About Kuma

Kuma Exchange is a high-performance decentralized perpetuals trading platform built for speed, flexibility, and trader control. Blending the efficiency of centralized exchanges with the transparency of blockchain settlement, Kuma redefines what’s possible for decentralized derivatives trading. With its custom-built XCHAIN Layer 2 and gas-free execution, Kuma offers a frictionless experience for advanced and everyday users alike.

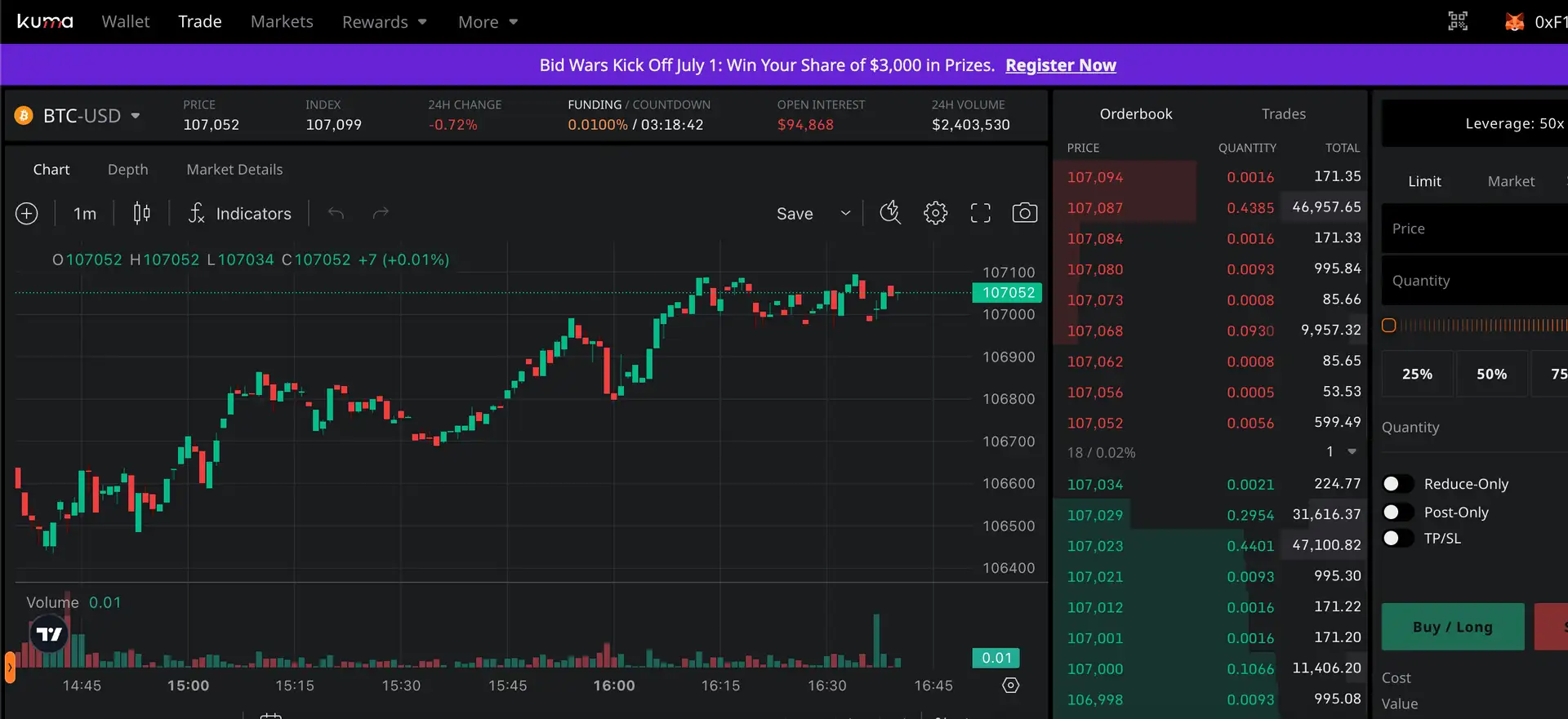

Operating on a hybrid model, Kuma pairs an off-chain matching engine and order book with on-chain settlement and custody through smart contracts. This architecture gives users access to millisecond latency, zero gas fees for trading, and full custody of their assets — all within a responsive and intuitive trading interface. Kuma is tailored for serious traders who demand the performance of a CEX without sacrificing the self-sovereignty of DeFi.

