About Hermes V2

Hermes V2 is a cutting-edge decentralized protocol that aims to optimize liquidity provision for decentralized exchanges. It is part of the Maia DAO ecosystem, focusing on improving capital efficiency through its innovative concentrated liquidity model. This allows liquidity providers to focus their contributions on specific price ranges, yielding higher rewards and reducing capital waste.

The platform is designed to integrate with popular decentralized exchanges, providing enhanced tools for yield farming and liquidity optimization. With a focus on decentralized governance and a deflationary tokenomics model, Hermes V2 gives users direct control over the protocol’s development. As part of the Maia DAO, Hermes V2 benefits from a strong and engaged community, ensuring long-term support and growth.

Hermes V2 is an advanced decentralized liquidity protocol within the Maia DAO ecosystem, designed to optimize liquidity for decentralized exchanges (DEXs) through its unique concentrated liquidity feature. Unlike traditional automated market makers (AMMs) that distribute liquidity across the entire price spectrum, Hermes V2 allows liquidity providers to concentrate their assets within specific price ranges. This leads to better capital efficiency and higher yields for liquidity providers.

Hermes V2 is similar to other liquidity optimization protocols like Uniswap V3 and PancakeSwap, both of which offer features that allow liquidity providers to optimize their returns. However, Hermes V2 sets itself apart by introducing more advanced yield farming opportunities and a more user-focused governance model through the HERMES token. Its governance system empowers users to participate in decision-making, shaping the future of the protocol.

Hermes V2 integrates with multiple DEXs, acting as a liquidity optimizer that enhances the performance of these platforms. Liquidity providers benefit from a dynamic, user-friendly interface that enables them to set liquidity ranges and adjust their positions based on market conditions. This flexibility allows them to take advantage of high trading volumes without the inefficiencies of traditional liquidity models.

The protocol's deflationary tokenomics structure is another important differentiator. A portion of fees generated through liquidity provision and trading activities is burned, reducing the total supply of HERMES tokens and increasing their scarcity. This ensures long-term value appreciation for token holders.

By constantly evolving and introducing new features, Hermes V2 maintains its position as a leading protocol for liquidity optimization in the DeFi space. Its integration with major DEXs and strong focus on governance gives it a competitive edge over other liquidity protocols, making it an attractive option for both novice and experienced DeFi users.

- Concentrated Liquidity Provision: Hermes V2 allows liquidity providers to focus their assets on specific price ranges, maximizing capital efficiency and potential returns.

- Yield Marketplace: A dedicated marketplace where users can explore yield farming opportunities, optimized for maximum capital efficiency.

