About Notional Finance

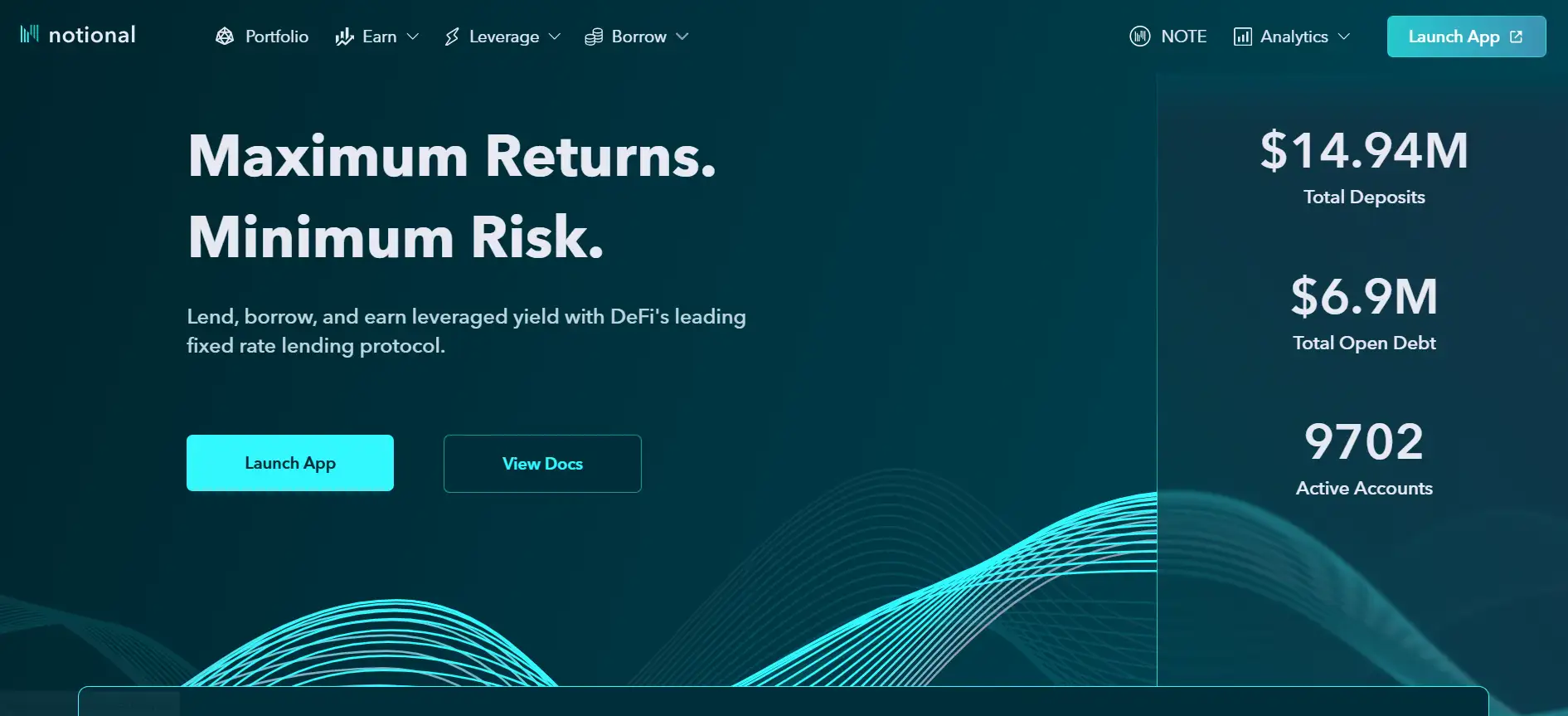

Notional Finance is a leading fixed-rate lending and borrowing protocol in the DeFi ecosystem, enabling users to earn, lend, and borrow crypto with capital efficiency and risk control. Built on Ethereum and Arbitrum, Notional Finance gives users access to leveraged yield strategies, passive earnings, and predictable borrowing terms—all through a user-friendly, permissionless platform.

