About Midas

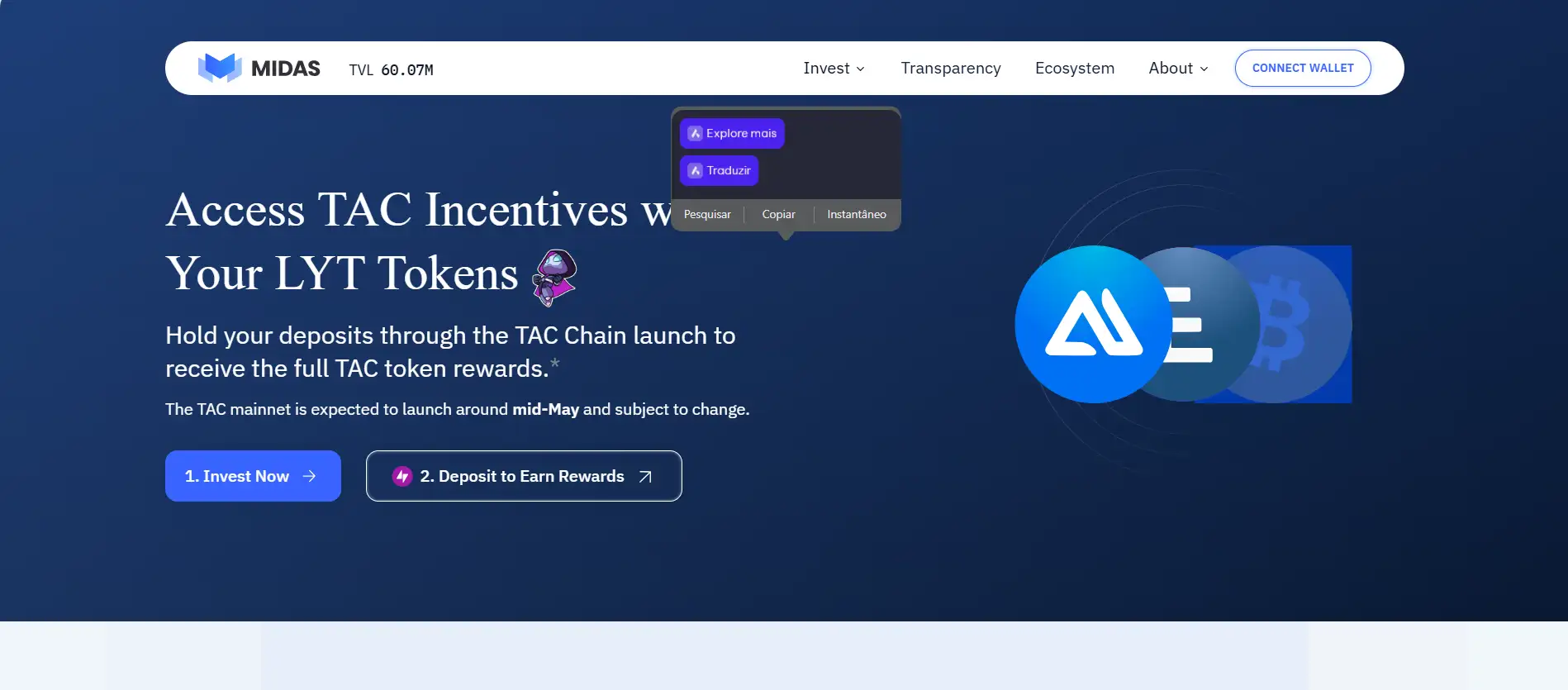

Midas is an advanced digital investment platform focused on delivering institutional-grade financial products through the power of blockchain infrastructure. Designed to merge the transparency and efficiency of decentralized finance (DeFi) with the discipline and compliance of traditional finance, Midas introduces an innovative way to access curated financial strategies via tokenized instruments.

Through its unique offering of Liquid Yield Tokens (LYTs), Midas empowers investors to access structured, yield-bearing assets in a compliant and composable format. Backed by an experienced leadership team and strategic partners such as Coinbase Ventures, BlockTower, and Framework Ventures, the platform bridges the gap between professional-grade investment strategies and a global investor base seeking transparency, performance, and ease of use.