Kuma is a next-generation decentralized perpetuals exchange purpose-built for speed, performance, and scalability. Unlike most DEXs that rely entirely on on-chain order matching, Kuma uses a hybrid model that brings off-chain performance to the DeFi world. All trade matching, order handling, and execution are managed off-chain through a centralized-like engine, while custody and final settlement occur on-chain using verified smart contracts.

This structure enables Kuma to offer execution speeds that rival top centralized exchanges while retaining the trustless benefits of decentralized finance. With tens of thousands of orders processed per second and order latency measured in milliseconds, the Kuma engine provides unmatched throughput and efficiency. The off-chain engine supports advanced order types like stop-loss, fill-or-kill, and post-only, allowing users to implement sophisticated trading strategies usually found only on centralized platforms.

Settlement and custody are handled on XCHAIN, Kuma's custom-built Arbitrum Orbit Layer 2, which offers instant finality, near-zero fees, and full EVM compatibility. Trades settle to XCHAIN, which checkpoints directly to Ethereum for long-term security, ensuring that users benefit from fast settlement without sacrificing decentralization. Kuma’s escrow-based smart contracts manage pre- and post-trade fund custody, guaranteeing the security and finality of each trade.

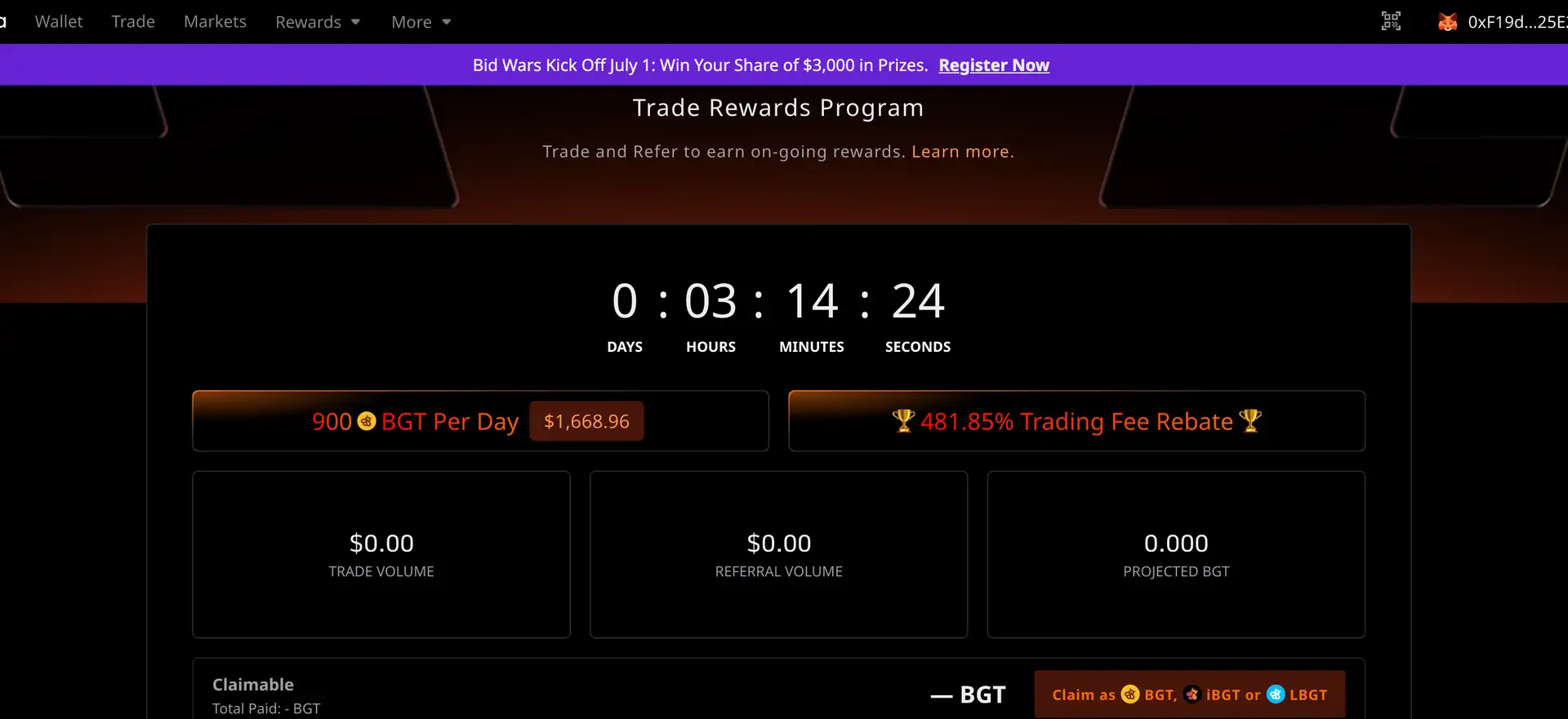

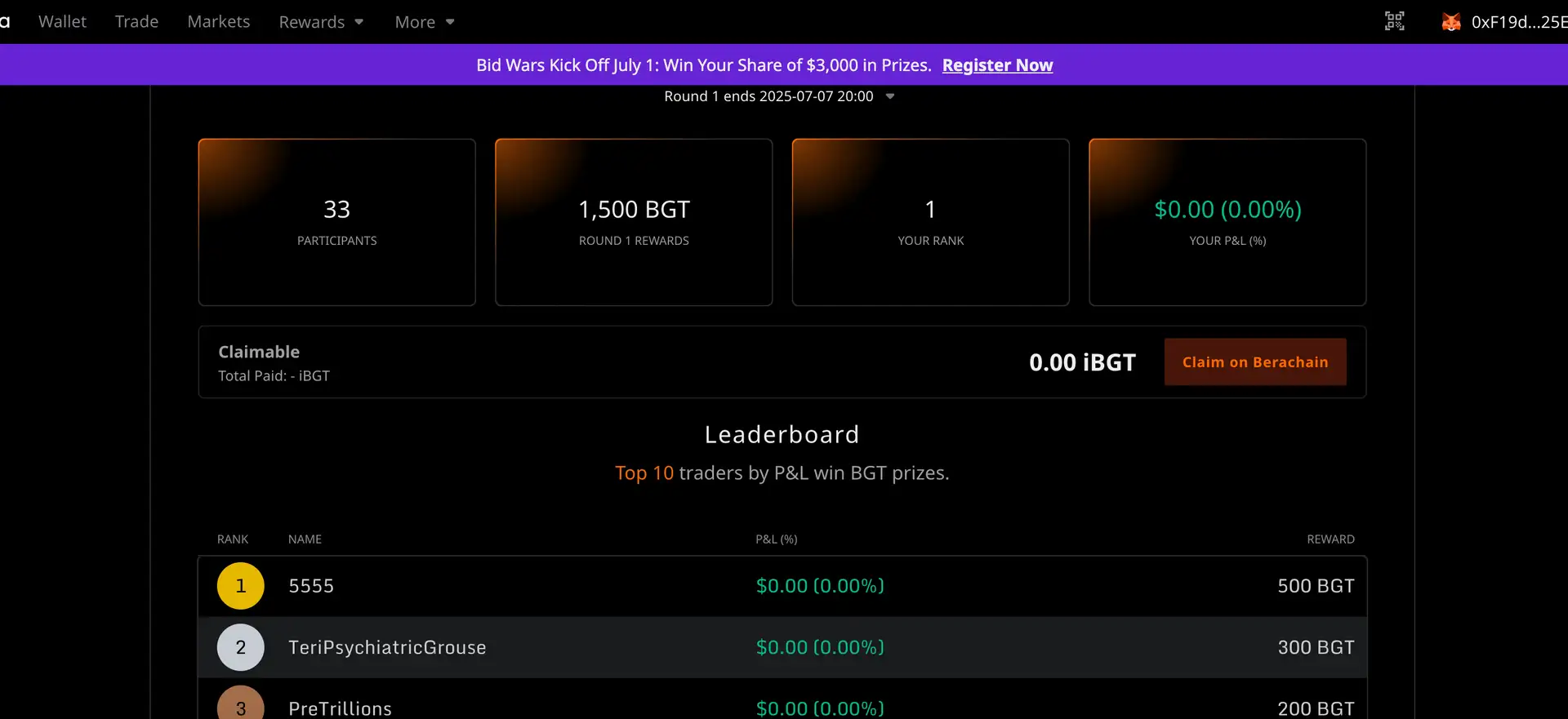

Additionally, Kuma offers robust tooling for developers and liquidity providers. The Kuma API and SDK allow fast integration for bots, trading strategies, and custom interfaces. Programs like the Market Maker Rewards and Kuma Points systems incentivize trading and liquidity provisioning with real-time metrics and rewards. Kuma’s reward system even includes activity-based emissions via BGT tokens and a unique mechanism using the Kuma Rewards Token (KRT) to fairly distribute earnings.

