About Noon Capital

Noon Capital is a Web3-native stablecoin ecosystem built to deliver intelligent, fair, and secure yield through automated capital deployment. Its mission is to empower users with market-leading through-cycle returns and equitable access to protocol-generated value, making it one of the most thoughtful innovations in decentralized finance. Noon Capital operates under the belief that smart capital allocation and ethical token distribution are not mutually exclusive, but mutually reinforcing.

At the heart of Noon is the ability to generate delta-neutral returns from battle-tested trading strategies while minimizing smart contract and counterparty risk. By combining composability, yield maximization, and verifiable solvency, Noon stands out in a crowded DeFi space. The platform is governed entirely by users, who are rewarded for their contribution with a generous allocation of its native governance token.

Noon Capital was designed around one fundamental question: “How can we maximize value for users?” This led the team to build a next-generation stablecoin protocol that combines intelligent yield generation with ethical token distribution. Unlike most DeFi projects, Noon prioritizes its community by allocating up to 80% of all governance tokens to users—not investors, advisors, or influencers. With an emphasis on capital efficiency, accessibility, and security, Noon aims to democratize powerful financial tools once reserved for institutional players.

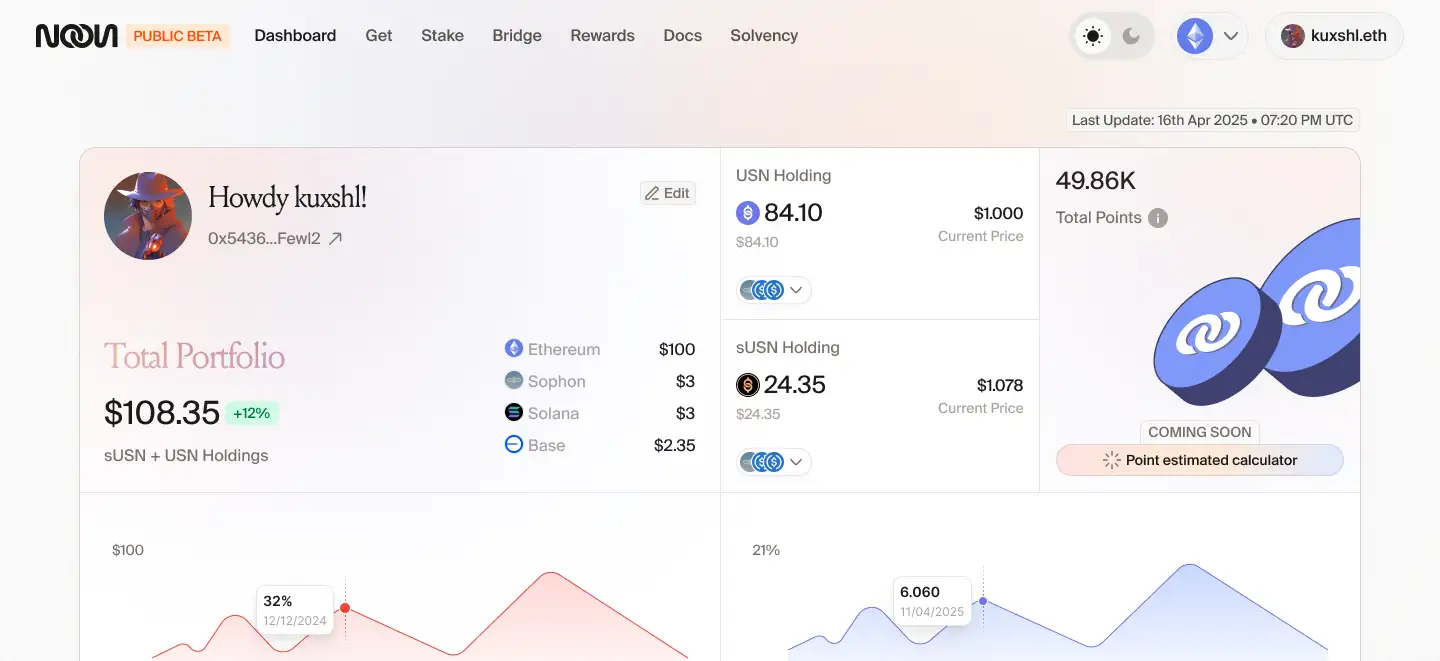

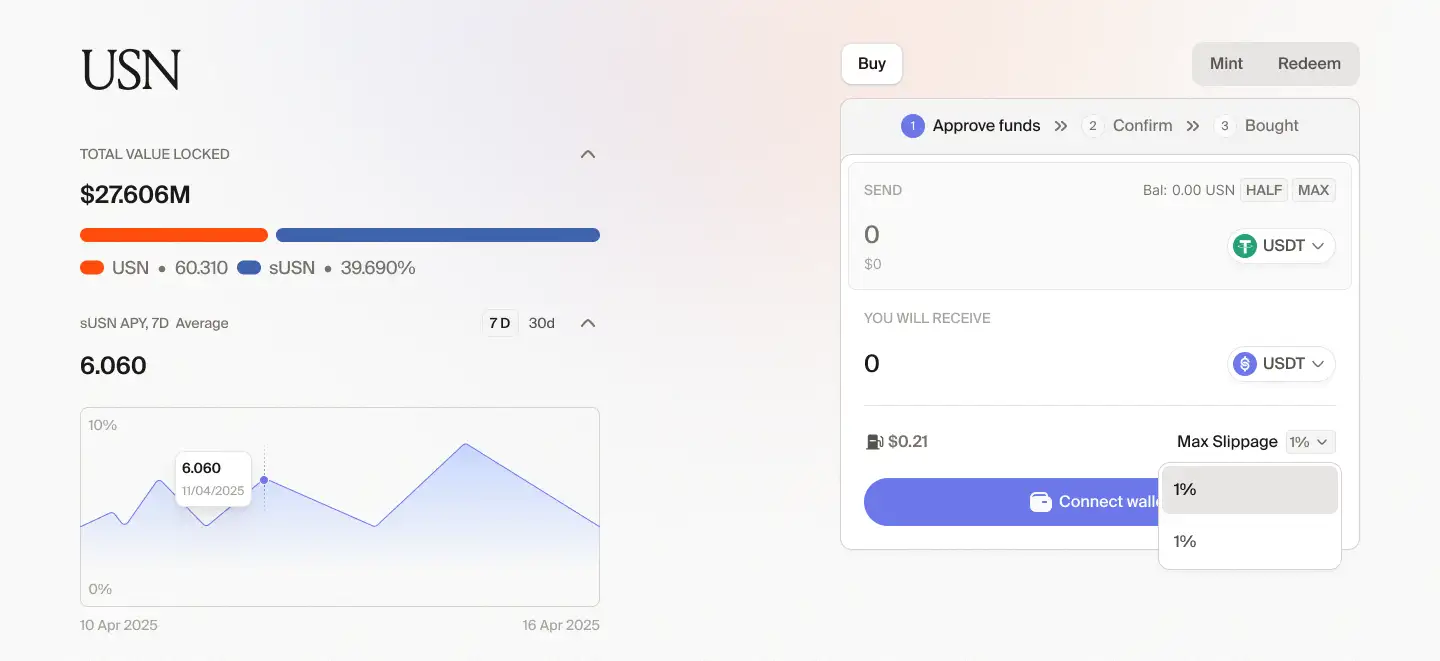

The system is centered on two core tokens: USN (the stablecoin) and sUSN (its staked, yield-bearing version). USN holders receive a large share of $NOON governance tokens, while sUSN holders benefit from a significant share of protocol-generated yield. The APY on sUSN currently sits at 7.22%, excluding additional token incentives. This dual-token approach allows Noon to serve users with varying risk profiles—from conservative yield-seekers to growth-focused governance participants.

Returns are generated via two main delta-neutral strategies: funding rate arbitrage and tokenized U.S. Treasury bills. These methods are dynamically allocated by the Noon trading team using a proprietary optimization engine. All strategies undergo strict due diligence, and capital deployment is constantly reevaluated for safety and performance. The system also includes real-time Proof of Solvency to ensure transparency and user confidence.

