About Hop

Hop Protocol is a decentralized, trustless bridge built specifically for the rollup-centric Ethereum ecosystem. Designed to solve the latency problem in cross-rollup communication, Hop enables users to send tokens across rollups nearly instantly without having to wait for challenge periods. By using an architecture of HTokens, canonical tokens, and bonders, Hop provides a fast, scalable, and reliable method for bridging assets.

With support for leading Layer-2 networks such as Arbitrum, Optimism, Polygon, Base, and Gnosis, Hop is positioned as a key infrastructure layer in the Ethereum scaling landscape. It simplifies the user experience of interacting with multiple chains, making token transfers fast, cheap, and seamless. This approach has allowed Hop to be integrated not just via its own UI, but also through third-party aggregators and applications.

Hop was launched on Ethereum mainnet in July 2021 as a solution to the long waiting times associated with bridging between rollups. Traditional rollups require a challenge period (often up to 7 days) to secure transfers to Ethereum or across rollups. Hop Protocol overcomes this by using liquidity providers and bonders who front the assets on the destination chain and later get reimbursed once the challenge period ends. This mechanism allows for near-instant transfers with low latency and efficient capital utilization.

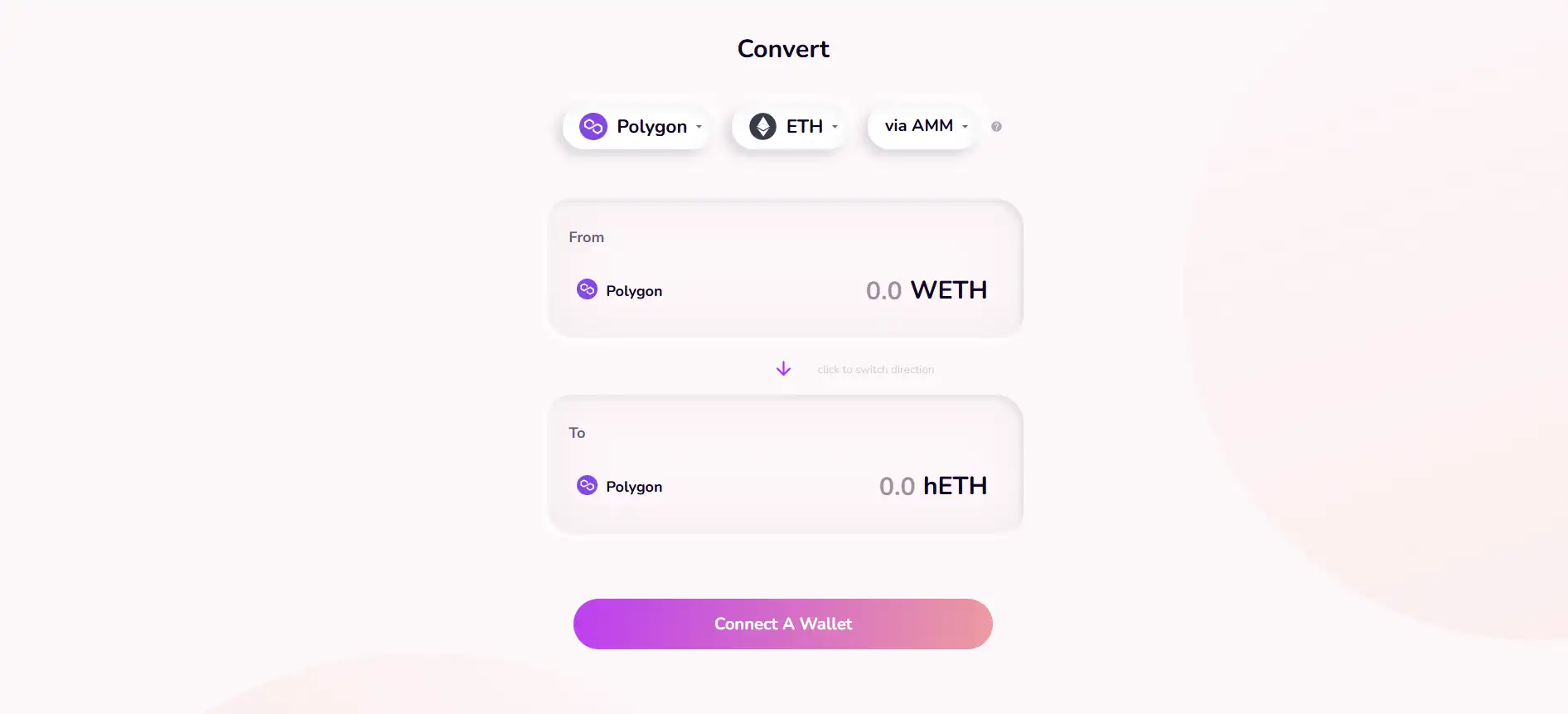

