About Mdex

MDEX is a leading decentralized exchange (DEX) that integrates multiple blockchain networks to offer efficient and cost-effective trading, liquidity mining, and yield farming. The platform was originally built on the HECO (Huobi ECO) Chain but has since expanded to support Binance Smart Chain (BSC) and Ethereum (ETH), providing a multi-chain trading experience. By leveraging automated market-making (AMM) technology, MDEX enables users to swap tokens with high liquidity and low fees.

One of the key aspects that sets MDEX apart from other DEX platforms is its dual mining mechanism, which rewards users for both trading and providing liquidity. This innovative reward model has helped MDEX achieve significant trading volume and attract a strong user base. Additionally, MDEX offers an IDO (Initial DEX Offering) launchpad, which allows new projects to raise funds and gain exposure within the DeFi ecosystem. With a combination of low fees, fast transactions, and lucrative rewards, MDEX has positioned itself as a major competitor to platforms like Uniswap, PancakeSwap, and SushiSwap.

MDEX is a feature-rich multi-chain decentralized exchange (DEX) that offers an advanced DeFi trading experience. Launched in 2021, MDEX started on the HECO Chain but quickly expanded to support BSC and Ethereum, allowing users to trade assets seamlessly across different blockchains. The platform is known for its low transaction fees, high-speed processing, and extensive liquidity pools, making it a preferred choice for many DeFi traders and liquidity providers.

One of the most significant innovations introduced by MDEX is its dual mining system. Unlike traditional DEX platforms that only offer rewards for liquidity providers, MDEX distributes MDX token rewards to both traders and liquidity providers. This approach not only incentivizes trading activity but also ensures that the platform maintains high liquidity levels. Additionally, MDEX includes an IDO launchpad that helps new blockchain projects gain exposure and secure funding from the community.

A major advantage of MDEX is its ability to support cross-chain transactions, enabling users to transfer and swap assets across HECO, BSC, and Ethereum. This multi-chain capability gives it a competitive edge over other popular DEXs, such as Uniswap, which operates primarily on Ethereum, and PancakeSwap, which is limited to BSC. By combining low fees, high liquidity, and powerful trading tools, MDEX continues to attract a growing number of users in the DeFi sector.

MDEX provides numerous benefits and features that make it one of the most competitive decentralized exchanges in the DeFi market:

- Cross-Chain Trading: MDEX supports HECO, Binance Smart Chain (BSC), and Ethereum, allowing users to trade assets across multiple networks efficiently.

