About NFTX

NFTX is a decentralized protocol that revolutionizes the way NFT liquidity is created, traded, and monetized. Through the use of fungible ERC-20 tokens called vTokens, NFTX enables instant buying, selling, and staking of NFTs across multiple collections and blockchains.

By wrapping NFTs into tradable vTokens and combining them with its own Uniswap V3-based AMM, NFTX empowers both casual collectors and DeFi-native users with unprecedented control over their digital assets. With a focus on liquidity, yield generation, and composability, NFTX provides a foundational layer for the financialization of NFTs.

NFTX was launched to address one of the most pressing challenges in the NFT space: liquidity. Traditional NFT marketplaces require matching buyers and sellers, which leads to long wait times and limited pricing data. NFTX solves this by wrapping NFTs into 1:1 ERC-20 tokens called vTokens, which are tradable through liquidity pools. This creates instantly accessible liquidity and enables NFTs to function like DeFi assets.

The protocol's architecture allows users to mint, redeem, and swap NFTs within vaults that represent specific collections. Every vToken is backed 1:1 by an NFT in the vault, giving users direct exposure to the collection’s floor price without needing to purchase a specific NFT. Users can mint vTokens by depositing NFTs into a vault, redeem NFTs by burning vTokens, or swap NFTs within the same vault.

