About Mai Finance

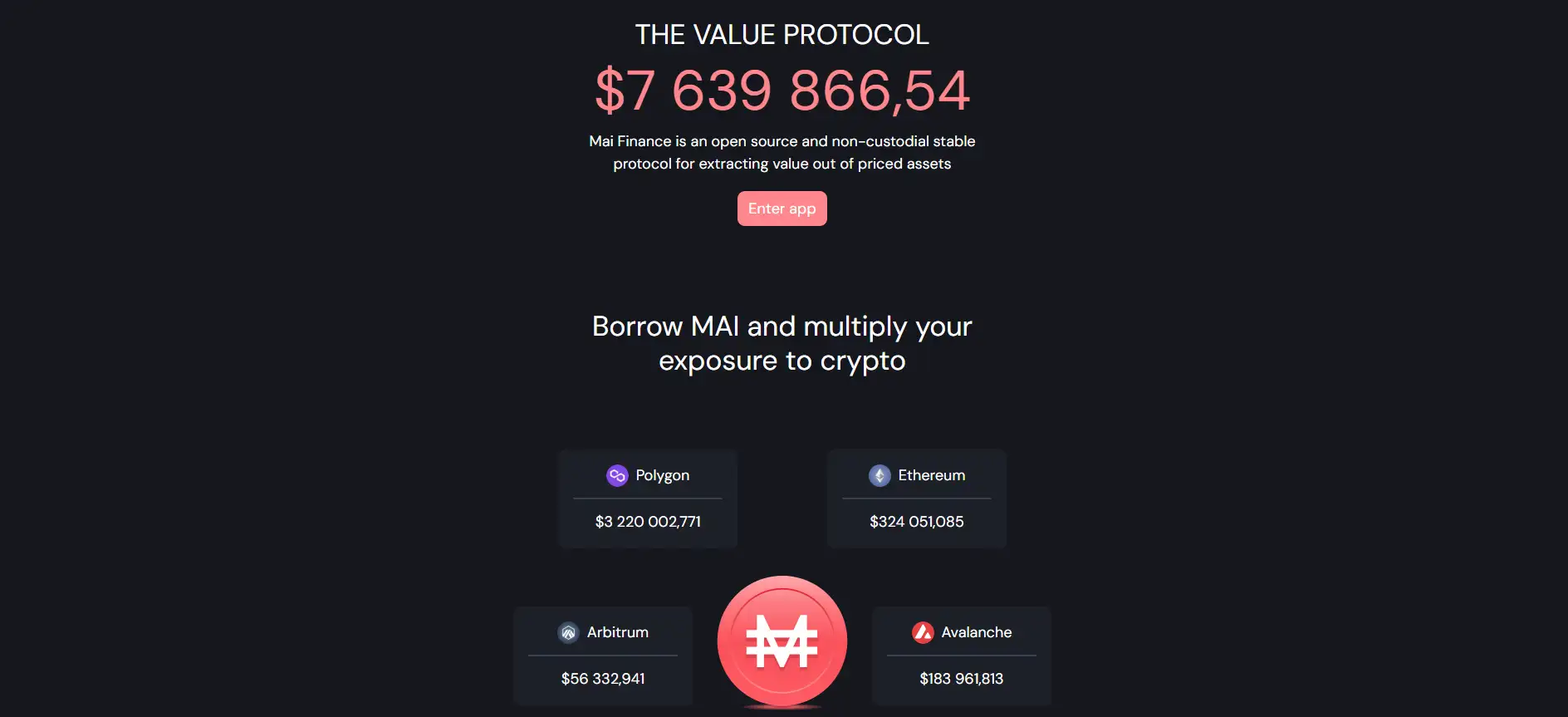

Mai Finance is a decentralized and open-source protocol that empowers users to unlock the value of their crypto holdings without selling them. Acting as the user interface for the QiDao Protocol, Mai Finance enables the creation of overcollateralized stablecoin loans through a seamless and intuitive web dashboard.

The protocol allows users to mint MAI, a fully backed and chain-native stablecoin, by depositing various crypto assets into self-managed vaults. With support across multiple major chains like Polygon, Ethereum, Fantom, Avalanche, and more, Mai Finance provides borderless access to borrowing, with 0% interest and no reliance on centralized intermediaries.

