About LIDO

Lido is a leading liquid staking platform that enables users to stake their Ethereum (ETH) and other Proof-of-Stake (PoS) assets while maintaining liquidity. Unlike traditional staking, which locks assets and prevents users from accessing their funds, Lido provides stakers with staked tokens (such as stETH, stMATIC, or stSOL), which can be used in DeFi applications while still earning staking rewards. This approach makes staking more flexible and capital-efficient, allowing users to participate in Decentralized Finance (DeFi) without sacrificing staking yields.

Built to remove technical and financial barriers in staking, Lido allows anyone to stake assets without needing 32 ETH (Ethereum’s minimum staking requirement) or setting up complex validator nodes. Governance and operations are managed by the Lido DAO, a decentralized community that ensures the platform remains secure and transparent. With support for Ethereum, Polygon, Solana, and other blockchains, Lido is the go-to solution for users looking to maximize their staking potential while keeping assets liquid.

Lido was launched in 2020 to solve the liquidity issues of Ethereum staking. When Ethereum introduced Proof-of-Stake (PoS) staking, one major drawback was the requirement to lock up 32 ETH per validator, which limited participation to large investors. Lido provided an innovative solution by allowing users to stake any amount of ETH and receive stETH, a liquid staking token that can be used in DeFi protocols like Aave, Curve, and Balancer.

Beyond Ethereum, Lido has expanded to multiple PoS blockchains, providing liquid staking solutions for:

- Ethereum (ETH): Users receive stETH, a liquid staking token for Ethereum.

- Polygon (MATIC): Users receive stMATIC, which remains usable in DeFi applications.

- Solana (SOL): Users receive stSOL, keeping Solana staking liquid.

- Polkadot (DOT) & Kusama (KSM): Future plans include liquid staking solutions for these networks.

Lido is a key player in the liquid staking market, competing with platforms like:

- Rocket Pool – A decentralized Ethereum staking protocol.

- StakeFish – A staking service for multiple PoS blockchains.

- Figment – A provider of staking infrastructure for institutions.

- Ankr Staking – A multi-chain liquid staking platform.

With its decentralized approach, multi-chain support, and integration with DeFi platforms, Lido has positioned itself as the industry leader in liquid staking.

Lido offers several unique benefits that make it the preferred choice for staking solutions:

- Liquid Staking: Users can stake assets and receive staked tokens (e.g., stETH, stMATIC, stSOL), allowing them to use funds in DeFi applications while still earning staking rewards.

- No Minimum Staking Requirement: Unlike Ethereum’s 32 ETH requirement, Lido allows anyone to stake any amount of ETH and earn staking rewards.

- Multi-Chain Support: Lido supports Ethereum, Polygon, Solana, and other PoS networks, making it a versatile staking solution.

- DeFi Integration: Users can maximize their rewards by using stETH, stMATIC, and stSOL in Aave, Curve, and other DeFi protocols.

- Decentralized & Secure: Governance is handled by the Lido DAO, which ensures decentralization, protocol security, and transparent staking operations.

