About Lenfi

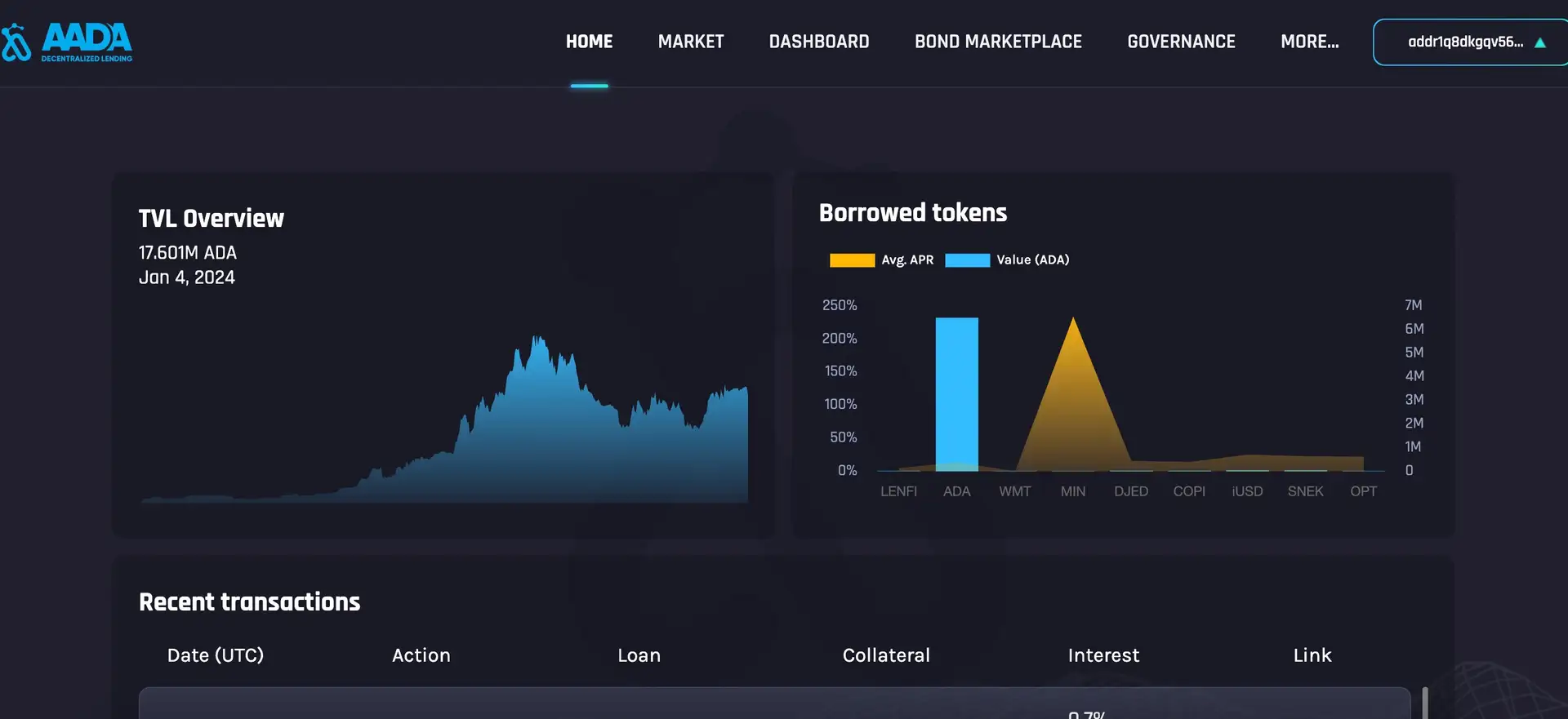

Lenfi, formerly known as Aada Finance, is a decentralized non-custodial lending and borrowing protocol built on the Cardano blockchain. It enables users to participate as depositors or borrowers in a peer-to-peer or peer-to-pool fashion. Lenfi aims to unlock financial potential by providing a range of services such as shorting, longing, yield farming, and stablecoin borrowing. The protocol emphasizes permissionless liquidity, non-custodial operations, and transparent governance, leveraging Cardano's eUTXO model to ensure secure and efficient transactions.

