About Locked Money

Locked Money is a self-custodial digital asset management platform that blends AI-powered trading, blockchain security, and advanced legal structures to help users protect and grow their crypto wealth. Designed for both retail users and high-net-worth individuals, it empowers users with tools that combine financial privacy, legal asset protection, and intelligent automation.

With a mission to bring elite asset protection to everyday users, Locked Money aims to revolutionize how individuals interact with crypto and Web3 finance by offering secure, private, and autonomous control of their assets.

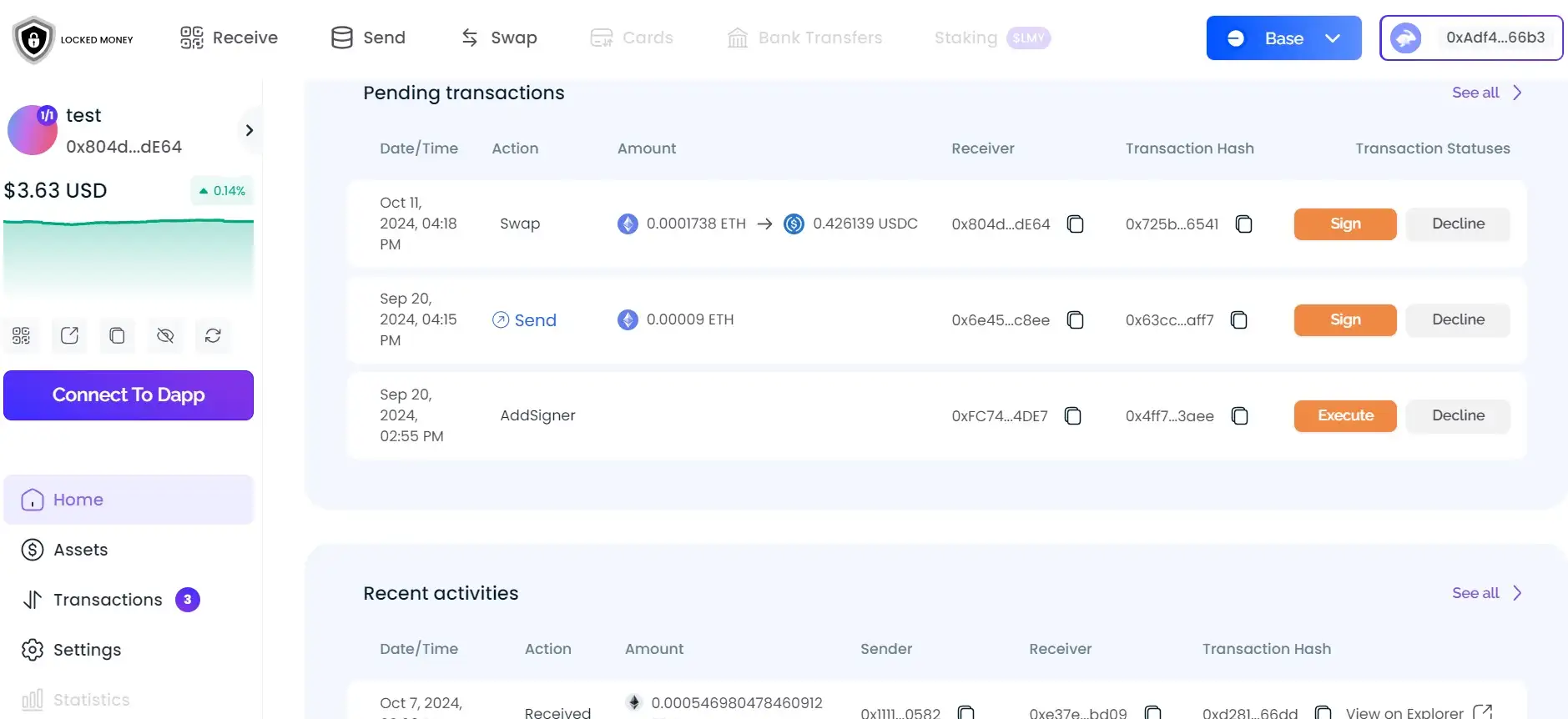

Locked Money is built around a robust ecosystem that includes multi-signature vaults, AI assistants for intelligent market analysis and autonomous trading, and access to Series LLC and Foundation frameworks for long-term legal and tax efficiency. The platform is designed to help users confidently navigate complex crypto markets while protecting assets from legal risks, volatility, and centralized threats.

