About Maxbid Pro

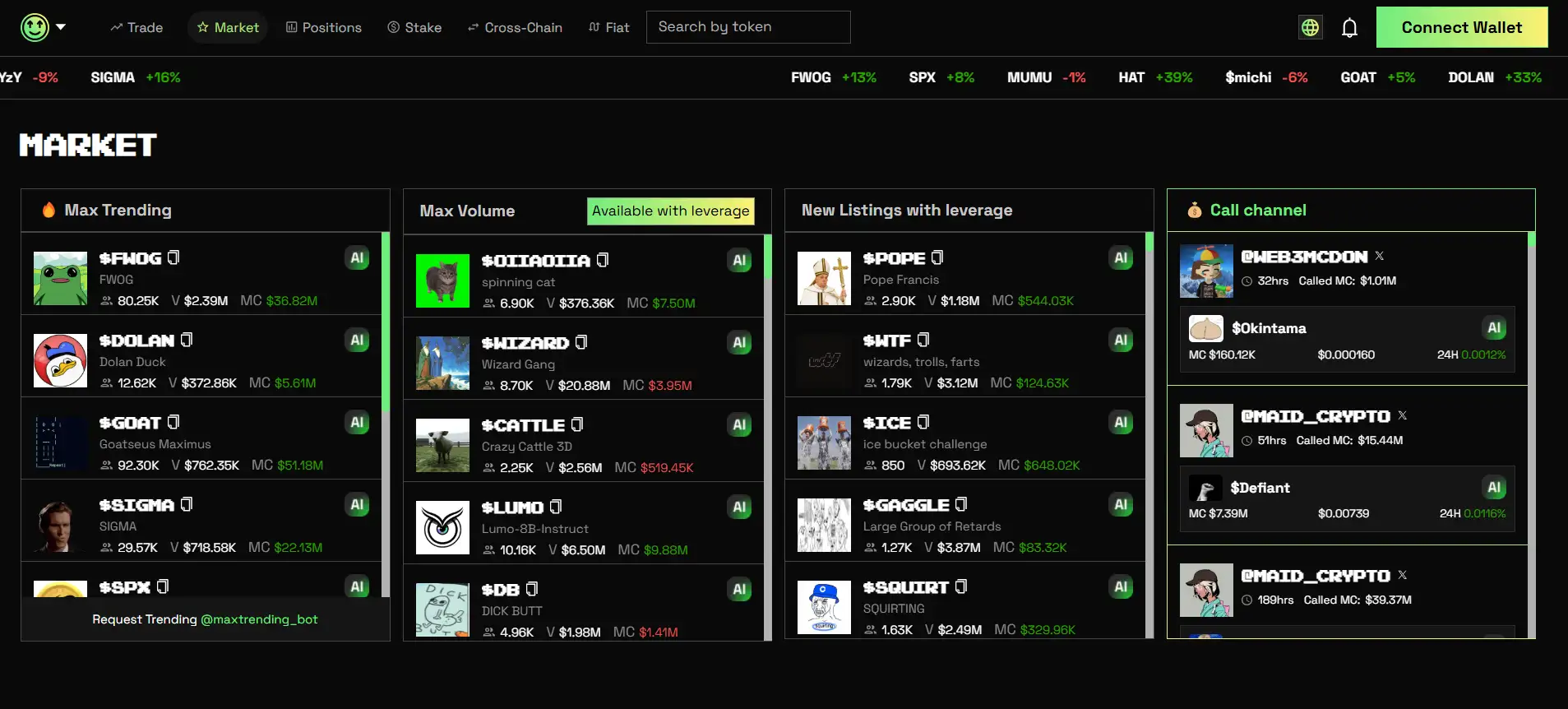

Maxbid Pro is an advanced platform for decentralized spot margin trading, specializing in long-tail assets such as memecoins. It operates as a dual-sided marketplace, enabling traders to access liquidity via decentralized exchanges using funds supplied by lenders and supported by stakers. Through integration with Jupiter’s routing, Maxbid Pro ensures optimal trade execution on-chain.

Designed with a focus on capital efficiency and decentralization, Maxbid Pro provides a streamlined yet powerful trading interface tailored to both professional and retail users. It fosters a truly non-custodial and permissionless environment, giving users full control over their assets while pushing forward the adoption of DeFi trading platforms.

