About GammaSwap

GammaSwap is a decentralized liquidity protocol designed to transform the DeFi landscape by offering liquidity providers (LPs) a unique way to profit from volatility while minimizing the risks of impermanent loss. By allowing users to long or short liquidity pools, GammaSwap opens up entirely new financial opportunities for traders and LPs. This innovative approach empowers users to engage with decentralized exchanges (DEXs) more efficiently and profitably. The platform’s primary goal is to enhance DeFi functionality and create a more dynamic and equitable trading environment.

Through seamless integration with major DEXs such as Uniswap, SushiSwap, and Balancer, GammaSwap provides users with tools to maximize their profits while ensuring capital efficiency. Its mission is to empower traders and liquidity providers with advanced tools to thrive in a rapidly changing financial landscape. By addressing pain points like impermanent loss and the lack of volatility-focused instruments, GammaSwap aims to redefine how users interact with DeFi protocols.

GammaSwap is a revolutionary DeFi protocol that enables traders and liquidity providers to unlock the financial potential of market volatility. At its core, the platform introduces the concept of trading liquidity itself as an asset, allowing users to hedge against risks or speculate on market dynamics. By building an additional layer on top of existing DEXs, GammaSwap makes it possible for users to earn from volatility and mitigate impermanent loss simultaneously.

