About Frankencoin

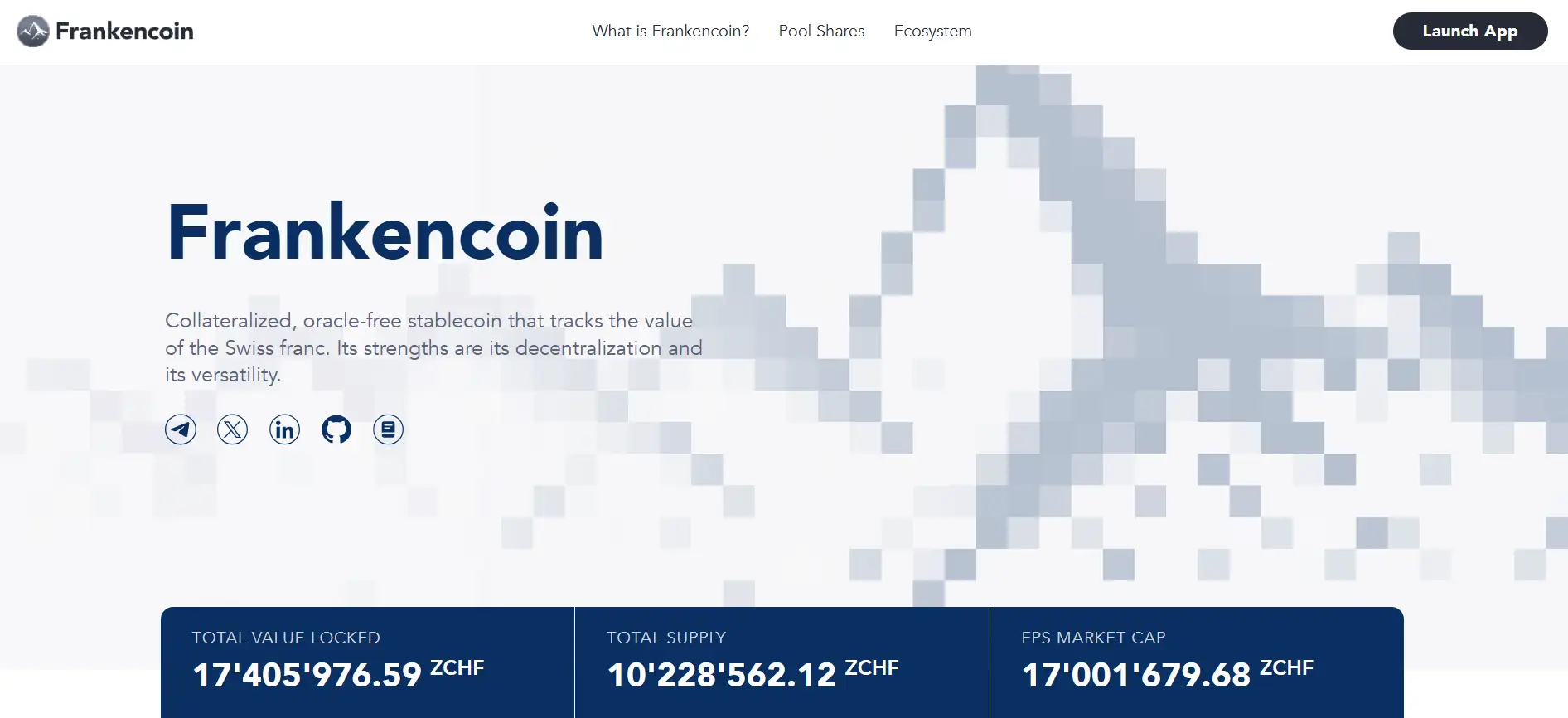

Frankencoin is a fully decentralized and oracle-free stablecoin protocol that mirrors the value of the Swiss Franc (CHF). It operates on the Ethereum mainnet and supports multiple chains, including Arbitrum, Polygon, Optimism, and Base. As a Swiss innovation rooted in academic research, Frankencoin presents a unique alternative to dollar-pegged stablecoins, providing CHF-denominated digital value without the reliance on centralized issuers or oracles. This empowers users with complete sovereignty over collateral and minting processes.

Designed as a versatile financial primitive, Frankencoin enables users to mint new coins using various forms of collateral, make payments, and earn yield through decentralized savings mechanisms. With zero centralized control and a veto-based governance system, the protocol offers a forward-thinking solution for global DeFi participants who seek resilient monetary infrastructure beyond the dollar standard.

