About Marginly

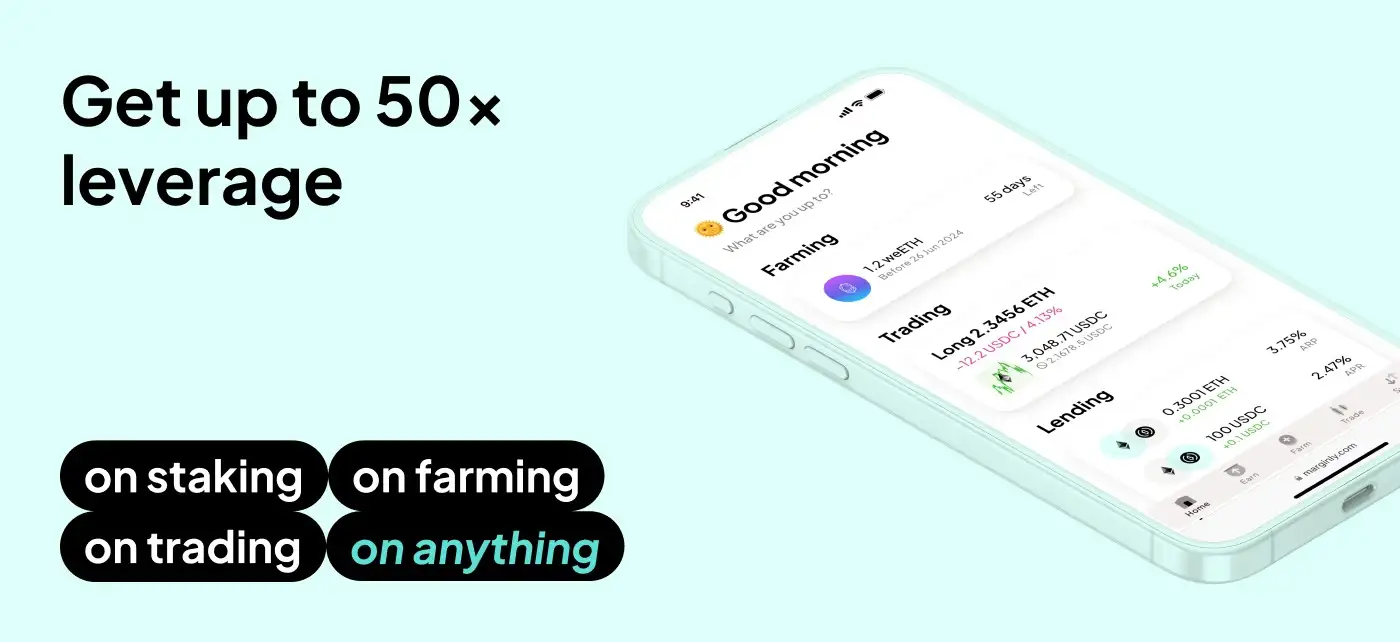

Marginly is an innovative decentralized protocol that enables cross-margin trading with up to 100x leverage on Ethereum-based assets. The platform is designed to empower traders by providing a flexible and efficient trading environment where users can maximize their potential returns on investments. Unlike traditional margin trading platforms, Marginly leverages smart contracts to automate processes, ensuring transparency, security, and decentralization. The project is part of the growing DeFi ecosystem and aims to offer users greater control over their trading strategies and risk management.

By focusing on cross-margin trading, Marginly allows users to optimize their capital efficiency, as they can use the same collateral to open multiple leveraged positions across different assets. This approach contrasts with isolated margin trading, where each position requires its own collateral. Additionally, Marginly is committed to providing a user-friendly interface that caters to both experienced traders and newcomers to the DeFi space. With a mission to democratize access to high-leverage trading tools, Marginly is poised to become a key player in the DeFi trading landscape.

Marginly was developed to address the limitations of traditional margin trading platforms by creating a decentralized alternative that offers cross-margin trading with high leverage. The platform is built on the Ethereum blockchain, utilizing smart contracts to manage trading operations securely and transparently. Marginly allows traders to use a single collateral pool to support multiple positions, enabling them to maximize capital efficiency and potentially increase their returns.