At its core, Hop uses a set of intermediary tokens called hTokens (like hETH, hUSDC, hDAI) that represent canonical tokens bridged across networks. The AMM layer on each rollup allows users to swap between canonical tokens and hTokens. Liquidity providers deposit into these AMMs to facilitate swaps and earn fees, while bonders provide collateralized liquidity across chains and are incentivized by transfer fees. Unlike centralized bridges, Hop is fully on-chain and can be accessed via smart contracts, aggregators like Swing, LiFi, Movr, or even IPFS-hosted UIs.

The protocol supports token transfers across Ethereum, Optimism, Arbitrum, Polygon, Base, and Gnosis. Transfers occur by burning hTokens on the source rollup and minting them on the destination chain, facilitated by bonders who must stake collateral and prove transfer roots. If no bonders are available, the fallback mechanism reverts to the rollup’s native challenge period.

Hop also incorporates governance via the $HOP token, which is used for voting on protocol parameters and improvements. Users must delegate their voting power to themselves or other delegates via portals like Tally to participate in governance.

Competitors include Synapse Protocol, Celer, Across, and but Hop stands out through its decentralized bonder architecture, verified contract transparency, and speed-focused rollup design.

Hop Protocol provides several core features and advantages tailored to a multichain Ethereum world:

- Instant Cross-Rollup Transfers: By using bonders who front liquidity, Hop enables transfers between rollups in minutes instead of days.

- Trustless and Fully On-Chain: The entire protocol is deployed on-chain and can be accessed through smart contracts by anyone with an Ethereum node.

- Decentralized Access Points: Interact with Hop via its main app, bridge aggregators (LiFi, Movr, Swing), or IPFS-based interfaces like hop.eth.limo.

