About Foxify

Foxify is a next-generation decentralized trading platform that combines perpetual futures with proprietary funding programs, all underpinned by Web3 infrastructure. The project is designed to empower traders with tools and access previously exclusive to centralized systems—now offered on-chain with full transparency and trustless execution. With Foxify, users can trade synthetic perpetual contracts with up to 50x leverage while participating in a completely decentralized and censorship-resistant environment.

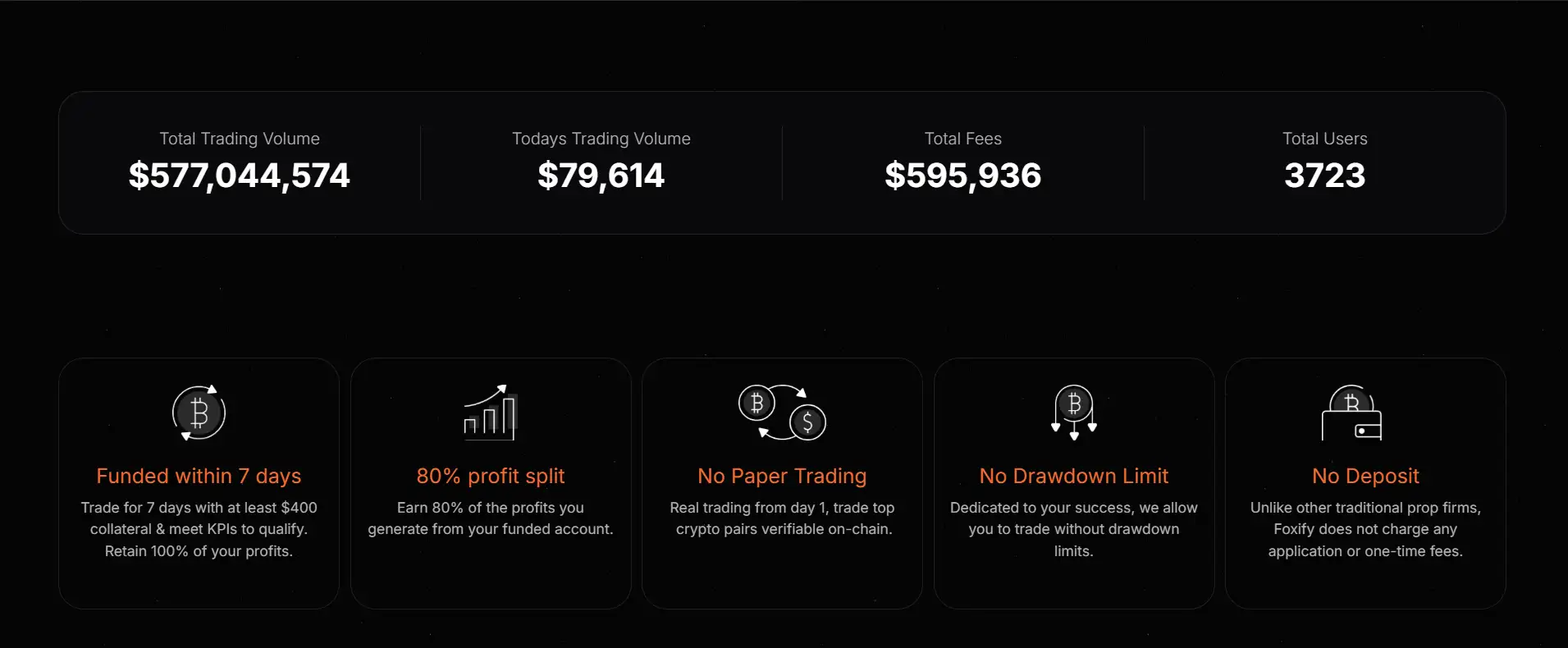

Foxify further stands out through its unique "FUNDED" program, the first and only Web3-native prop trading application. Unlike traditional firms, it allows users to access capital without any upfront fees, and keeps incentives aligned—users retain 80% of the profits they generate. Combined with seamless mobile access, gas-efficient transactions, and strong community backing, Foxify is poised to redefine the intersection of DeFi and leveraged trading.

Foxify is built as the first fully integrated Web3 trading platform offering both synthetic perpetual contracts and a proprietary trader funding mechanism. While the perpetual DEX space is filled with limitations—such as slippage, poor execution, and lack of capital efficiency—Foxify uses a synthetic peer-2-pool model to allow efficient trading with up to 50x leverage. The platform offers a high-performance trading experience with low latency, on-chain transparency, and real-time pricing powered by Pyth and Chainlink oracles.

