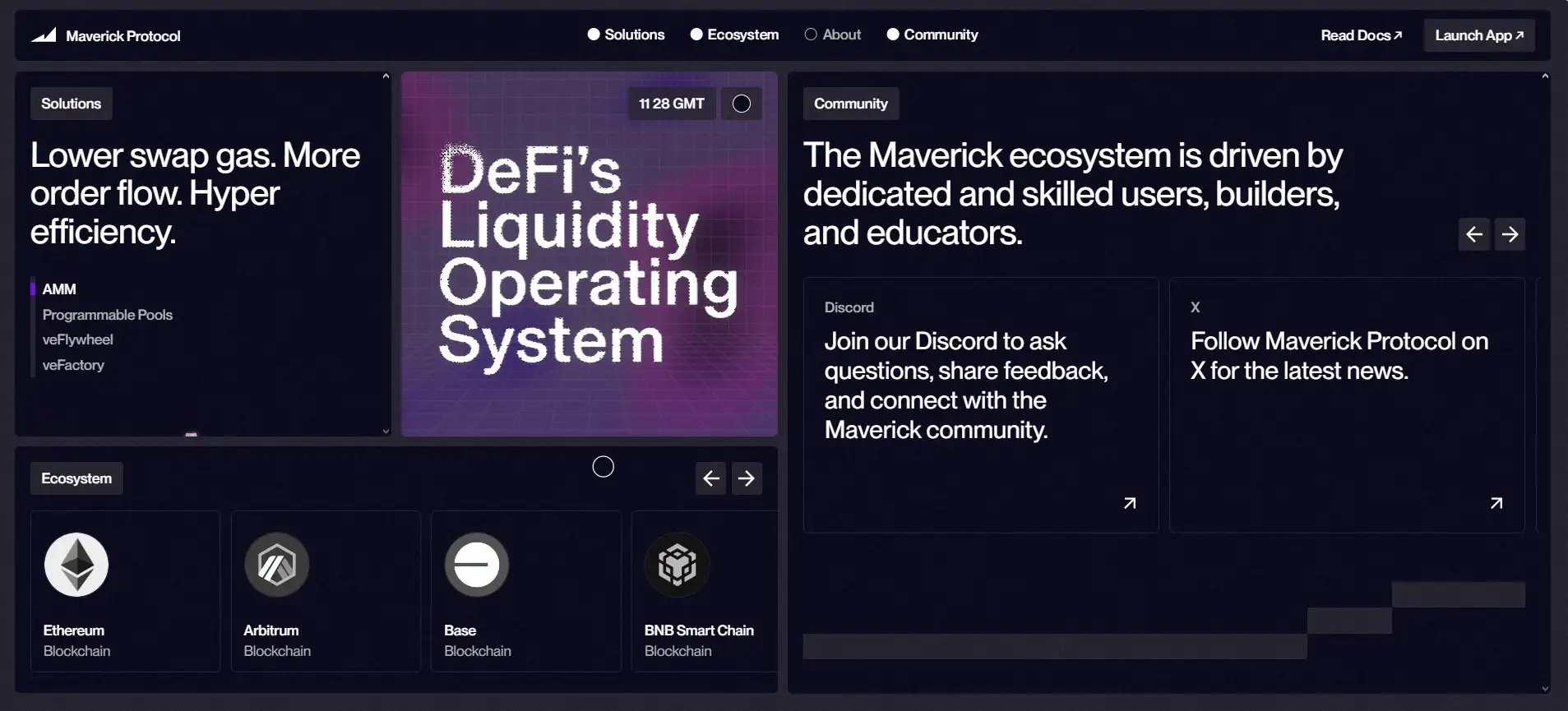

About Maverick Protocol

Maverick Protocol is an advanced decentralized finance (DeFi) platform designed to enhance capital efficiency, automate liquidity management, and provide innovative trading solutions. The project introduces a unique Automated Market Maker (AMM) system that optimizes liquidity movement, benefiting both liquidity providers and traders. Unlike traditional AMMs, Maverick uses a dynamic liquidity-moving mechanism, making it a more capital-efficient and flexible solution in the DeFi space.