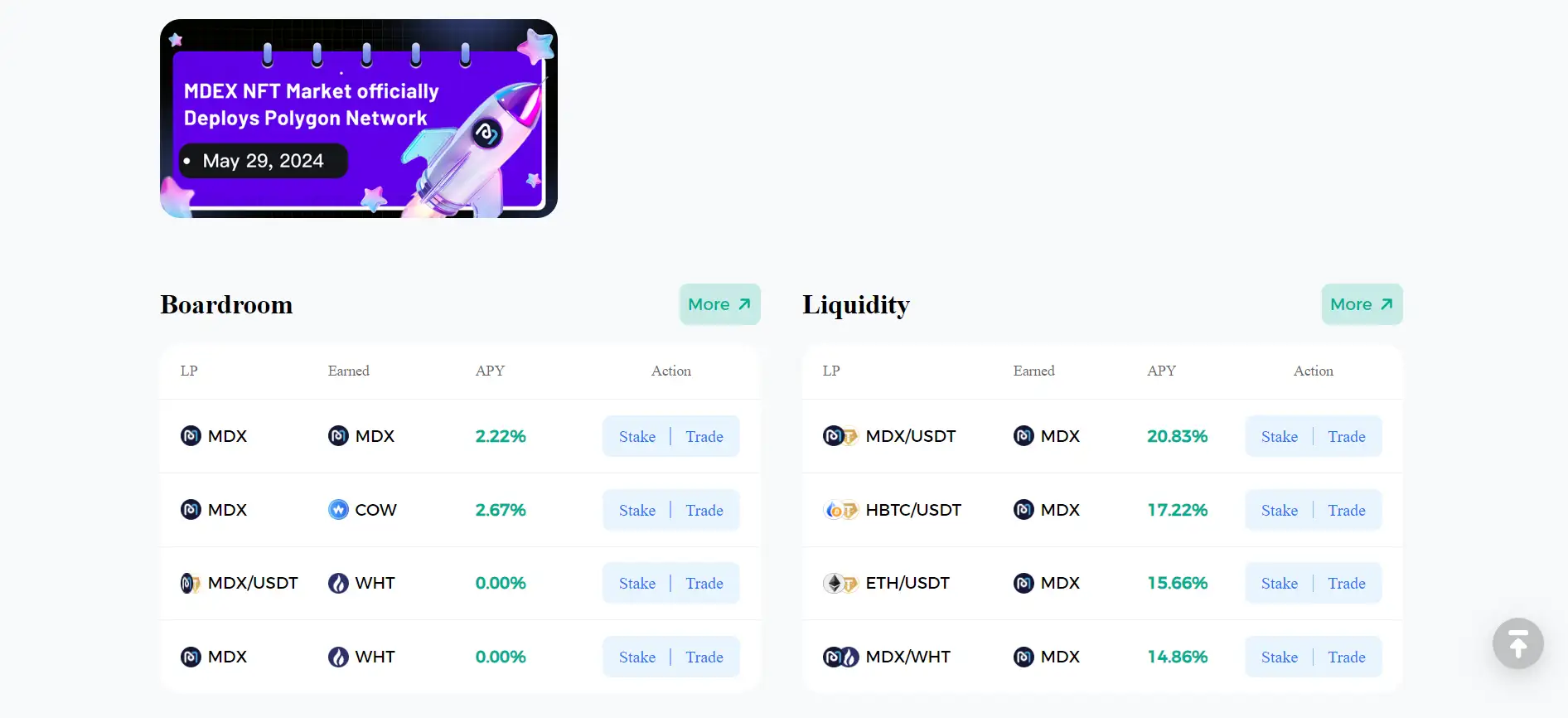

- Dual Mining Rewards: Users earn MDX tokens both from transaction mining and liquidity mining, increasing potential earnings.

- Low Trading Fees: Transactions on MDEX are significantly cheaper than those on Ethereum-based DEXs, thanks to its integration with HECO and BSC.

- IDO Launchpad: The platform provides an Initial DEX Offering (IDO) launchpad that enables blockchain startups to raise funds and gain exposure.

- High Liquidity and Trading Volume: As one of the most active DEXs, MDEX consistently ranks among the top platforms in terms of total value locked (TVL) and daily trading volume.

Getting started with MDEX is easy and only requires a few simple steps:

- Step 1: Connect a Wallet – To trade on MDEX, you need a Web3 wallet that supports HECO, BSC, or Ethereum, such as:

- Step 2: Add Funds – Deposit HT (Huobi Token), BNB (Binance Coin), or ETH (Ethereum) into your wallet, depending on the network you plan to use.

- Step 3: Swap Tokens – Use the MDEX swap interface to trade your tokens with minimal fees.

- Step 4: Provide Liquidity (Optional) – Deposit tokens into a liquidity pool to earn MDX rewards.

- Step 5: Yield Farming (Optional) – Stake your LP tokens in liquidity mining pools to earn additional rewards.

Mdex FAQ

MDEX offers a unique dual mining system that rewards both traders and liquidity providers with MDX tokens. Unlike traditional DEXs, where only liquidity providers earn incentives, MDEX allows traders to receive MDX rewards based on their trading activity, a concept known as transaction mining. Additionally, users who contribute liquidity to trading pairs earn MDX rewards through liquidity mining. This approach ensures a continuous flow of activity on the platform, maintaining high trading volume and deep liquidity.

MDEX stands out from single-chain DEXs like Uniswap and PancakeSwap by offering multi-chain compatibility. Users can trade assets seamlessly across HECO, Binance Smart Chain (BSC), and Ethereum, avoiding limitations tied to a single blockchain. This cross-chain functionality not only increases asset availability but also provides flexibility in choosing lower transaction fees. By integrating multiple chains, MDEX ensures a more cost-effective and efficient trading experience for users worldwide. Explore cross-chain trading at MDEX.

Yes! While MDEX supports the Ethereum network, it also operates on HECO and Binance Smart Chain (BSC), both of which offer significantly lower transaction fees compared to Ethereum’s gas fees. By choosing to trade on HECO or BSC, users can swap tokens at a fraction of the cost, making MDEX a more affordable alternative for DeFi trading. To get started, connect a compatible Web3 wallet such as MetaMask and choose the preferred network for your trades.

MDEX provides an Initial DEX Offering (IDO) launchpad that helps blockchain startups raise funds and gain exposure within the DeFi community. Unlike traditional fundraising methods, IDO projects listed on MDEX benefit from instant liquidity, transparent pricing, and a decentralized token sale process. Investors can participate in promising new projects at an early stage, while project teams access a vast DeFi user base. To explore upcoming IDO opportunities, visit MDEX.

Liquidity Provider (LP) tokens represent a user’s share in a liquidity pool on MDEX. When a user deposits assets into a trading pair, they receive LP tokens in return. These tokens can be staked in liquidity mining pools to earn additional MDX rewards. LP tokens also enable users to withdraw their deposited funds at any time while continuing to earn passive income. By providing liquidity, users contribute to lower slippage and better price stability on the platform.

You Might Also Like