Through products like fixed rate lending, leveraged vaults, and liquidity provision, Notional empowers both passive and advanced users to take advantage of yield opportunities while maintaining transparency and control. With over $15 million in deposits and $6.9 million in open debt, Notional Finance continues to shape the future of decentralized finance by bridging the gap between traditional financial certainty and blockchain-based innovation.

Notional Finance is a decentralized lending protocol designed to bring fixed interest rates to the DeFi ecosystem. While most protocols rely on variable rates, Notional enables users to lock in borrowing and lending rates for defined terms, offering much-needed predictability and financial planning advantages. It currently operates on both Ethereum and Arbitrum, with a growing user base and protocol usage.

The protocol introduces two primary market types: fCash Markets for fixed-rate instruments, and Prime Cash Markets for variable rates. Users can lend, borrow, or provide liquidity to earn interest, fees, and incentives. Advanced users can access Leveraged Vaults, allowing them to borrow and deploy assets into integrated strategies like Convex or Aura, maximizing yield while managing exposure through overcollateralization.

Notional is built with a robust security framework, featuring open-source smart contracts audited by firms like Sherlock and Halborn, alongside a $250,000 bug bounty through Immunefi. The protocol also applies rigorous risk mitigation strategies, including collateral haircuts, debt buffers, and oracle price protections to guard against volatility and manipulation.

Governance is handled through NOTE and sNOTE holders who vote on proposals via Snapshot. Community contributors can also apply for grants from the Notional Foundation to support protocol growth. Compared to competitors like Aave or Compound, Notional Finance is uniquely positioned as the go-to protocol for fixed-rate DeFi lending—a critical financial primitive for sustainable on-chain finance.

