About GMX

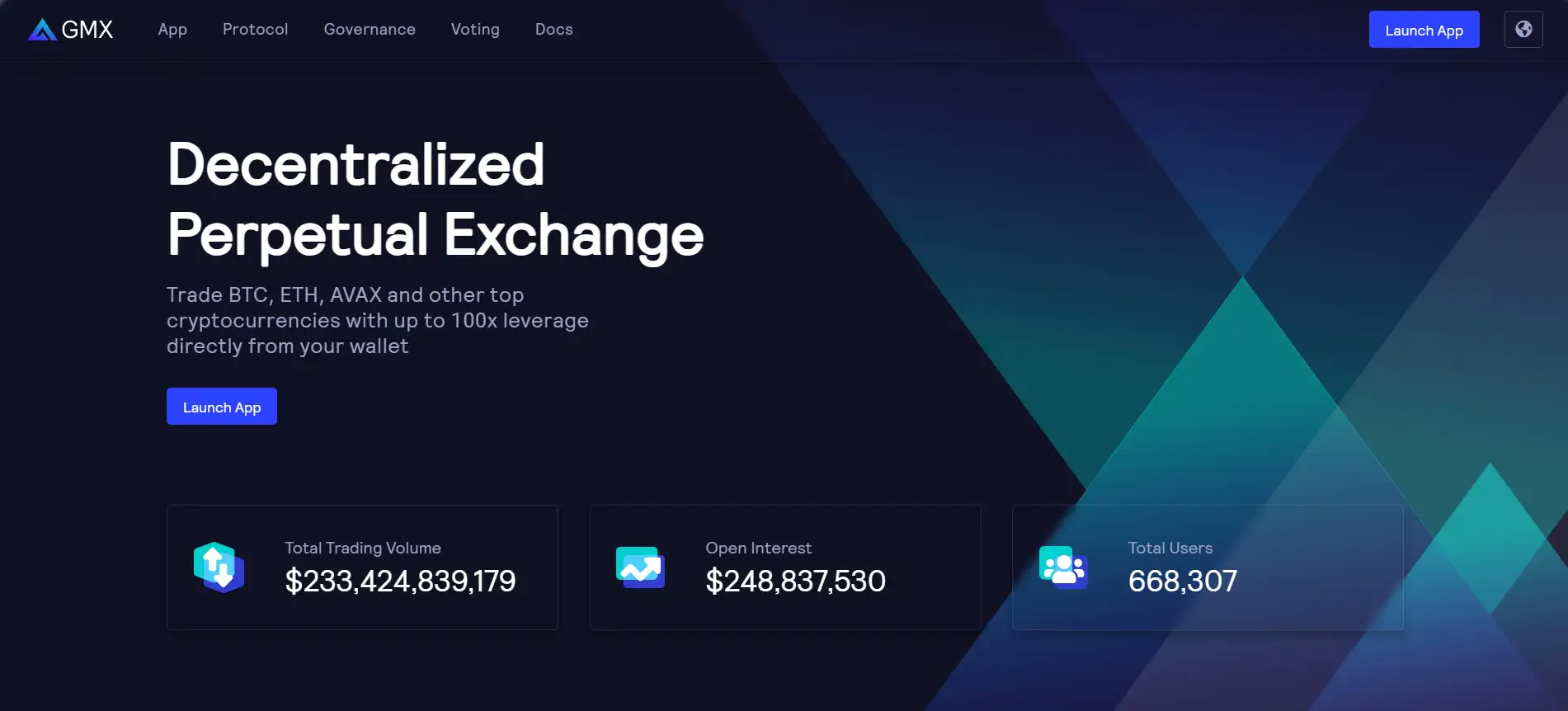

GMX is a cutting-edge decentralized perpetual exchange that operates on the Arbitrum and Avalanche networks. It allows users to trade major cryptocurrencies, such as Bitcoin (BTC) and Ethereum (ETH), with up to 50x leverage. Designed to offer a seamless trading experience, the platform eliminates slippage by using Chainlink Oracles and pricing feeds from top exchanges. GMX prioritizes user empowerment, transparency, and efficiency, enabling traders and liquidity providers to benefit from decentralized finance without relying on centralized intermediaries.