The protocol is built for various applications, including decentralized exchanges (DEXs), lending protocols, and other financial instruments. Its mission is to revolutionize on-chain trading by reducing inefficiencies and offering a more profitable and user-friendly experience for all participants in the ecosystem. With its innovative design, Maverick Protocol is transforming the way liquidity operates in the DeFi sector, setting a new standard for automated liquidity management.

Maverick Protocol is a next-generation DeFi solution that redefines liquidity provisioning through its innovative AMM technology. Traditional AMMs like Uniswap and Curve face inefficiencies in capital allocation, often leading to high slippage and wasted liquidity. Maverick addresses these issues by introducing its novel Dynamic Distribution AMM, which allows liquidity to move automatically based on market conditions.

The project was developed to create a more capital-efficient ecosystem, where traders get better execution prices and liquidity providers (LPs) earn more rewards without constant manual adjustments. Maverick’s system offers an automated and flexible way to manage liquidity, reducing the need for active monitoring and rebalancing. This benefits both institutional and retail participants, as it minimizes impermanent loss while increasing potential returns.

One of the core innovations of Maverick Protocol is its ability to automatically adjust liquidity based on price movements. In traditional AMMs, liquidity is distributed statically, meaning providers often face inefficiencies when asset prices shift. With Maverick, the system ensures that liquidity is always optimally placed, reducing price slippage for traders and improving capital efficiency.

Another key feature is Maverick’s customizable liquidity strategies, which allow users to select different liquidity movement modes based on their risk tolerance and market outlook. This makes it an ideal platform for traders, market makers, and DeFi protocols looking for optimized trading conditions.

Maverick competes with major DeFi platforms such as Uniswap, Curve, and Balancer, but differentiates itself through its automated liquidity movement and enhanced capital efficiency. By integrating these innovations, it provides a superior alternative for liquidity management and trading in the DeFi sector.

Maverick Protocol provides numerous benefits and features that make it a standout project in the DeFi landscape:

- Dynamic Liquidity Movement: Unlike traditional AMMs where liquidity remains static, Maverick's mechanism moves liquidity dynamically, optimizing capital efficiency.

- Lower Slippage: By concentrating liquidity around the most relevant price ranges, traders experience reduced price impact on their trades.

- Customizable Liquidity Strategies: Liquidity providers can choose from different modes that dictate how their liquidity moves, providing a personalized DeFi experience.

- Reduced Impermanent Loss: The protocol’s efficient liquidity management minimizes the risks associated with impermanent loss, protecting LP earnings.

- Higher Capital Efficiency: Maverick allows users to maximize their returns by ensuring liquidity is always allocated where it’s most effective.

- Multi-Asset Support: Supports a wide range of tokens, making it a versatile tool for liquidity provision and trading.

- Composability with Other DeFi Protocols: Maverick integrates with other DeFi platforms, enhancing interoperability and use cases.

