About Goldfinch

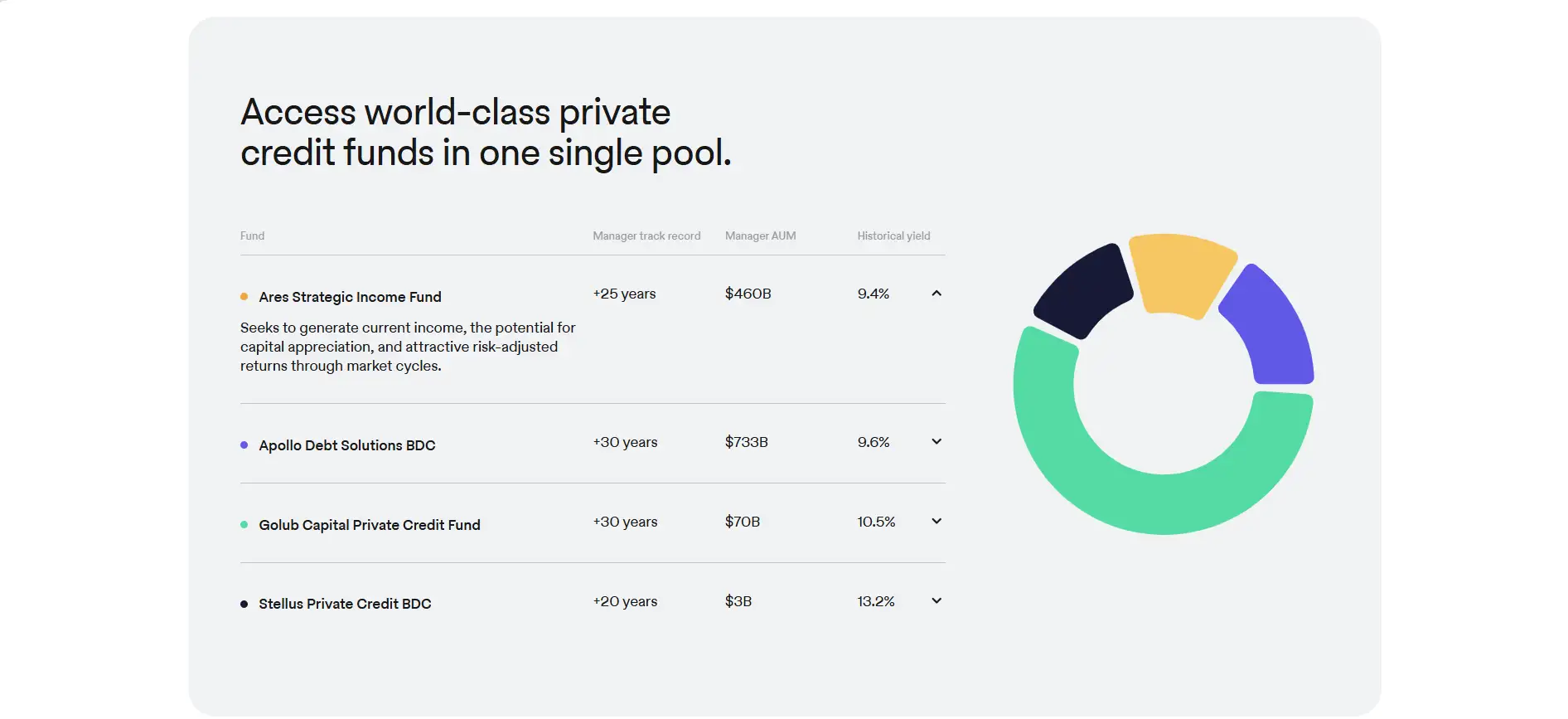

Goldfinch Prime is bringing world-class private credit investing onchain by offering users direct access to multi-billion dollar private credit funds through a single, diversified DeFi product. By curating institutional-grade funds like Ares, Apollo, Golub Capital, and more, Goldfinch Prime opens up investment opportunities that were traditionally reserved for institutional players and high-net-worth individuals.

This innovative protocol lets investors earn estimated yields of 10–12% annually from over 1000 loans issued across various sectors, all backed by experienced fund managers with $1T+ in assets under management. Goldfinch Prime uses stablecoins and the Base blockchain to deliver a seamless and cost-efficient way for global investors to participate in the growing alternative credit asset class, without the barriers of paperwork, exclusivity, or lock-up periods.

Goldfinch Prime represents the next evolution in real-world finance onchain. It solves one of the most persistent challenges in alternative investing: access. While private credit has long been a high-performing, low-volatility asset class for institutional investors, it has remained largely inaccessible to the average user due to high entry requirements, regulatory hurdles, and lack of digital infrastructure. Goldfinch Prime removes those obstacles by building a fully onchain gateway to proven, professionally managed private credit strategies.