Noon’s governance model revolves around the upcoming $NOON token. Unlike tokens launched with VC backing, $NOON is distributed entirely through user activity and engagement. It includes a flexible vesting mechanism with multipliers, incentivizing longer-term staking and governance participation. The governance token is also backed by revenue streams—unused funds from the Noon Insurance Fund are used to buy back NOON tokens, redistributing them to sNOON holders.

Competitively, Noon Capital stands apart from platforms like Frax, and Angle Protocol by offering a community-first model with full transparency and no private token allocations. The project also avoids the rapid yield decay seen in many competitors by using its large community reserve to maintain user incentives over a 5+ year period. For more, visit Noon Capital.

Noon Capital provides numerous benefits and features that make it a standout protocol in the stablecoin and DeFi yield landscape:

- Dual-Token Structure: Noon utilizes USN and sUSN to offer users the flexibility to choose between governance rewards or yield earnings depending on their risk appetite.

- Intelligent Yield Allocation: Capital is deployed to delta-neutral strategies like funding rate arbitrage and tokenized T-bills, ensuring stable through-cycle returns for sUSN holders.

- Fair Token Distribution: Up to 80% of $NOON tokens are allocated to users rather than insiders or VCs, prioritizing fairness and decentralization.

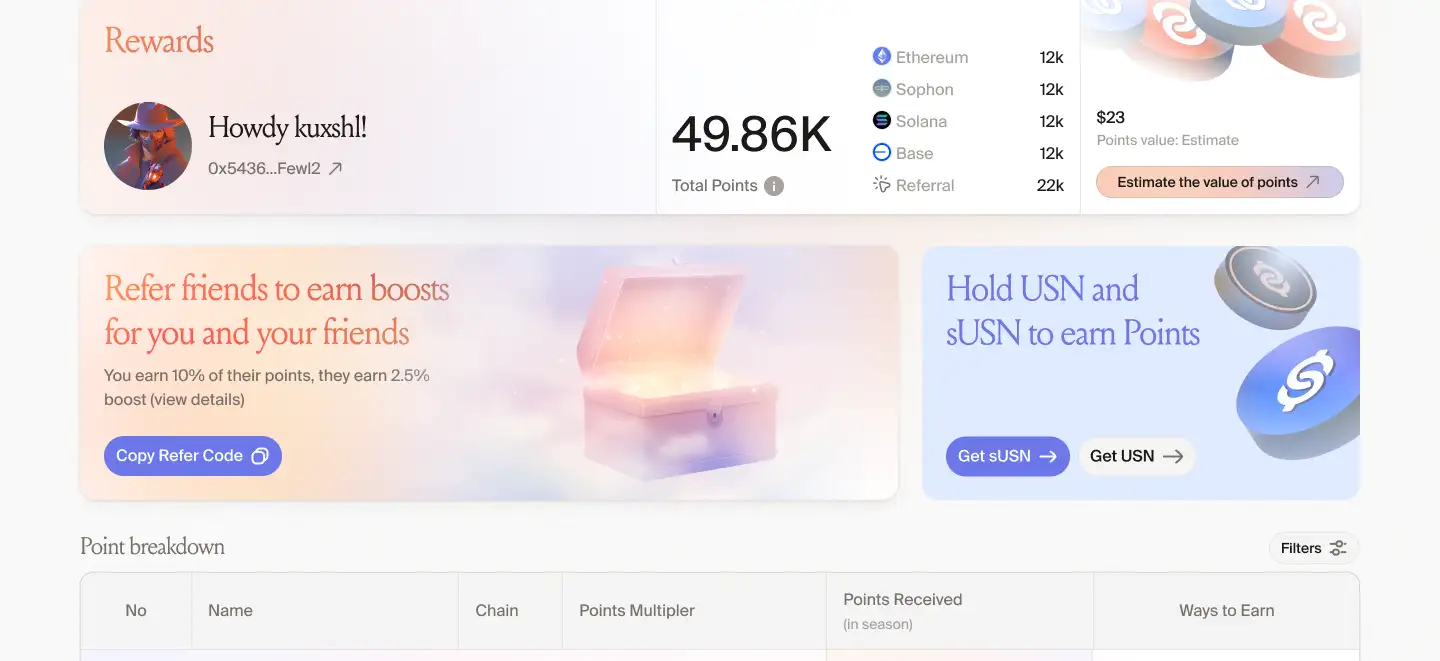

- Points-Based Reward System: Early users earn convertible points based on holdings and ecosystem activity, with powerful multipliers for actions like DEX liquidity provisioning or staking duration.