It also bridges the gap between traditional and decentralized finance with upcoming features like crypto-linked debit cards and bank-to-crypto integration, making fund movement seamless. Competitors in the space include platforms like Argent, Gnosis Safe, and ZenGo, but Locked Money stands out by integrating AI automation and tax-optimized legal structures.

Locked Money provides numerous benefits and features designed to empower users in the Web3 financial space:

- AI-Powered Insights: A dedicated AI assistant provides trading strategies, DeFi protocol suggestions, and predictive analytics.

- Autonomous Trading: The AI can execute trades on users' behalf based on pre-set strategies and market conditions.

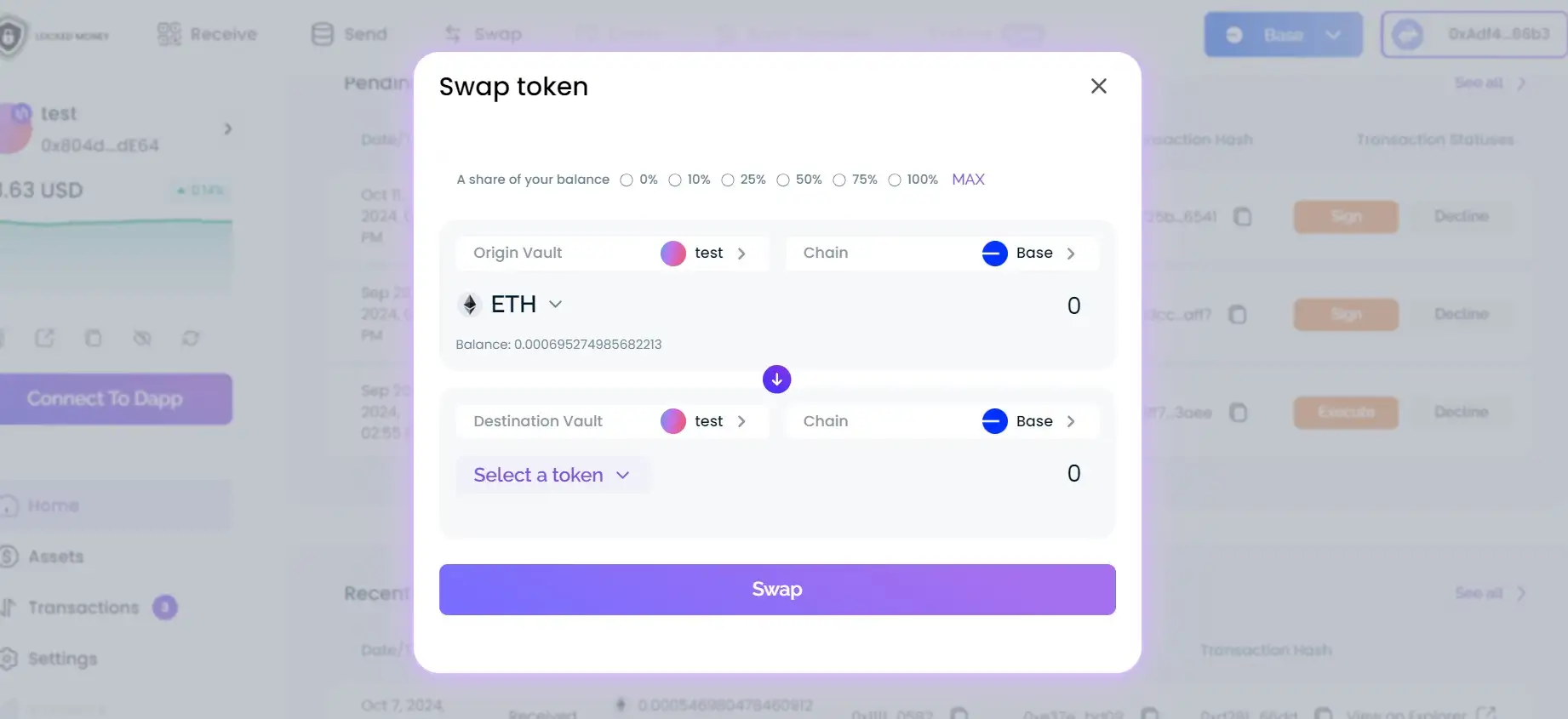

- Self-Custody Vaults: Seedless multi-signature vaults offer full user control with no centralized access to funds.

