About MAIV

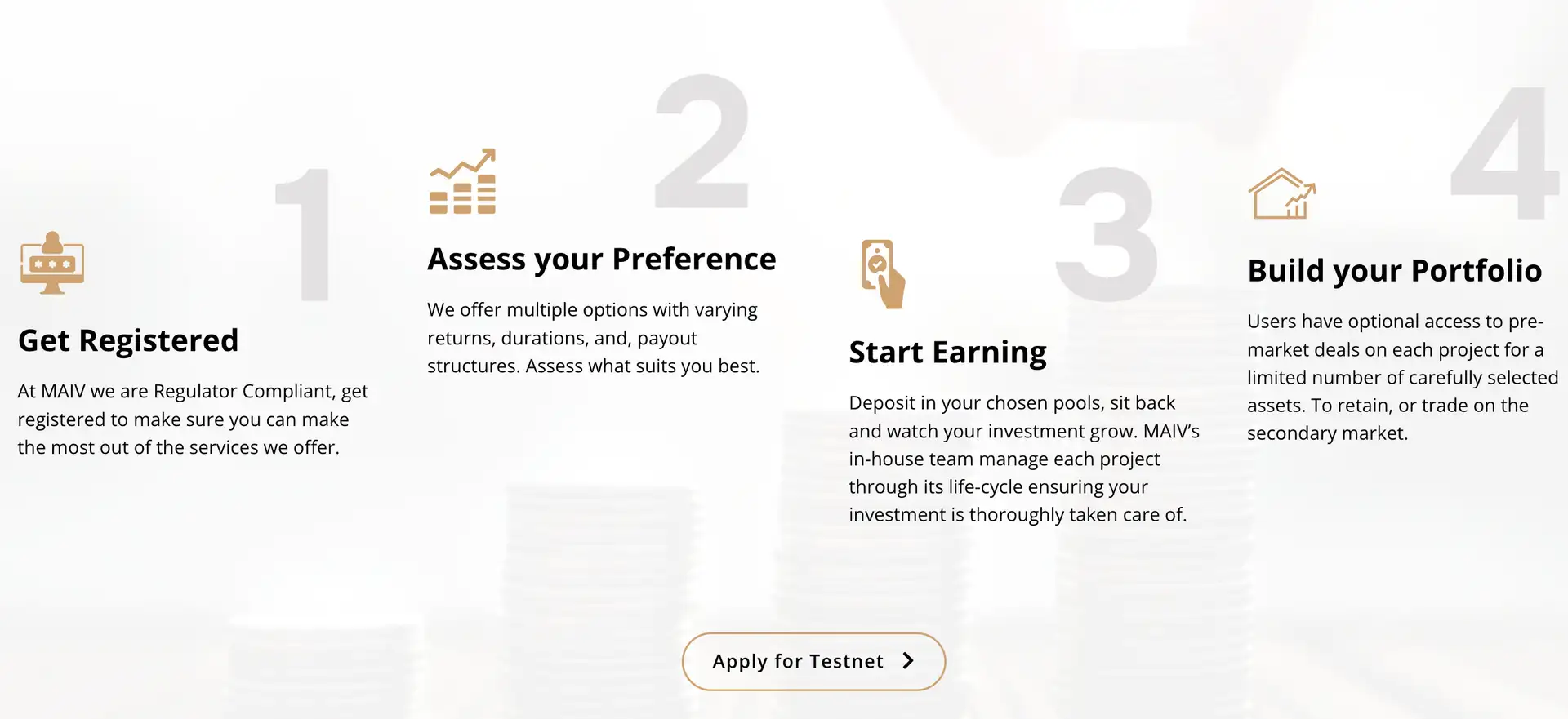

MAIV is a pioneering multi-asset investment platform that bridges the gap between decentralized finance (DeFi) and traditional finance (TradFi). With a mission to democratize access to institutional-grade capital markets, MAIV enables individual and professional investors to participate in secure, high-yield real-world asset (RWA) investment opportunities once reserved for elite institutions. Through MAIV, users can explore fractionalized investment pools across real estate, infrastructure, and commercial lending, all underpinned by tokenized finance structures.

As a fully EU-registered and MiCA-compliant platform, MAIV offers regulated access to a new era of inclusive capital formation. By prioritizing accessibility, transparency, and fixed-yield security, MAIV is redefining how developers raise capital and how investors gain exposure to vetted, asset-backed opportunities. With secure yields up to 20% per annum and early-stage project participation, MAIV represents a fundamental shift in how modern financial ecosystems operate.