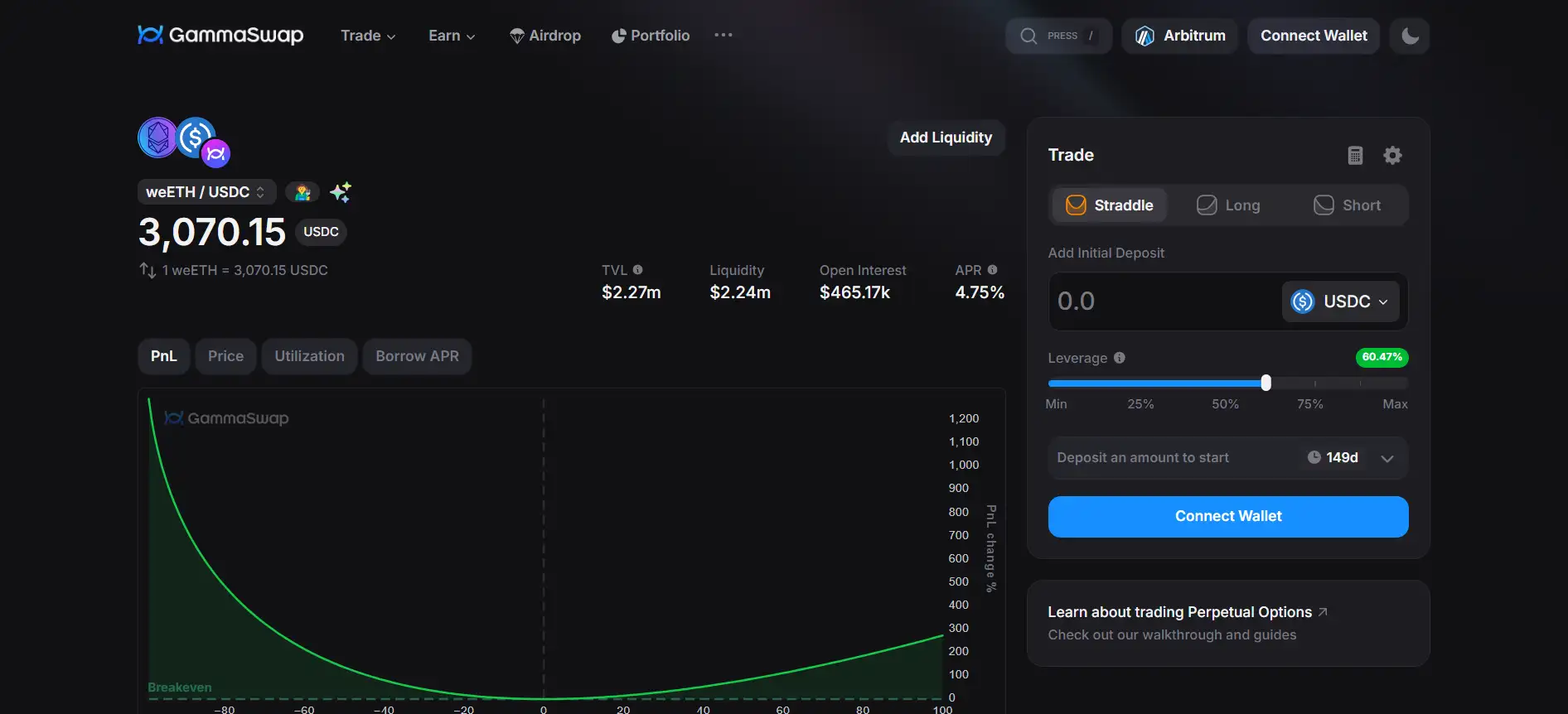

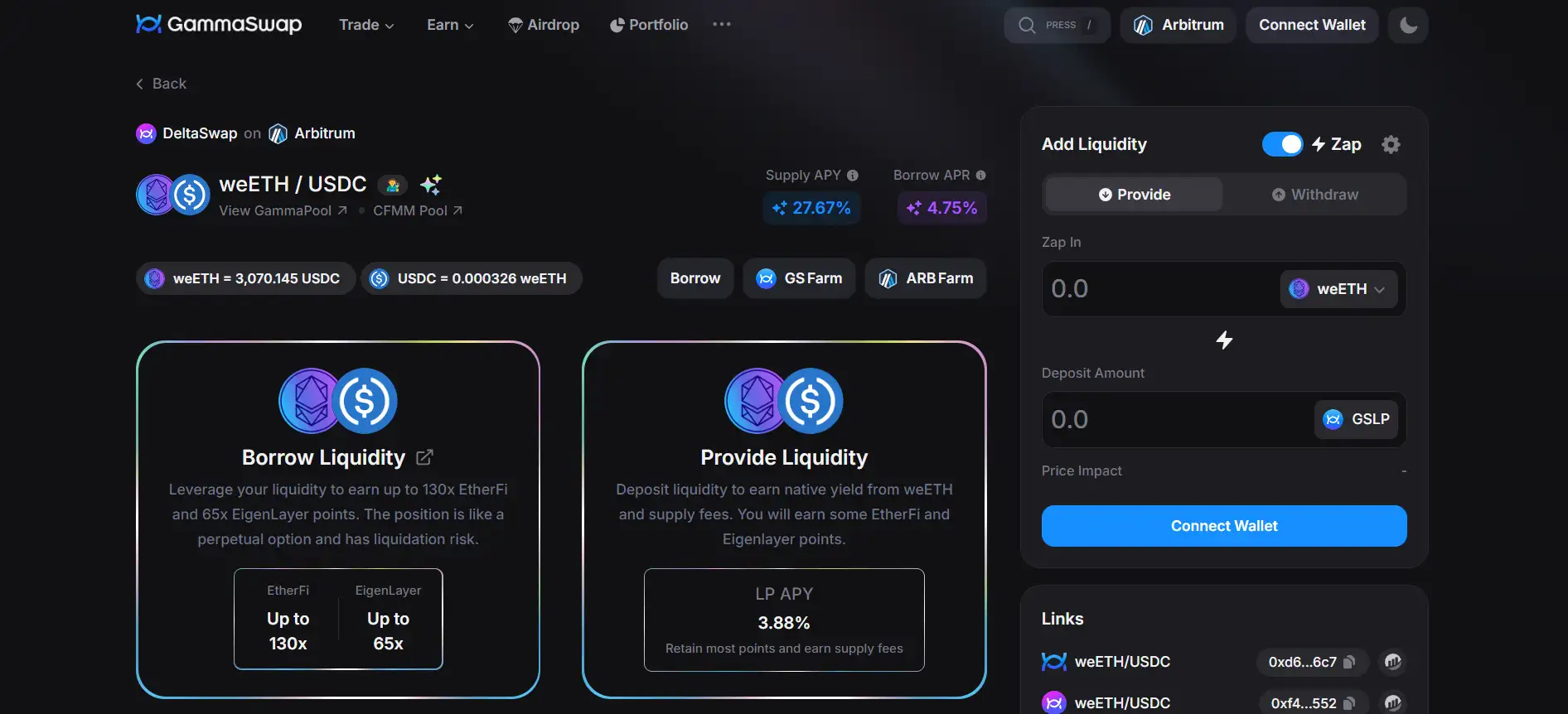

The protocol operates by letting users borrow or lend liquidity using collateral. Traders can speculate on the volatility of liquidity pools, while LPs can enjoy a steady income stream regardless of market fluctuations. This innovative approach is particularly valuable for those who want to engage in volatility trading without the need to hold underlying assets. As a result, GammaSwap expands the scope of financial instruments available in the DeFi space.