Mai Finance is a decentralized application that serves as the gateway to the QiDao Protocol — a non-custodial platform for minting and managing overcollateralized stablecoins. The protocol is governed by the community through the Qi token and supports a multi-chain architecture that includes Polygon, Ethereum, Arbitrum, Fantom, Avalanche, Metis, and others. Users interact with Mai Finance by opening personal vaults, depositing accepted collateral tokens, and minting MAI, a USD-pegged stablecoin. These vaults are completely self-managed, and users retain full control of their assets throughout the process.

The standout aspect of Mai Finance is the 0% interest borrowing model. Loans in MAI do not accrue ongoing interest, and users are only charged minimal fees upon repayment. The platform supports a broad range of collateral types, including yield-bearing assets like Beefy, Aave, and Yearn tokens, enabling users to earn passive income while securing a loan. The system is secured through a liquidation mechanism based on collateral-to-debt ratios, with all vaults overcollateralized by 130–150%.

The protocol is designed to be fully decentralized and adaptable, with debt ceilings and peg stability mechanisms implemented to maintain MAI’s 1:1 USD peg. MAI is minted natively on each supported chain, eliminating bridge risk and increasing liquidity in local ecosystems. Unlike traditional algorithmic or bridged stablecoins, MAI’s architecture enhances security and usability. Competitive projects include Abracadabra, Sky, and Liquity, but Mai Finance’s 0% interest model and chain-native stability give it a distinct advantage in DeFi lending.

All aspects of the protocol are governed by the community via QiDao Improvement Proposals (QIPs), and the DAO decides on key parameters like collateral types, fees, and upgrades. Voting power is based on “Qi Powah,” which includes all held, vested, and LP-deposited Qi tokens. This level of engagement ensures that Mai Finance remains user-focused, permissionless, and aligned with DeFi values.

