About Nexus Mutual

Nexus Mutual is a pioneering decentralized insurance alternative that enables individuals to collectively share risk within a blockchain-powered mutual framework. Built on Ethereum, the protocol empowers users to purchase discretionary cover against the most prevalent risks in the DeFi ecosystem, such as smart contract exploits, governance attacks, and validator slashing. Unlike traditional insurers, Nexus Mutual operates as a community-driven mutual where every participant becomes a member and engages in key protocol functions.

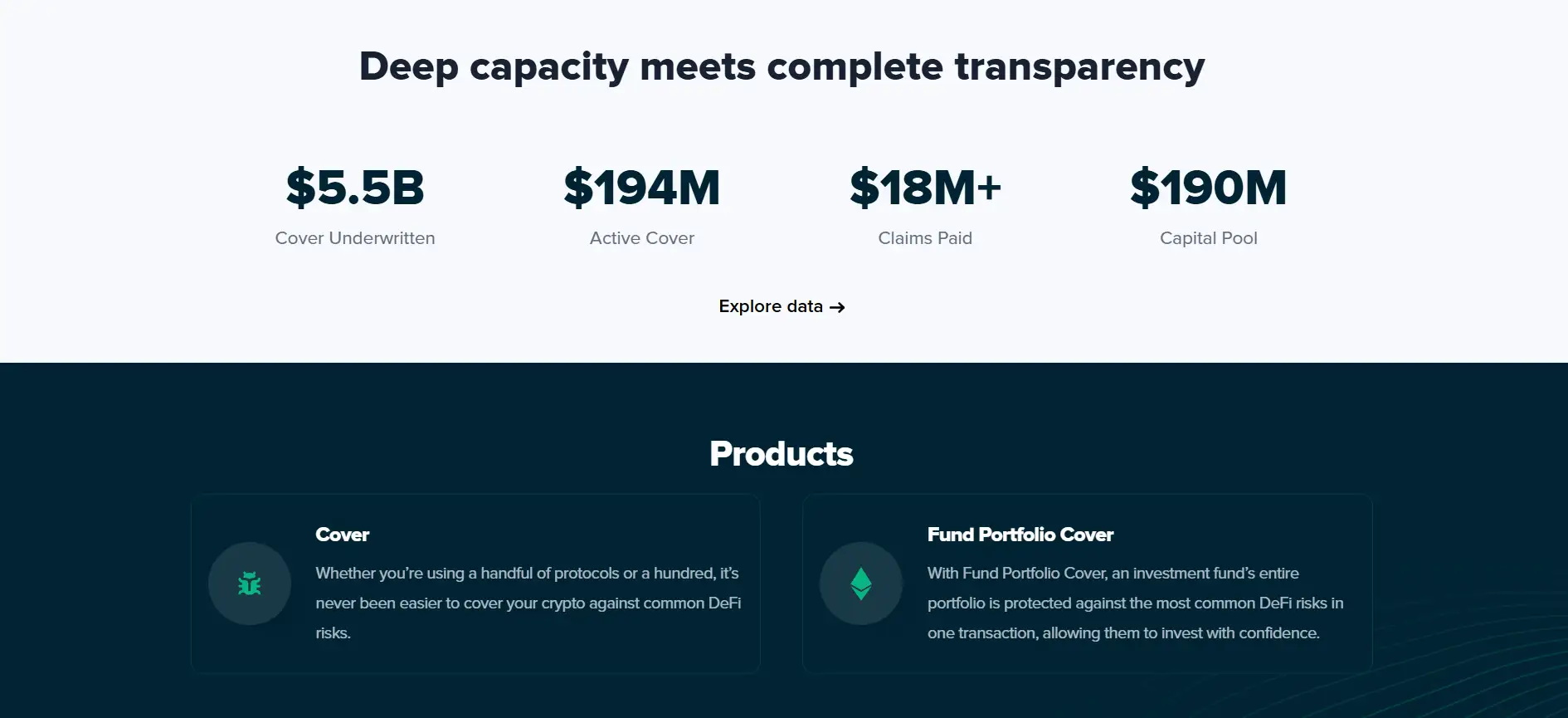

Members of Nexus Mutual have the ability to contribute to the mutual through staking, governance participation, and claims assessment, providing a level of transparency and decentralization rarely seen in the insurance world. The project has successfully underwritten over $5.5 billion in cover, paid out over $18 million in claims, and manages a $190 million capital pool. Through a robust, member-powered DAO structure, Nexus Mutual continues to reshape how crypto users protect their assets onchain.

Nexus Mutual is a decentralized alternative to traditional insurance, purpose-built for the rapidly evolving DeFi ecosystem. Established in 2019, the project is rooted in the idea that risk-sharing can be achieved without relying on centralized intermediaries. By leveraging blockchain technology, Nexus Mutual enables users to cover and manage crypto-related risks with complete transparency, backed by a collective capital pool governed by its members.

The protocol is structured around a discretionary mutual model, meaning all participants must become members before interacting with the system. Members can buy cover products, stake NXM to underwrite risk, assess claims, and contribute to DAO governance. The core infrastructure is built on Ethereum, ensuring decentralization, security, and accessibility across the globe. The project also features a Ratcheting Automated Market Maker (RAMM), an innovative two-pool system for minting and redeeming the native NXM token while balancing liquidity and capital efficiency. This system ensures that all claims are payable even in the event of catastrophic losses.

The product suite offered by Nexus Mutual includes a diverse array of cover options for individuals, funds, and protocols. These include Protocol Cover for protecting deposits in a single DeFi protocol, Bundled Protocol Cover for multi-protocol strategies, DeFi Pass Cover for ecosystem-wide protection, Fund Portfolio Cover for asset managers, and ETH Slashing Cover for validators and node operators. Each cover type addresses different facets of smart contract risk, ensuring broad applicability in the DeFi landscape.

