About Integral

Integral is an advanced decentralized finance (DeFi) protocol designed to address the challenges faced by large-scale traders in the cryptocurrency market. By minimizing slippage, enhancing liquidity, and reducing execution costs, the platform provides a trading environment tailored to the needs of institutional-grade users and professional traders. Unlike traditional decentralized exchanges (DEXs), which often fall short in handling high-volume trades, Integral leverages innovative mechanisms to ensure better trading outcomes for its users. This focus on large-order efficiency positions Integral as a game-changer in the DeFi space.

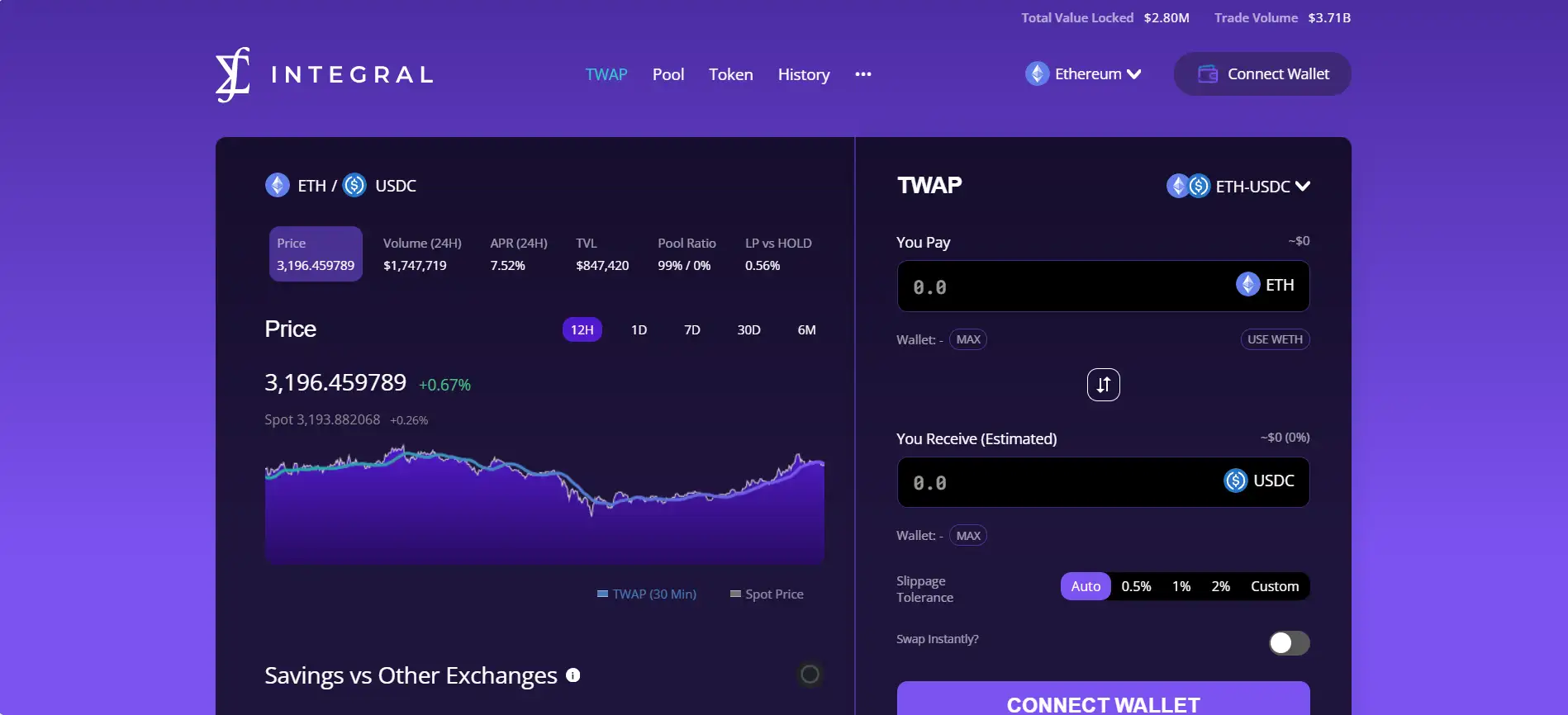

At its core, Integral aims to bridge the gap between centralized exchanges (CEXs) and DEXs, combining the transparency and decentralization of blockchain technology with the efficiency and scalability typically found in centralized trading systems. The platform's proprietary Time-Weighted Average Price (TWAP) trading system is one of its standout features, allowing users to execute large trades over time to minimize price impact. By solving critical inefficiencies in the DeFi ecosystem, Integral empowers traders to manage their assets effectively without sacrificing the benefits of decentralization.

