About Liquid Swap

Liquidswap is a decentralized exchange (DEX) built on the Aptos blockchain, offering users a seamless and secure way to trade digital assets. As the first DEX on Aptos, Liquidswap plays a pivotal role in the network’s growing DeFi ecosystem, providing fast transactions, deep liquidity, and minimal fees. Developed by Pontem Network, the platform utilizes an advanced Automated Market Maker (AMM) model to facilitate token swaps without intermediaries. Liquidswap supports both stable and volatile liquidity pools, catering to diverse trading strategies while ensuring optimal pricing and efficiency.

Unlike centralized exchanges, Liquidswap is fully decentralized, allowing users to trade directly from their wallets while maintaining full custody of their funds. The platform's integration with Aptos ensures ultra-fast transactions and significantly lower gas fees compared to Ethereum-based exchanges. With features such as yield farming, liquidity provision, and cross-chain compatibility in development, Liquidswap continues to evolve, enhancing the accessibility and functionality of decentralized finance.

Liquidswap is the first and most prominent decentralized exchange (DEX) on the Aptos blockchain, designed to provide a high-speed, low-cost trading experience. The platform was developed by Pontem Network, a key contributor to the Aptos ecosystem, with the goal of revolutionizing DeFi on this next-generation blockchain. By leveraging Aptos’ unique architecture, Liquidswap offers instant trade execution, reduced congestion, and near-zero transaction fees, setting a new standard for blockchain-based trading platforms.

A defining feature of Liquidswap is its innovative dual AMM model. The platform supports both stable AMM pools, which optimize trading for low-volatility assets like stablecoins, and volatile AMM pools, which cater to high-risk, high-reward trading pairs. This approach enhances liquidity efficiency and provides users with optimal pricing mechanisms. Additionally, the platform's non-custodial nature ensures that users retain complete control over their funds, with all trades executed via secure smart contracts.

Security and transparency are at the core of Liquidswap. The platform's code is open-source, fostering community participation and continuous improvements. It also integrates advanced safety measures to protect user funds, reducing risks commonly associated with centralized exchanges. As part of its roadmap, Liquidswap aims to introduce cross-chain interoperability, governance mechanisms, and enhanced yield farming opportunities.

The DeFi landscape is competitive, and Liquidswap competes with major DEXs across multiple blockchains. Key competitors include Uniswap on Ethereum, PancakeSwap on Binance Smart Chain, and Curve Finance, which specializes in stablecoin swaps. However, by leveraging Aptos’ high throughput and low transaction costs, Liquidswap offers a more efficient trading experience, positioning itself as a leading DEX in the next wave of blockchain innovation.

Liquidswap offers a wide range of benefits and features that set it apart from traditional and blockchain-based exchanges. Below are the key highlights of the platform:

- Dual AMM Model: Supports both stable and volatile AMM pools, optimizing liquidity and reducing slippage.

- Ultra-Low Fees: Built on Aptos, transactions are significantly cheaper than Ethereum-based DEXs.

- Non-Custodial Trading: Users retain full control over their funds with secure, trustless smart contracts.

- High-Speed Transactions: Aptos' parallel execution model enables near-instant trade settlements.