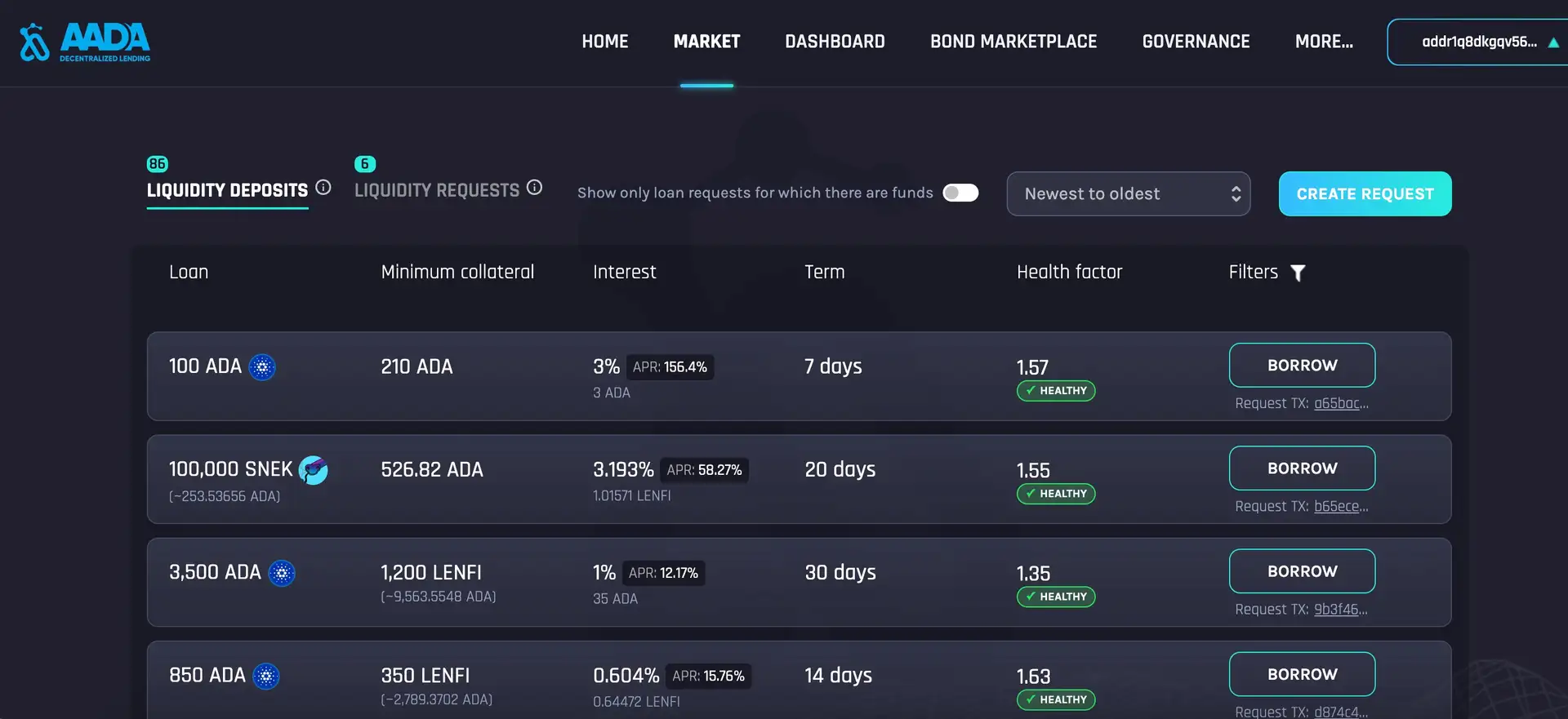

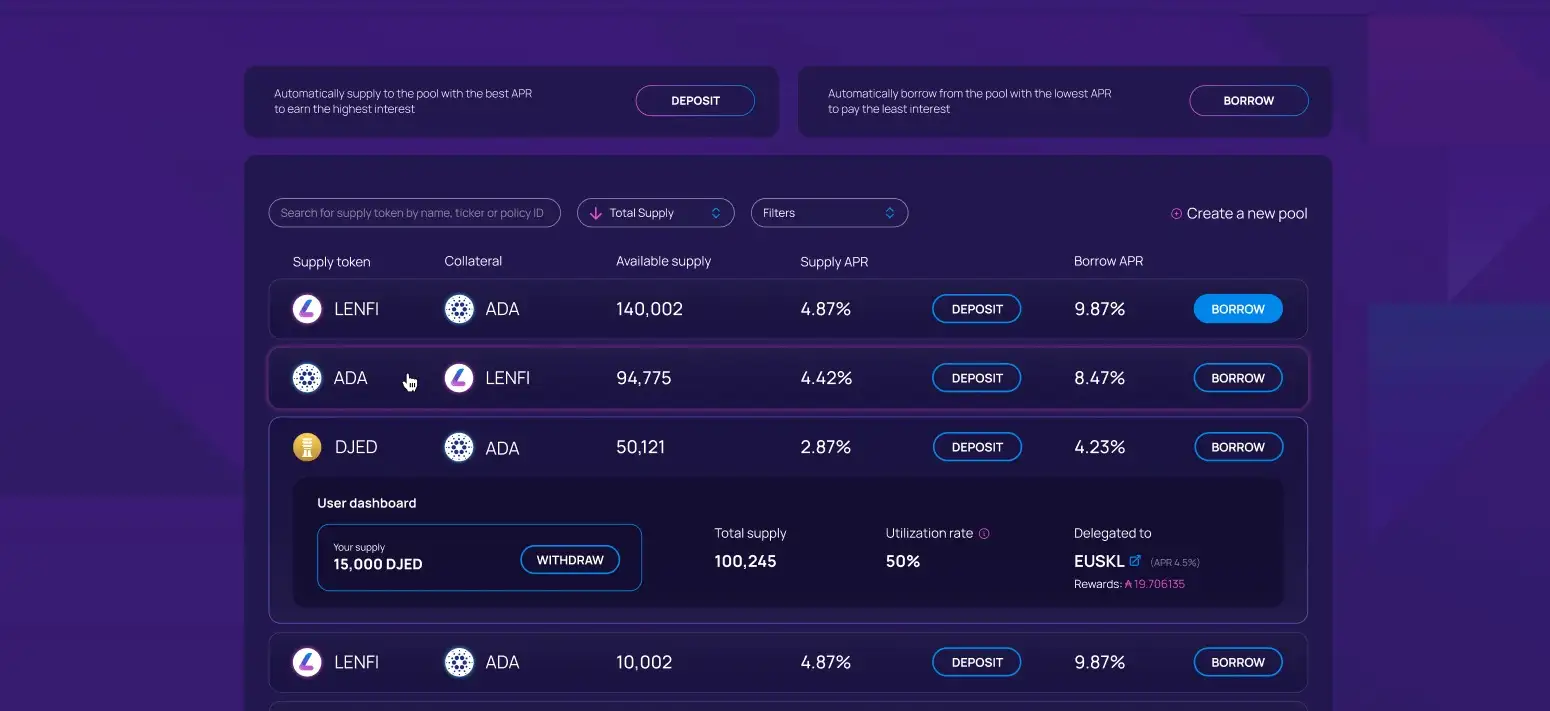

Lenfi has evolved significantly from its initial version, Aada V1, which focused primarily on peer-to-peer lending and borrowing. The protocol offers a variety of features designed to cater to different financial needs, making it a versatile tool in the decentralized finance (DeFi) space. Depositors on Lenfi can provide liquidity by depositing funds with pre-set terms or by contributing to any of the liquidity pools available on the platform, thus earning passive income.

Borrowers, on the other hand, have the option to submit peer-to-peer overcollateralized requests or to utilize the liquidity pools for overcollateralized loans. This dual approach provides flexibility and ensures that users can find financial solutions that best fit their needs.

A significant milestone in Lenfi's development was the introduction of NFT Bonds, which are unique financial instruments that enhance the functionality and flexibility of loans within the protocol. Additionally, the platform supports overcollateralized loans, ensuring security for lenders by requiring borrowers to provide collateral that exceeds the loan amount/.

One of the standout features of Lenfi is its commitment to non-custodial operations. Users maintain full control over their assets, significantly reducing the risks associated with custodial services. This aligns with the broader DeFi principle of decentralization and user empowerment.

Governance on Lenfi is managed through a transparent DAO (Decentralized Autonomous Organization) model. This allows for decentralized decision-making processes where community members can participate in protocol management by voting on proposals and engaging in discussions. This approach ensures that the protocol evolves in a manner that reflects the collective interests of its users.

The platform also leverages Cardano's eUTXO model, which provides a more efficient and secure framework for executing transactions compared to traditional models. This technical advantage is crucial for maintaining the high level of performance and reliability that users expect from a DeFi protocol.

