About Goat Protocol

Goat Protocol is redefining the way crypto users interact with yield opportunities by offering automated, intelligent, and optimized yield vaults across the most secure DeFi protocols. Rather than expecting users to chase marginal gains manually, Goat Protocol turns idle capital into high-performance investments through smart vaults that reallocate funds to the top-performing strategies in real time.

Designed for both novice and experienced investors, Goat Protocol focuses on solving “lazy wealth” by simplifying access to yield-bearing DeFi strategies. Through its smart contract system and data-driven oracles, Goat automates everything from asset conversion to fund allocation—removing the need to track APYs or manually rebalance portfolios. Its unique integrations with Uniswap v4 hooks, custom vault infrastructure, and real-time strategy execution make it a highly efficient and user-friendly DeFi platform that consistently delivers market-leading returns.

Goat Protocol is an automated yield optimization platform that reimagines passive income for crypto holders by eliminating idle capital and maximizing capital efficiency. At its core, Goat utilizes multi-strategy yield vaults that dynamically allocate user deposits across top-performing DeFi protocols, ensuring optimal returns at all times. Through data aggregation, oracle-driven proposals, and smart contract automation, the protocol acts as a sophisticated robo-advisor for DeFi yields, handling rebalancing and compounding without user intervention.

Users can deposit any major cryptocurrency, which is automatically converted to the vault’s base asset using Goat Zap. From there, the funds are allocated across integrated yield strategies on platforms like Uniswap v4, with oracles continuously monitoring performance metrics such as APY, TVL, security scores, and historical yield stability. If a more profitable opportunity is detected, the oracle proposes a reallocation, which is reviewed and executed by protocol managers, keeping vaults optimized at all times.

Goat also tackles one of DeFi’s long-standing problems—idle LP capital. With its integration of Uniswap v4 hooks, Goat ensures that even out-of-range LP positions remain productive. This means liquidity providers can continue earning yield without constant manual rebalancing. On the backend, automated asset reallocation occurs through smart contracts using a secure trigger mechanism, translating oracle signals into real-time fund movements without latency.

Advanced users can also deploy custom vaults using Goat’s middleware infrastructure. These vaults allow users to define their own parameters and strategies while earning yield from other participants using them. This supports a decentralized, permissionless layer of community-generated yield optimization that encourages innovation.

Security is prioritized with audits by Blocksec, Fortifyx, and Tpiliposian. Goat Protocol’s smart contracts are modular, efficient, and built to scale. Everything is governed by the community via the GOA DAO, which also manages the protocol’s limited-supply GOA token. Unlike centralized yield platforms, Goat Protocol remains non-custodial, trustless, and aligned with the core ethos of decentralized finance. Competitors such as Yearn Finance, Beefy, and Autofarm offer similar aggregation, but lack Goat's advanced use of oracle-driven strategies, LP utility via v4 hooks, and custom vault deployment flexibility.

Goat Protocol offers cutting-edge features and benefits that make it a top-tier choice for yield optimization in DeFi:

