About MultichainZ

MultichainZ is a next-generation omnichain credit platform designed to connect real-world assets (RWAs) with decentralized finance. By enabling users to borrow against yield-bearing assets across multiple blockchains without bridging, it redefines capital efficiency and liquidity accessibility. Built to support both retail and institutional users, MultichainZ delivers a powerful, trustless framework for asset-backed lending in the Web3 ecosystem.

At its core, MultichainZ facilitates frictionless lending and borrowing of tokenized assets, credit notes, or liquid staking tokens through a fully interoperable, omnichain system. By offsetting borrowing costs using productive collateral—like tokenized T-bills or stETH—users gain access to a seamless, low-cost liquidity experience. With modular components and institutional-grade infrastructure, the platform bridges TradFi and DeFi for the modern digital economy.

MultichainZ is the first omnichain credit protocol to offer a scalable solution for borrowing against yield-generating real-world assets (RWAs) and crypto assets. Its architecture is built on top of a powerful Omnichain Collateral Engine, which allows users to borrow or lend on any supported blockchain without the need for manual bridging. This unlocks instant cross-chain settlements and a fluid user experience.

One of MultichainZ’s key innovations is Yield-Offset Borrowing. Instead of requiring borrowers to pay high interest, the protocol allows them to use yield-bearing assets as collateral, such as tokenized bonds, real estate, or institutional debt. These assets continue to generate income during the loan period, offsetting or even covering the loan’s interest entirely. This creates a self-repaying dynamic that is more capital-efficient and sustainable than traditional DeFi borrowing models.

The platform also introduces the concept of Composable RWA Architecture, where various tokenized financial instruments can be used flexibly across chains as either collateral or borrowable assets. This creates a deeply integrated and composable lending environment for tokenized treasuries, stablecoins, and digital assets across ecosystems like Ethereum, Base, Avalanche, and Plume.

Designed for both institutional and retail audiences, MultichainZ is committed to delivering modular, auditable, and secure infrastructure. All smart contracts are open, verifiable, and governed by community-led decisions. With features like health monitoring, liquidation protection, and collateral rebalancing, borrowers have access to real-time tools that protect positions while maximizing utility.

MultichainZ’s ecosystem spans community lending pools, token lending markets, NFT lending protocols, and RWA-backed credit facilities. Whether you're deploying capital for passive yield or unlocking liquidity from productive assets, MultichainZ creates an all-in-one, omnichain lending system that is truly interoperable, efficient, and transparent. Visit MultichainZ to explore the future of decentralized credit markets.

