About GRVT

GRVT is a next-generation custodial exchange leveraging zero-knowledge (ZK) technology to offer enhanced privacy, security, and efficiency for digital asset trading. Positioned as the first official Appchain on zkSync’s Hyperchain, GRVT embodies cutting-edge decentralized finance (DeFi) features, focusing on robust privacy and permission control through advanced access management. Its unique architecture supports both individual and business accounts, each benefiting from high-level security measures facilitated by zero-knowledge proofs and Permission-Based Access Control (PBAC), ensuring that users maintain control over their digital assets.

Developed with support from Matter Labs, the creators of zkSync, GRVT integrates zkSync’s rollup technology to ensure scalability and minimal transaction fees, enhancing the accessibility of blockchain services for a broader audience. GRVT’s commitment to delivering a high-performance and secure trading experience is evident through a range of offerings. For more details, visit the GRVT website.

GRVT envisions a future where secure, decentralized trading is the norm, aiming to empower users by giving them maximum control over their digital assets. The project's inspiration lies in addressing common issues in the digital asset industry: lack of security, transparency, and effective privacy. By building on zkSync’s Hyperchain, GRVT aims to make custodial exchanges faster, cheaper, and inherently more secure, appealing to both individual and institutional users. This focus on user control and privacy aligns with GRVT’s broader goal of establishing a new standard for digital asset management.

One of the core elements of GRVT's development is its Permission-Based Access Control (PBAC) system, which allows business accounts to designate specific permissions for each user. This system includes roles such as Funding Admin, Trading Admin, and Trade, which offer a granular approach to account control and security. By offering multi-level access within accounts, GRVT ensures that companies can manage their assets with flexibility and trust. This granular permission structure is especially beneficial for institutional clients, who require high-level security and precise management of their funds.

GRVT’s unique approach to combining custodial trading with advanced privacy measures opens up new opportunities for secure and user-centric DeFi engagement. Its architecture is designed to promote a high degree of interoperability within zkSync’s ecosystem, allowing for faster and more cost-effective transactions. Through this structure, GRVT strives to create an inclusive platform that can be used by traders of all backgrounds and experience levels. Learn more about this vision on the GRVT website.