- Legal Frameworks: Access to Series LLC and Foundation structures for professional-grade asset protection and tax efficiency.

- Passive Income: Users can stake and earn from their assets within secure vault environments.

- Traditional Finance Integration: Crypto debit cards and fiat ramps (coming 2025) will allow fluid movement of funds.

Getting started with Locked Money is fast and secure. Here’s how:

- Create Your Vault: Visit Locked Money and set up your self-custodial vault. No seed phrase required.

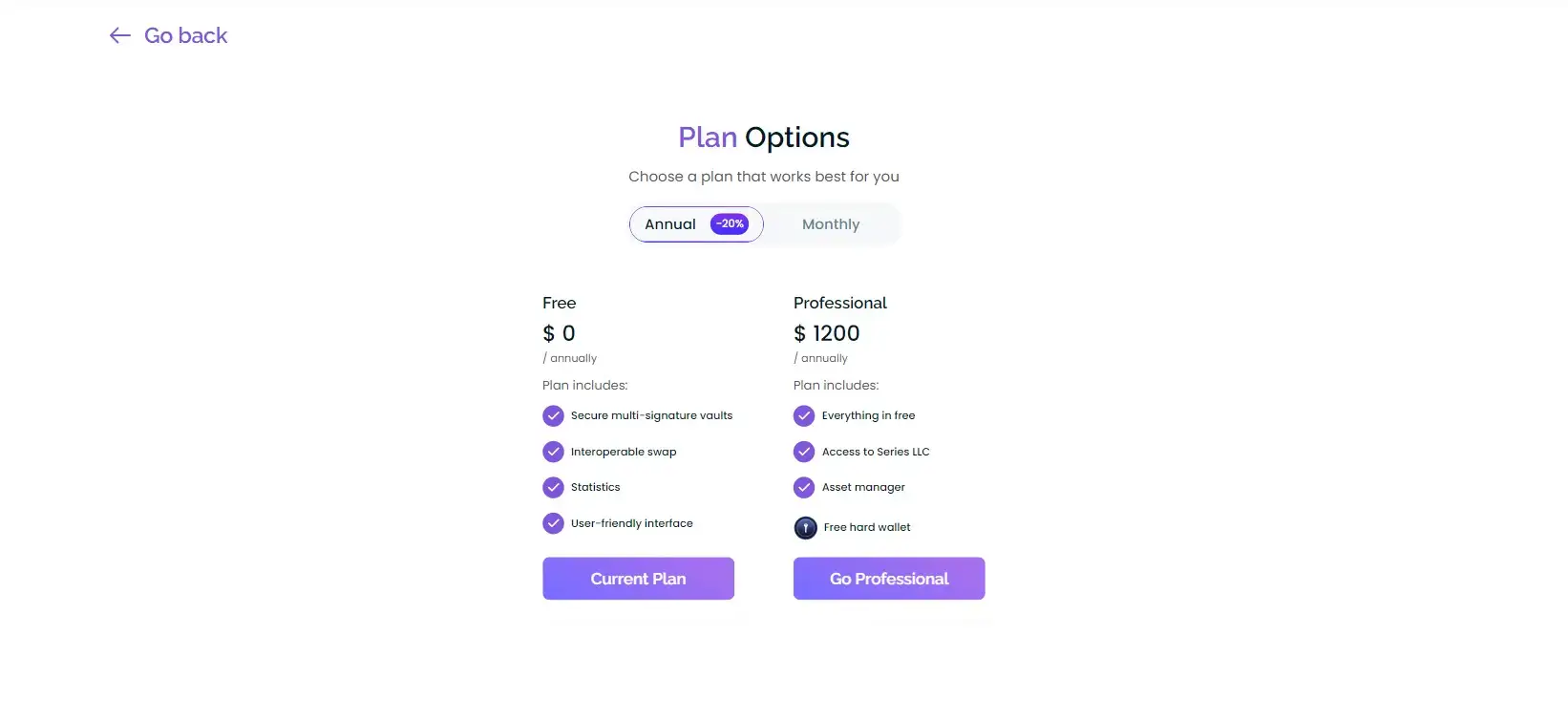

- Choose a Plan: Select the free or professional plan depending on your desired features. The professional plan includes legal tools and AI trading.

- Fund Your Wallet: Transfer digital assets to your vault to begin secure asset management.

- Access AI Tools: Use the AI assistant to analyze markets or automate your crypto trading strategy.