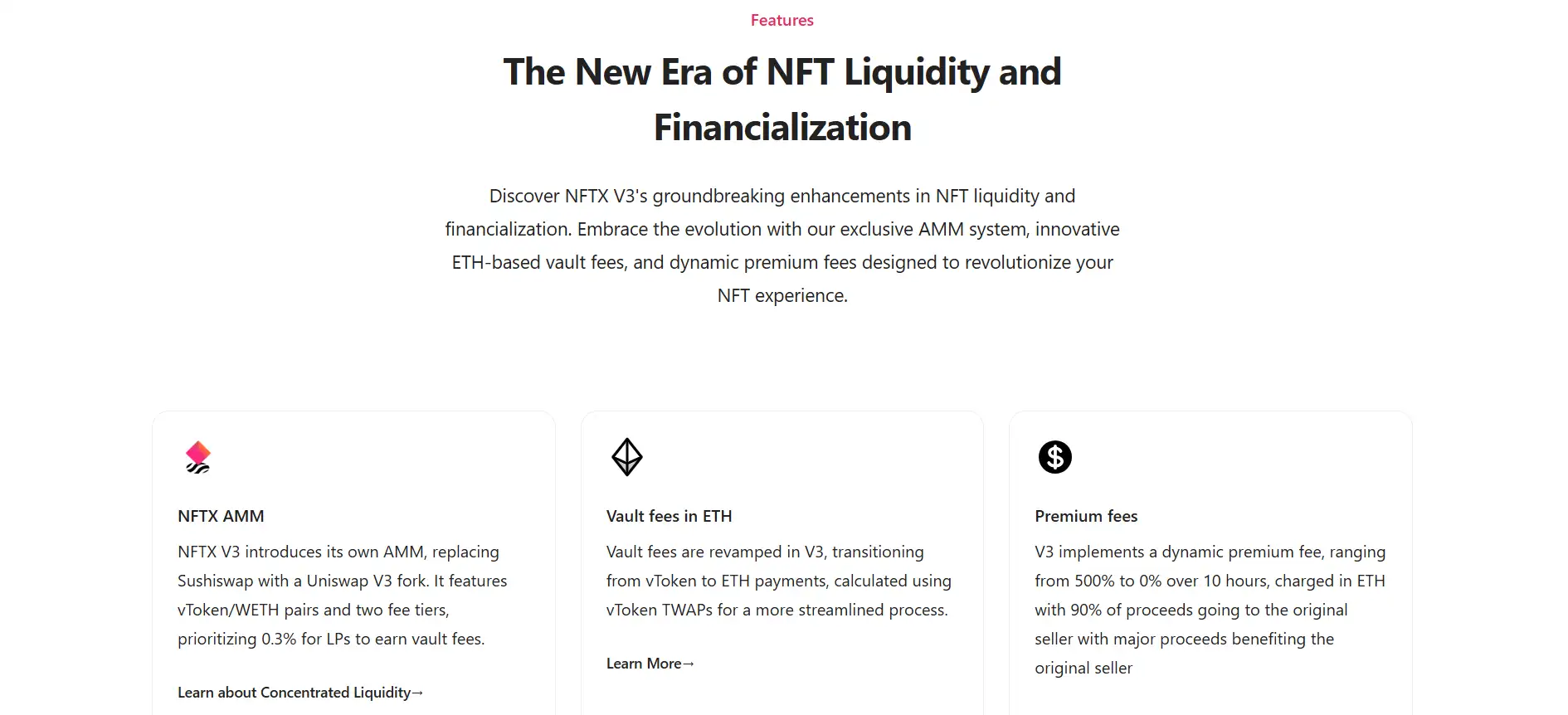

With the release of V3, NFTX introduced major technical upgrades including a new concentrated liquidity AMM, ETH-based vault fees, premium fees for newly deposited NFTs, and vault positions represented as NFTs (xNFTs). The protocol operates across Ethereum, Base, and Arbitrum, and supports advanced features such as inventory staking and early withdrawal options with dynamic time locks.

NFTX enables users to earn ETH rewards by either staking inventory (vTokens/NFTs) or providing liquidity to AMM pools. In V3, 80% of ETH vault fees are rewarded to LPs, and 20% go to inventory stakers. These mechanisms incentivize deeper liquidity and broader collection diversity. A unique Dutch auction-inspired premium fee is also applied to newly deposited NFTs, rewarding the seller while maintaining fair access.

Unlike many protocols, NFTX operates entirely as a DAO using Snapshot, Aragon, and community forums for governance. All decisions, including fee changes and protocol upgrades, are voted on by token holders. The ecosystem also includes the NFTX Academy, providing comprehensive learning paths for both stakers and shoppers.

NFTX competes with platforms such as Sudoswap, Blur, and Uniswap (for fractionalized NFT liquidity), but distinguishes itself through its own AMM, ERC721-represented positions, and in-depth DAO infrastructure. It aims to become the foundational layer of NFT liquidity for the broader Web3 financial system.

NFTX provides several cutting-edge features that redefine NFT ownership, liquidity, and utility:

- Instant Buy/Sell/Swap: Convert NFTs to ETH or vice versa without waiting for a counterparty.

- vTokens: Wrap NFTs into fungible tokens that represent collection exposure and can be traded or staked.

- Custom AMM: Uses a Uniswap V3 fork with 0.3% and 1% fee tiers for optimized yield and trading.

- Vault Fees in ETH: All mint, redeem, and swap operations now use ETH for simpler accounting.

- Premium Fees: Dutch auction-style dynamic fees that reward the last depositor and balance demand.

- Inventory Staking: Earn ETH from vault fees by staking vTokens or NFTs with no impermanent loss.

- Liquidity Provider Rewards: Provide vToken/WETH liquidity to earn AMM + vault fee rewards.

- ERC721 Positions: Both LP and inventory staking positions are represented as tradable NFTs.

- Governance via DAO: Transparent on-chain governance using Snapshot, Aragon, and community forums.

- Multi-Chain Deployment: Live on Ethereum, Base, and Arbitrum, with L2 support expanding soon.

NFTX is designed to be accessible for collectors, traders, and builders alike. Here’s how to get started on NFTX:

- Connect Your Wallet: Visit app.nftx.io and connect your preferred wallet (MetaMask, WalletConnect, etc.).