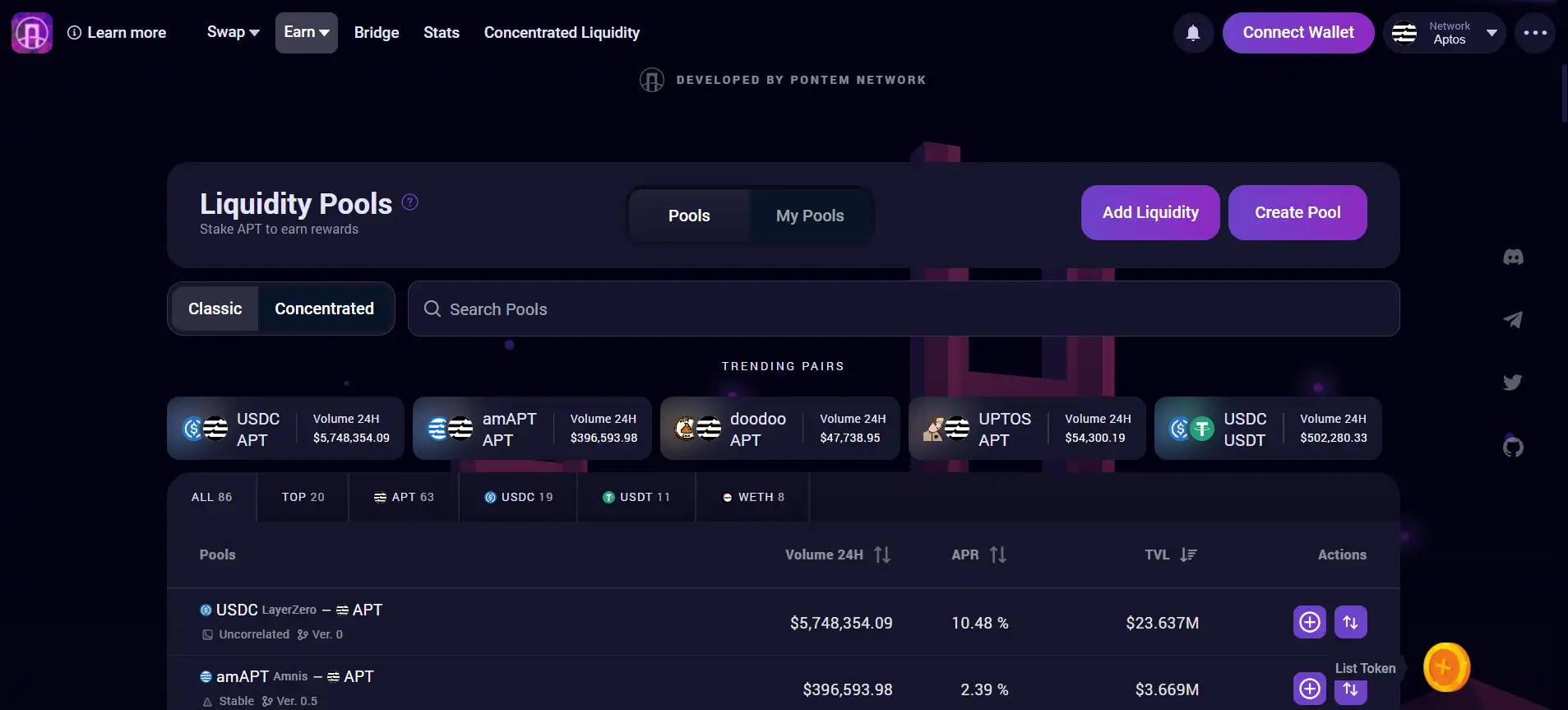

- Yield Farming & Liquidity Rewards: Users can earn passive income by participating in liquidity pools.

- Cross-Chain Functionality: Future interoperability will allow seamless asset movement across multiple blockchains.

- Community-Driven Development: Open-source infrastructure encourages innovation and transparency.

Getting started with Liquidswap is simple. Follow these steps to begin trading and providing liquidity on the platform:

-

Step 1: Connect Your Wallet

- Go to Liquidswap.

- Click "Connect Wallet" and select an Aptos-compatible wallet such as Petra Wallet or Martian Wallet.

- Authorize the connection and ensure you have Aptos tokens in your wallet for gas fees.

