About Kriya Finance

Kriya Finance is a comprehensive DeFi protocol built on the Sui blockchain, offering an institutional-grade experience for on-chain traders, liquidity providers, and strategists. With an intuitive suite of tools including spot swaps, limit orders, strategy vaults, and perpetual derivatives, Kriya Finance transforms fragmented DeFi experiences into a seamless ecosystem.

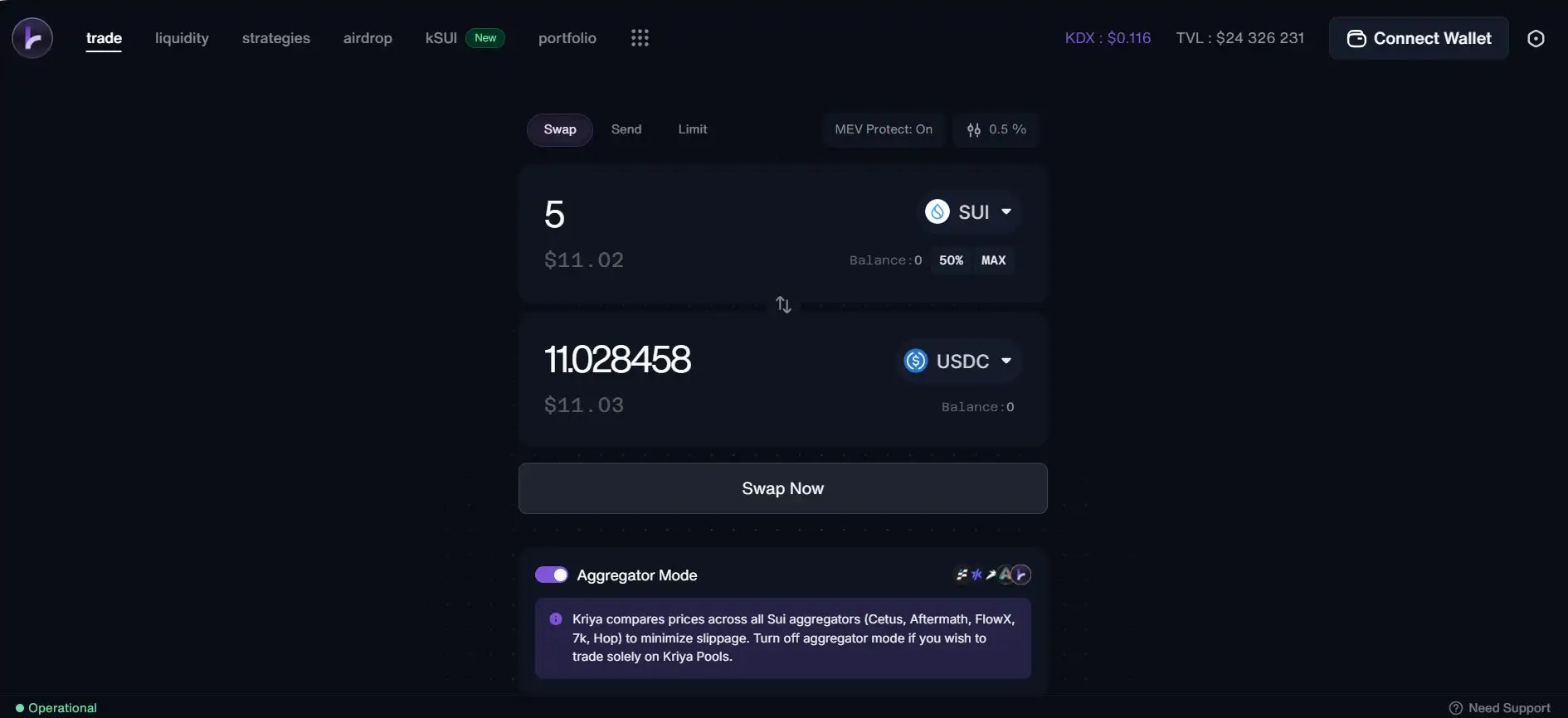

From active traders to DeFi newcomers, Kriya lowers the barrier to entry by offering CeFi-grade UX, deep liquidity, cross-DEX routing, and gas-efficient transactions powered by Sui. With real-time order aggregation, strategy automation, and MEV protection by default, Kriya ensures users interact with DeFi on Sui in the fastest, smartest, and most secure way possible.

