About Harvest Finance

Harvest Finance is a decentralized yield farming platform that helps users earn optimized returns on their crypto assets through automated strategies. By leveraging smart contracts and integrations with leading DeFi protocols across multiple blockchains, Harvest enables anyone to participate in high-yield opportunities without complex manual management.

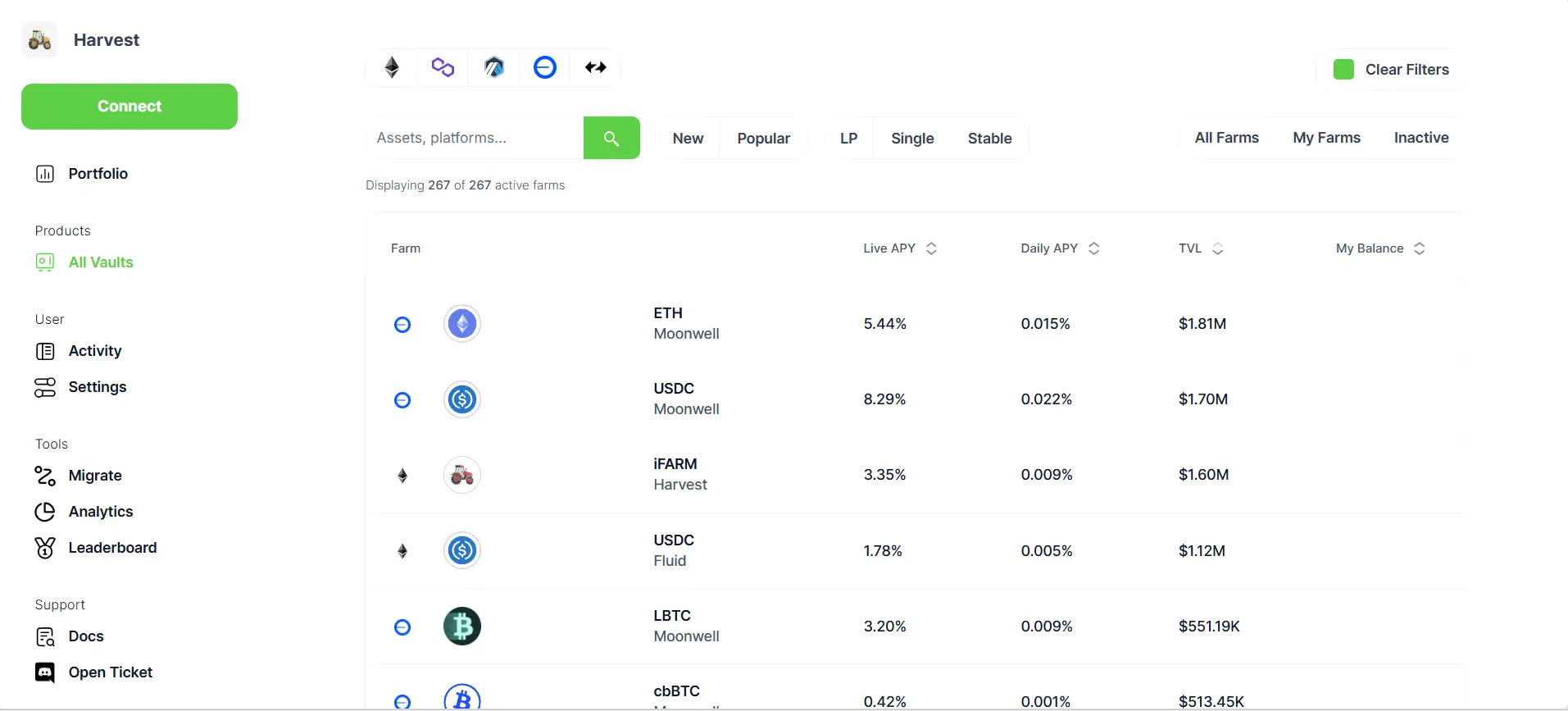

Whether you're a complete beginner or an experienced DeFi user, Harvest Finance allows you to stake, lend, and farm assets like ETH, USDC, and WBTC with just a few clicks. The platform offers auto-compounding strategies, transparent performance analytics, and a beginner-friendly interface to help users grow their holdings efficiently. With over 100 supported vaults and strategies spanning across Ethereum, Arbitrum, Base, Polygon, and zkSync Era, Harvest remains one of the most versatile and accessible tools in the DeFi ecosystem.

Harvest Finance was launched to automate the complex process of yield farming and make it accessible to everyone. As DeFi platforms expanded, users were overwhelmed by the need to constantly monitor protocols, swap assets, and manually claim and compound rewards. Harvest solves this by enabling auto-compounding strategies that optimize rewards from lending, staking, and liquidity provision — all in a single platform.