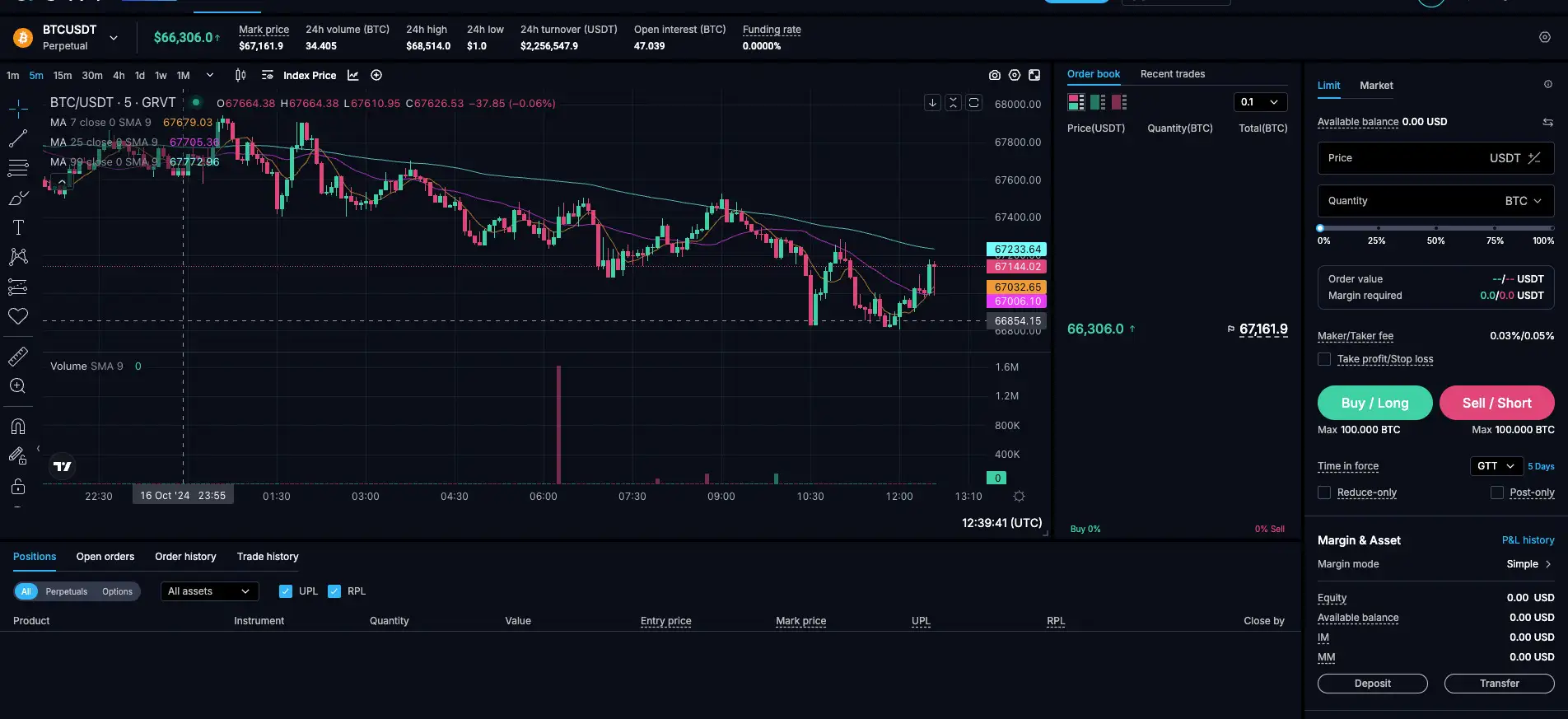

GRVT has crafted an ambitious development roadmap with milestones crucial for establishing its innovative hybrid exchange model on zkSync’s Validium ZK Chain. The initial phases have been focused on building a scalable hybrid infrastructure that balances off-chain order matching with on-chain settlements, achieving up to 600,000 transactions per second at low latency. Starting January 2024, GRVT plans to roll out support for crypto perpetuals and options trading in a controlled mainnet environment, followed by a comprehensive spot trading functionality expected in April.

Following its foundational Closed Beta Phase 1.0, GRVT is moving towards a Closed Beta Phase 2.0, scheduled for April 2024, to widen access and gather further insights from community testers. The roadmap highlights an Open Beta phase by May 2024, during which GRVT will be fine-tuning for mainnet readiness. In September, GRVT plans to release additional features like social trading to enhance user engagement and trading experience. For a deeper look into GRVT's roadmap, visit the GRVT website.

GRVT’s leadership team includes Hong Yea (CEO), Aaron Ong, and Matthew Quek, who bring experience from firms like Goldman Sachs, Facebook, and DBS Bank. Their mission is supported by a high-profile investor network, including Matter Labs, the creators of zkSync, as well as Matrix Partners, Delphi Digital, and QCP Capital. GRVT’s hybrid structure and focus on self-custody have attracted a range of institutional backers, positioning GRVT as a key player in crypto markets.

Strategic advisors, such as Darius Sit of QCP Capital and Tom Shaughnessy from Delphi Digital, provide guidance on product development and ecosystem expansion. Additionally, GRVT has secured partnerships with over 16 major market makers, including Galaxy Digital and Flow Traders, ensuring ample liquidity and trading stability. These strategic relationships underscore GRVT’s commitment to offering a high-performance, trustless exchange for diverse user groups. For more on GRVT’s team and investor support, see the GRVT website.