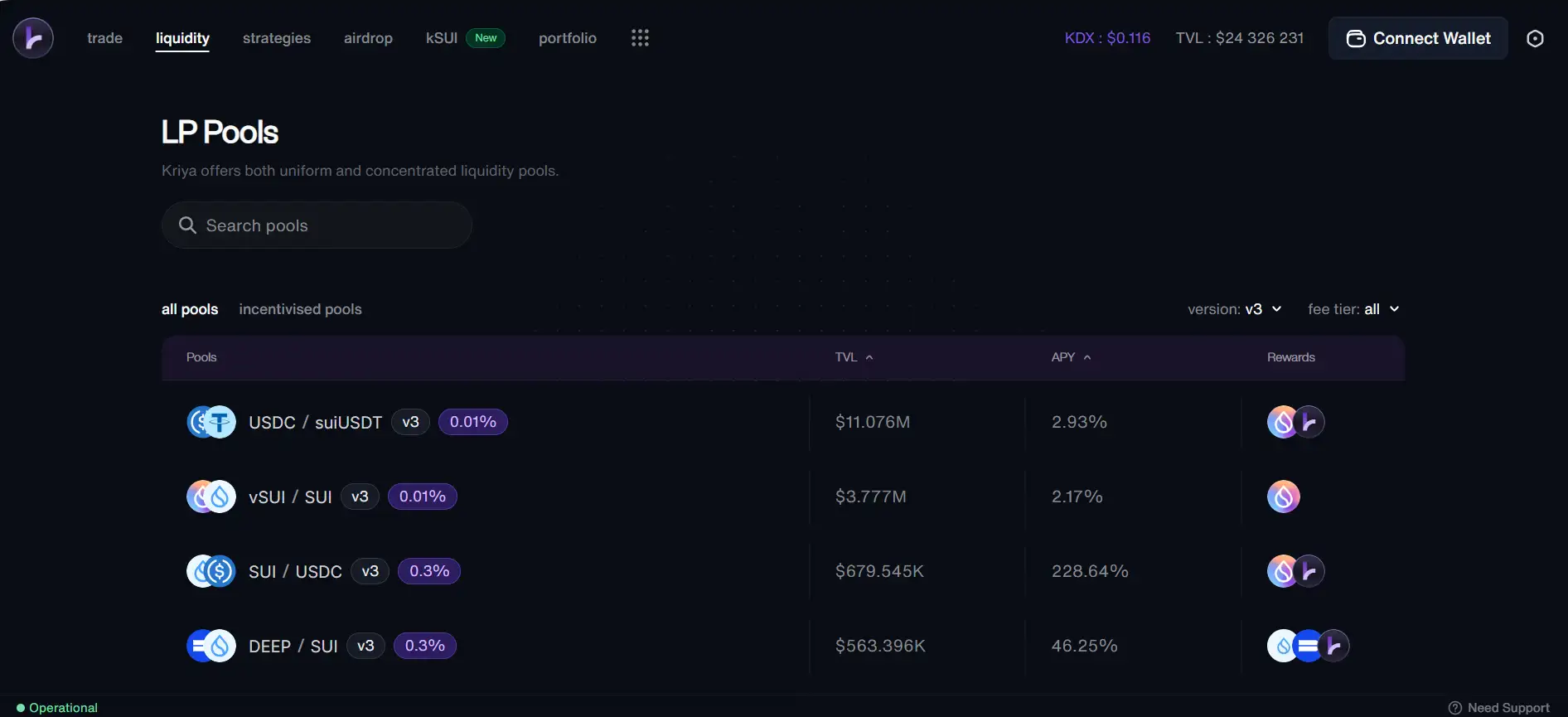

Kriya Finance was created to solve the inefficiencies that plague traditional DeFi ecosystems—high gas fees, low throughput, poor capital efficiency, and steep learning curves. Deployed on Sui Network, Kriya leverages Sui’s parallel execution engine, horizontal scaling, and security-by-design model to offer an elite trading and staking experience. By aggregating key DeFi primitives—AMMs, CLMMs, perps, lending, vault strategies—into one vertically integrated protocol, Kriya Finance creates a seamless journey from bridging funds to earning optimized yields.