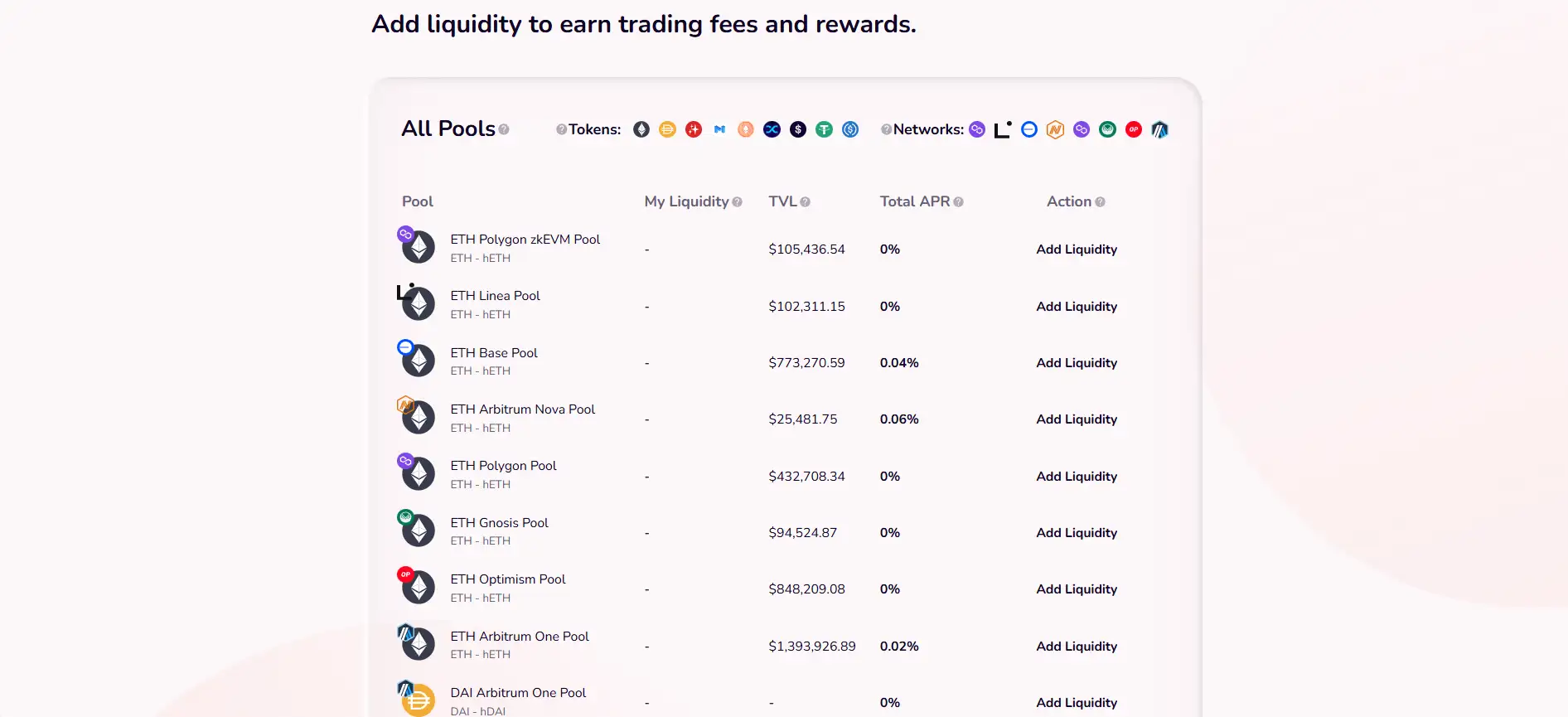

- AMM and Liquidity Incentives: LPs earn swap fees by providing liquidity to AMMs that allow conversion between hTokens and canonical tokens.

- Robust Governance: The $HOP token enables decentralized governance through community voting and delegation.

- Reward Mechanisms: Optimism grants and bridging incentives in $OP are used to subsidize transaction costs into the Optimism network.

- Open-Source and Audited: Smart contracts are audited and available on GitHub, ensuring transparency and security.

Hop Protocol is designed for ease of use, whether you're a user transferring tokens or a developer building integrations:

