About inSure DeFi

Insure Token is a decentralized blockchain-based platform that aims to modernize the insurance industry by tackling its inefficiencies and fostering trust among stakeholders. Traditional insurance models often suffer from delays, high costs, and opaque processes that create friction between insurers and policyholders. Insure Token addresses these issues by utilizing blockchain technology to provide a transparent, efficient, and secure ecosystem for managing insurance policies and claims. The platform leverages smart contracts to automate processes, drastically reducing the time and cost associated with claims processing while eliminating the need for intermediaries.

With a mission to make insurance accessible, fair, and fraud-proof, Insure Token empowers users globally by providing decentralized governance and a user-friendly platform. It ensures that policyholders maintain control over their data while providing secure transactions through advanced cryptographic techniques. By bridging the gap between traditional insurance and blockchain, the project is poised to reshape the industry, delivering innovative solutions that align with the evolving needs of modern consumers.

Insure Token is a cutting-edge platform designed to transform the traditional insurance sector through the power of blockchain. The insurance industry has long been plagued by inefficiencies such as lengthy claim processes, high operational costs, and issues with fraud. Insure Token seeks to overcome these challenges by building a transparent and efficient ecosystem where policyholders and insurers can interact with trust and confidence.

At its core, Insure Token utilizes smart contracts to automate essential processes like policy management and claims settlement. This ensures that policies are executed as agreed, and claims are processed promptly without manual intervention or delays. The use of blockchain technology provides an immutable and transparent ledger, reducing the risk of fraudulent activities and disputes. Furthermore, decentralized oracles are employed to verify external data, ensuring the accuracy of claims and other critical information.

Since its launch, Insure Token has established itself as a leader in decentralized insurance solutions. One of its key innovations is its decentralized governance model, where token holders can vote on platform updates, new insurance products, and other critical decisions. This democratized approach ensures that the platform evolves in alignment with the needs of its community.

The project has achieved significant milestones, including partnerships with global insurers and blockchain-based data providers. These collaborations have helped integrate real-world insurance data into the blockchain ecosystem, enabling seamless operations. Moreover, its privacy-centric design ensures that users’ sensitive data is protected using advanced cryptographic protocols, distinguishing it from traditional insurers that often struggle with data breaches.

Compared to competitors like Nexus Mutual and Etherisc, Insure Token offers a more user-friendly approach with a strong emphasis on data security and affordability. While competitors also rely on blockchain to decentralize insurance, Insure Token stands out by focusing on eliminating fraud, minimizing costs, and providing a faster claims process. Its ecosystem is designed to accommodate both individual users and large-scale businesses, making it a versatile solution for modern insurance needs.

As the project continues to grow, it is setting a precedent for how blockchain can revolutionize not only insurance but other industries that require trust, transparency, and efficiency. With its unique combination of technological innovation and user-centric design, Insure Token is reshaping the future of insurance globally.

Insure Token provides a host of features that make it an exceptional platform for decentralized insurance. Some of the standout benefits include:

- Smart Contract Integration: Automates claims processing and policy execution, ensuring error-free and tamper-proof transactions.

- Decentralized Governance: Token holders have voting rights on key decisions, ensuring the platform evolves in alignment with community interests.

- Cost Efficiency: Eliminates intermediaries, reducing overhead costs and offering more affordable insurance options.

- Enhanced Fraud Prevention: Blockchain's immutable ledger and transparent operations significantly reduce fraudulent claims and disputes.

- Data Security: Utilizes advanced cryptographic techniques to safeguard user information and transactions.

- Global Reach: Accessible worldwide, allowing users across borders to benefit from blockchain-based insurance solutions.

Getting started with Insure Token is a simple process. Here’s how you can join the platform:

- Visit the Website: Go to the official Insure Token website and click on the “Sign Up” button.

- Create an Account: Provide your email address and a strong password to register on the platform.

- Complete KYC Verification: Upload the required identity documents for KYC verification, which ensures compliance with legal standards.