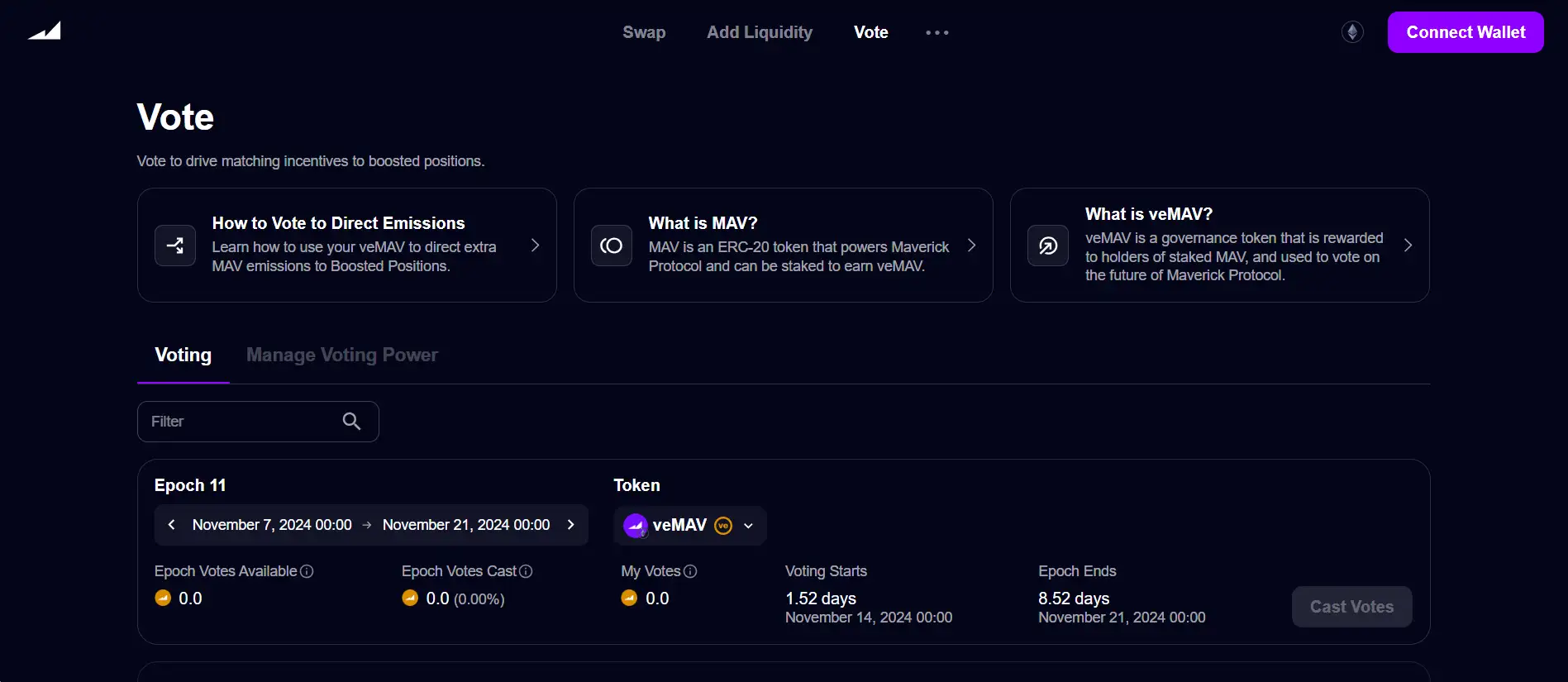

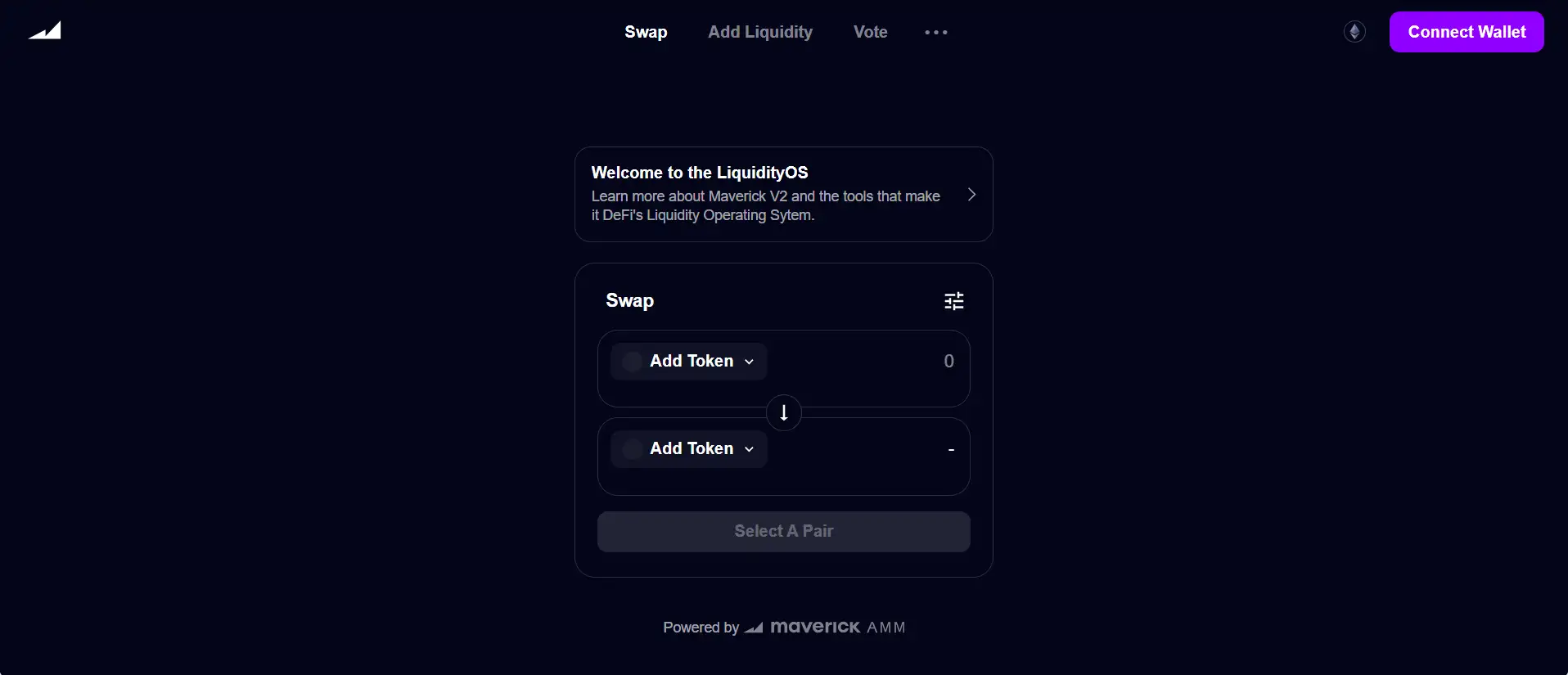

To start using Maverick Protocol, follow these steps:

- Visit the Official Website: Go to Maverick’s website and explore the platform.

- Connect Your Wallet: Click on “Connect Wallet” and choose a supported wallet like MetaMask or WalletConnect.

- Deposit Funds: Add supported tokens to your wallet for trading or liquidity provision.

- Select a Liquidity Strategy: Choose from different liquidity movement modes that best fit your risk tolerance and investment strategy.

- Start Trading or Providing Liquidity: Use the platform to trade assets or provide liquidity to earn rewards.

Maverick Protocol FAQ

Traditional Automated Market Makers (AMMs) like Uniswap use static liquidity pools where assets remain in fixed positions, requiring manual rebalancing. Maverick Protocol, on the other hand, introduces a Dynamic Distribution AMM that moves liquidity automatically based on price movements. This ensures capital is always optimally allocated, improving capital efficiency while reducing slippage for traders and enhancing earnings for liquidity providers.

Yes! Maverick Protocol offers customizable liquidity strategies that allow users to dictate how their liquidity moves in response to price changes. Liquidity providers (LPs) can select different modes, such as following upward or downward price trends or remaining concentrated within a fixed range. This flexibility helps LPs tailor their strategies to their risk appetite and market outlook, making DeFi liquidity provisioning more dynamic than ever.

Impermanent loss occurs when an LP’s deposited assets lose value relative to simply holding them. Maverick Protocol minimizes this risk by ensuring liquidity is dynamically adjusted to track price movements. Unlike traditional AMMs where liquidity remains stagnant and exposed to price divergence, Maverick actively reallocates liquidity, reducing exposure to large price fluctuations and optimizing rewards for LPs.

Capital efficiency is a major challenge in DeFi, with many protocols leaving liquidity underutilized. Maverick Protocol enhances efficiency by allowing liquidity to move dynamically instead of staying idle in broad price ranges. This results in more effective use of liquidity, lower trading costs, and better execution prices, making DeFi trading and market-making more cost-effective and profitable.

Yes, Maverick Protocol is built to be fully composable with other DeFi platforms. This means it can integrate seamlessly with lending protocols, DEX aggregators, and automated trading strategies. By working within the broader DeFi ecosystem, Maverick enhances interoperability, making liquidity management more efficient across multiple protocols.

You Might Also Like