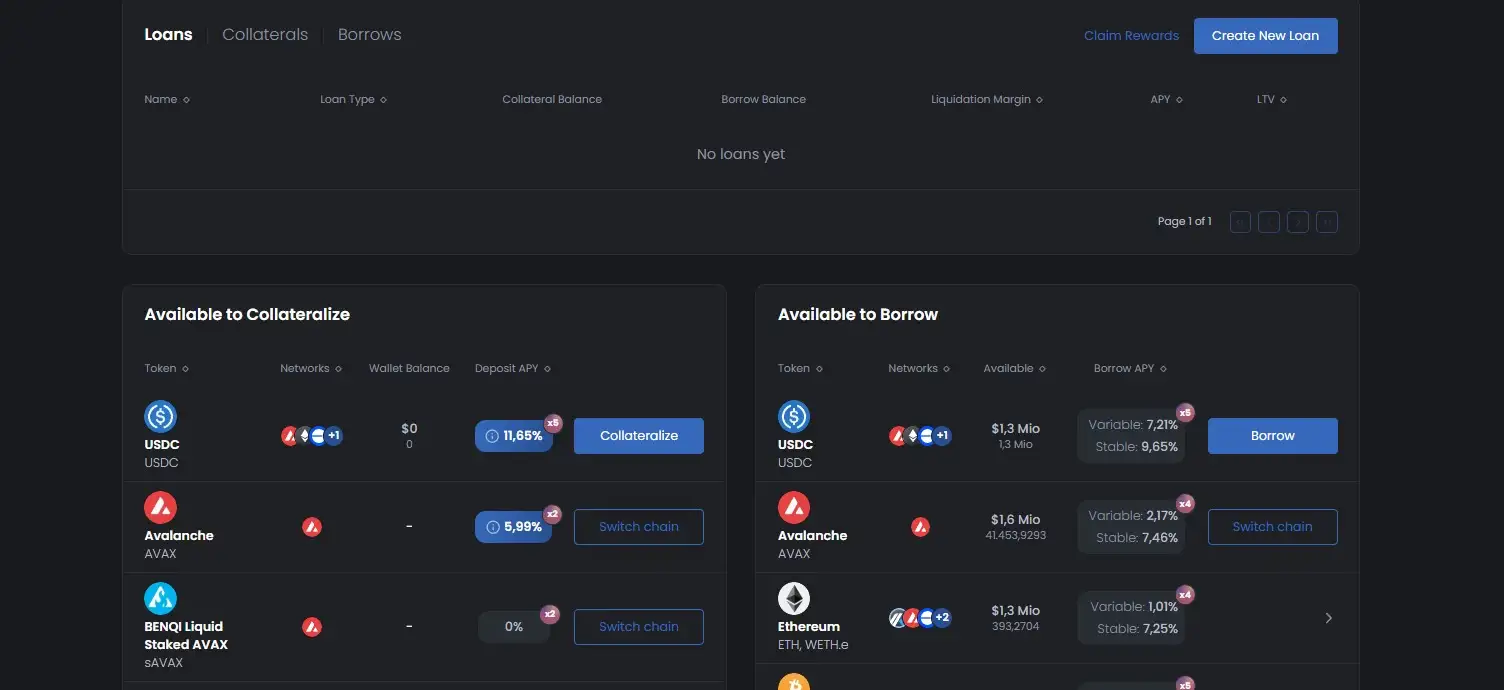

- Decentralized Lending & Borrowing: Users can lend assets to earn interest or borrow against collateral without intermediaries, ensuring full control over their funds.

- Liquid Governance: The unique Liquid Governance feature allows users to participate in Algorand governance while maintaining asset liquidity.

- Low Fees & High-Speed Transactions: Leveraging Algorand’s PPoS consensus, transactions are processed quickly with minimal costs compared to traditional Ethereum-based DeFi platforms.

- Automated & Optimized Interest Rates: Smart contracts dynamically adjust lending and borrowing rates based on market supply and demand.

- Non-Custodial & Secure: Funds remain under user control at all times, with smart contracts audited to ensure maximum security.

- Deep Liquidity Pools: Efficient liquidity provisioning enables seamless borrowing and lending experiences with competitive rates.

- Seamless Wallet Integration: Compatible with popular Algorand wallets, including Pera Wallet and MyAlgo, for easy asset management.

Getting started with Folks Finance is simple and requires just a few steps:

- Visit the Official Website: Go to Folks Finance to explore its DeFi services.

- Connect Your Wallet: Use a compatible Algorand wallet like Pera Wallet or MyAlgo to access the platform.

- Deposit Assets: Choose an asset to deposit into Folks Finance’s liquidity pools to start earning interest.

- Borrow or Stake: Borrow funds using deposited assets as collateral or stake assets for additional earnings.

- Participate in Governance: Use Liquid Governance to participate in Algorand’s decision-making without locking up funds.

- Monitor & Manage: Use the Folks Finance dashboard to track your lending, borrowing, and staking activities.

Folks Finance Reviews by Real Users

Folks Finance FAQ

Folks Finance offers a unique feature called Liquid Governance, which enables users to engage in Algorand governance without locking up their assets. When users commit ALGO tokens to governance through Folks Finance, they receive a liquid token representation, allowing them to continue using their funds for lending, borrowing, or trading while still earning governance rewards. This ensures maximum capital efficiency without sacrificing participation in the Algorand ecosystem. Learn more at Folks Finance.

If the value of your collateral falls below the required loan-to-value (LTV) ratio, your position may be partially or fully liquidated to protect the platform’s liquidity. Folks Finance uses automated smart contracts to monitor price fluctuations and execute liquidations when necessary. To avoid liquidation, users can either repay part of their loan or deposit additional collateral. The platform also provides alerts and monitoring tools to help users manage their positions effectively. Check your loan status at Folks Finance.

Folks Finance integrates with automation tools that allow users to optimize their DeFi strategies without constant manual management. Through smart contract functionalities, users can set auto-repay mechanisms, yield farming strategies, and automatic collateral top-ups to prevent liquidation risks. Additionally, third-party automation services compatible with Algorand can be used for further strategy customization.

Folks Finance prioritizes security through rigorous smart contract audits conducted by top blockchain security firms. The platform’s smart contracts are built on the highly secure Algorand blockchain, reducing attack vectors common in other ecosystems. Additionally, the protocol utilizes insurance mechanisms and bug bounty programs to mitigate risks and incentivize community-driven security enhancements.

Yes, Folks Finance supports the use of staked assets as collateral for borrowing. This feature allows users to maximize their capital efficiency by earning staking rewards while leveraging the value of their assets for loans. By staking tokens such as ALGO or other supported assets, users can maintain network participation while accessing additional liquidity for DeFi strategies. Check the latest supported staking options at Folks Finance.

You Might Also Like