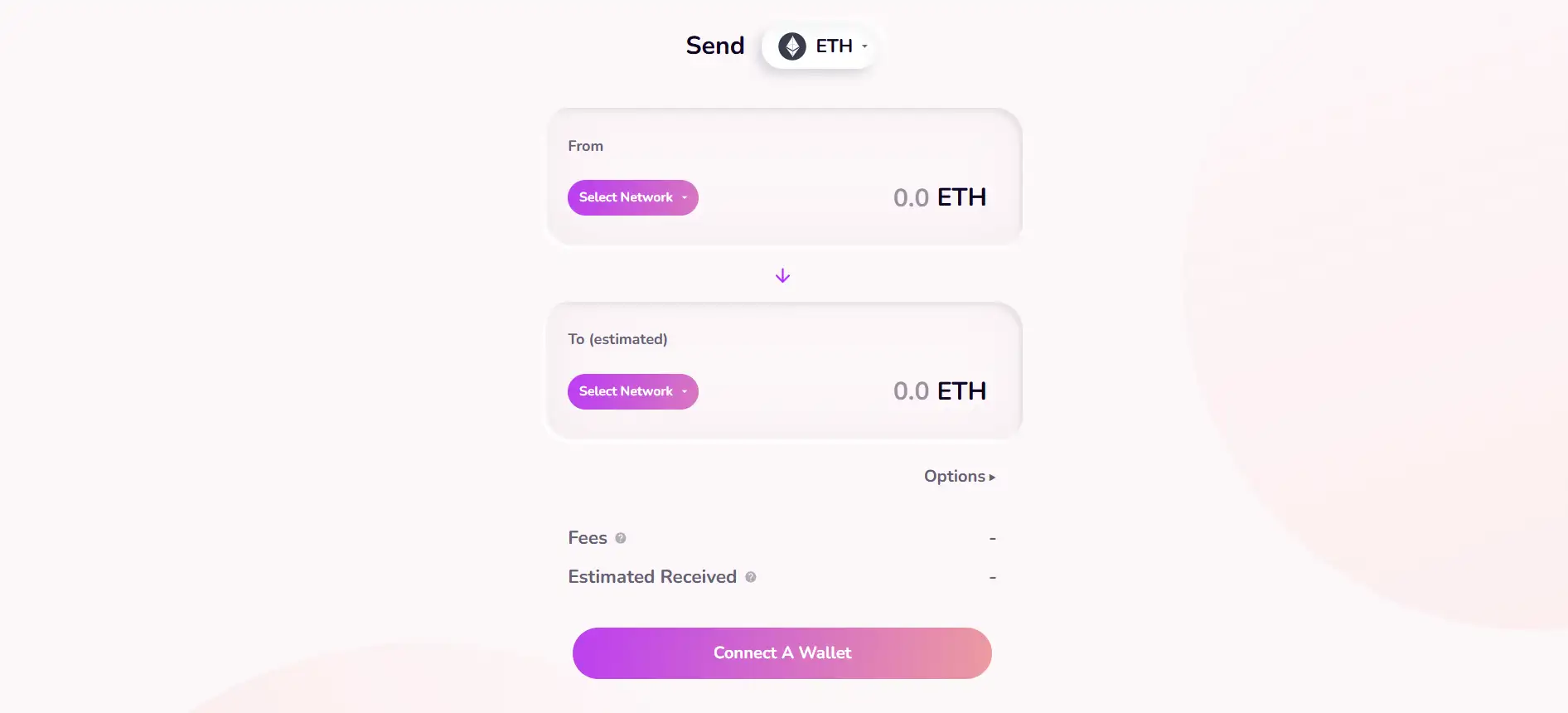

- Access the App: Visit the official site at app.hop.exchange.

- Choose Your Networks: Select source and destination rollups such as Optimism, Arbitrum, Base, or Polygon to bridge supported tokens.

- Transfer Tokens: Input the amount and destination address, and execute the transaction. Bonders will provide instant liquidity on the destination.

- Claim Rewards: Bridging to Optimism may qualify you for $OP incentives. Claim these in the "Rewards" section after 14 days.

- Add Liquidity: Become an LP to earn fees by adding assets to supported AMM pools. Visit the Pools section in the app.

- Participate in Governance: Delegate and vote using the $HOP token through platforms like Tally.

- Use Developer Tools: Dive into the GitHub repos for contract integration, and review transfer logs via the Hop Explorer.

- Access Help: Check the extensive FAQs and docs at help.hop.exchange or join their community via Discord.

Hop FAQ

hTokens serve as the foundational mechanism behind Hop Protocol's fast cross-rollup transfers. They act as intermediary assets that represent bridged canonical tokens, enabling liquidity to move without waiting for the rollup’s native challenge period. When users initiate a transfer, hTokens are minted or burned across chains, allowing seamless swaps using AMMs. This model allows Hop to deliver near-instant transactions while preserving on-chain trustlessness.

Though bonders facilitate instant transfers by fronting liquidity, they do not control funds or the outcome of transfers. They act as temporary liquidity agents, and all actions are eventually settled on-chain via verifiable proofs. The system is designed so that no bonder can misappropriate assets. If bonders fail or go offline, fallback mechanisms trigger, and the transfer reverts to the rollup's native withdrawal method. This hybrid model preserves decentralization and censorship resistance while improving user experience. Read more at hop.exchange.

Hop’s AMMs dynamically rebalance liquidity across chains by allowing users and arbitrageurs to swap between hTokens and canonical tokens. This system encourages organic rebalancing of funds where they’re most needed. Traditional pools can become fragmented or illiquid across rollups, but AMMs incentivize arbitrage to maintain parity. This is especially critical in a multichain world where asset demand can shift rapidly. Learn more on the Hop app.

If a bonder does not finalize a transfer before the challenge period ends, users can still retrieve their funds manually through the Hop Withdraw page. This fallback ensures fund recovery without relying on any single party. The protocol bundles outgoing transfers into a transfer root, which is propagated and verified on Layer-1 before final settlement. Once this root is committed, the transfer becomes manually claimable, maintaining trustless security guarantees.

Yes, Hop Protocol is fully smart contract-based and open-source, which means developers can interact directly with its contracts on-chain. Besides the official UI, Hop is also accessible through bridge aggregators like LiFi, Movr, Swing, and IPFS-hosted UIs. This ensures permissionless integration and flexibility for developers building cross-chain applications. All contracts and guides are available at Hop’s GitHub.

You Might Also Like