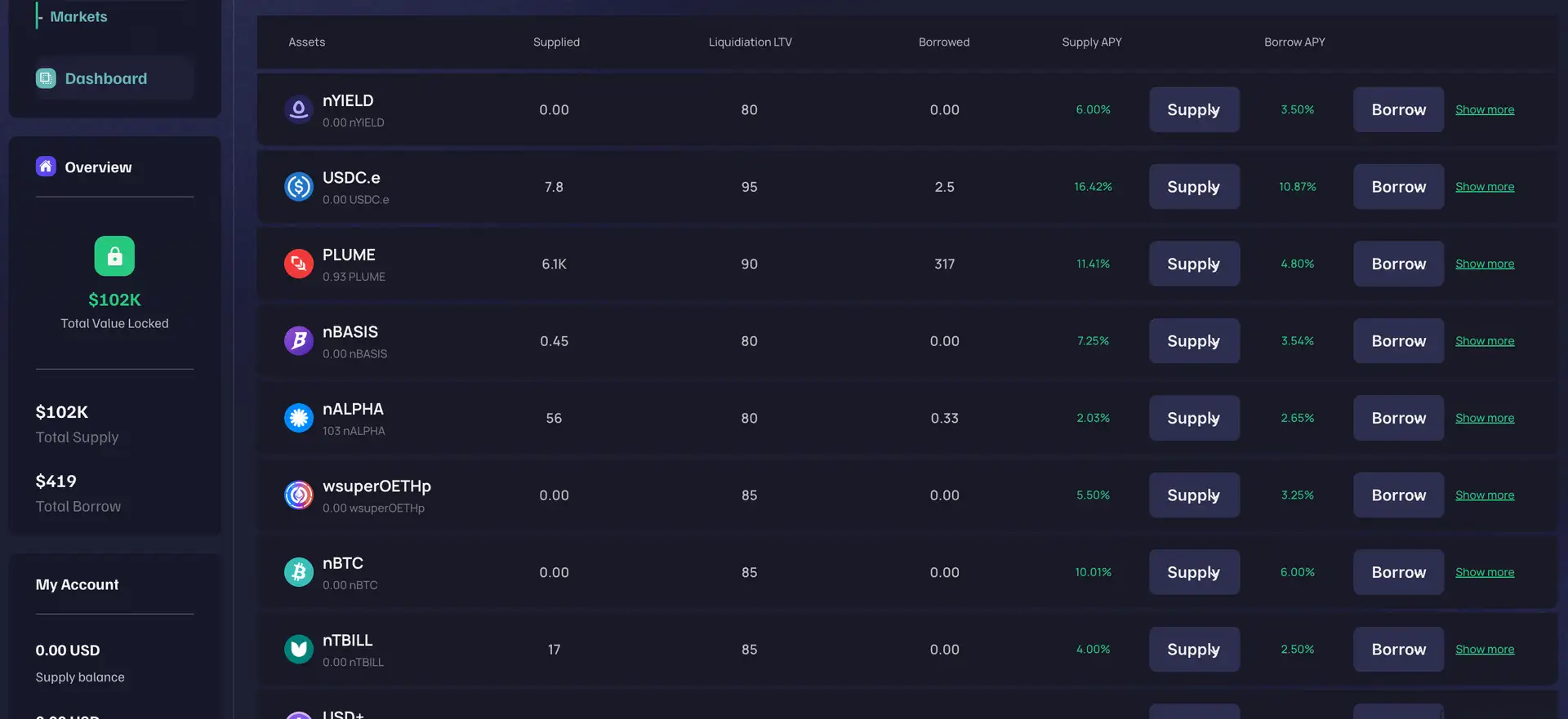

MultichainZ provides numerous benefits and features that make it a standout protocol in the RWA lending and omnichain DeFi space:

- Omnichain Borrowing: Borrow on one blockchain using collateral from another—no bridging required.

- Yield-Offset Loans: Use yield-generating RWAs as collateral that help repay loan interest automatically.

- Self-Repaying Mechanism: Integrated real-world yields can cover loan repayments, reducing manual interaction.

- Dynamic Interest Rates: Rates adjust based on cross-chain demand, asset risk, and governance settings.

- Institutional-Grade Security: Smart contracts are verifiable, with no intermediaries or hidden fees.

- Cross-Chain Settlements: Real-time transactions across chains with full audit trails.

- Real World Asset Collateral: Borrow against tokenized T-bills, real estate, and institutional debt.

- NFT and Token Lending: Unlock liquidity from NFTs and token assets using specialized lending protocols.

Getting started with MultichainZ is simple and designed to support both everyday users and institutions:

- Visit the App: Go to multichainz.com and click on "Launch App" to access the lending dashboard.

- Connect Your Wallet: Use MetaMask, WalletConnect, or other supported wallets to sign in and access your portfolio.

- Supply Assets: Choose a lending pool and deposit tokenized RWAs, stablecoins, or yield-bearing crypto assets to start earning interest.

- Borrow Across Chains: Select your borrowing chain and asset. The platform handles cross-chain execution in real-time.

- Repay Loans: Repay manually or use the RWA’s yield to auto-repay interest via the protocol’s self-repaying mechanism.

- Monitor Health Factor: Use the real-time dashboard to track your loan-to-value (LTV), interest accrual, and liquidation safety ratio.