Governance and community participation are at the heart of the Nexus Mutual ecosystem. All members who pass KYC/AML requirements can participate in protocol governance by voting on proposals, staking NXM, and evaluating claims. The DAO structure also enables community members to request grants and contribute independently to protocol development, marketing, and education efforts. Members are incentivized through rewards generated from staking and successful claim assessments, encouraging responsible behavior and deeper involvement.

The protocol’s performance is backed by compelling metrics: over $5.5 billion in cover underwritten, $194 million in active cover, and more than $18 million in claims paid. This level of activity highlights Nexus Mutual's role as a leader in onchain risk protection. Security is another top priority—the protocol’s codebase is audited by top firms, and it runs a live bug bounty program through Immunefi to continuously protect its infrastructure.

Competitively, Nexus Mutual stands apart from traditional insurance providers by removing centralized control and bringing risk sharing directly to users. In the Web3 space, it is often compared to platforms like Etherisc, which also focuses on decentralized insurance, or InsurAce, a protocol offering similar multi-chain cover services. However, Nexus Mutual's unique mutual model and long-standing performance distinguish it in terms of trust and usability.

Overall, Nexus Mutual represents a significant evolution in how people access and manage risk protection in the digital economy. By merging onchain infrastructure with a cooperative model, it sets a strong precedent for community-driven financial protection mechanisms in Web3.

Nexus Mutual provides numerous benefits and features that make it a standout project in the onchain insurance landscape:

- Decentralized Risk Sharing: Operates as a member-owned mutual with no central authority, allowing users to share risk and earn rewards by contributing to the protocol.

- Wide Range of Cover Products: Offers tailored products including Protocol Cover, Bundled Cover, ETH Slashing Cover, Fund Portfolio Cover, and more, each designed for specific risk scenarios in the DeFi and Web3 space.

- Transparent Claims Process: Members stake NXM and vote on claim submissions in a community-led system, with all decisions recorded onchain for transparency and accountability.