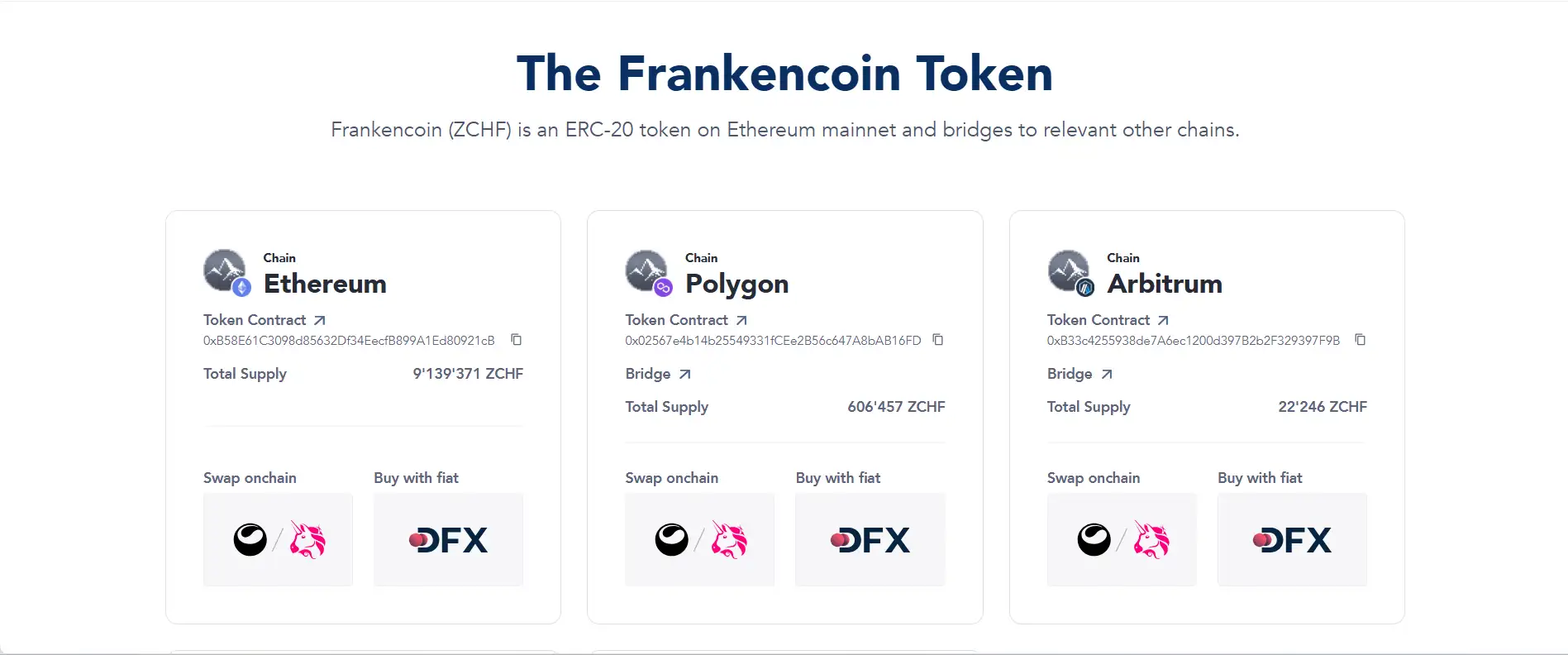

Frankencoin emerged from a PhD research project at the University of Zurich’s Department of Finance and is inspired by economic game theory and decentralized governance principles. Its architecture is based on the concept of a “Continuous Capital Corporation,” which allows for automatic minting and redemption of tokens under a fixed ruleset. The system’s primary stablecoin, ZCHF, is pegged to the Swiss Franc and exists as an ERC-20 token across several chains. With a total supply of over 10 million ZCHF and more than 17 million ZCHF in value locked, the protocol is already demonstrating real adoption.

What sets Frankencoin apart is its oracle-free liquidation mechanism. Instead of using price feeds from third-party oracles, the protocol relies on market-driven incentives and community governance to manage risk. The governance model itself is uniquely veto-based: while anyone can propose new collateral types or system changes, only 2% of the voting power is needed to reject a proposal. This ensures decentralization without compromising on security or resilience.