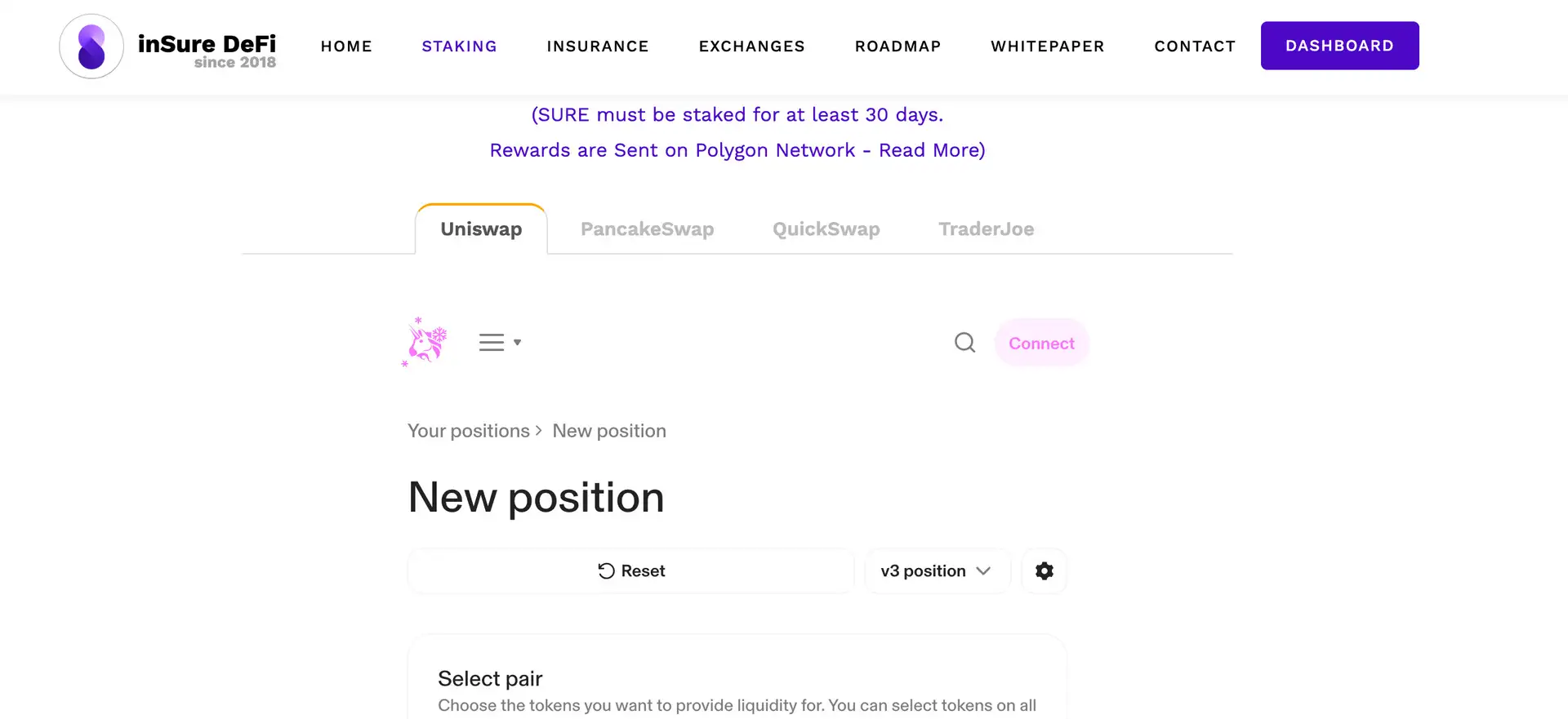

- Connect a Wallet: Link a compatible cryptocurrency wallet, such as MetaMask or Trust Wallet, to securely manage your tokens.

- Select Insurance Products: Browse through available insurance options, choose a product that suits your needs, and pay using supported cryptocurrencies.

- Monitor Policies: Use the dashboard to track your active policies, payment history, and claims status.

- File Claims: In the event of an incident, file a claim directly through the platform. Claims are processed swiftly using blockchain technology.

inSure DeFi Reviews by Real Users

inSure DeFi FAQ

Insure Token uses a combination of smart contracts and decentralized oracles to verify claims. Smart contracts automate claim processing, ensuring that policy terms are met before approving payouts. Decentralized oracles connect blockchain data to real-world events, such as verifying documents or incidents, ensuring that all claims are accurate and legitimate without requiring third-party intermediaries.

Yes, Insure Token offers customizable insurance policies that cater to various industries and businesses. By leveraging its decentralized platform, businesses can create tailored policies based on specific needs, such as cybersecurity, logistics, or asset protection. This flexibility ensures that clients receive policies that align with their unique requirements.

Insure Token prioritizes data privacy and security by using advanced cryptographic methods and blockchain technology. Sensitive user data is encrypted and stored securely on the blockchain, making it tamper-proof and inaccessible to unauthorized parties. Additionally, the platform uses secure wallet integrations to protect financial transactions.

In the event of a claim dispute, Insure Token leverages its decentralized governance model and arbitration system. Token holders and neutral validators review the claim, utilizing blockchain-verified data to determine its validity. The resolution process is designed to be impartial, transparent, and efficient, ensuring fairness for all parties involved.

Yes, token holders on Insure Token can unlock additional benefits, such as discounts on insurance premiums, priority claim processing, and access to exclusive products. By participating in the ecosystem, token holders also gain rewards through staking and other platform incentives, enhancing their overall experience.

You Might Also Like