Compared to perpetual DEX competitors like Perpetual Protocol, dYdX, or GMX, Kuma stands out with its combination of centralized exchange performance, gasless execution, customizable trading logic, and fully transparent settlement. While others struggle with front-running, slow updates, or high gas fees, Kuma users benefit from a smooth, CEX-like experience with the trustlessness of DeFi.

Kuma Exchange delivers a powerful suite of features and advantages for modern perpetuals traders:

- Instant Execution: Orders are processed in real-time with millisecond latency, ensuring trades are confirmed and balances updated instantly.

- Gas-Free Trading: Place and cancel orders without paying gas fees thanks to Kuma’s off-chain engine and custom XCHAIN settlement layer.

- Advanced Order Types: Execute strategies using CEX-style orders such as stop-loss, post-only, and fill-or-kill.

- Non-Custodial Security: Smart contracts hold collateral securely, allowing users full control over funds while eliminating exchange risk.

- Custom Layer 2 Settlement: XCHAIN enables fast and congestion-free settlement of trades without volatile gas pricing.

- Kuma SDK and API: Automate your strategies or build on top of Kuma’s infrastructure with enterprise-grade developer tools.

- Kuma Points & Trade Rewards: Earn rewards and incentives for active participation, referrals, and liquidity provisioning.

- Delegated Keys: Trade securely in real-time without signing every action — great for mobile trading and bot integration.

Getting started with Kuma Exchange is quick and seamless for both retail and professional traders:

- Visit the Exchange: Go to Kuma and click “Launch” to open the trading interface.

- Connect Your Wallet: Use MetaMask or your preferred wallet to connect and authorize your session securely.

- Deposit USDC: Bridge USDC to XCHAIN via Stargate from Berachain or another supported network — deposits are gasless and instant.

- Start Trading: Choose from available perpetual markets and place market or limit orders with zero gas fees and instant execution.

- Track Rewards: Earn BGT emissions and Kuma Points for trading and referring others. Visit the Rewards page to monitor and claim.

- Explore Advanced Tools: Integrate trading bots, plug into the Kuma SDK, or become a market maker through the Kuma Market Maker Program.

- Refer & Earn: Share your referral code and earn 10% of your referrals’ trading fees in USDC — claimable anytime, gas-free.

Kuma Reviews by Real Users

Kuma FAQ

Kuma leverages a hybrid architecture where orders are executed off-chain using a high-performance engine capable of millisecond latency. When users place orders on Kuma, the order is signed and transmitted to the trading engine, which matches it instantly with existing liquidity. Only after the trade is matched is the final settlement sent on-chain. This design removes the delay of blockchain confirmation while maintaining on-chain custody via smart contracts.

XCHAIN is Kuma’s custom-built Arbitrum Orbit Layer 2 settlement network, optimized specifically for trade finality. It processes settlements with near-zero fees and without competition for blockspace, eliminating congestion. This setup allows Kuma to offer gas-free trading for all off-chain actions like placing and canceling orders, while only settling executed trades on-chain efficiently.

Kuma uses a points-based scoring system that assesses market makers based on three metrics: depth of liquidity, order uptime, and qualified maker volume. These are tracked across one-minute snapshots to determine real-time contribution quality. Eligible makers receive a share of 2.5% of the total KUMA token supply at the end of each season, encouraging meaningful, active participation in the order book.

KRT is a synthetic rewards token that represents a user’s share of trading activity on Kuma. Because the Berachain BGT vault requires on-chain deposits to allocate rewards, Kuma uses KRT to mirror user contributions off-chain. As users trade or refer others, KRT adjusts their vault allocation automatically, ensuring fair and activity-based BGT distribution even if users haven’t deposited assets directly into the vault.

Kuma’s off-chain order engine eliminates reliance on miners or validators for transaction sequencing, preventing front-running and sandwich attacks. Orders are signed and sent directly to the matching engine, where execution follows strict arrival-time priority. Since order placement and cancellation happen off-chain and in real time, users are insulated from the inconsistent execution and reordering found on typical on-chain DEXs. Final trades are later submitted to XCHAIN for deterministic settlement.

You Might Also Like