- Explore Documentation: Dive into detailed guides and developer docs at docs.multichainz.com.

- Join the Community: Connect with support and updates via Discord and Telegram.

MultichainZ envisions building a borderless financial system that bridges traditional finance with decentralized technology. Its cross-chain lending and borrowing services aim to solve liquidity issues across digital asset markets, providing users with access to liquidity pools spanning various blockchain networks. This innovation enhances interoperability while reducing friction in cross-chain transactions.

A key part of MultichainZ's vision is its focus on NFT lending, where users can utilize NFTs as collateral to unlock liquidity, increasing the overall liquidity of digital assets. Moreover, the platform offers RWA lending, allowing users to tokenize real-world assets like real estate or bonds to obtain loans, thereby creating a significant link between traditional finance and decentralized finance.

The platform's commitment to security and compliance sets it apart, offering advanced risk management mechanisms and audited smart contracts, making it an attractive solution for both individual and institutional users. Learn more about the project’s vision and offerings in their official documentation.

MultichainZ’s development roadmap highlights key upcoming features, such as cross-chain lending pools, expanding the number of supported blockchain networks, and optimizing the platform’s compliance frameworks. Future milestones include the introduction of yield farming options, enabling users to earn passive income through liquidity pools, and advancements in NFT lending protocols.

The roadmap also outlines plans to introduce more solutions for RWA lending in the coming quarters. For additional details on the roadmap, you can visit the platform’s official documentation.

MultichainZ was co-founded by Aanchal Thakur, who serves as Chief Operating Officer, and Alex Bernstein, both bringing significant expertise in blockchain and decentralized finance. The company’s current CEO is Sash Jeetun, who focuses on the platform’s overall strategy and development.

Although the platform has received funding, details of specific investors remain private. For more insights into the team and platform, visit the official MultichainZ website.

MultichainZ Reviews by Real Users

MultichainZ FAQ

MultichainZ introduces a self-repaying loan mechanism by allowing users to collateralize yield-bearing real-world assets (RWAs) such as tokenized T-bills or bonds. These assets continue to generate income while locked, and that natural yield is automatically applied toward the loan’s interest. This reduces or eliminates manual repayments. Borrowers keep exposure to the underlying yield, improving capital efficiency and making debt management easier. Learn more at MultichainZ.

Omnichain borrowing with MultichainZ allows users to post collateral on one blockchain and borrow on another without manually bridging assets. Unlike traditional models that rely on custodians or wrapped tokens, MultichainZ uses interoperable smart contracts to execute trustless transactions across chains. This results in lower fees, faster settlements, and streamlined loan management from a single interface. Explore how it works at MultichainZ.

Yes, MultichainZ supports lending markets for NFTs and tokenized real estate under its RWA and NFT lending protocols. Users can post these digital or physical-backed assets as collateral and access liquidity while retaining ownership. NFT owners can unlock value without selling, and real estate tokens can earn passive yield while backing loans. The system provides liquidity, transparency, and smart contract governance for these asset classes. Visit MultichainZ to explore available pools.

MultichainZ implements a dynamic Safety Ratio model based on asset-specific liquidation thresholds and real-time pricing. Users are alerted when their Loan-to-Value (LTV) ratio nears risk levels. Borrowers can boost their ratio by repaying or adding more collateral. The protocol supports partial liquidation mechanisms and cross-chain monitoring to ensure borrowers maintain a healthy position. Transparent smart contracts and automated health checks minimize surprises. Learn more at MultichainZ.

MultichainZ offers institutional-grade lending infrastructure with modular smart contracts, cross-chain interoperability, and support for tokenized securities such as bonds, treasuries, and credit instruments. Institutions can create custom pools, configure liquidation parameters, and offer loans backed by on-chain RWAs. Combined with auditable contracts and decentralized governance, MultichainZ enables full regulatory transparency while maintaining Web3-native functionality. Visit MultichainZ for partnership options.

You Might Also Like