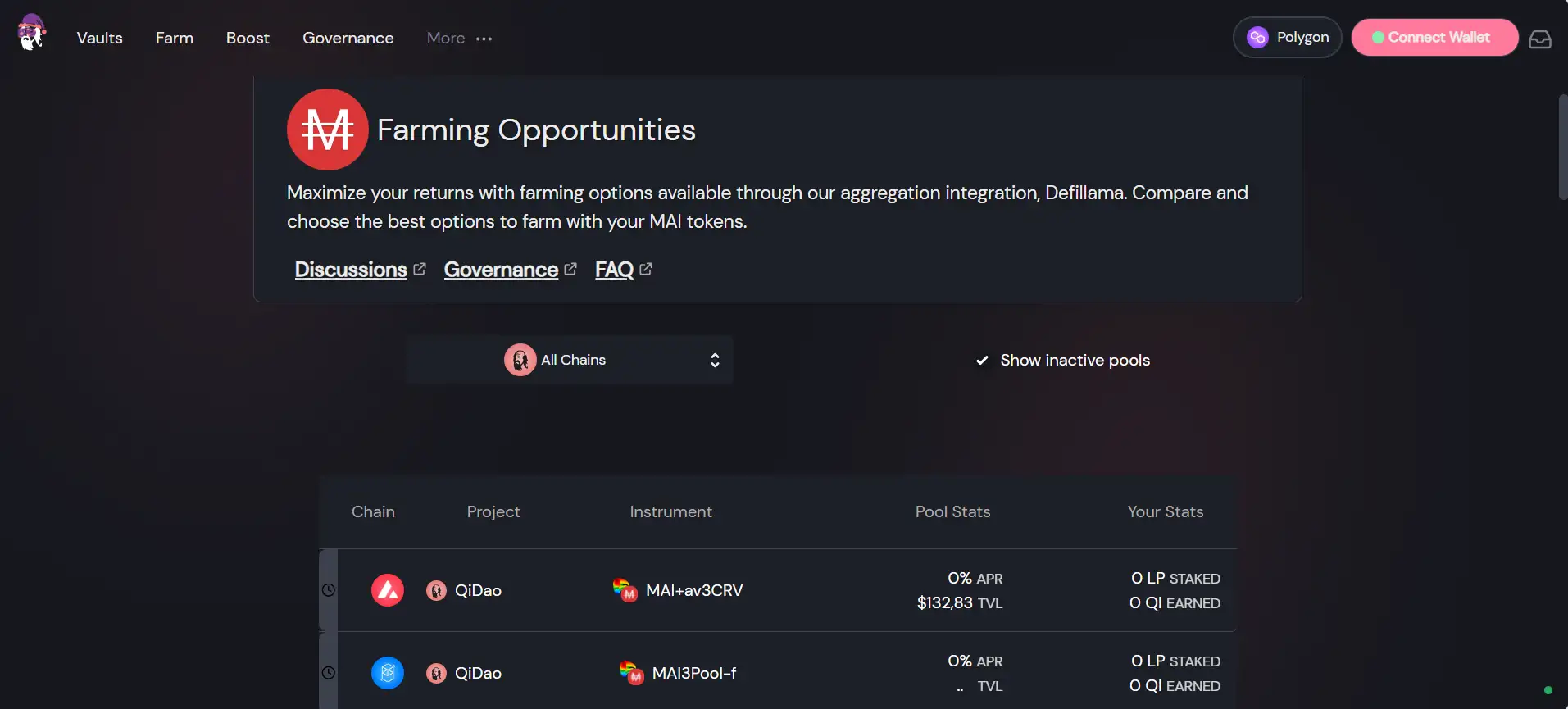

Mai Finance offers a compelling suite of features and benefits that position it as a standout protocol in the decentralized lending and stablecoin ecosystem:

- 0% Interest Loans: Users can mint MAI without paying any ongoing interest, maximizing capital efficiency.

- Chain-Native Stablecoin: MAI is minted natively on each supported chain, avoiding bridge risk and ensuring local liquidity.

- Multi-Chain Support: Available on Polygon, Avalanche, Fantom, Ethereum, Arbitrum, Metis, and more.

- Decentralized Governance: Community-led protocol governed via Qi token and QIPs.

- Collateral Flexibility: Supports standard and yield-bearing assets, including Aave, Beefy, and Yearn tokens.

- Peg Stability Module: Helps MAI maintain a 1:1 USD peg using arbitrage and reserve backing.

- Risk-Optimized Liquidations: Partial liquidation model prevents full collateral loss and protects users during market dips.