Maxbid Pro is reshaping how margin trading is conducted in the decentralized space. Acting as a non-custodial liquidity protocol, the platform facilitates leveraged spot trading by integrating directly with decentralized exchanges. This means traders can open leveraged positions without giving up custody of their assets, while liquidity providers can earn yield through lending and staking mechanisms.

The architecture of Maxbid Pro comprises three main components: trading, lending, and staking. At present, the dApp provides full access to trading and staking, while the lending feature is planned for future releases. Trading on the platform allows users to open leveraged positions on various tokens, benefitting from Jupiter’s optimal routing for trade execution.

In the staking module, users can stake SOL to receive mpbSOL, a yield-bearing token. This asset remains liquid, as part of the staked funds is delegated to Solana validators for native yield, while the rest is used within lending pools to generate additional returns. Unstaking mpbSOL burns the token and initiates a 5-day cooldown period before SOL can be claimed back, promoting responsible liquidity management.

Unlike centralized exchanges (CEXs) such as Binance or Coinbase, Maxbid Pro is completely decentralized and non-custodial. It also differs from decentralized perpetual protocols like GMX or Perpetual Protocol, which primarily deal with synthetic futures. Instead, Maxbid Pro is focused on spot margin trading—allowing actual asset exchange with leverage. This makes it a unique DeFi protocol that sits at the intersection of capital efficiency and decentralized access.

Through its referral system, zero opening fees, and permissionless access, Maxbid Pro presents itself as a highly attractive option for users seeking control, transparency, and yield opportunities. As it continues to evolve, future updates will roll out the lending component and additional features to improve capital mobility across DeFi.

Maxbid Pro provides numerous benefits and features that make it a standout platform in the DeFi margin trading ecosystem:

- Non-Custodial Leverage Trading: Full control over assets without reliance on centralized intermediaries.

- Permissionless Access: No registration or KYC required—just connect a wallet and start trading.

- Yield-Optimized Staking: Stake SOL to earn via delegation and platform lending, all while retaining liquidity with mpbSOL.

- Jupiter Integration: Executes trades using Jupiter’s DEX routing aggregator to ensure the best rates and low slippage.

- Transparent Fee Structure: 0% opening and profit fees (limited promotion), and trading fees between 0.5–1% based on the DEX used.

- Referral Rewards: Users earn 5% on leveraged trading volume and 100% of swap fees through a unique referral link.

- Gradual Feature Rollout: With staking and trading already active, lending features will be integrated in future updates for complete capital efficiency.