Competitors in the DeFi lending and borrowing space include Aave, Compound, and MakerDAO. Each of these platforms offers similar services, but Lenfi differentiates itself through its unique features such as NFT Bonds, permissionless liquidity pools, and its utilization of the Cardano blockchain.

The protocol's history is marked by continuous development and innovation, with a focus on providing a secure, user-friendly, and efficient platform for decentralized lending and borrowing. The evolution from Aada V1 to Lenfi represents a commitment to enhancing user experience and expanding the protocol's capabilities to meet the growing demands of the DeFi market.

- Permissionless Liquidity: Users can create their own liquidity pools and become Pool Managers, offering unparalleled flexibility and inclusivity.

- NFT Bonds: These unique financial instruments enhance the functionality and flexibility of loans within the protocol, providing innovative ways to manage collateral.

- Overcollateralized Loans: This feature ensures security for lenders by requiring borrowers to provide collateral that exceeds the loan amount, minimizing risk.

- Non-custodial Operations: Users maintain control over their assets at all times, significantly reducing the risks associated with custodial services.

- Transparent DAO Governance: Decentralized decision-making processes allow community participation in protocol management, ensuring that the platform evolves according to the collective interests of its users.

- Utilizable Token: The token is integral to the protocol’s operation, facilitating various functions within the ecosystem.

- Cardano eUTXO Model: Leveraging this model provides more efficient and secure transaction execution, enhancing the overall performance of the protocol.

- Diverse Financial Services: Lenfi offers a range of financial services including shorting, longing, yield farming, and stablecoin borrowing, catering to various user needs.

- Community Engagement: Active community participation through voting and discussions helps shape the future of the platform.

- Create an Account: Visit the Lenfi website and sign up by connecting your Cardano-compatible wallet.

- Deposit Funds: Choose to deposit funds with pre-set terms or into a liquidity pool to start earning passive income. Detailed guides are available in the Lenfi documentation.

- Borrow Funds: Submit a peer-to-peer borrow request or take a loan from the liquidity pool. Ensure you have sufficient collateral as per the protocol’s requirements.

- Participate in Governance: Engage in the decentralized governance process by voting on proposals and participating in community discussions. This is facilitated through the DAO model.

- Explore Features: Utilize the platform’s features such as NFT Bonds and overcollateralized loans to maximize your financial potential. Detailed instructions can be found in the Lenfi documentation.

- Access Resources: Refer to the Lenfi GitHub page for additional resources, including the whitepaper and lightpaper.

- Community Support: Join the Lenfi community on Telegram, Discord, or other social media platforms for support and updates. Links are available on the Lenfi website.

Lenfi Reviews by Real Users

Lenfi FAQ

Lenfi’s NFT Bonds are unique financial instruments that allow users to leverage their digital assets in a more flexible and innovative way. These bonds enhance the functionality of loans within the protocol, providing users with the ability to utilize their NFTs as collateral for borrowing and lending. This not only opens up new opportunities for asset utilization but also integrates the growing NFT market into the DeFi ecosystem, making Lenfi a pioneer in combining these two revolutionary technologies.

Lenfi’s permissionless liquidity feature allows individual investors to create their own liquidity pools without requiring any approval from centralized entities. This empowers users to have full control over their funds and the conditions under which they are lent out. It democratizes the investment process, making it accessible to a broader range of users, and enables anyone to become a pool manager, thus increasing the diversity and resilience of the ecosystem.

The eUTXO model used by Lenfi enhances transaction efficiency by providing a more scalable and secure way to process transactions. Unlike traditional models, the eUTXO model allows for multiple outputs from a single transaction, which can be processed in parallel. This reduces bottlenecks and increases the throughput of the network, ensuring that Lenfi can handle a higher volume of transactions efficiently and securely.

The Lenfi DAO ensures transparent and fair governance through its decentralized decision-making process. All proposals and changes to the protocol are voted on by the community, with each vote being recorded on the blockchain for transparency. This means that no single entity has control over the protocol, and all decisions are made collectively by the stakeholders, ensuring that the interests of the community are represented and safeguarded.

Lenfi employs several security measures to protect user assets, including smart contract audits, non-custodial operations, and overcollateralization. Smart contracts are rigorously tested and audited by third-party security firms to identify and fix vulnerabilities. Being non-custodial, users retain control of their private keys, reducing the risk of hacks. Overcollateralization ensures that borrowers provide more collateral than the value of the loan, protecting lenders from defaults.

You Might Also Like