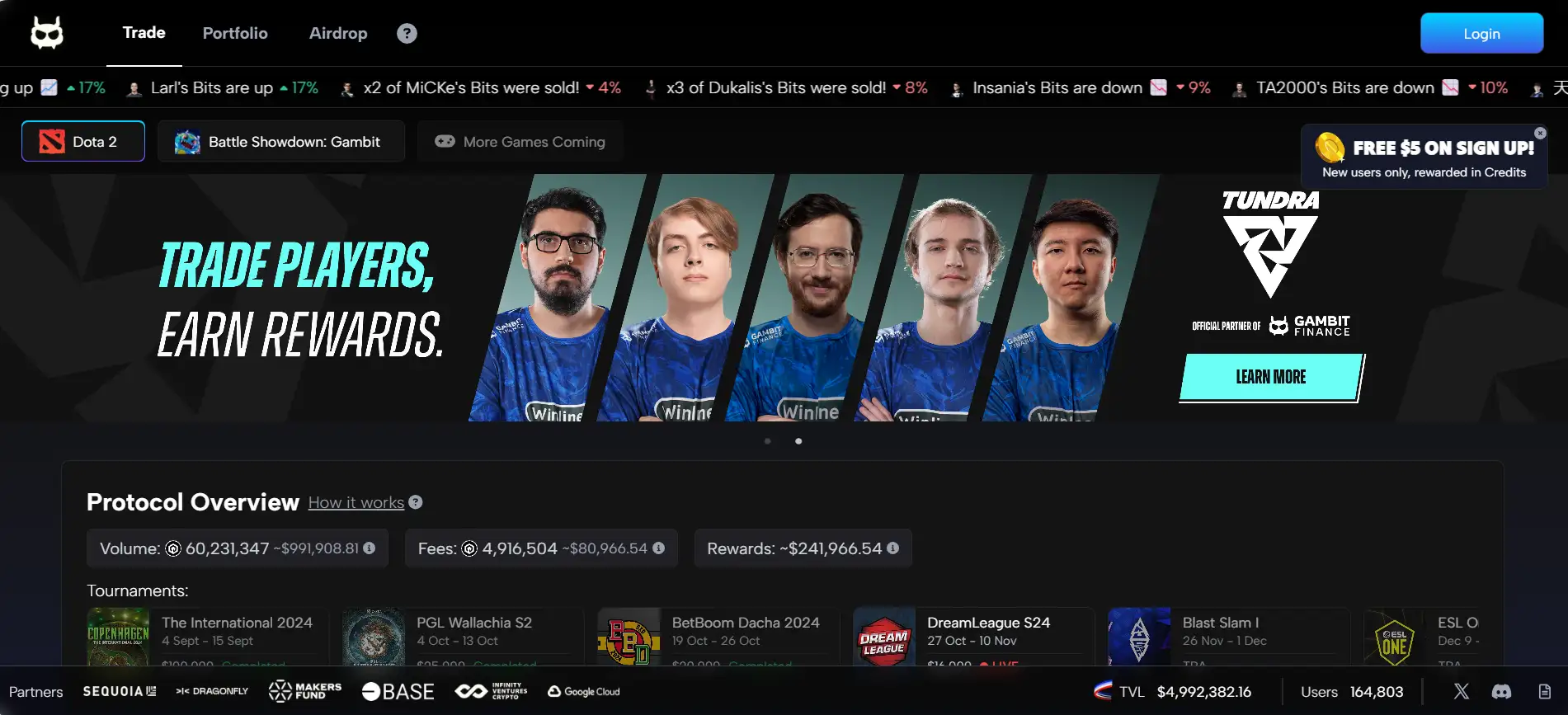

About Gambit Finance

Gambit Finance is a cutting-edge decentralized trading platform built on the Binance Smart Chain (BSC). It specializes in offering perpetual futures and spot trading without relying on intermediaries, enabling users to maintain full control of their assets. By leveraging the efficiency and scalability of blockchain technology, Gambit Finance provides traders with a transparent, trustless environment that minimizes risks associated with centralized platforms. Its mission is to revolutionize the trading landscape by offering advanced tools and features tailored to the needs of both beginners and experienced traders.