-

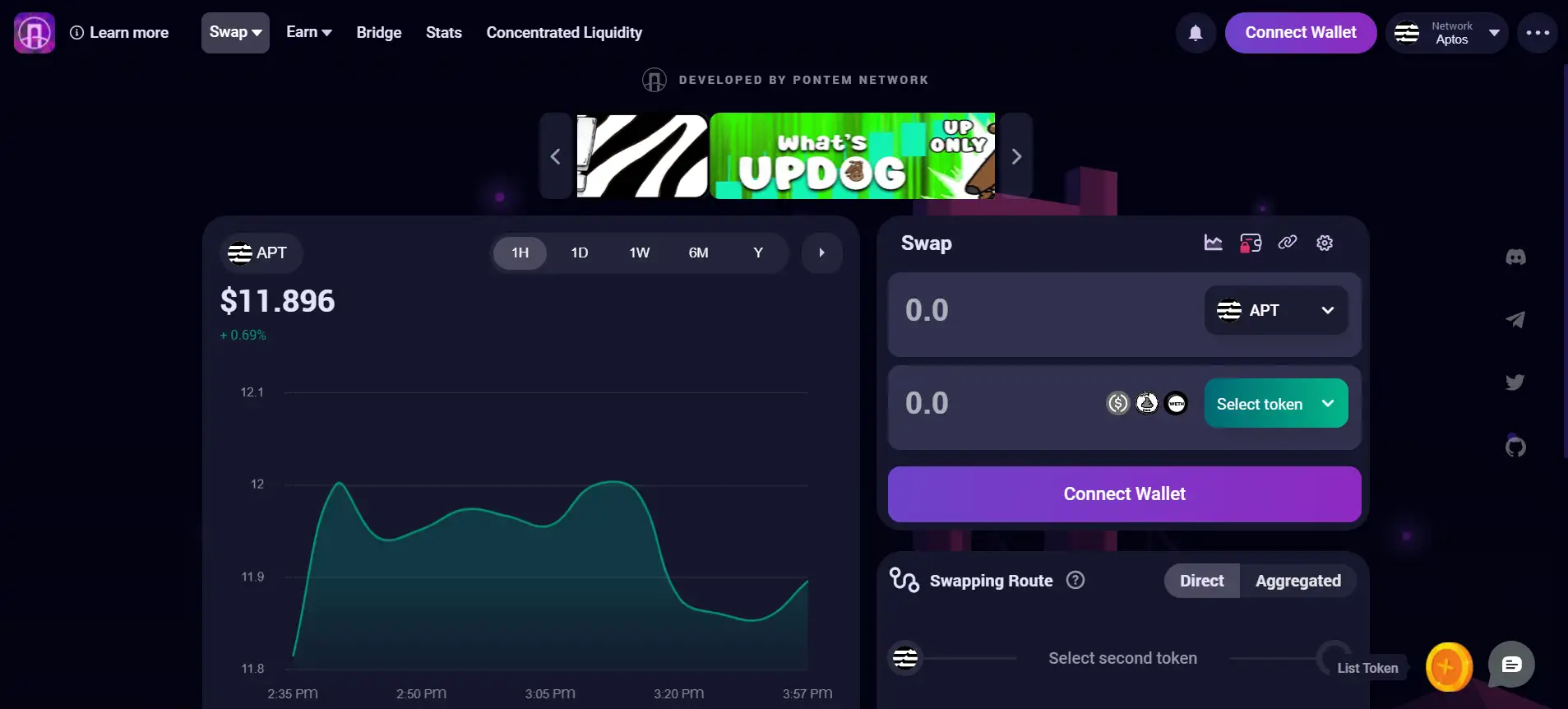

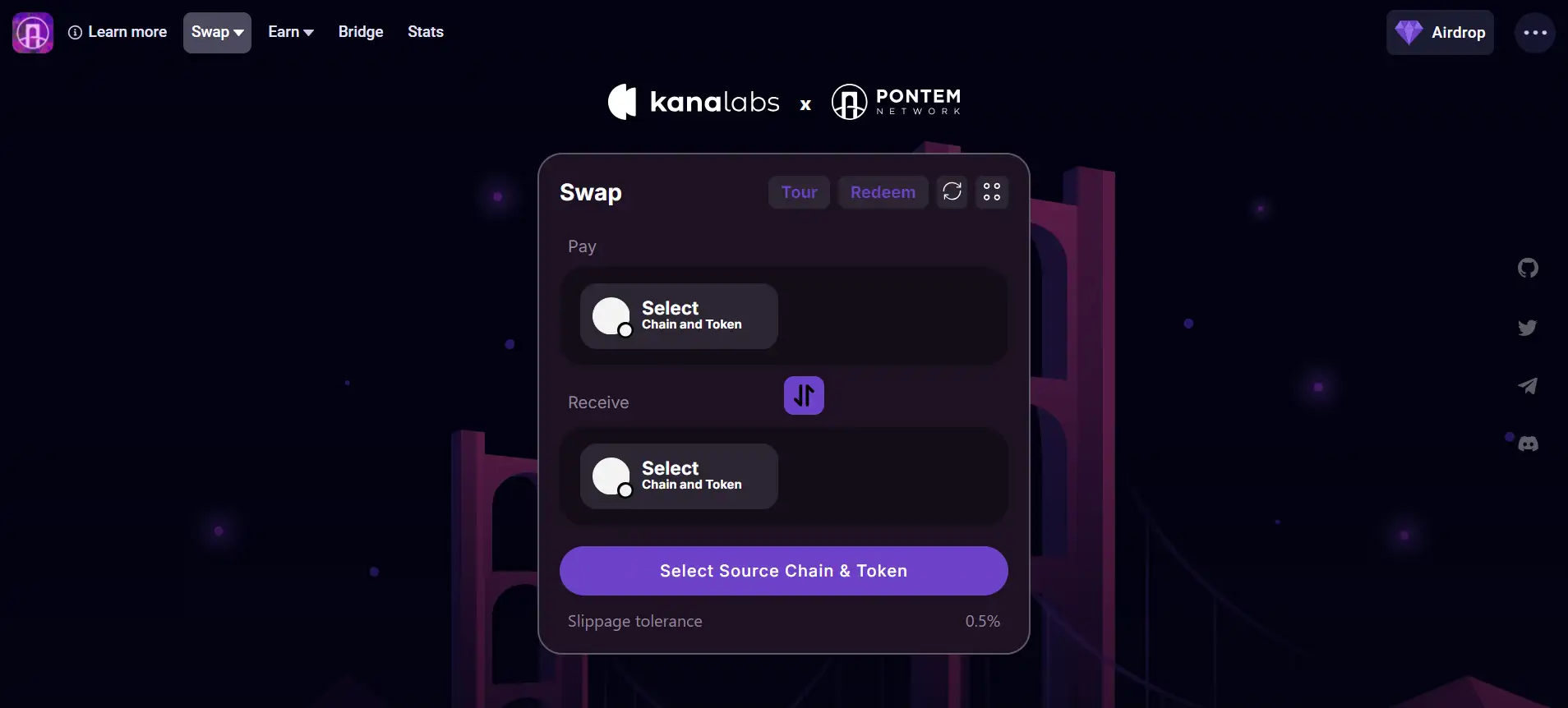

Step 2: Swap Tokens

- Select the tokens you wish to trade.

- Enter the desired amount and review the estimated swap details.

- Confirm the trade and approve the transaction in your wallet.

-

Step 3: Provide Liquidity

- Navigate to the "Liquidity" section.

- Choose a trading pair and deposit your tokens.

- Receive Liquidity Provider (LP) tokens and start earning a share of transaction fees.

-

Step 4: Yield Farming (Optional)

- Visit the "Farming" section.

- Stake your LP tokens in available farming pools.

- Collect rewards periodically.

Liquid Swap FAQ

Liquidswap utilizes a dual Automated Market Maker (AMM) model, which enhances trading efficiency by optimizing liquidity for different asset types. The Stable AMM is designed for low-volatility assets like stablecoins, reducing slippage and maintaining tight price spreads. The Volatile AMM supports riskier assets, ensuring fair pricing even during high market fluctuations. This system allows traders to swap tokens efficiently based on their risk preferences. Learn more at Liquidswap.

No, you need an Aptos-compatible wallet to use Liquidswap. If you don’t have one, visit Petra Wallet or Martian Wallet and download the browser extension. After installation, create a new wallet, back up your recovery phrase, and fund it with Aptos (APT) tokens to cover transaction fees. Once set up, go to Liquidswap and click "Connect Wallet" to start trading.

When you provide liquidity on Liquidswap, you receive Liquidity Provider (LP) tokens, representing your share in the pool. If you withdraw liquidity too soon, you may not have earned enough from trading fees, and your returns could be affected by impermanent loss. To maximize rewards, many users stake their LP tokens in yield farming pools, earning extra incentives over time. Check available pools on Liquidswap.

Pricing on Liquidswap is determined by its AMM algorithm, which automatically adjusts token prices based on supply and demand. For volatile assets, the platform includes dynamic slippage control and adjusted liquidity weightings to stabilize price swings and prevent price manipulation. Traders can also set maximum slippage limits to avoid unfavorable trade execution. More details are available on Liquidswap.

Yes, cross-chain swaps are part of Liquidswap’s long-term roadmap. The team is working on interoperability solutions that will allow seamless asset transfers between Aptos, Ethereum, Binance Smart Chain, and other major blockchains. This will eliminate the need for centralized exchanges, making Liquidswap more versatile. Stay updated on upcoming features at Liquidswap.

You Might Also Like