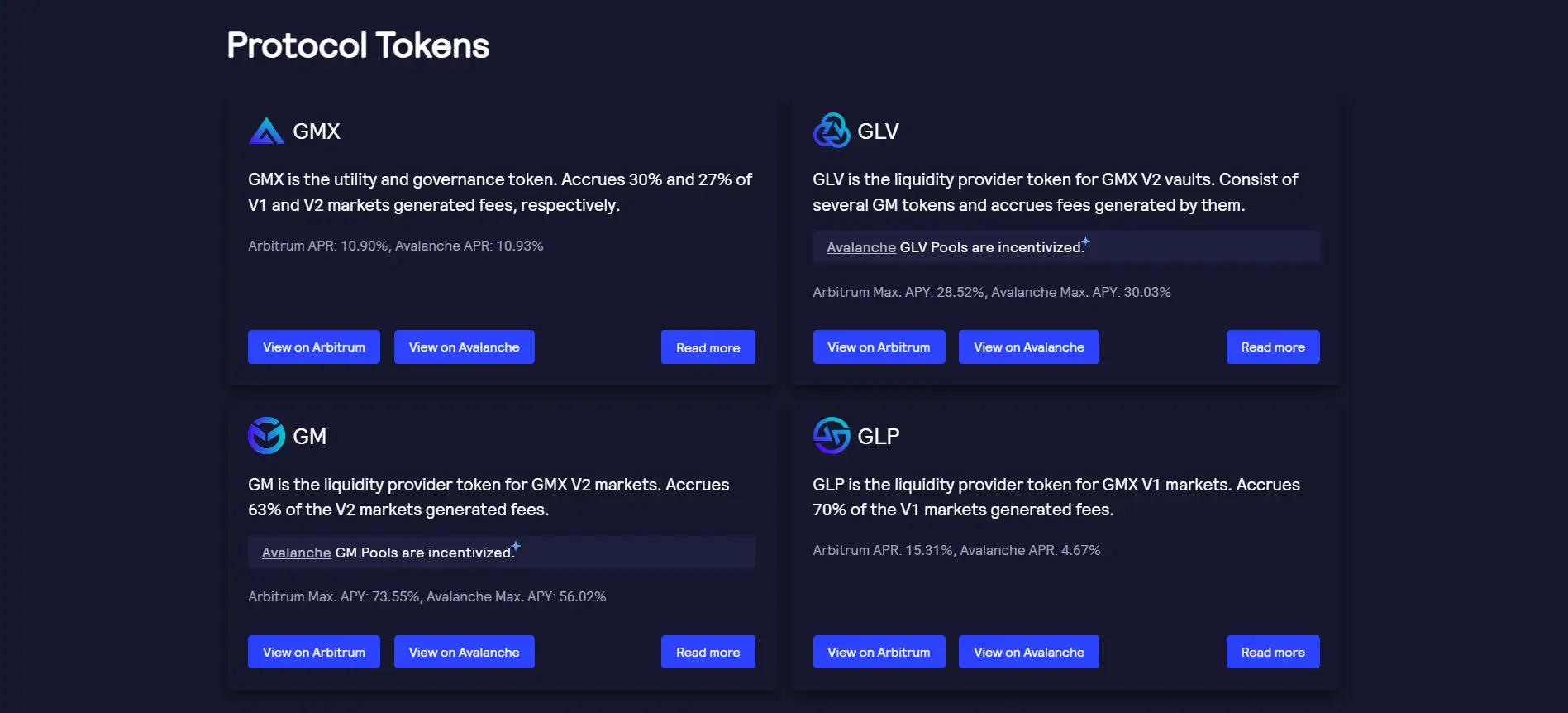

The platform's standout features include low trading fees, high leverage, and a robust liquidity model powered by its GLP token. Liquidity providers can stake assets in the GLP pool, earning rewards from transaction fees, while traders gain access to highly liquid markets. With its focus on innovation and user-centric solutions, GMX is transforming decentralized trading, bridging the gap between DeFi and professional-grade trading platforms.