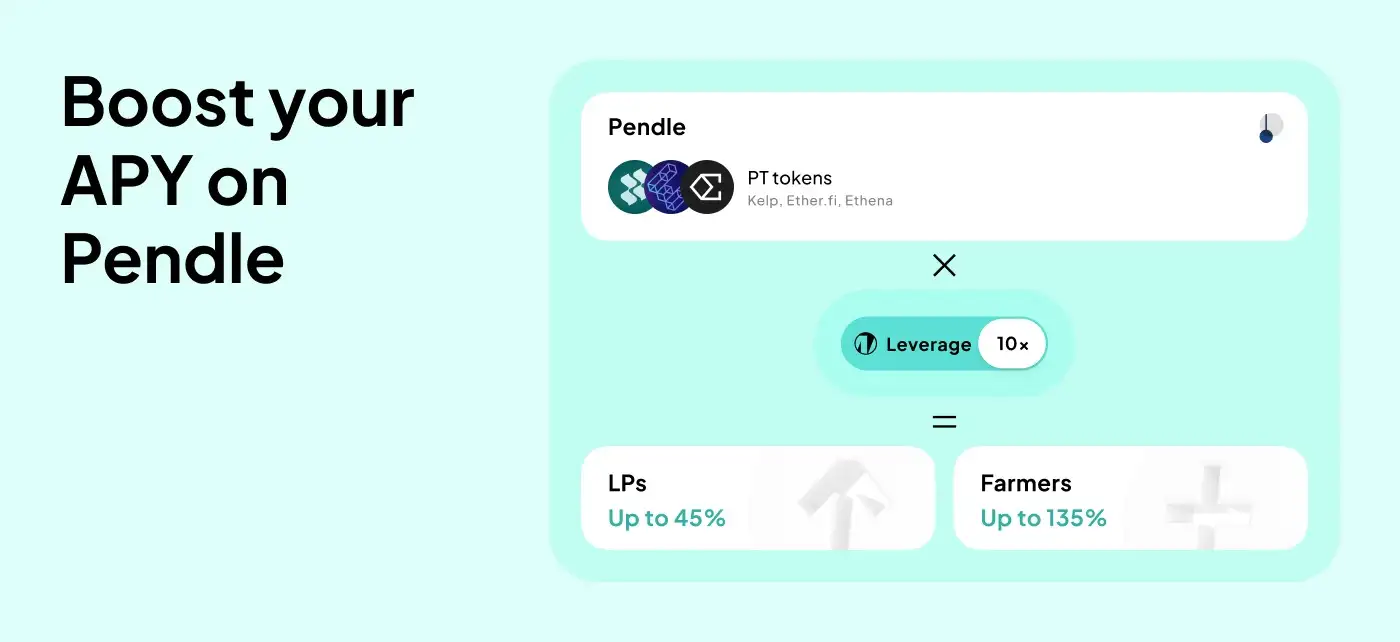

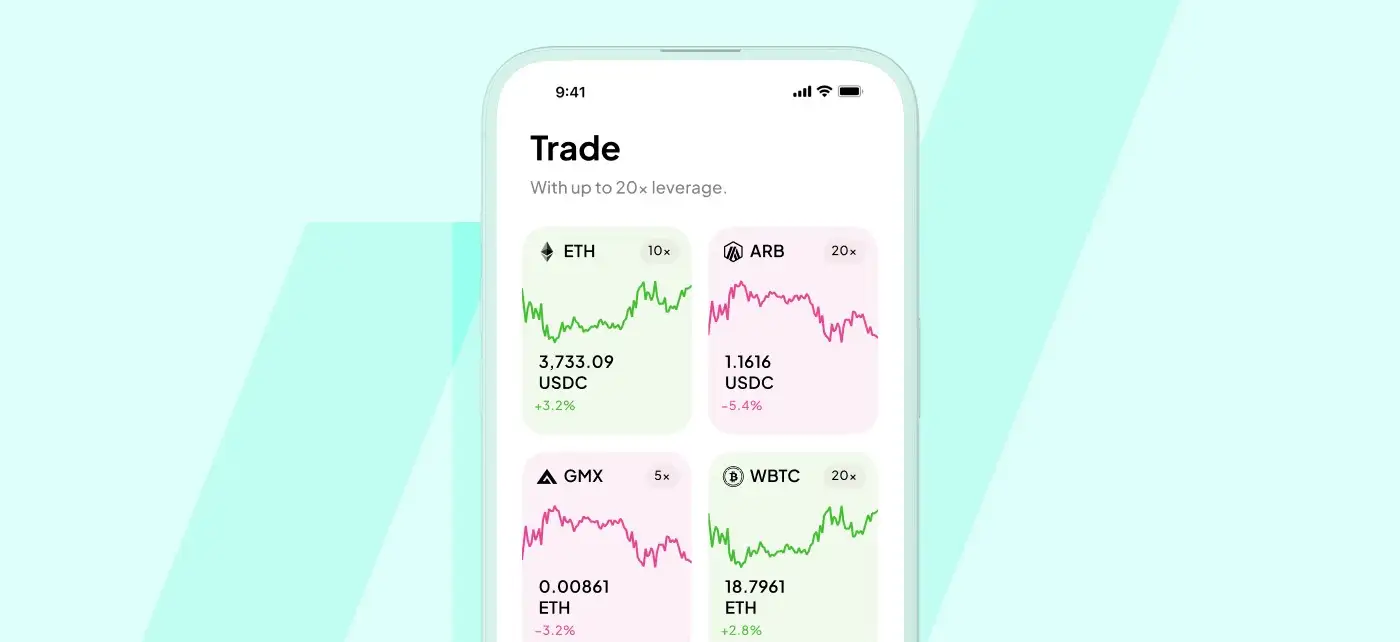

One of the core innovations of Marginly is its approach to managing leverage. Unlike other platforms that offer isolated margin accounts, Marginly enables cross-margin trading, where the same collateral can be used to open and maintain multiple positions. This feature reduces the risk of liquidation across different trades and provides traders with greater flexibility. The platform also supports up to 100x leverage, making it a powerful tool for traders who wish to amplify their positions.

Security and transparency are at the heart of Marginly. The use of smart contracts ensures that all transactions are executed in a trustless manner, with no need for intermediaries. This not only reduces costs but also minimizes the risk of fraud or manipulation. The platform has undergone rigorous security audits to ensure that user funds are protected, and its open-source nature allows for continuous community scrutiny and improvement.

Competitors in the DeFi margin trading space include platforms like dYdX and MUX. However, Marginly differentiates itself with its cross-margin trading capabilities, high leverage options, and user-centric design. The platform's focus on capital efficiency and risk management makes it an attractive choice for both professional traders and those new to margin trading in the DeFi ecosystem.

The key benefits and features of Marginly include:

- Cross-Margin Trading: Allows the use of the same collateral for multiple positions, enhancing capital efficiency.

- High Leverage: Supports up to 100x leverage, enabling traders to amplify their positions and potential returns.

- Decentralization and Security: Utilizes smart contracts on the Ethereum blockchain to ensure transparency, security, and a trustless trading environment.

- User-Friendly Interface: Designed to cater to both experienced traders and newcomers, making high-leverage trading accessible to a broader audience.

- Comprehensive Risk Management: Provides tools and features that help traders manage their risk, including automatic liquidation thresholds and real-time monitoring.

- Integration with DeFi Ecosystem: Easily integrates with other DeFi platforms and protocols, allowing for seamless interaction within the broader decentralized finance landscape.

To get started with Marginly, follow these steps:

- Create a Wallet: If you don’t already have one, create an Ethereum-compatible wallet like MetaMask or WalletConnect.

- Connect Your Wallet: Visit the Marginly App and connect your wallet by following the on-screen instructions.