The flagship feature, FUNDED, allows users to qualify for up to $250,000 in trading capital without KYC or application fees. Through a 7- to 25-day challenge, traders must grow their collateral by 15% to unlock funded accounts. These challenges are split into tiers ranging from $20,000 to $250,000 and reward users with 80% of net profits. Withdrawals are handled via smart contracts, ensuring instant, trustless settlements.

Key statistics from the platform show its growing traction: over $577 million in total trading volume, 3,700+ users, and nearly $600,000 in fees generated. Unlike traditional prop firms like FTMO or MyForexFunds, which profit from traders losing, Foxify is built to scale alongside its users' success. It offers a decentralized, fair, and open alternative to centralized trading evaluation systems.

By addressing critical pain points found in platforms like GMX, dYdX, and Level Finance, Foxify introduces better capital efficiency, instant execution, and fully decentralized trust mechanisms. These qualities place it in a new category of DeFi platforms focused not just on access but also sustainability and fairness in advanced trading strategies.

Foxify provides numerous benefits and features that make it a standout project in the DeFi perpetual trading ecosystem:

- High Leverage: Trade with up to 50x leverage on leading crypto pairs such as BTC, ETH, and ARB.

- Decentralized Trading Engine: Full on-chain execution with smart contracts and verifiable trade data.

- FUNDED Program: Unique to Foxify, traders can qualify for up to $250,000 in trading capital without KYC or upfront payments.

- Real Yield Earning: Stake and earn from real protocol revenue through a variety of staking pools.

- Trustless & Transparent: No signups, no deposits required—just connect your wallet and trade.

- Advanced Tools: Features like chart trading, mobile compatibility, and one-click trading (coming soon).

- Risk Management: Dynamic borrow fees and liquidity-driven position balancing to avoid pool imbalances.

- No Drawdown Limits: Focus purely on performance with zero artificial constraints.

Foxify makes it simple to begin trading on its decentralized perpetual platform. Here’s how to get started:

- Step 1 – Get a Wallet: Use a wallet compatible with the Arbitrum One Network like MetaMask, Coinbase Wallet, or WalletConnect.

- Step 2 – Fund Your Wallet: Ensure you have USDC for trading and ETH for gas fees.

- Step 3 – Connect to Foxify: Go to Foxify Perps and connect your wallet.

- Step 4 – Start Trading: Choose your trading pair, set your leverage (up to 50x), and place your trade.

- Step 5 – Explore FUNDED: Join the FUNDED challenge by depositing collateral and meeting KPIs to qualify for funded trades.

- Optional – Stake & Earn: Stake via one of the available pools to earn protocol rewards. Full guide here: Foxify Staking Guide.

Foxify FAQ

Yes, Foxify offers the world’s first Web3-native prop trading experience with no KYC, no upfront fees, and no paperwork. The FUNDED challenge allows traders to qualify for up to $250,000 in trading capital purely based on performance. All you need is a Web3 wallet and 7 days to meet the KPIs. It’s fully decentralized, so your identity remains private throughout the process.

Foxify uses a synthetic peer-2-pool model where you’re trading against a pool, not other users or market makers. That means no front-running, no slippage, and no manipulated wicks. Trades are executed on-chain, and prices are powered by trusted oracle providers like PYTH and CHAINLINK, ensuring high-accuracy real-time feeds with minimal deviation. It’s fair, transparent, and impossible to rig.

Failing the FUNDED challenge on Foxify comes with zero penalties. You retain 100% of your profits during the challenge and lose nothing if you don’t meet the 15% growth target. There are no drawdown limits, no account bans, and no reset fees. You can simply try again with a fresh challenge when ready. It’s designed to support your growth—not punish you for experimenting.

Absolutely. Foxify uses a deflationary staking model via its ebFOX pool, where 50% of all deposit and withdrawal fees are used to organically burn $FOX tokens. This creates constant buy pressure and shrinks circulating supply. On top of that, stakers earn a share of the trading fee revenue, ensuring real yield. This setup is structurally tied to platform growth and sustains long-term value for all participants.

Foxify combats these common DeFi problems through a liquidity-efficient synthetic environment. Unlike traditional AMM-based DEXs, users trade against a synthetic pool where trades do not affect the asset price. Execution is handled via smart contracts using real-time oracle data from Pyth Network, preventing price manipulation and latency exploits. This allows Foxify to deliver guaranteed, slippage-free execution for all users.

You Might Also Like