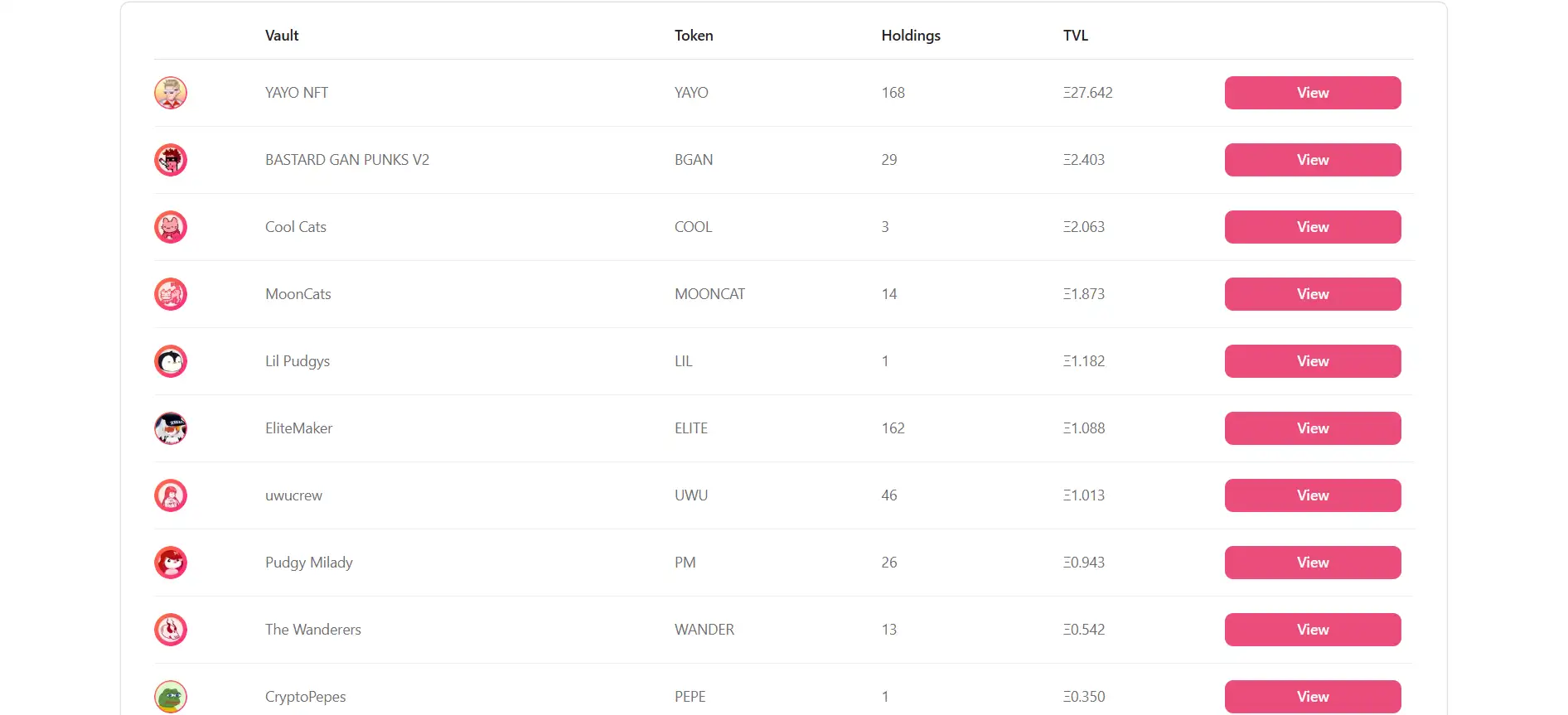

- Explore Vaults: Browse the list of supported collections and their associated vTokens.

- Buy or Sell NFTs: Instantly sell your NFT for ETH or purchase from vault inventory using the custom AMM.

- Mint & Stake: Mint vTokens by depositing NFTs, and stake them to earn ETH-based vault fees.

- Provide Liquidity: Add vToken/ETH to an AMM pool and earn swap + vault rewards.

- Swap NFTs: Swap an NFT you own for another one in the same vault and pay a small ETH swap fee.

- Participate in Governance: Get involved in proposals via the Forum, Snapshot, and Discord.

- Learn with NFTX Academy: Check out NFTX Academy to master staking, vaults, and trading strategies.

NFTX FAQ

NFTX uses a concentrated liquidity AMM, similar to Uniswap V3, which allows LPs to choose specific price ranges for their liquidity. The closer their liquidity is to the current market price, the more fees they earn from trades. This design incentivizes LPs to keep prices competitive while maximizing their returns from vault and swap fees.

Every staking or liquidity position on NFTX is tokenized as an ERC-721 NFT. This makes positions tradable, portable, and transparent. Users can hold, transfer, or even sell their staking or LP positions, giving unprecedented flexibility and composability in DeFi. It also improves protocol transparency by tracking each position’s metadata on-chain.

Premium fees are part of NFTX’s V3 innovation. If an NFT is freshly deposited, users must pay a dynamic fee (up to 500%) to redeem it early. This acts like a Dutch auction that gradually reduces over 10 hours. The fee ensures that the depositor is rewarded (receiving 90% of the fee in ETH), while also preventing sniping behavior that could discourage inventory contributions.

No, when you deposit an NFT into a vault on NFTX, you receive a fungible vToken in return. This vToken can be redeemed for any NFT from the vault, but not necessarily the one you deposited. This model promotes liquidity over ownership specificity and allows NFTs to behave like DeFi assets with real-time trading capability.

Time-locks are applied to both inventory and LP positions to prevent abuse. Standard locks are 2-3 days, but users can opt for 1-hour time-locks if they only interact with vTokens. Early withdrawals incur a dynamic exit fee in vTokens, discouraging short-term arbitrage. This ensures fairness and maintains the protocol’s balance between utility and security.

You Might Also Like