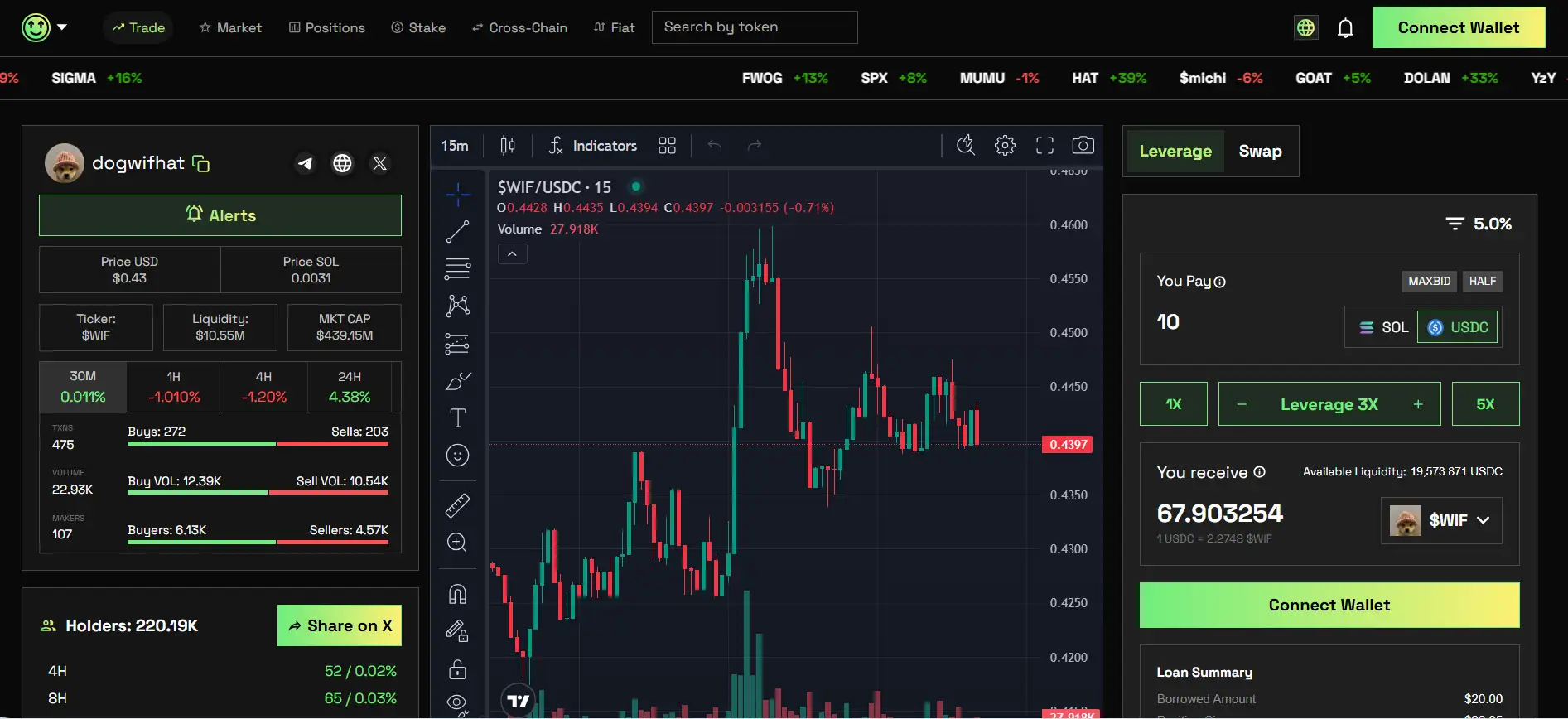

Maxbid Pro offers a simple and intuitive interface to start trading with leverage and earning passive income through staking:

- Visit the Platform: Head over to Maxbid Pro and connect your Solana-compatible wallet (e.g., Phantom).

- Trading: Navigate to the trading screen, select your token pair, set leverage, and execute the trade. Trades are routed via Jupiter to maximize efficiency.

- Staking: Go to the “Stake” tab to stake your SOL and receive mpbSOL. You’ll earn passive yield from both staking and lending pools.

- Unstaking: To unstake, visit the “Unstake” tab, select the amount, and confirm. Unstaking takes 5 days before SOL becomes claimable.

- Claiming: After 5 days, go to the “Claim” section and initiate the final step to receive your unstaked SOL back into your wallet.

- Referral Earnings: Navigate to your profile, copy your unique link, and share it. Earn rewards instantly from swaps and weekly from leverage trading.

For further assistance or questions, join the community on Telegram or follow updates on their Twitter.

Maxbid Pro FAQ

Maxbid Pro uses a dual strategy to maintain liquidity while staking SOL. When users stake, they receive mpbSOL, a liquid token representing their position. A portion of the staked SOL is delegated to Solana validators to generate native yield, while the rest is deposited into Maxbid Pro’s lending pools to support margin trading. This structure ensures that liquidity remains usable within the protocol while still earning optimized returns. Visit Maxbid Pro for more.

mpbSOL is unique because it not only earns yield from staking on Solana but also from participation in Maxbid Pro’s lending pools. This dual-earning mechanism gives holders a compounded source of income. Additionally, mpbSOL can be used freely within the ecosystem for trading and other DeFi activities. It’s tailored specifically to Maxbid Pro, making it more integrated and flexible than other Solana staking tokens.

Maxbid Pro targets long-tail assets like memecoins because they are often overlooked by major trading platforms but present high volatility and rapid volume shifts. These characteristics offer traders better opportunities for leveraged gains. By supporting these assets via Jupiter’s DEX routing, Maxbid Pro allows users to capture value in niche markets while remaining decentralized and non-custodial.

Maxbid Pro automates interest payments through smart contracts. Every 7 days, if the accrued interest on an open position exceeds 0.1 SOL, the protocol sells part of the collateral and transfers the equivalent to the lender. This ensures consistent repayment and prevents underpayment. It adds predictability for lenders and aligns with Maxbid Pro’s goal of high capital efficiency in a trustless environment.

Currently, Maxbid Pro applies a fixed liquidation threshold of 90% LTV to protect lenders and ensure capital integrity. Although direct customization isn’t available yet, traders can manage exposure by choosing lower leverage or trading assets with more stable price behavior. Future versions of Maxbid Pro may introduce more granular risk configuration options for experienced users.

You Might Also Like