- Transparent Solvency Model: Noon is the first stablecoin to implement real-time proof of solvency, verified by third parties, enhancing trust and protocol integrity.

- Governance Utility via sNOON: Long-term users who stake $NOON receive sNOON, enabling participation in protocol governance and access to residual yield from the Insurance Fund.

- Flexible Yield Profiles: Whether aiming for moonshot rewards with USN or stable income with sUSN, Noon accommodates both speculative and conservative DeFi users.

- Composability & Web3-Native Integration: Noon tokens are built to interact across chains and DeFi platforms, enhancing liquidity and utility throughout the broader ecosystem.

Noon Capital offers a smooth onboarding process that empowers users to earn yield or accumulate governance power with just a few clicks:

- Step 1: Visit the dApp: Head over to Noon Capital and connect your Web3 wallet like MetaMask or WalletConnect.

- Step 2: Acquire USN: Swap USDC or USDT for USN via the app or buy directly on supported DEXes.

- Step 3: Choose Your Strategy: Stake your USN in the protocol to receive sUSN and start earning real yield, or hold USN for higher governance token rewards.

- Step 4: Track Your Rewards: Monitor your APY, points accumulation, and upcoming NOON allocations through the app’s dashboard.

- Step 5: Participate in Governance: After the NOON TGE (expected in Q2 2025), claim your tokens using your points and choose to stake them for sNOON to unlock voting rights and Insurance Fund distributions.

- Step 6: Boost Your Points: Maximize your NOON token rewards by participating in activities like DEX liquidity provisioning or lending with partner protocols.

- Step 7: Stay Updated: Follow official channels like Twitter, Telegram, and Noon Capital to receive updates on reward boosts, governance proposals, and protocol upgrades.

Noon Capital Token

Noon Capital Reviews by Real Users

Noon Capital FAQ

Noon Capital prioritizes capital preservation and consistent returns. Instead of speculative DeFi yield farming, it uses delta-neutral strategies such as funding rate arbitrage and tokenized U.S. Treasury bills. These approaches generate sustainable yield while minimizing exposure to market volatility. This intelligent yield mechanism allows Noon to offer high through-cycle APYs with reduced downside risk. Learn more at Noon Capital.

USN is always backed 1:1 by USDC, USDT, or short-term Treasury bills, stored in secure custodial wallets. Additionally, Noon provides real-time Proof of Solvency, independently verified by a trusted third-party. This transparency ensures users can verify that collateral exceeds circulating supply at any given moment. Visit Noon Capital to explore their solvency dashboard.

USN holders forgo raw protocol yield but receive significantly more $NOON rewards and points for early participation. sUSN holders, on the other hand, receive 80% of real yield generated by Noon’s delta-neutral strategies and a smaller share of governance tokens. This gives users the flexibility to choose between higher yield or higher token upside. More info at Noon Capital.

Noon Capital made a deliberate decision to avoid VC or KOL allocations. Instead, 65-80% of all $NOON tokens are reserved for users through a points-based rewards program. These points are earned through holding USN, sUSN, and contributing liquidity or other on-chain activities. This ensures a fair, decentralized governance structure fully driven by its active community. Details available at Noon Capital.

Yes, staking $NOON to earn sNOON gives users governance rights. This includes voting on proposals such as which new yield strategies to add, changes to reward mechanisms, or allocation of insurance funds. sNOON holders also benefit financially by receiving unused Insurance Fund assets, adding tangible value to active governance participation. Get involved at Noon Capital.

You Might Also Like