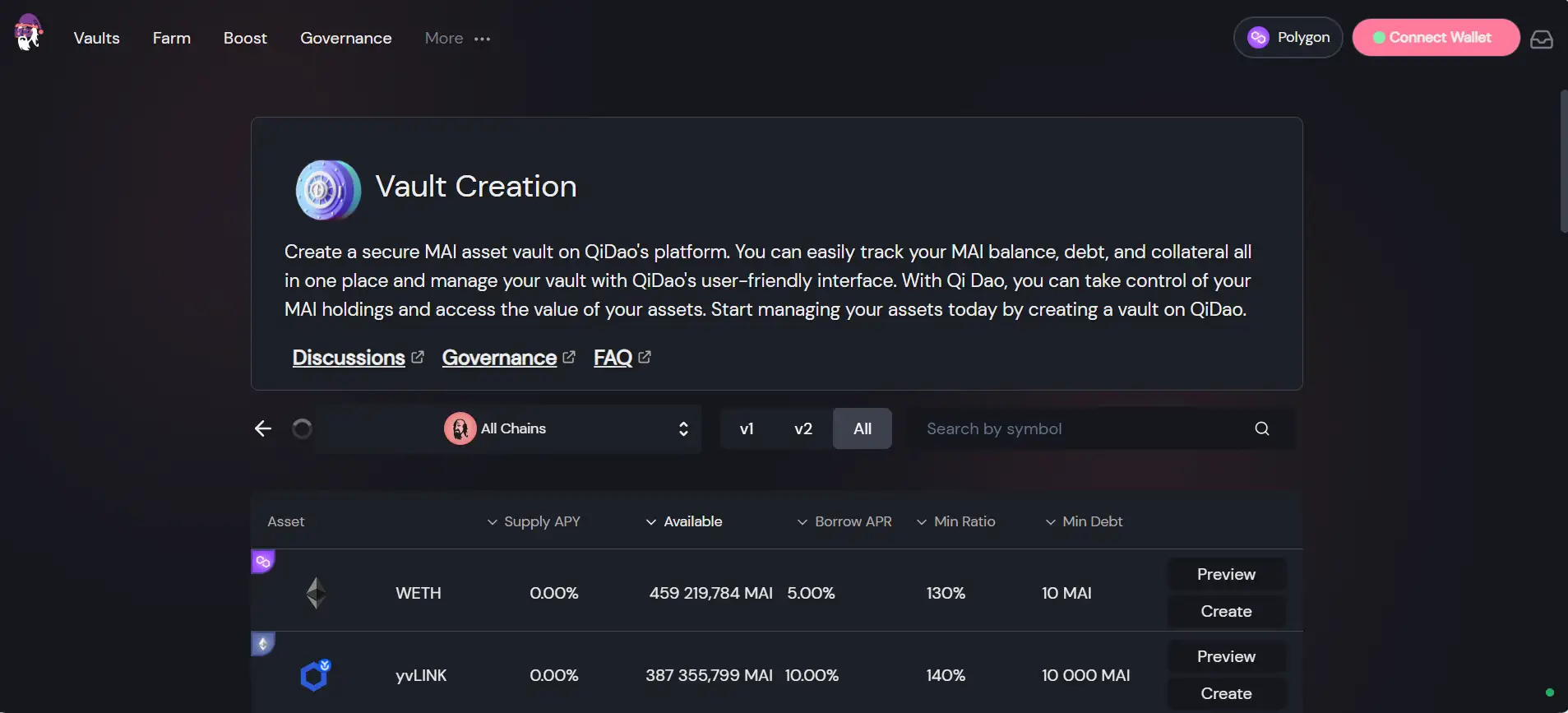

Getting started with Mai Finance is simple and intuitive for any user familiar with Web3 wallets:

- Access the App: Navigate to the Mai Finance homepage and click “Enter App.”

- Connect Wallet: Use a wallet like MetaMask or WalletConnect to connect to the app on your preferred chain.

- Choose a Vault Type: Select a supported collateral and chain (e.g., MATIC on Polygon or ETH on Ethereum).

- Create a Vault: Deposit your chosen collateral and create your vault via the app interface.

- Borrow MAI: Mint MAI up to your allowed collateral ratio and receive it in your wallet instantly.

- Manage Position: Repay MAI at any time, add more collateral, or withdraw as your collateral ratio improves.

- Participate in Governance: Stake Qi tokens or LPs to gain voting power and join DAO discussions on the Mai Discord.

Mai Finance FAQ

MAI maintains its USD peg using a combination of overcollateralization, dynamic interest policies, and a Peg Stability Module (PSM). Unlike algorithmic stablecoins, Mai Finance only allows minting when users lock sufficient collateral, ensuring every MAI is backed by more than its value. In periods of deviation, the DAO can increase fees to contract supply or boost LP incentives to raise demand. This system preserves stability without relying on algorithmic or centralized price manipulation.

Mai Finance vaults use a partial liquidation model that minimizes the impact of market crashes. If a vault falls below the collateral threshold, only a portion of the debt is repaid and matched with a corresponding amount of collateral. This reduces the user’s penalty while still maintaining the protocol’s solvency. By avoiding full liquidation, users retain ownership of their vault and have a chance to recover without total asset loss, creating a more user-friendly DeFi borrowing experience.

MAI is natively minted on each chain it operates on, unlike bridged stablecoins that are minted on one chain and moved across others via bridges. Native minting avoids bridge risk, enhances composability with local DeFi protocols, and provides better liquidity control. For example, when users mint MAI on Polygon or Fantom, the collateral is deposited directly on that chain. This ensures higher efficiency, lower latency, and stronger support for each ecosystem connected to Mai Finance.

The Peg Stability Module (PSM) lets users mint and redeem MAI 1:1 with other stablecoins like USDC, providing an arbitrage opportunity that helps MAI stay close to its USD target. The PSM is permissionless and routes deposited assets into yield-bearing strategies like Compound or MakerDAO’s DSR. This boosts protocol liquidity and provides MAI with deep on-chain liquidity without relying on external market makers. The structure also supports debt ceiling expansion with minimal impact on DEX slippage, making Mai Finance highly scalable and stable.

QiDao uses a partial liquidation mechanism that reduces user losses while protecting protocol solvency. If a vault becomes undercollateralized, only a portion of the loan is repaid by a liquidator, and the user retains control of the vault. This prevents the “death spiral” seen in other protocols where full liquidation worsens collateralization ratios. The system also includes a buyRisky function for vault transfers, offering opportunities for liquidators and stability for borrowers, making the protocol both secure and accessible for all DeFi participants.

You Might Also Like