The protocol is built around the belief that sustainable liquidity must be nurtured from foundational products. This begins with low-beta spot trading infrastructure (Kriya Swap), expands into CLMM LP optimization and leverage lending vaults, and culminates in high-beta derivative instruments like perpetuals and options. Each layer of the Kriya Suite works together to unlock greater capital efficiency and usability for both institutional and retail users.

Kriya’s integration with Wormhole Connect, Transak, Celer, and other partners enables easy bridging and fiat-to-SUI onboarding, making it extremely easy for users to start using the protocol. Its interface includes support for aggregator mode (comparing prices across DEXs like Cetus, FlowX, 7k, Hop, Aftermath) to reduce slippage and optimize execution. Tools like Kriya Bridge, Kriya Swap, and Perpetuals DEX support users throughout their journey, from deposit to trading.

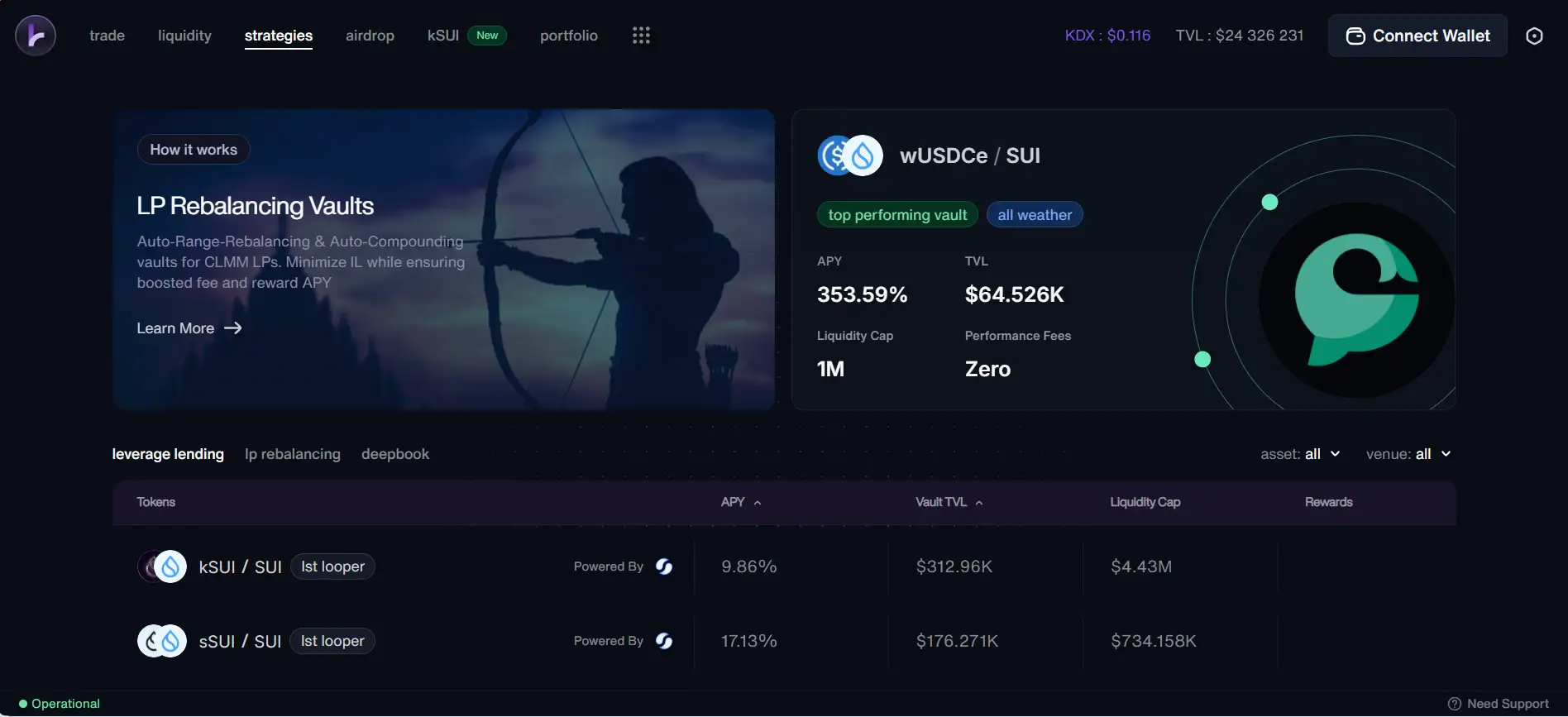

The protocol also supports Kriya Strategy Vaults, which automate complex investment strategies across lending and LP optimization. These include Leverage Lending Vaults and CLMM LP Optimizer Vaults, which combine yield farming, auto-compounding, and position rebalancing into one simple interface. As DeFi grows on Sui, Kriya is poised to serve as its core infrastructure, bridging the user experience gap between DeFi and traditional finance.