One of the key features of GammaSwap is its seamless integration with major decentralized exchanges like Uniswap, SushiSwap, and Balancer. This ensures that users can enhance their existing liquidity strategies without disrupting their current setups. Compared to competitors like dHEDGE and Ribbon Finance, which focus on portfolio management and options, GammaSwap offers a unique approach by directly targeting the dynamics of liquidity and volatility.

Since its launch, GammaSwap has positioned itself as a pioneer in the DeFi ecosystem, continually pushing the boundaries of what is possible with decentralized liquidity. By addressing critical pain points like impermanent loss and providing advanced tools for volatility trading, the platform ensures its relevance in a competitive and fast-evolving market. Its innovative solutions not only benefit traders but also improve the efficiency and depth of liquidity in the broader DeFi ecosystem.

GammaSwap introduces several unique benefits and features that make it a standout player in the DeFi space:

- Volatility Trading: GammaSwap enables users to trade volatility directly without needing exposure to the underlying assets, providing traders with a new way to profit from market movements.

- Protection Against Impermanent Loss: Liquidity providers can leverage the platform to hedge against impermanent loss, ensuring their profitability even during volatile market conditions.

- Seamless Integration: The protocol integrates with leading DEXs like Uniswap, SushiSwap, and Balancer, enabling users to enhance their existing strategies effortlessly.

- Borrowing and Lending of Liquidity: By allowing liquidity to be borrowed or lent with collateral, GammaSwap introduces a unique financial instrument to the DeFi ecosystem.

- User-Friendly Interface: The platform is designed with simplicity in mind, ensuring that users of all experience levels can benefit from its features.

Getting started with GammaSwap is straightforward. Follow these steps to begin:

- Visit the Official Website: Go to the GammaSwap website to explore its offerings and features.

- Connect Your Wallet: Click on “Connect Wallet” and link a wallet like MetaMask, WalletConnect, or Coinbase Wallet to start.

- Select a DEX: Choose from supported decentralized exchanges such as Uniswap, SushiSwap, or Balancer to find a liquidity pool that suits your goals.

- Explore Liquidity Positions: Utilize the platform’s intuitive interface to go long or short on liquidity, depending on your trading strategy.

- Monitor Your Portfolio: Use the dashboard on GammaSwap to keep track of your trades and optimize your strategy over time.

- Leverage Learning Resources: Review the guides and documentation available on the GammaSwap website for additional support and tips.

GammaSwap FAQ

GammaSwap offers a unique mechanism that allows liquidity providers to mitigate impermanent loss by trading liquidity as an asset. By borrowing or lending liquidity in exchange for collateral, users can create a hedge that offsets potential losses caused by market volatility. This strategy ensures that LPs can maintain profitability even when token prices fluctuate significantly. Learn more about how this works on the GammaSwap website.

Yes, GammaSwap enables traders to profit from market volatility without owning the underlying tokens. The platform allows users to speculate on the volatility of liquidity pools directly, providing a unique way to capture profits from price movements without the risks of holding volatile assets.

Liquidity longs and shorts are innovative financial instruments introduced by GammaSwap. A liquidity long allows users to borrow liquidity to capitalize on an increase in pool value, while a liquidity short lets users bet against a pool’s performance. These tools enable traders to profit from both upward and downward market movements, making GammaSwap a versatile platform for volatility-based strategies.

GammaSwap is designed to cater to both experienced traders and newcomers to the DeFi space. The platform features a user-friendly interface and comprehensive guides, ensuring that even those new to DeFi can easily navigate its features. Advanced tools like liquidity longs and shorts are available for experienced users, while simplified functionalities make the platform accessible to all.

You Might Also Like