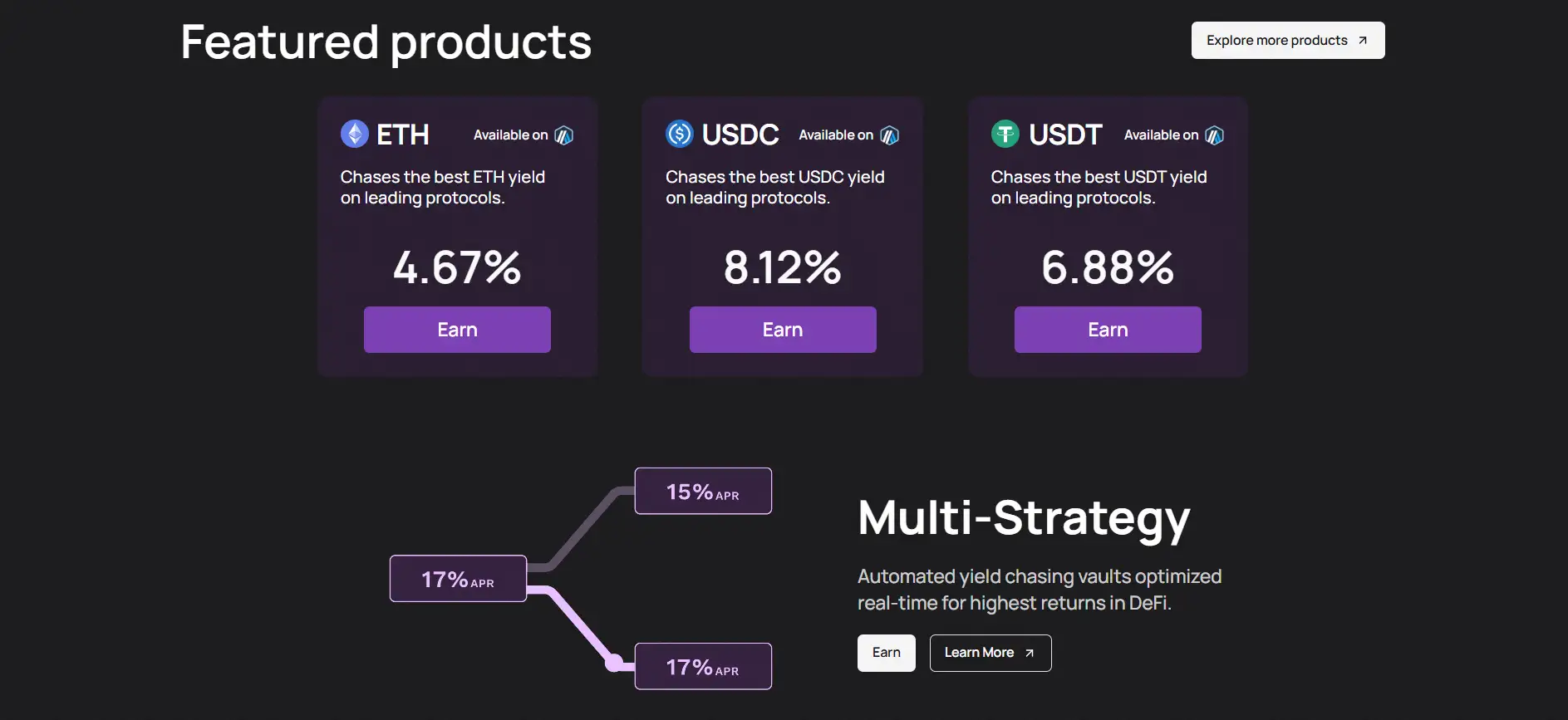

- Multi-Strategy Vaults: Funds are automatically reallocated across top-yielding DeFi protocols in real time, maximizing ROI with minimal user intervention.

- Uniswap v4 Hook Integration: Utilizes out-of-range LP assets to ensure continuous yield generation, solving a long-time inefficiency in DeFi liquidity.

- Zap Infrastructure: Convert any major token to the vault's base asset in a single transaction using Goat Zap for seamless deposits and withdrawals.

- Custom Vault Deployment: Users can launch personalized vaults with their own strategy parameters and earn yield when others use them.

- Oracle-Driven Strategy Proposals: Advanced algorithms and data aggregation continuously monitor markets and propose new strategies.

- Non-Custodial & DAO-Governed: Users always retain control of funds, and protocol decisions are made by the GOA community.

- Fully Audited & Secure: Goat Protocol has undergone multiple security audits by firms like Blocksec and Fortifyx, with continuous monitoring in place.

- Performance-Based Fee Structure: Goat charges a competitive 10% performance fee, all of which goes to GOA stakers, aligning incentives directly with user success.

Getting started with Goat Protocol is quick and user-friendly, whether you're a passive investor or an advanced yield optimizer:

- Visit the official website: Go to goat.fi and click “Vaults” to browse available strategies.

- Connect your wallet: Use MetaMask, WalletConnect, or other EVM-compatible wallets to link your account.

- Choose a vault: Select from available vaults such as ETH, USDC, or USDT yield chasers. Each displays the current APY and strategy details.

- Deposit your assets: Use Goat Zap to deposit any major token. The system will automatically convert it into the vault’s base asset.

- Earn passive yield: Once deposited, your funds are auto-compounded and reallocated across top-performing strategies—no action needed from your side.

- Track performance: Monitor your APYs and earnings via the vault dashboard. Withdraw at any time with no lock-in.

- Stake GOA tokens: Participate in governance and earn protocol revenue by staking GOA or wrapping it into wstGOA to autocompound your share.

- Create custom vaults: Advanced users can deploy personalized vaults with specific strategies and earn fees when others deposit into them.

- Bridge assets as needed: Use the GOA Bridge to move assets between Ethereum and Arbitrum seamlessly.

Goat Protocol FAQ

Goat Protocol functions like a smart yield strategist that automates fund allocation across DeFi’s top protocols. Once you deposit into a Goat Vault, the protocol uses a combination of real-time data, oracles, and automated smart contracts to reallocate your funds toward the most profitable strategies. There's no need to monitor yields, manually switch platforms, or compound rewards—Goat handles it all for you.

Yes, that’s one of Goat Protocol’s most innovative features. With its integration of Uniswap v4 hooks, Goat ensures that LP positions continue to generate yield even when they’re out of the optimal trading range. This removes the need for manual rebalancing and reduces idle capital, solving a major issue faced by traditional LPs on Uniswap.

Goat Zap is a powerful feature that lets users deposit into any vault with just one transaction, even if they don’t already hold the vault’s base asset. For example, you can deposit ETH into a stablecoin vault, and Goat Zap will swap, provide liquidity, and deposit the LP tokens for you using DEX aggregators—all automatically. It streamlines the process and guarantees optimized execution routes.

Custom Vault Deployment allows advanced users to define their own vault strategies using Goat’s middleware infrastructure. Once live, these vaults are available to the community, and the creator earns a portion of the fees generated by other users investing in them. This feature promotes user-led innovation and creates a decentralized way to profit from strategy design.

Oracles are at the heart of Goat Protocol’s decision engine. They aggregate data from across DeFi, analyzing metrics like APYs, TVL, security scores, and historical performance. Based on this data, oracles propose strategy reallocations that are reviewed by managers and executed via smart contracts. This allows Goat to adapt in real time and constantly optimize vault performance without human micromanagement.

You Might Also Like