Key competitors include Uniswap, Cetus, and dYdX, though Kriya differentiates itself through its full-stack integration on Sui, institutional UX, and native strategy automation.

Kriya Finance offers a powerful range of DeFi features designed for speed, efficiency, and institutional-grade usability:

- Kriya Swap: Native spot AMM and CLMM engine with dynamic price curves and integration with Deepbook for pro-grade execution.

- Aggregator Mode: Aggregates prices from top DEXs (Cetus, FlowX, 7k, Hop, Aftermath) to optimize swaps with minimal slippage.

- Kriya Strategy Vaults: Passive income vaults with CLMM optimization and lending leverage strategies, featuring auto-compounding and smart rebalancing.

- Orderbook Perpetuals: On-chain orderbook DEX with 20x leverage for trading under-collateralized perpetuals and futures contracts.

- MEV Protection: Built-in MEV prevention layer ensures secure execution with minimal front-running risk.

- In-App Bridging: Seamlessly move funds to Sui via integrated Wormhole Connect, Transak, Celer, or Heroswap.

- Degen Corner: A no-code token launcher, airdrops, and alpha tools for early-stage DeFi participants.

Getting started with Kriya Finance is easy and designed to get users up and running on Sui quickly:

- Visit the App: Go to app.kriya.finance and connect your wallet (supports Sui, MSafe, Martian, and others).

- Fund Your Wallet: Use the in-app bridge powered by Wormhole or fiat onramp via Transak to get SUI tokens.

- Choose a Tool: Swap tokens, provide liquidity, stake in strategy vaults, or trade perps via the unified dashboard.

- Enable Aggregator Mode: Let Kriya scan all major Sui DEXs to route your trade with minimal slippage.

- Explore Vaults: Select from CLMM LP Optimizers or Leverage Lending Vaults and stake with just one click.

- Manage & Track: Monitor TVL, portfolio performance, and vault positions from the integrated interface.

- Join Airdrops & More: Participate in Kriya Airdrop campaigns and discover early-stage DeFi tools through the Degen Corner.

Kriya Finance FAQ

Kriya offers superior swap execution through its Aggregator Mode, which sources liquidity across all major Sui DEXs—Cetus, Aftermath, FlowX, 7k, and Hop. This cross-DEX comparison reduces slippage, improves price execution, and gives users the best rate possible without needing to manually compare platforms. You can toggle the feature on/off depending on whether you want routed or pure-Kriya liquidity trades.

Kriya Strategy Vaults are composable, automated investment products that optimize yield across DeFi primitives. Two core types exist: Leverage Lending Vaults and CLMM LP Optimizer Vaults. These vaults are ideal for users who want passive exposure to yield farming, fee rewards, and market upside without manual strategy management. Kriya handles rebalancing, auto-compounding, and capital allocation on your behalf.

Kriya chose Sui Network because of its DAG-based architecture, low-latency finality, parallelized execution, and ultra-low gas fees. These features make Sui uniquely suited for running high-performance applications like real-time orderbooks and on-chain matching engines, which would be cost-prohibitive on Ethereum. Sui also supports zkLogin and gas sponsorship, improving the user onboarding experience dramatically.

Yes. Kriya is designed for both active traders and passive investors. You can stake in strategy vaults, provide liquidity to AMMs or CLMMs, or participate in airdrop programs and points campaigns without actively trading. These options allow you to earn yield and rewards simply by depositing assets and letting the protocol optimize returns on your behalf.

To use Kriya, you'll need to bridge funds to Sui. The platform supports an in-app bridge via Wormhole Connect, as well as integrations with Transak for fiat purchases and Heroswap or Celer for token bridging. Just connect your source wallet, choose the asset and amount, and follow the prompts. Within minutes, your funds will appear in your Sui wallet—ready for swaps, vaults, or trading.

You Might Also Like