The vision behind MAIV is to unlock institutional-grade investing for the masses by transforming how capital flows between investors and real-world projects. Unlike traditional tokenized platforms that tie value to fluctuating property or business markets, MAIV introduces a model focused on tokenized financial agreements, creating structured, low-risk investment avenues with clearly defined contractual terms. These agreements give users exposure to rights such as fixed interest rates, security provisions, and profit-sharing without the volatility.

MAIV’s approach to real estate and infrastructure funding empowers users to finance high-quality, early-stage development projects. This model emphasizes stable returns that are not dependent on long-term property market performance. At the same time, developers benefit from faster, cheaper capital with better repayment terms. This creates a mutually beneficial cycle that drives growth and fosters predictable financial outcomes—disrupting the outdated norms of real estate and private equity investing.

Additionally, MAIV enables businesses to refinance existing liabilities with better terms while allowing investors to tap into secure and diversified refinancing opportunities. Its commitment to scalability is further demonstrated by its white label solutions, empowering institutions to replicate MAIV’s model under their own branding. MAIV isn't just building a platform—it's building the infrastructure for the future of cross-sectoral decentralized finance.

The MAIV roadmap outlines a multi-phase expansion strategy, focused on compliance, ecosystem growth, and global scalability. According to the project image roadmap, MAIV has prioritized regulated foundation-building in Europe, followed by aggressive product scaling and institutional adoption phases. The roadmap details strategic milestones including platform expansion, white-label deployments, and increased RWA pool diversity to cater to both retail and enterprise-level participants.

Through its 2024-2025 roadmap, MAIV is set to roll out key platform modules including DeFi-to-TradFi integration layers, launchpad support, and real estate-backed token infrastructures. Each step is aligned with MAIV’s overarching mission to unlock new financial pathways while maintaining regulatory integrity and investor protection.

The leadership behind MAIV combines deep experience across finance, real estate, blockchain, and communications—driving the platform’s mission to redefine access to institutional-grade investment opportunities. The team is committed to transparency, innovation, and delivering secure, high-yield financial products through the integration of DeFi and TradFi. Learn more at the official MAIV website.

-

Nicolas Taggart – Founder / CEO

Nicolas brings over a decade of experience in construction and development, having delivered more than $300 million worth of projects. His leadership is focused on making institutional-grade investing accessible and secure for all participants. -

Sane Stewart – Co-Founder / COO

As Chief Operating Officer, Sane contributes strategic and operational expertise to ensure platform scalability and global expansion. -

John Spillane – Chief Commercial Officer

John leads MAIV’s commercial strategy, ensuring strong investor relations and expanding partnerships across key financial markets. -

Jonathan King – Director of Partnerships

Jonathan oversees the development of MAIV’s strategic alliances, with a focus on aligning with top-tier real estate and financial partners. -

Simon Moser – Head of Communications

With experience leading campaigns for clients like Gate.io and SIMBA Chain, Simon drives the platform’s outreach and communication strategy. -

Finn Robson – Community Manager

Known as “Zeus” in the Web3 space, Finn has 5+ years of experience managing communities and advising protocols. He plays a key role in building and nurturing MAIV’s ecosystem.

MAIV Token

MAIV Suggestions by Real Users

MAIV FAQ

Unlike platforms that tokenize physical assets such as buildings or company equity, MAIV tokenizes financial agreements. This means users invest in tokenized instruments that represent contractual rights—such as fixed interest, profit sharing, and security provisions—rather than volatile asset ownership. This innovative model provides more predictable returns and lowers exposure to market fluctuation. Learn more at MAIV.

Early-stage real estate investments through MAIV offer fixed, high-yield returns not tied to the uncertain performance of completed rental properties. Unlike tokenized rent models, which are affected by occupancy rates and market cycles, MAIV's projects provide secure yields—up to 20% p.a.—with the added potential of shared profits from development milestones.

Yes. MAIV’s refinancing services allow businesses to restructure existing financial agreements to secure better interest rates, improved cash flow, or more favorable repayment terms. For investors, these pools offer stable, low-risk opportunities backed by strong repayment histories. Explore refinancing options at MAIV.

The $MAIV token unlocks exclusive access to investment pools, launchpad opportunities, and real estate experiences such as luxury stays and sponsored events. By locking tokens, users gain cost savings, bonus yields, and premium access. From portfolio perks to fee reductions, the token integrates deeply with the platform's ecosystem. Details at MAIV.

MAIV’s white-label offering empowers institutions to launch branded investment platforms without developing the backend. It includes full access to tokenized RWA infrastructure, support for real estate, lending, and refinancing products, and seamless TradFi integration. This allows banks and funds to unlock new revenue streams and offer innovative financial products to their clients.

You Might Also Like