Users can start farming with as little as $1 worth of ETH or USDC, and the system does the rest — from strategy selection to compounding. The platform supports over 100+ vaults and strategies, allowing yield exposure to tokens like ETH, USDC, WBTC, USDT, and many others. These strategies span multiple blockchains and support advanced features like Autopilots, which rebalance user funds automatically based on performance metrics, gas costs, and market conditions.

The platform also introduced iFARM, a receipt token that auto-compounds staking rewards and allows composability across DeFi, offering better gas efficiency and ease of use. Harvest’s Communal Harvest pool also lets users earn a portion of the platform's performance fees by staking FARM tokens, enabling broader participation in the ecosystem’s growth.

Security and transparency are at the heart of Harvest's mission. The protocol is audited by firms like Halborn, Certik, and PeckShield, and its smart contracts are open-source and verifiable on GitHub. Users can also track past performance, harvest history, and APY projections through in-depth dashboards and performance charts. Compared to other yield aggregators like Yearn Finance, Beefy Finance, or AutoFarm, Harvest stands out for its beginner-friendly UX and highly detailed yield analytics.

From the "One Click Convert" system powered by Portals.fi to advanced tools for power users, Harvest Finance continues to deliver a powerful, seamless, and transparent yield farming experience across DeFi.

Harvest Finance offers a powerful suite of DeFi yield optimization features:

- Auto-compounding Vaults: Automatically reinvest your crypto yield to increase returns over time.

- Multichain Support: Yield strategies span Ethereum, Base, Arbitrum, Polygon, and zkSync Era.

- Beginner-Friendly Farming: Start with just $1 worth of ETH or USDC via intuitive dashboards and guided onboarding.

- One-Click Conversion: Use any token in your wallet to farm thanks to the Portals.fi integration.

- Dynamic Yield Insights: View live APY, share price, and token performance charts across multiple timeframes.

- Autopilot Vaults: Automatically rebalance your assets across top-performing strategies with zero lockups.

- iFARM & Communal Harvest: Earn protocol fees and auto-compounding benefits through advanced FARM token staking.

- Open-Source & Audited: Transparent smart contracts with multiple security audits from firms like Halborn.

Ready to become a crypto farmer? Here’s how to start with Harvest Finance:

- Visit the app: Go to app.harvest.finance and click “Connect Wallet.”

- Choose your network: Harvest supports Ethereum, Base, Arbitrum, and more. Switch networks within the app.

- Deposit any token: Use ETH, USDC, or any asset in your wallet. The platform will convert it into a supported farming token automatically.

- Select a farm: Use the dashboard to find strategies with high APYs or start with the Beginner section on Base.

- Confirm transactions: Approve and convert your crypto. Once done, you’ll receive fTokens representing your stake.

- Track performance: Use real-time charts and dashboards to monitor your daily, monthly, and lifetime earnings.

- Revert anytime: Return your fTokens for original tokens or choose a different one using the Revert feature.

- Earn more with staking: Stake fTokens or FARM to unlock extra rewards and iFARM benefits.

Harvest Finance FAQ

Harvest Finance automates DeFi yield farming by deploying pre-programmed smart contracts that aggregate and compound rewards from top protocols like Aave, Curve, Moonwell, and more. Instead of manually claiming and reinvesting tokens, Harvest uses auto-compounding strategies to reinvest yield, increasing a user’s token balance over time. This significantly reduces gas costs and enhances long-term returns while offering a simplified farming experience through one-click conversions and integrated wallets.

fTokens are interest-bearing tokens users receive after converting their crypto into a Harvest strategy. They represent the user's share in the farm and include both the principal and the accrued yield. Over time, the value of fTokens increases compared to the original token (e.g., 1 fETH becomes worth more than 1 ETH). These tokens are essential for tracking rewards and can be reverted back into supported assets at any time through the Harvest app. They also enable participation in additional staking opportunities for bonus rewards.

FARM is the native utility and governance token of Harvest Finance, while iFARM is an interest-bearing version of FARM. When users stake FARM in the Communal Harvest pool, they receive iFARM in return. iFARM auto-compounds all rewards generated by the protocol, making it ideal for long-term holders who want to maximize passive income. Additionally, iFARM tokens are transferrable and can be used in other DeFi protocols, offering better flexibility and composability than regular FARM tokens.

Autopilot is an advanced allocation engine that rebalances your crypto across the most profitable Harvest vaults without needing manual intervention. It uses predefined optimization rules that consider performance metrics, gas costs, and liquidity levels. Funds are shifted only when it makes sense economically, avoiding unnecessary gas spending. This feature is especially useful for users who want a hands-off farming experience while still earning competitive APYs from multiple strategies.

Yes, Harvest Finance supports yield strategies across multiple blockchains including Ethereum, Arbitrum, Base, Polygon, and zkSync Era. Users can easily switch between chains within the app’s interface and use the One-Click Convert tool to farm with any token in their wallet. Each chain offers unique vaults with varying APYs, allowing users to diversify their strategies and maximize returns across the DeFi landscape.

You Might Also Like