- Proven Capital Efficiency: Backed by a $190M+ Capital Pool and over $18M in claims already paid out, demonstrating its reliability and long-term viability.

- Security First: The protocol has undergone audits by leading security firms and runs a bug bounty program via Immunefi, reinforcing its commitment to protecting users’ funds.

- Governance by Members: Every member can propose and vote on DAO initiatives, ensuring that strategic decisions are always made collectively.

- Earn Through Participation: Members can stake NXM to underwrite risk and participate in claim assessments, earning rewards based on cover usage and decision-making.

- Global Accessibility: Built on Ethereum, the platform is accessible to anyone with a wallet and internet connection (excluding sanctioned jurisdictions).

Nexus Mutual offers a streamlined onboarding experience designed to get users protecting their crypto assets as quickly and securely as possible:

- Step 1 – Join as a Member: Visit nexusmutual.io and click on the "Membership" button. You’ll begin the Know-Your-Customer (KYC) process by uploading a valid government ID.

- Step 2 – Pay Membership Fee: Submit a small membership fee (currently 0.0020 ETH) to finalize your onboarding and become an official Nexus Mutual DAO member.

- Step 3 – Browse Cover Products: After becoming a member, explore available products such as Protocol Cover or Fund Portfolio Cover directly from the Nexus Mutual app.

- Step 4 – Buy Cover: Select a product, enter the coverage amount, choose the asset (ETH, USDC, or cbBTC), and confirm your transaction using your connected wallet.

- Step 5 – Stake NXM or Participate: Earn rewards by staking NXM to underwrite risk or by assessing claims submitted by other members.

- Step 6 – Vote & Propose: Get involved in governance by voting on proposals that guide the future of the protocol. Use Snapshot to voice your opinion on treasury spending, product development, and more.

- Additional Resources: For more detailed instructions, you can access the full documentation here or visit the main site and click "Docs."

Nexus Mutual FAQ

Yes, you can. With Nexus Mutual's DeFi Pass Cover, members can flexibly protect their assets across multiple DeFi protocols on a network without needing to repurchase new coverage for each one. This cover model allows you to move funds freely between approved protocols, maintaining full protection during transfers and rebalances. This design makes Nexus Mutual highly effective for fund managers and active DeFi users managing capital across strategies.

Nexus Mutual uses a member-governed claims process where NXM stakers assess claims through a voting mechanism. In mass-event scenarios, such as high-profile protocol exploits, claims are evaluated transparently using blockchain data and community input. While traditional insurers might limit payouts in such cases, Nexus Mutual ensures every valid claim is reviewed and decided by its decentralized community of assessors, all incentivized to maintain fairness and protocol integrity.

Although Nexus Mutual operates on decentralized infrastructure, its legal structure as a discretionary mutual necessitates a KYC/AML process for membership. This ensures compliance with global regulations while allowing the mutual to operate legally and responsibly. Members gain access to governance rights and claim processing, and since they collectively own the protocol’s capital pool, identity verification is essential. You can start the KYC process at nexusmutual.io with your Ethereum wallet and government-issued ID.

Staking pools are central to how Nexus Mutual underwrites and prices risk. Members with specific expertise can launch staking pools targeting certain protocols, signaling both confidence and underwriting capacity. Other members may delegate their NXM tokens to these pools, increasing available cover and generating fees. This system ensures risks are priced dynamically and governed by those who understand them best. Through staking pools, Nexus Mutual transforms risk underwriting into a decentralized, market-driven process.

The capital pool in Nexus Mutual is funded by cover premiums, staking rewards, NXM purchases, and strategic crypto investments. When a member buys cover or mints NXM, those assets flow into the shared pool. The protocol also invests a portion of funds to generate additional yield, with all activity governed by community votes. Capital is deployed using a carefully structured system called the Ratcheting AMM, ensuring liquidity and solvency. Learn more at nexusmutual.io.

You Might Also Like