Through features such as portfolio margining and leverage trading, Gambit Finance empowers users to optimize their trading strategies while keeping fees and processing times low. Unlike traditional trading platforms, all transactions on Gambit are conducted on-chain, ensuring security and transparency. Competing with platforms like dYdX, Perpetual Protocol, and GMX, Gambit distinguishes itself through its user-friendly design, cost-efficient operations, and innovative approach to margining and trading.

Gambit Finance, launched on the Binance Smart Chain, is a decentralized trading protocol specializing in perpetual futures and spot trading. By combining the efficiency of blockchain technology with advanced trading tools, Gambit offers a platform where traders can fully control their assets while accessing diverse financial instruments. Its core design revolves around transparency, efficiency, and user autonomy, making it a popular choice for traders seeking a decentralized solution to traditional finance.

One of the standout features of Gambit Finance is its portfolio margining system. This allows traders to use their entire portfolio as collateral, enhancing flexibility and capital efficiency. Additionally, the platform supports leveraged trading, enabling users to amplify their positions for potentially higher returns. The low fees and fast transaction speeds—courtesy of the BSC network—further enhance the user experience, making the platform accessible for both casual and professional traders.

Gambit’s decentralized nature ensures that all trades are executed on-chain, providing a level of transparency and security that centralized platforms cannot match. Using an automated market maker (AMM) system, the platform maintains liquidity and ensures fair pricing across assets. Moreover, the absence of intermediaries reduces risks like hacking, withdrawal restrictions, and operational censorship often associated with centralized exchanges.

In terms of competition, Gambit Finance faces rivals such as dYdX, which excels in advanced perpetual contracts, Perpetual Protocol, known for its virtual AMM model, and GMX, which offers a robust liquidity pool structure. Despite this, Gambit’s focus on simplicity, portfolio margining, and cost-effective operations positions it as a compelling alternative for traders looking to optimize their strategies on a decentralized platform.

Gambit Finance offers a robust set of features and benefits that cater to a wide range of traders:

- Decentralized and Transparent: All transactions are executed on-chain, ensuring full transparency and removing the need for intermediaries.

- Portfolio Margining: Traders can use their entire portfolio as collateral, allowing for increased flexibility and efficient capital usage.

- Leverage Trading: Gambit supports leveraged trading, enabling users to amplify their positions and potentially achieve higher returns.

- Low Fees: Built on the Binance Smart Chain, Gambit benefits from low transaction fees, making it an affordable option for traders.

- User Ownership: Unlike centralized platforms, users retain full control over their assets, reducing risks associated with hacking or withdrawal restrictions.

- Advanced Trading Tools: The platform offers a range of trading tools, including stop-loss and take-profit features, for precise trading management.

- Scalable and Fast: Leveraging BSC’s high-speed capabilities, trades are executed quickly and efficiently.

- Beginner-Friendly Interface: The intuitive design ensures accessibility for all traders, regardless of experience level.

Getting started with Gambit Finance is straightforward. Follow these steps to begin trading:

- Visit the Website: Go to the official Gambit Finance website.

- Set Up a Wallet: Ensure you have a compatible wallet, such as MetaMask or Trust Wallet, installed and funded with BNB or supported assets.

- Connect Your Wallet: Use the "Connect Wallet" button on the website to link your wallet to the platform.

- Deposit Funds: Transfer assets to your wallet for trading, ensuring you have sufficient BNB for transaction fees.