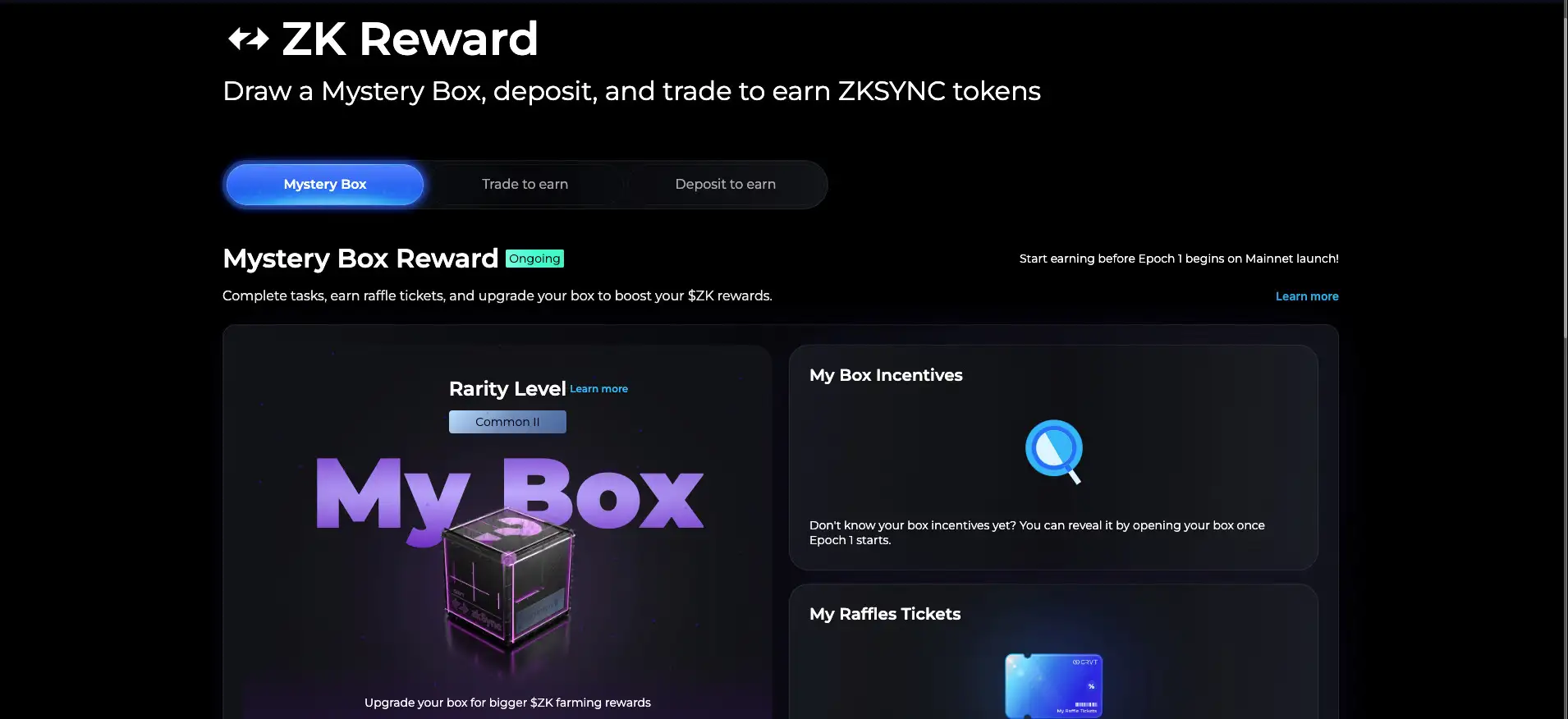

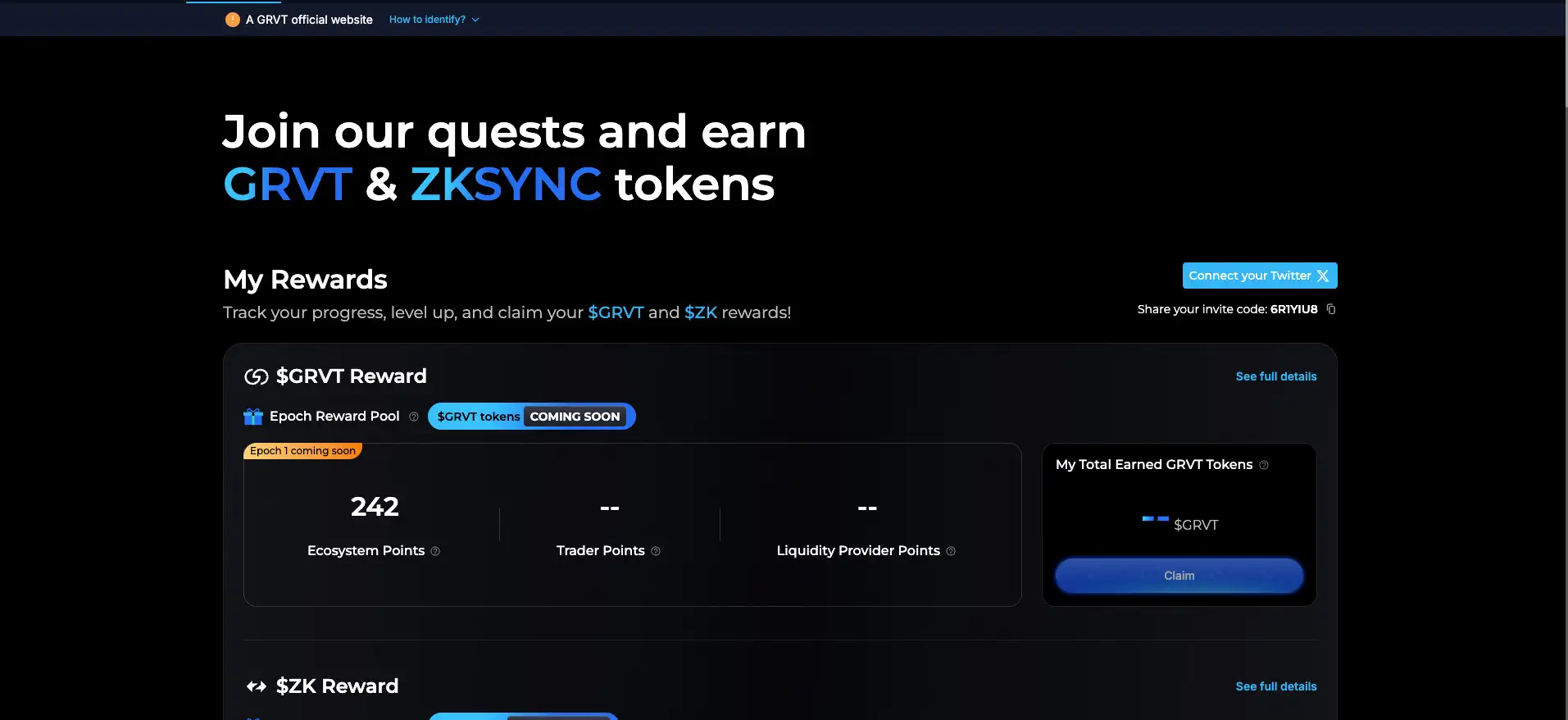

GRVT has launched its beta program in a phased approach to rigorously test its hybrid exchange features. In Phase 1.0, select institutional partners and market influencers were invited to trial its self-custodial trading and high-speed order-matching capabilities. Phase 2.0, expected by April 2024, will extend beta access to a broader community audience, allowing users to experience key GRVT functionalities before the full public beta launch in May. With more than 2.5 million users already on the waitlist, the phased beta allows GRVT to carefully implement and adjust features based on real-time feedback.

Through these early access phases, testers can explore GRVT's hybrid model, which includes an order book model with decentralized settlement, aiming to deliver a transparent and secure trading experience. The platform's mainnet, projected for the second half of 2024, is expected to bring enhanced privacy, efficiency, and user control. Details on participation in the beta program and future developments can be found on the GRVT website.

GRVT Suggestions by Real Users

GRVT FAQ

GRVT uses a hybrid approach that separates order matching and settlement. While trade orders are processed off-chain using a central order book, settlements are finalized on-chain via smart contracts on zkSync, ensuring that assets remain under the user's control. This structure lets users maintain self-custody of their assets while still benefiting from the efficiency of a centralized system.