GMX is a decentralized perpetual trading platform that was launched in September 2021. Built on the Arbitrum and Avalanche networks, GMX offers users a fast, cost-efficient, and scalable trading experience. The platform is designed to address key challenges in traditional and centralized exchanges, including high fees, slippage, and the lack of transparency. By integrating Chainlink Oracles and liquidity from leading exchanges, GMX ensures that all trades are executed at precise market prices with zero slippage.

A significant innovation introduced by GMX is its GLP pool, which functions as a multi-asset liquidity system. Liquidity providers deposit assets such as stablecoins and major cryptocurrencies into the pool and earn rewards from transaction fees and other incentives. This model not only ensures deep liquidity for traders but also provides passive income opportunities for liquidity providers. GMX’s platform supports leveraged trading, enabling users to open positions with up to 50x leverage, which is particularly appealing to professional traders.

In addition to its innovative trading features, GMX has established itself as a leader in the decentralized trading space by prioritizing community-driven governance. Token holders actively participate in shaping the platform’s future through proposals and voting, ensuring that the platform evolves in alignment with its users’ needs. This decentralized ethos sets GMX apart from competitors like Perpetual Protocol, dYdX, and Gains Network.

Since its launch, GMX has achieved several milestones, including robust user adoption and continuous feature enhancements. The platform has recently introduced advanced risk management tools and detailed analytics to support traders in optimizing their strategies. Additionally, GMX’s low-fee structure, transparent operations, and commitment to decentralization have solidified its reputation as a trusted and innovative trading platform in the DeFi ecosystem.

GMX stands out due to its unique set of benefits and features:

- Zero-Slippage Trading: Accurate trade execution using Chainlink Oracles and liquidity from top exchanges.

- Permissionless and Decentralized: No reliance on centralized intermediaries, ensuring full user control.

- High Leverage Options: Trade with up to 50x leverage, enabling substantial returns with smaller investments.

- Incentives for Liquidity Providers: Earn rewards through the GLP pool by contributing liquidity.

- Multi-Chain Support: Operates on Arbitrum and Avalanche for low-cost and high-speed transactions.

- Transparent Governance: Community-driven decisions via governance proposals and voting mechanisms.

- Low Transaction Fees: A cost-efficient fee structure that caters to both retail and professional traders.

Getting started with GMX is simple and intuitive. Follow these steps:

- Set Up a Web3 Wallet: Install a compatible wallet, such as MetaMask, and configure it to support Arbitrum or Avalanche.

- Connect Your Wallet: Visit the official GMX platform and link your wallet by clicking "Connect Wallet."

- Fund Your Wallet: Deposit cryptocurrencies like ETH or AVAX to your wallet for trading and gas fees.

- Start Trading: Go to the trading interface, choose a trading pair, and place your trade with options for high leverage.

- Provide Liquidity: To earn passive income, deposit assets into the GLP pool and start receiving rewards.

GMX FAQ

GMX uses Chainlink Oracles and pricing feeds from major exchanges to provide accurate and transparent market prices. By aggregating data from multiple sources, GMX eliminates slippage, ensuring that trades are executed at the exact price requested without deviation.

The GLP pool is GMX's liquidity mechanism, consisting of assets such as stablecoins and major cryptocurrencies. Liquidity providers contribute assets to the pool and receive GLP tokens in return. These providers earn rewards through trading fees and additional incentives. To join, visit GMX.

Yes, GMX is designed to be user-friendly, even for those new to decentralized exchanges. The platform provides clear guides, a simple interface, and detailed analytics. Visit GMX Documentation to learn how to get started.

Leveraged trading can amplify profits but also increases potential losses. Traders on GMX must monitor market movements closely, as liquidation can occur during high volatility. It is essential to understand risk management and only trade amounts you are willing to lose.

GMX allows token holders to participate in decision-making through governance proposals and voting mechanisms. Users can vote on platform updates, new features, and policies, ensuring that the community plays a central role in shaping the project’s future direction.

You Might Also Like