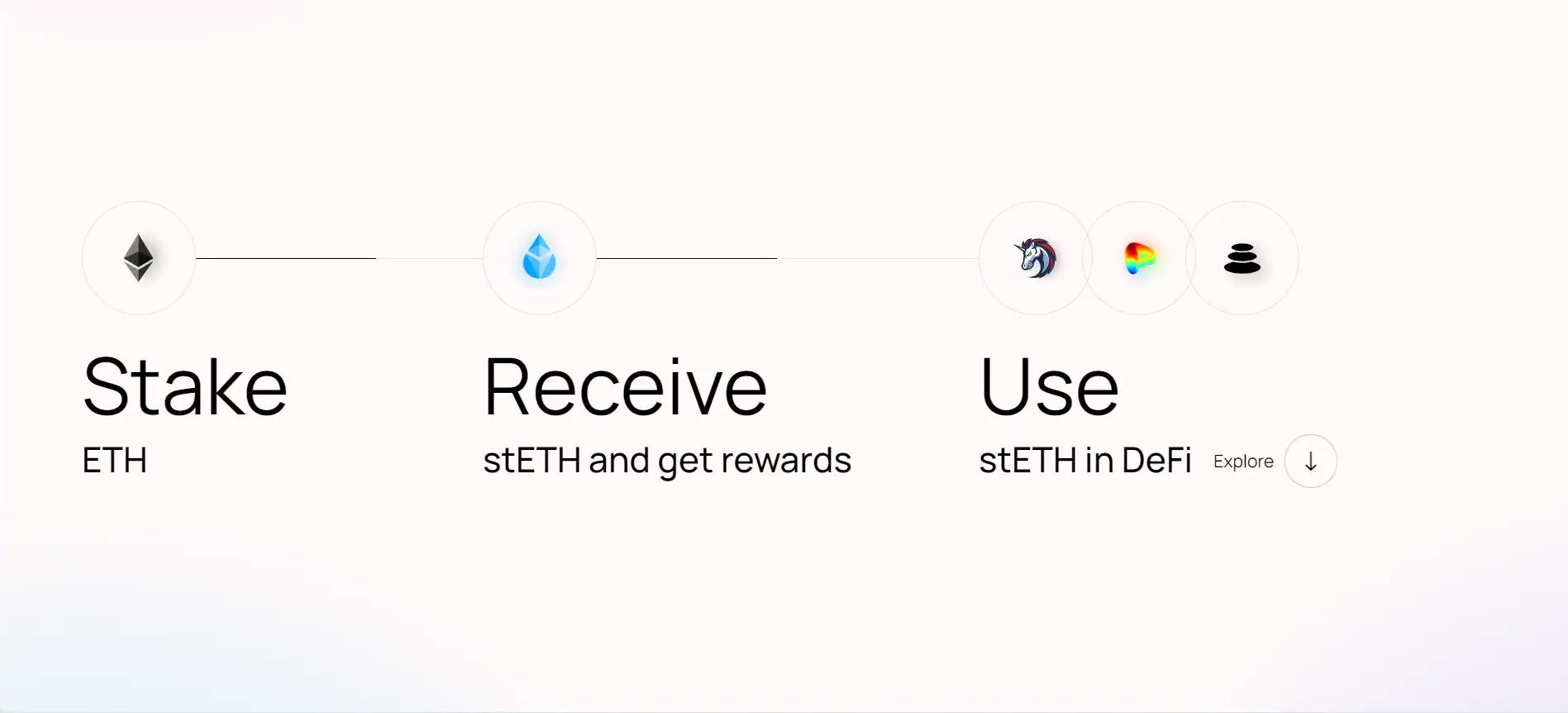

Staking with Lido is quick and straightforward. Follow these steps to start earning staking rewards while keeping your assets liquid:

- Visit the Lido Staking Platform: Go to stake.lido.fi.

-

Connect Your Wallet: Lido supports the following wallets:

- MetaMask

- Ledger

- Trezor

- WalletConnect-compatible wallets

- Choose Your Asset: Select the token you want to stake (ETH, MATIC, SOL, etc.).

- Stake & Receive Staked Tokens: After confirming your staking transaction, you will receive stETH, stMATIC, or stSOL, which remain liquid and usable in DeFi applications.

- Monitor Your Staking Rewards: Check your staking rewards and balances using the Lido dashboard: Lido.fi.

LIDO FAQ

When you stake Ethereum (ETH) with Lido, your ETH is pooled with other users’ funds and delegated to a network of trusted validators. Instead of locking your ETH, you receive stETH, a liquid token that represents your staked ETH plus accrued rewards. stETH maintains its value and automatically updates its balance to reflect staking rewards, meaning you don’t need to claim them manually. Additionally, stETH can be used in DeFi applications like lending, trading, and yield farming while still earning staking rewards.

Lido is designed to align with Ethereum’s official upgrades, ensuring that your staked ETH remains unaffected. If Ethereum undergoes a hard fork, Lido DAO will decide how to handle forked assets and whether additional tokens will be distributed to users. Since Lido is governed by a decentralized community, any major decisions are made transparently through governance proposals. Users can stay informed about upcoming network changes by visiting the Lido Blog.

Yes! Lido’s liquid staking allows users to continue using their assets while earning staking rewards. stETH, stMATIC, and stSOL are widely accepted across the DeFi ecosystem. You can provide liquidity on decentralized exchanges, use staked tokens as collateral for loans, or trade them without needing to unstake your assets. Popular DeFi platforms like Curve, Aave, and Uniswap support Lido’s staked assets, giving you more flexibility in managing your crypto investments.

Lido employs multiple layers of security, including decentralized governance, validator selection, and smart contract audits. Validators are carefully chosen based on performance and decentralization principles, reducing the risk of network disruptions. Additionally, Lido DAO oversees the protocol to ensure transparency and security. Smart contracts are regularly audited by top security firms such as Quantstamp and MixBytes.

Lido applies a 10% staking fee, which is deducted from staking rewards rather than from your initial deposit. This fee is split between node operators, who validate transactions, and the Lido DAO treasury, which funds protocol development, security audits, and ecosystem growth. Unlike centralized staking providers, Lido operates with full transparency, allowing users to track all fees and fund distributions through the DAO governance system. There are no hidden fees, and users can withdraw their staked tokens at any time without additional costs. To check the latest fee structure, visit the Lido FAQ page.

You Might Also Like