GRVT’s PBAC system allows businesses to set detailed roles and permissions for account management. Through this system, a Funding Admin can assign roles such as Trading Admin or Trade Only, giving granular control over who can manage funds, make trades, or approve withdrawals. This multi-layered access approach offers flexibility for corporate clients while enhancing security and accountability.

GRVT leverages zkSync’s Validium technology to ensure transaction privacy. By integrating zero-knowledge proofs, GRVT keeps on-chain transactions confidential, hiding details like trade and margin specifics from public view. This feature allows users to benefit from the transparency of blockchain while protecting sensitive trading data, a balance that is rare in the DeFi landscape.

GRVT’s platform is optimized for institutional clients by offering high-speed execution with 600,000 TPS and co-location services for larger orders. Additionally, GRVT’s portfolio and cross-margin models allow institutional traders to manage risk more effectively across multiple assets. GRVT has partnered with major market makers like Galaxy Digital to ensure deep liquidity and stable trading environments for all users.

GRVT combines Web2 and Web3 security protocols, including traditional login credentials, two-factor authentication, and wallet whitelisting. To access GRVT, users register with a password and can connect through external wallets like Metamask. Every withdrawal requires an approved wallet address to prevent unauthorized access, and security partners like Spearbit DAO and NCC Group audit the system regularly.

You Might Also Like