About Mayan Finance

Mayan Finance is a cross-chain auction-based protocol designed to enable ultra-fast, secure, and cost-effective asset transfers across different blockchains. Built on top of the Solana network, Mayan Finance offers an intent-based bridging experience that allows users to swap assets in seconds with the best rates on the market, all through a fully non-custodial system.

By combining smart auctions, composable transfers, and Wormhole infrastructure, Mayan empowers users and developers to interact with multiple chains without ever sacrificing speed, price, or security. With over $7.8 billion in bridged volume and a rapidly growing ecosystem of wallets and integrators, Mayan Finance has solidified its place as one of the most innovative cross-chain protocols in the DeFi space.

Mayan Finance is not just a bridge — it’s a high-performance, multi-chain intent-driven swap protocol that integrates three powerful cross-chain methods: WH Swap, Swift, and MCTP. Together, these allow users to benefit from flexible trade-offs between speed, cost, and execution precision depending on their needs.

At the heart of Mayan Finance's architecture is a fully on-chain English-style auction system that settles on Solana. When a user initiates a cross-chain swap, an auction is triggered where drivers (liquidity providers) compete to offer the best rate. The winning driver executes the trade, either instantly on Solana via Flash Swap, or across chains using the Wormhole protocol. The architecture leverages Solana’s performance to maintain high throughput and settlement speed, regardless of the source or destination chain.

The Swift protocol focuses on speed, where a user locks assets on the source chain and the driver fulfills the order on the destination chain before claiming the locked funds. MCTP, built with Circle’s CCTP, ensures seamless value transfer by converting tokens to USDC and executing trades through relayers and Flash Swaps on the destination chain. Finally, WH Swap offers a flexible and secure method for atomic swaps using Solana as the intermediary, integrating with Wormhole’s token bridge.

The Mayan ecosystem has seen major growth with over 1 million unique wallets and 3 million+ swaps processed. Its widget and SDK make it incredibly easy for developers to integrate cross-chain functionality into any dApp, wallet, or DeFi product. Supported by a vibrant community and used by industry leaders like Phantom, Mayan Finance continues to redefine what it means to be a bridge in the modern DeFi landscape.

In a growing field of cross-chain interoperability, Mayan Finance distinguishes itself from competitors like Synapse, LayerZero, and Across Protocol by offering faster execution, lower fees, and fully on-chain auctions with transparent routing logic. While others offer cross-chain messaging or basic token transfers, Mayan builds a robust, intent-based layer with highly composable and developer-friendly infrastructure tailored for real-time, multichain liquidity access.

Mayan Finance provides numerous benefits and features that make it one of the most powerful tools in the cross-chain DeFi infrastructure:

- Fastest Bridging Times: Complete cross-chain swaps in as little as 5 seconds using Swift protocol for intent-based fulfillment.

- Smart Auction Mechanism: English-style auctions on Solana ensure users always get optimal swap rates in real time.

- Three Swap Methods: Choose between WH Swap, MCTP, or Swift to balance between speed, price, and compatibility.

- Gas on Destination: Automatically receive gas tokens along with your bridged assets so you can transact immediately upon arrival.