Investors gain exposure to a curated pool of senior secured loans issued by managers like Ares, Apollo, Stellus, and Golub Capital. These funds are traditionally housed in Business Development Companies (BDCs), specifically in their non-traded forms, which historically offer higher returns and lower volatility compared to public market alternatives. Through Goldfinch Prime, users invest in contingent payment notes issued by Heron entities, which hold equity interests in these institutional funds.

The portfolio spans over 1000 loans and is built to generate predictable income with minimized risk. These loans are diversified across industries, selected based on track record, loan structure quality, and manager experience. Each fund in the pool has a history of consistent income distribution, over 90% senior secured loans, less than 5% payment-in-kind interest, and target non-accrual rates below 0.75%.

Goldfinch also brings transparency to private credit, showing users the exact assets backing their portfolios. With no lock-up period and quarterly redemption processing, it offers a liquidity framework far more flexible than typical private market investments. Goldfinch Prime is ideal for investors looking for steady yield, low volatility, and diversified alternative exposure.

Compared to other DeFi protocols such as Maple Finance, Centrifuge, and Credix, Goldfinch Prime offers a more institutionalized approach with exposure to traditional finance giants and a deeper emphasis on portfolio diversification, stability, and income generation.

Goldfinch Prime provides users with access to powerful real-world asset strategies and a host of benefits designed for yield-seeking investors:

- Institutional-Grade Access: Invest in top private credit funds like Ares, Apollo, Golub, and Stellus without institutional barriers.

- Diversified Loan Portfolio: Exposure to over 1000 senior secured loans across multiple industries and managers for minimized concentration risk.

- Transparent Holdings: View every asset in your portfolio with full visibility, a rarity in the private credit space.

- Quarterly Redemptions, No Lockups: No long-term commitment is required. Redemptions are processed quarterly with no exit penalties.

- Blockchain-Powered Efficiency: Stablecoin investments on Base keep fees low and execution fast.

- Consistent Income: Monthly or quarterly distributions paid out based on the underlying cash flows from fund dividends.

- Global Participation: Available to users worldwide (excluding a short list of restricted countries) who pass KYC checks.

- Low Fees: Only a 0.5% annual management fee and 0.5% withdrawal fee, both netted from displayed returns.

Getting started with Goldfinch Prime is simple and designed for ease of access to institutional-grade income:

- Visit the site: Go to goldfinch.finance and navigate to the “Invest” section.

- Check your eligibility: Goldfinch Prime is available to users worldwide except for specific unsupported countries including the U.S., U.K., Russia, and others.

- Complete KYC: Submit identity verification to access the protocol and begin investing.

- Deposit USDC: Invest using USDC on Base. Funds are automatically allocated into the Prime pool of institutional credit.

- Monitor returns: Receive steady income distributions monthly or quarterly. View your exact portfolio composition and performance through your dashboard.

- Withdraw any time: Redemption requests are processed on a quarterly basis, subject to available liquidity. There are no lockups or early exit fees.

- Stay informed: Use Goldfinch Docs, Discord, or Substack to track protocol updates, governance changes, and fund performance.

Goldfinch FAQ

Goldfinch Prime streamlines and democratizes private credit access by allowing users to invest in institutional-grade credit funds onchain with no lockup period or paperwork. Traditionally, private credit required direct relationships, large capital, and complex documentation. With Goldfinch Prime, anyone outside unsupported regions can gain diversified exposure to $1T+ of AUM via stablecoins in a transparent and efficient system.

Goldfinch Prime partners with leading private credit managers such as Ares, Apollo, Golub, and Stellus. It bundles exposure to their high-quality, senior secured loans into a single onchain product. These funds typically serve institutions only, but with Goldfinch Prime, users gain fractional access to the same loan portfolios via contingent payment notes, all without going through legacy financial gatekeeping.

No lockup period applies. Unlike traditional private credit funds, Goldfinch Prime lets users submit withdrawal requests at any time, which are processed on a quarterly best-effort basis. There’s also no early withdrawal penalty. A 0.5% withdrawal fee is applied automatically, and delays are possible if underlying funds pause redemptions, but users are always notified proactively.

Goldfinch Prime curates a highly diversified portfolio of over 1000 loans managed by experienced institutional credit managers. These loans are primarily senior secured positions, with less than 5% PIK interest and a target non-accrual rate under 0.75%. Combined with careful manager vetting, regular monitoring, and full transparency, this design helps spread exposure and minimize sector and credit concentration risk.

Yes, full transparency is a key feature. Unlike traditional private funds, Goldfinch Prime lets you view every asset in your portfolio, including fund performance, historical returns, and distribution metrics. This visibility helps users make informed decisions and builds trust in a traditionally opaque asset class.

You Might Also Like