Integral was launched with the primary goal of addressing inefficiencies in the DeFi trading ecosystem, specifically for large-scale traders who face issues like high slippage, unpredictable fees, and low liquidity. By using the innovative Time-Weighted Average Price (TWAP) trading mechanism, Integral allows users to execute large transactions over a pre-defined time frame, thereby reducing price impact and enhancing efficiency.

What makes Integral stand out is its hybrid approach that combines Automated Market Maker (AMM) architecture with TWAP execution. This provides a unique value proposition compared to competitors such as Uniswap and SushiSwap, which are designed for more general-purpose trading. In contrast, Integral focuses on institutional-grade and professional users, offering tools specifically tailored for high-volume trades.

Since its inception, Integral has achieved significant milestones, including the successful launch of TWAP pools and its integration into major Ethereum-based ecosystems. The platform’s commitment to lowering costs, improving capital efficiency, and maintaining transparency makes it a top-tier solution for advanced traders in the growing DeFi market. Learn more by visiting the official website: Integral.

Key Benefits and Features of the Integral platform include:

- Time-Weighted Average Price (TWAP) Trading: A unique system that allows traders to execute large transactions over a specific period to minimize slippage and price impact.

- Reduced Slippage: Integral is optimized for high-volume trades, ensuring minimal price deviation and better execution compared to traditional DEXs.

- Hybrid AMM Architecture: The platform blends AMM functionality with TWAP execution for a superior trading experience tailored to large-scale traders.

- Low Transaction Costs: Integral minimizes trading fees, offering significant cost savings for institutional and professional users.

- Full Decentralization: Built on the Ethereum blockchain, the platform provides a trustless, transparent, and highly secure environment.

- Seamless Ecosystem Integration: Integral works seamlessly with Ethereum-based assets and other DeFi protocols, increasing its versatility and appeal.

Getting started with Integral is simple. Follow these steps:

- Visit the Official Website: Go to the Integral platform to explore its features and learn more about its services.

- Connect Your Wallet: Use a compatible wallet such as MetaMask or another Ethereum-compatible wallet.

- Fund Your Wallet: Ensure you have sufficient ETH or other supported tokens to cover transaction fees and trading balances.

- Choose a TWAP Pool: Familiarize yourself with the TWAP pools available on the platform and select the one that suits your trading needs.

- Execute Your Trade: Adjust the time frame and parameters to optimize your transaction, then complete the trade following the platform's guidelines.

- Monitor and Analyze: Use the platform’s analytics tools to track your trades and evaluate performance over time.

Integral FAQ

Integral's Time-Weighted Average Price (TWAP) system allows users to execute large trades by splitting them into smaller, evenly distributed transactions over a set time frame. This approach minimizes the price impact typically caused by high-volume trades, ensuring traders achieve better execution prices. The Integral platform uses mathematical models to optimize the process, making it an ideal solution for institutional-grade users.

Yes, Integral is designed to integrate seamlessly with existing DeFi strategies. Traders can use the platform alongside yield farming, staking, or liquidity mining to maximize their portfolio's efficiency. Its support for Ethereum-based assets ensures compatibility with popular DeFi protocols, making it highly versatile for professional users.

Integral stands out for its focus on large-scale trading with minimal slippage and optimized transaction costs. Unlike platforms such as Uniswap, Integral's TWAP system ensures better execution prices by spreading trades over time. This makes it particularly effective for institutional-grade traders handling high volumes.

Integral achieves full decentralization by operating on the Ethereum blockchain and relying on transparent, trustless smart contracts. The platform incorporates advanced DeFi tools and maintains an open-source architecture to provide institutional-grade trading features without compromising on transparency or security. Learn more on their official website.

Integral prioritizes transparency by implementing open-source smart contracts and publicly accessible on-chain data. All transactions are executed directly on the blockchain, eliminating intermediaries and ensuring complete traceability. Additionally, the platform undergoes regular audits to maintain the highest levels of security and user trust.

You Might Also Like