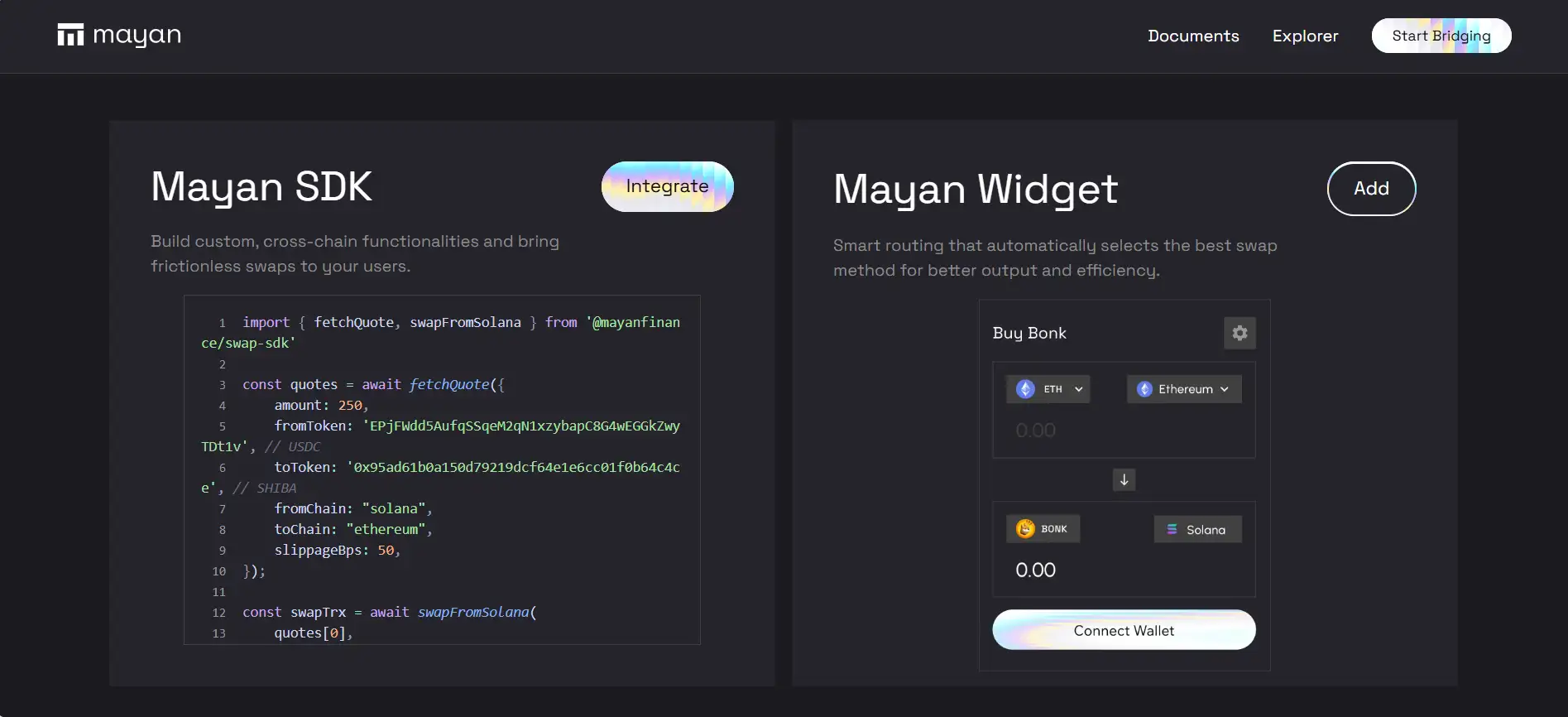

- Developer SDK & Widget: Integrate Mayan’s bridging logic with just a few lines of code using the Mayan SDK or embedded widget.

- Non-Custodial and Audited: Full control of user funds with a transparent, audited protocol structure using Wormhole message passing.

- Dedicated Explorer: Track swap status live using the Mayan Explorer built specifically for cross-chain visibility.

Mayan Finance makes it incredibly simple to begin bridging and swapping assets across chains:

- Visit the platform: Head to Mayan Finance and connect a wallet like Metamask or Phantom.

- Select your chains and tokens: Choose your source chain and asset, then select your destination chain and the asset you want to receive.

- Review price impact: Pay attention to the “price impact” metric before confirming to ensure you’re getting an efficient rate.

- Adjust gas on destination: If needed, customize how much gas you receive with the bridged asset on the destination chain.

- Initiate the swap: Confirm the transaction. Relayers handle the rest by committing the swap messages and fulfilling your order.

- Track it live: Use the Mayan Explorer to monitor your swap status in real time.

- For developers: Implement the Mayan SDK or widget for fast integration of cross-chain swaps into your own product.

Mayan Finance FAQ

Mayan Finance uses a fully on-chain English-style auction system that activates the moment a user initiates a cross-chain swap. Drivers—entities capable of fulfilling swaps—compete to offer the best rate by bidding in real time. The auction takes place on Solana to leverage its low-latency and high-throughput capabilities. The winning driver fulfills the swap either via Flash Swap (on Solana) or by transferring output tokens to the destination chain, depending on the swap method selected. This auction-first approach guarantees users get the most competitive rates with full transparency. Learn more at Mayan Finance.

Gas on Destination is a unique feature that provides users with gas tokens alongside their bridged assets, enabling them to transact immediately upon arrival. Unlike other platforms, which leave users stuck without gas on the destination chain, Mayan Finance automatically calculates and delivers a preset or user-adjusted amount of native gas token. This includes support for chains like Ethereum, Solana, Polygon, Arbitrum, and others. The feature is intelligently hidden if gas is already present, ensuring a frictionless UX every time. Explore this functionality on Mayan Finance.

Mayan Finance supports WH Swap, Swift, and MCTP because no single method fits all user scenarios. WH Swap provides atomic and secure transfers via Solana. Swift is designed for speed using an intent-based lock-then-fulfill approach. MCTP, powered by Circle CCTP, optimizes for stablecoin conversion and liquidity routing. By offering all three under one unified UI, Mayan gives users and integrators the ability to choose the most effective path depending on trade-offs between speed, cost, and liquidity. Each method is powered by Wormhole messaging, ensuring secure interoperability. See them in action at Mayan Finance.

Developers can quickly integrate cross-chain functionality via the Mayan SDK and Mayan Widget. The SDK supports programmable swaps using methods like

fetchQuoteandswapFromSolana, while the widget offers a plug-and-play UI with smart routing. Both are designed to maintain fast response times and seamless flow between wallet connection, swap execution, and confirmation. Full documentation and open-source packages are available on GitHub, making integration smooth and scalable for teams building wallets, dApps, or DeFi tools.Relayers are essential to Mayan’s infrastructure. These actors handle message delivery between chains using Wormhole VAAs (Verifiable Action Approvals). When a user initiates a swap, relayers register the transaction, monitor VAAs, and complete the swap on the destination chain. They also pay network gas fees during execution, which is why users pay a relayer fee. This fee ensures swaps are handled without users needing to interact with multiple chains manually. It's a key part of making Mayan Finance seamless and automated from start to finish.

You Might Also Like