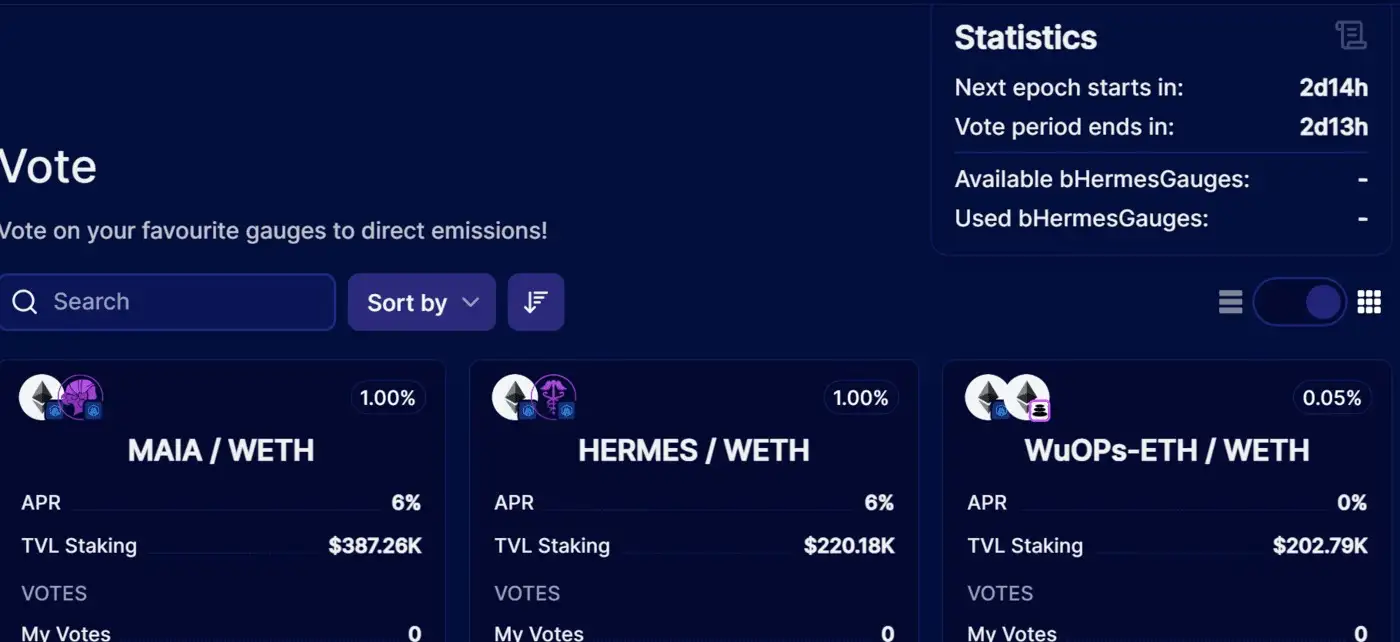

- Decentralized Governance: The governance system allows HERMES token holders to vote on protocol upgrades, reward structures, and other key decisions.

- Deflationary Tokenomics: Part of the transaction fees is burned, reducing the total supply of HERMES tokens and increasing their value over time.

- Staking and Rewards: Users can stake HERMES tokens to earn rewards and benefit from the platform’s fee distribution model.

- Integration with DEXs: Hermes V2 integrates with leading decentralized exchanges, enhancing liquidity provision for platforms like Uniswap V3 and PancakeSwap.

- Create a Wallet: Connect a decentralized wallet such as MetaMask to the Hermes V2 platform.

- Acquire HERMES Tokens: Buy HERMES tokens through decentralized exchanges or earn them by providing liquidity.

- Explore Liquidity Pools: Select the liquidity pools available on the platform and choose specific price ranges for optimized capital deployment.

- Stake HERMES Tokens: Lock your HERMES tokens in staking contracts to earn rewards from the platform's transaction fees.

- Participate in Governance: Use your HERMES tokens to vote on governance proposals. The governance portal displays all active proposals for you to engage in the decision-making process.

- Monitor Positions: Keep track of your staking rewards and liquidity positions through the Hermes V2 dashboard, adjusting positions as needed to maximize returns.

For more details, visit the official documentation.

Hermes V2 Token

Hermes V2 Reviews by Real Users

Hermes V2 FAQ

Concentrated liquidity allows liquidity providers on the Hermes V2 platform to allocate their funds into specific price ranges rather than spreading them across the entire price spectrum. This results in higher capital efficiency, as liquidity is focused where it is most needed, allowing for better returns when there is active trading within the selected price range.

The governance model of Hermes V2 allows HERMES token holders to vote on critical protocol decisions, such as upgrades and reward structures. This decentralized governance structure ensures that the community plays an active role in the protocol’s future, aligning it with user interests. To participate, token holders simply need to stake their tokens and cast votes via the governance portal.

The yield marketplace on Hermes V2 stands out because it is optimized for users to explore highly efficient yield farming opportunities. Unlike other platforms, Hermes V2 focuses on maximizing returns through its concentrated liquidity model, making it easier for liquidity providers to earn higher yields while reducing capital wastage. Users can access the marketplace through the Hermes V2 interface.

Hermes V2 ensures the long-term value appreciation of the HERMES token through a deflationary tokenomics model. A portion of transaction fees generated within the protocol is burned, reducing the circulating supply of tokens. This deflationary pressure, coupled with increasing demand for tokens through staking and liquidity provision, enhances the overall value of the token over time. Learn more about the tokenomics via the documentation.

To participate in the Hermes V2 governance, you need to stake your HERMES tokens and vote on proposals through the platform’s governance portal. Governance proposals typically involve protocol upgrades, reward adjustments, and other essential changes. Each vote helps shape the protocol’s future, ensuring that the community has control over its evolution.

You Might Also Like