The Frankencoin ecosystem extends beyond simple stablecoin functionality. Users can mint new ZCHF, pay with it using integrated payment solutions like Ammer.cash, and earn by participating in savings mechanisms. The protocol also supports Pool Shares (FPS), a governance token representing equity capital. Holders of FPS participate in fee distribution and liquidation proceeds but also take on residual system risk, similar to equity holders in a traditional bank. Their incentive is to grow and stabilize the system while benefiting from its success.

The platform integrates with a growing number of Swiss and European fintech players including Aktionariat for tokenized shares, DFX for fiat on/off ramps, and Uniswap for decentralized exchange access. This ecosystem approach reflects Frankencoin’s goal to offer a robust, multi-functional DeFi infrastructure for institutional and retail users alike.

Frankencoin provides numerous benefits and features that set it apart in the decentralized stablecoin space:

- Oracle-Free Stability: Maintains the CHF peg using market dynamics instead of external price feeds, reducing manipulation and dependency.

- Fully Decentralized: Governed by community stakeholders through a veto-based system, with no centralized entity controlling minting or supply.

- Multi-Chain Compatibility: Live on Ethereum, Polygon, Arbitrum, Optimism, and Base with seamless bridging and on-chain swapping.

- Academic Foundation: Built upon rigorous financial theory from the University of Zurich, ensuring a robust and well-modeled protocol design.

- Real-World Applications: Integrated with payment, tokenization, and DeFi services including wallets, merchant tools, and tokenized equity platforms.

- Permissionless Minting: Anyone can mint ZCHF by locking accepted collateral—no gatekeeping or whitelisting required.

- Sustainable Yield: Users can lock ZCHF and earn yield through decentralized savings products, contributing to platform health and scalability.

Frankencoin is designed to be accessible to both crypto-savvy users and newcomers. Here’s how to get started with Frankencoin:

- Step 1 – Choose Your Chain: Frankencoin is live on Ethereum, Polygon, Arbitrum, Optimism, and Base. Select your preferred network.

- Step 2 – Access the App: Visit the Frankencoin website and click on “Launch App” to access the protocol interface.

- Step 3 – Connect a Wallet: Use wallets like MetaMask, WalletConnect, or other EVM-compatible options.

- Step 4 – Mint or Buy ZCHF: Mint ZCHF by depositing collateral, or swap on supported DEXs like Uniswap. You can also buy using fiat through DFX.

- Step 5 – Start Using ZCHF: Use ZCHF to pay, save, or invest in various DeFi opportunities across the ecosystem.

- Optional – Explore Ecosystem Apps: Browse services like Aktionariat for tokenized securities or Ammer.cash for crypto payments.

Frankencoin FAQ

Frankencoin relies on a unique oracle-free liquidation mechanism that uses open-market incentives rather than external price feeds. When minting ZCHF, users must overcollateralize with approved assets. If the collateral's value drops too low, others can liquidate the position to protect the system. This design reduces manipulation risk and dependency on third-party oracles, ensuring trustless and decentralized price stability.

In the Frankencoin governance model, any proposal to add a new collateral type can be vetoed by stakeholders. Only 2% of the total voting power is needed to block any proposal. This means that risky or low-quality collateral types can be quickly rejected, ensuring that only secure and broadly accepted assets enter the minting process. The system prioritizes security and decentralization through this flexible, community-driven governance.

Frankencoin is designed to offer currency diversity within the DeFi space by pegging its value to the Swiss Franc (CHF), one of the world’s most stable fiat currencies. Most stablecoins are USD-pegged, creating systemic risk due to dollar dependency. By introducing a CHF-denominated option, Frankencoin opens up new opportunities for Europeans, Swiss users, and global investors seeking alternative stable digital assets.

Not quite. While Frankencoin is permissionless and allows minting by anyone, only approved collateral types can be used. These assets are subject to governance approval, and the process includes a veto mechanism to ensure safety. Currently supported collateral types are chosen based on volatility, liquidity, and risk metrics. The goal is to keep ZCHF stable and overcollateralized while allowing innovation in asset selection.

Yes. Frankencoin was conceived as part of a PhD thesis in finance at the University of Zurich. The protocol’s design is grounded in game theory and introduces the concept of a “Continuous Capital Corporation.” This theoretical model allows tokens to be issued and redeemed according to optimal economic principles under a wide range of assumptions. It’s one of the few stablecoin protocols with a rigorous academic foundation.

You Might Also Like