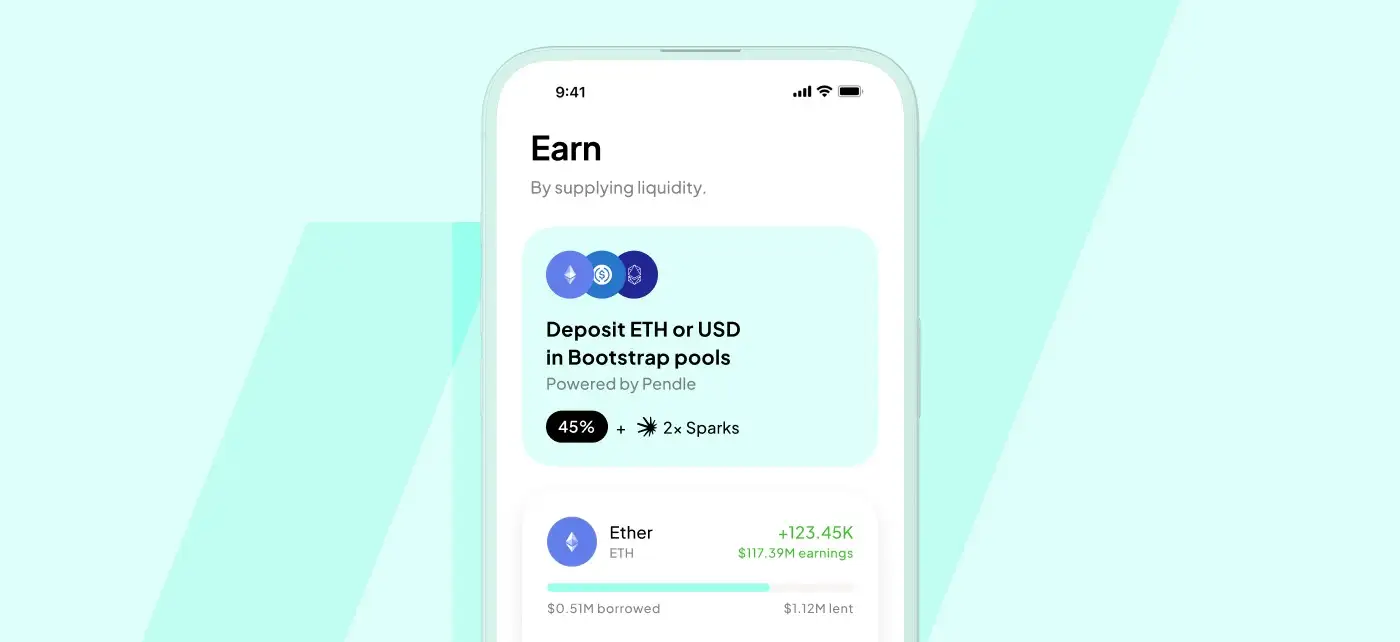

- Deposit Collateral: Transfer the desired amount of ETH or supported ERC-20 tokens to your Marginly account to serve as collateral for your trades.

- Open Positions: Use the trading interface to open leveraged positions on supported Ethereum-based assets. Adjust your leverage and manage your positions using the platform’s intuitive tools.

- Monitor and Manage: Keep track of your positions in real-time, utilizing the platform's risk management features to avoid liquidation and optimize your trading strategy.

- Explore Advanced Features: Take advantage of Marginly’s advanced features, such as cross-margin trading and integration with other DeFi platforms, to enhance your trading experience.

- Withdraw Profits: Once you’ve closed your positions, you can withdraw your profits back to your connected wallet at any time.

Marginly Reviews by Real Users

Marginly FAQ

Marginly uses an advanced risk management system that monitors positions in real-time. When the collateral value falls below the maintenance margin, the system triggers a partial liquidation to maintain the required margin level, minimizing the risk of complete liquidation. This approach allows traders to manage positions even with up to 100x leverage, ensuring that they have the flexibility to recover from adverse market movements.

Yes, Marginly allows you to use the same collateral across multiple positions thanks to its cross-margin trading feature. This means you can open and maintain several leveraged positions on different Ethereum-based assets without needing separate collateral for each. This feature enhances capital efficiency and allows you to manage your portfolio more effectively.

Marginly is built on the Ethereum blockchain, using smart contracts to automate all trading operations. This ensures that all processes, from order execution to liquidation, are transparent and immutable. The platform’s open-source code allows anyone to review and verify its operations, adding an extra layer of trust and transparency to the trading environment.

Marginly stands out due to its cross-margin trading capability, which allows traders to use a single collateral pool for multiple leveraged positions. Additionally, the platform offers up to 100x leverage, significantly higher than many competitors. Its focus on user-friendly design, advanced risk management tools, and integration within the DeFi ecosystem further differentiate it from other platforms like dYdX and MUX.

To get started with Marginly, create an Ethereum-compatible wallet like MetaMask and connect it to the Marginly App. Before trading, consider the risks associated with high leverage, including potential liquidation. Familiarize yourself with the platform’s risk management tools and start with lower leverage to understand the mechanics before scaling up.

You Might Also Like