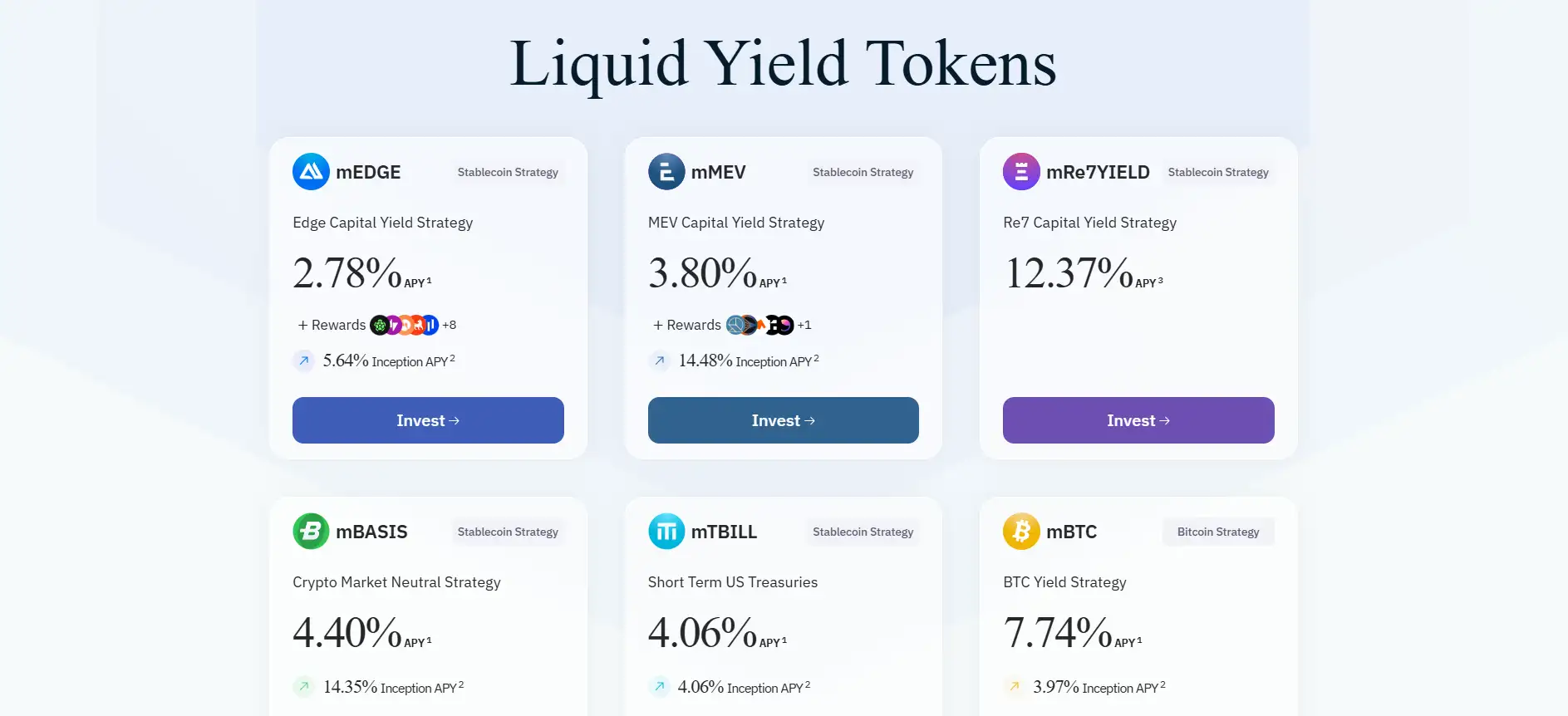

Midas is transforming how modern investors interact with financial products by offering an on-chain investment platform built with regulatory compliance and transparency at its core. Headquartered in Berlin under Midas Software GmbH, the platform enables users to invest in yield-bearing digital assets tied to curated financial strategies, all made accessible via composable ERC-20 tokens. These tokens—such as mBTC, mTBILL, mMEV, and mEDGE—represent investment products backed by real-world strategies like short-term U.S. Treasuries, crypto-neutral portfolios, MEV-driven trades, and more.

The uniqueness of Midas lies in its architecture, which supports instant issuance and redemption of tokens, with fallback support for standard modes in varying market conditions. The platform integrates atomic redemption and shared liquidity pools to ensure high availability and capital efficiency across DeFi applications. By introducing Liquid Yield Tokens that are not pegged to $1, Midas bypasses the inherent risks of de-pegging associated with traditional yield-bearing stablecoins, enabling a broader and more flexible collateral design.