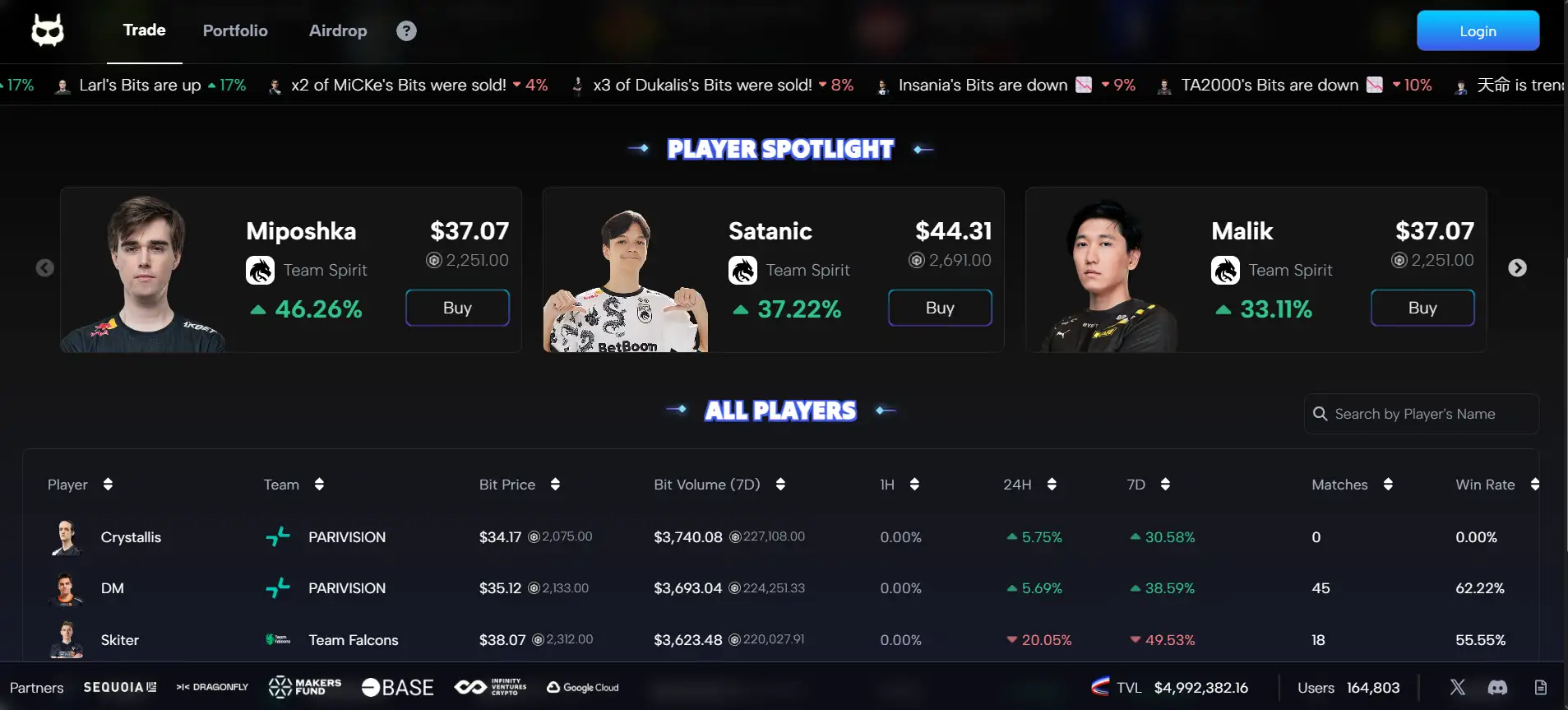

- Choose a Market: Explore available trading pairs and select the desired market for spot or perpetual trading.

- Place Trades: Enter your trade parameters, including leverage, stop-loss, and take-profit levels, then execute the trade.

- Monitor and Adjust: Use the dashboard to track your trades and make adjustments as necessary to optimize your strategy.

Gambit Finance FAQ

Gambit Finance utilizes a unique portfolio margining system that allows traders to use their entire portfolio as collateral for trades. This means that instead of limiting collateral to a single asset, the system calculates a user’s total asset value to determine their margin. This flexibility enables traders to optimize capital efficiency and better manage risk across different positions.

Gambit Finance ensures security by operating entirely on-chain, which provides full transparency and verifiability of transactions. Unlike centralized exchanges, users retain custody of their assets at all times, reducing risks like hacking or unauthorized withdrawals. Additionally, the protocol undergoes regular security audits to ensure it meets the highest standards of safety and reliability.

Yes, building on the Binance Smart Chain (BSC) provides Gambit Finance with significant advantages, including low transaction fees and high-speed processing. These features ensure that trades are executed quickly and cost-effectively, which is particularly beneficial for high-frequency or leveraged traders. Additionally, the robust infrastructure of BSC allows Gambit to scale efficiently as user demand grows.

Yes, Gambit Finance supports leverage trading, allowing users to amplify their positions. The platform provides integrated risk management tools, including stop-loss and take-profit mechanisms, which enable traders to automate their strategies and minimize potential losses. These features are designed to make leveraged trading safer and more accessible, even for users with limited experience.

Gambit Finance employs an automated market maker (AMM) system to maintain liquidity for trading pairs. The AMM uses algorithms to calculate asset prices and ensures that users can execute trades without relying on order books or centralized market makers. This approach enhances liquidity availability and reduces slippage, even during periods of high market volatility.

You Might Also Like