- Enable Add-ons: Opt-in for the debit card, staking tools, or vault integrations as they roll out.

The mission of Locked Money is to transform how digital assets are managed by introducing an advanced, secure asset management platform that empowers users with both autonomy and legal protections. At its core, the project seeks to bridge the traditional gaps in crypto management by offering services that enhance financial planning, minimize tax liabilities, and provide comprehensive asset protection. By combining technological innovation with a legal foundation, Locked Money aims to redefine how users secure their digital wealth.

The platform’s self-custodial model is key to its vision, providing users with exclusive control over their assets through “seedless vaults” that eliminate the risks associated with traditional storage methods. Locked Money's architecture is designed to prioritize privacy, with features that minimize public exposure of asset holdings. This user-centric approach reflects Locked Money’s dedication to creating a safe, private, and legally sound environment for wealth management.

Furthermore, the development of debit card access within the platform signifies its commitment to practical usability and real-world applications. By enabling easy fund transfers and crypto expenditure, Locked Money opens doors for users to integrate digital assets into their everyday lives without compromising on security. This feature encapsulates the project's broader vision: to make crypto asset management both accessible and legally compliant for all.

Locked Money has already achieved significant early milestones, including raising over $1.1 million in seed funding aimed at developing its secure and legally compliant digital asset management solutions. The platform’s roadmap highlights planned features such as banking integrations and debit card access to enable users to manage their digital assets alongside traditional finances. Upcoming releases also include tiered user plans, providing both free access and subscription options that unlock additional security, tax optimization, and custom asset management benefits.

Additional roadmap objectives focus on developing the LMY Token ecosystem to support staking and utility functions across the platform, further enhancing user engagement and rewards. The team plans to implement new services focused on security and usability, including partnerships with industry experts to improve custodial functionality and compliance. For more information about the roadmap, visit the official Locked Money site.

Led by CEO Gediminas Butkus, who has an extensive background in legal consulting within the cryptocurrency sector, Locked Money is supported by a team with expertise across traditional finance, digital assets, and blockchain technology. Butkus’ experience, along with that of the broader leadership team, includes navigating complex regulatory environments and designing compliant financial structures that make advanced asset protection strategies accessible to everyday investors.

The project has established strategic partnerships with Tangem, which supplies branded hardware wallets to enhance platform security, and Peckshield, known for its rigorous auditing standards that help ensure the security of Locked Money’s smart contracts. Additionally, advisors such as Mark Mhilli, a tokenomics expert, contribute to developing Locked Money’s ecosystem. This carefully selected team and its partnerships underscore the platform’s focus on innovation, compliance, and user security.

Locked Money offers interested users the opportunity to join its early access program by signing up for updates on its website. This beta phase aims to gather feedback from participants, helping the team to refine the platform and ensure a user-centric experience. In addition, the platform’s social channels and website provide ongoing announcements for its testnet program, which will serve as a pre-launch phase for real-time testing of security and functionality improvements.

Participants in the beta program can experience the platform’s trustless digital asset vaults and multi-signature features, providing an early look at Locked Money’s capabilities for asset protection and tax efficiency. This early access approach demonstrates the team’s commitment to transparency and community involvement, allowing users to influence platform development through active participation. To sign up for early access, visit Locked Money’s official site.

Locked Money Activities

Locked Money Reviews by Real Users

Locked Money FAQ

Locked Money combines advanced AI automation, legal asset protection, and self-custodial control. Unlike standard wallets or vaults, LM integrates Series LLC frameworks for legal shielding, multi-signature vaults for technical security, and a trading AI that predicts trends and executes trades autonomously.

The built-in AI assistant continuously monitors market data, sentiment analysis, and trends to offer tailored investment suggestions. In professional plans, it can autonomously trade on your behalf using pre-set strategies or real-time analysis, offering a hands-free crypto management experience.

Locked Money enables access to legal structures like Foundations and Series LLCs, traditionally used by high-net-worth individuals. These frameworks can provide asset segregation, tax benefits, and litigation protection, all embedded into your crypto management workflow.

Yes. Despite its advanced features, Locked Money is designed with a user-friendly interface, easy onboarding, and pre-configured vault options. Whether you're a new user or seasoned investor, the platform is built to simplify digital asset protection and growth.

Yes. Locked Money will soon support debit cards (coming in 2025), which will allow you to link your vaults and spend crypto like fiat. Combined with bank-to-crypto integration, it bridges the gap between traditional and decentralized finance.

You Might Also Like