The platform’s compliance-first approach, including verification agents such as Ankura Trust and a legally approved prospectus, reflects its mission to align DeFi innovation with institutional standards. Unlike quasi-stablecoin models that risk regulatory scrutiny and investor confidence, Midas structures its tokens as regulated debt instruments with transparent price oracle methodologies. Real-time updates via blockchain oracles and third-party reference validation ensure the platform remains reliable and credible.

With a Total Value Locked (TVL) exceeding $60 million, Midas is rapidly becoming a foundational layer for compliant, high-performance DeFi investing. Competitors in the institutional-grade DeFi investment space include Ondo Finance, Maple Finance, and Ribbon Finance, although Midas differentiates itself with its regulatory-first architecture and real-world asset alignment.

Midas offers a range of powerful features and benefits that position it as a standout solution in the landscape of on-chain investing:

- Regulatory-Compliant Infrastructure: All products issued by Midas follow a formally approved prospectus, aligning with European securities laws and offering a level of trust rarely seen in DeFi.

- Liquid Yield Tokens (LYTs): Midas introduces non-pegged, yield-generating tokens that avoid the risks of de-pegging common in traditional stablecoin strategies. Each LYT reflects the performance of its underlying investment strategy.

- Instant Issuance & Redemption: The platform enables instant token conversion via crypto, while fallback modes ensure flexibility during periods of high demand or market stress.

- Atomic Redemption & Shared Liquidity Pools: Tokens benefit from capital-efficient redemptions thanks to shared liquidity architecture, unlocking broader DeFi use cases without depending on costly subsidies.

- Institutional Grade Security: Custody and verification are managed by third-party agents like Ankura Trust, ensuring proof-of-reserve validation and full asset transparency.

- Composability with DeFi: As ERC-20 assets, Midas tokens are fully composable within the DeFi ecosystem, allowing seamless integration into DEXs, yield aggregators, and lending platforms.

- Experienced Team & Strong Backers: Midas is led by former professionals from Goldman Sachs, Capital Group, Ondo Finance, and more, with backing from Coinbase Ventures, Framework Ventures, and others.

Midas makes it easy for users to start investing in DeFi yield strategies through an intuitive and secure process:

- Visit the Official Website: Go to midas.app to access the platform and explore available products and strategies.

- Connect Your Wallet: Use a Web3 wallet like MetaMask to connect to the Midas platform. You may need to switch networks to Ethereum or Base depending on the token.

- Pass Eligibility Check: Midas performs automatic eligibility verification to ensure compliance with regional regulations. U.S. persons and other restricted jurisdictions are not allowed.

- Choose a Token Strategy: Browse through various mTokens like mTBILL (US Treasury strategy), mBTC (Bitcoin yield), mMEV (MEV capture), and others.

- Approve and Invest: Approve the smart contract to spend your crypto, then enter the desired investment amount. You’ll receive your mToken upon confirmation.

- Track and Redeem: Monitor performance directly on midas.app and redeem your tokens instantly or via standard redemption depending on liquidity mode.

- Review Legal Docs: Before investing, check out the full prospectus and disclaimers for compliance and transparency.

Midas FAQ

In cases where instant redemption is not available, Midas defaults to Standard Mode, which processes redemptions via a queue within 1–7 business days. This fallback ensures access to your funds even during high-demand periods. Investors can track redemption capacity and mode live on the platform, adding an extra layer of transparency and trust.

Liquid Yield Tokens (LYTs) issued by Midas are not pegged to a fixed $1 value. Instead, they use a floating reference value based on asset performance. This allows Midas to issue them under a regulated debt instrument framework, supported by a formally approved prospectus, enabling full compliance with European securities law.

Midas provides institutional-grade access to DeFi through features like third-party asset verification, proof-of-reserve systems, and strict adherence to regulatory compliance. Combined with yield strategies based on real-world financial instruments and ring-fenced token structures, Midas offers the controls and standards institutions expect.

The shared liquidity mechanism at Midas uses atomic redemption to reallocate liquidity among various mTokens. When an investor redeems a token, the liquidity pool is automatically rebalanced by topping up the reserve, ensuring consistent access and efficiency across the protocol without needing deep individual token reserves.

Yes, the redemption price on Midas is backed by a proof-of-reserve oracle system and verified daily by independent agents like Ankura Trust. These oracles update based on the underlying strategy’s performance and are made publicly available on-chain, helping maintain pricing integrity and investor trust.

You Might Also Like