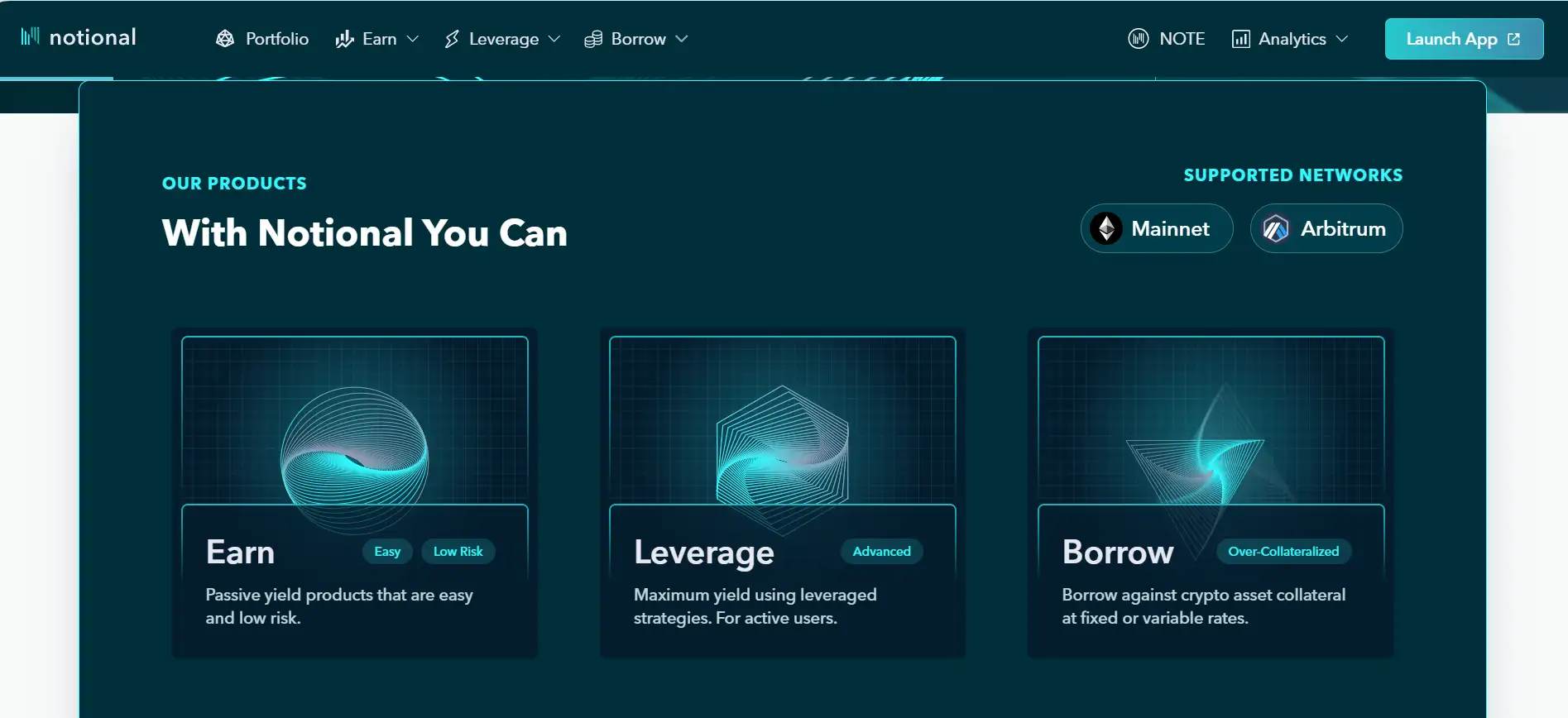

Notional Finance offers a unique combination of fixed-rate lending, leveraged yield strategies, and low-risk passive income opportunities, making it one of the most comprehensive fixed income solutions in DeFi:

- Fixed Interest Rates: Lend or borrow at locked rates over defined terms, giving users predictability that’s rare in DeFi.

- Leveraged Vaults: Borrow crypto at a fixed or variable rate to earn amplified yield through whitelisted DeFi strategies like Convex and Aura.

- Passive Yield Products: Easily earn interest on idle crypto with low-risk lending opportunities designed for simplicity.

- Liquidity Provision: Provide assets to fixed rate markets and earn interest, trading fees, and NOTE incentives.

- Security-First Architecture: Backed by multiple audits and a $250K bug bounty, with full transparency via Dune and Defi Llama.

- Cross-Network Access: Operates on Ethereum and Arbitrum, allowing users to choose the most suitable network for speed or cost.

- Decentralized Governance: Protocol decisions are made by NOTE and sNOTE holders via community voting and proposals.

Getting started with Notional Finance is simple and accessible to users of all experience levels. Whether you're looking to earn passive income or pursue leveraged strategies, Notional provides a seamless onboarding process:

- Go to notional.finance and click "Launch App" to open the application.

- Connect your crypto wallet (e.g., MetaMask) on Ethereum or Arbitrum network to begin interacting with the platform.

- Choose a product path: Earn, Leverage, Borrow, or Provide Liquidity—each with dedicated sections in the app.

- To lend, deposit supported tokens and select your preferred maturity to earn fixed interest.

- To borrow, select collateral, choose a fixed or variable rate, and borrow supported assets over your desired term.

- To use Leveraged Vaults, borrow from the platform and deposit into an integrated yield strategy—returns are amplified based on your exposure.

- For step-by-step instructions, refer to the User Documentation or join the Notional Discord for support and community Q&A.

Notional Finance FAQ

Notional Finance offers fixed-rate lending through its proprietary fCash system, allowing users to lock in predictable returns over a set maturity. Everything happens fully on-chain, and the protocol is non-custodial and open source, meaning users retain control of their funds while benefiting from the same predictability offered by traditional finance. Learn more on notional.finance.

Leveraged Vaults on Notional allow users to borrow at fixed or variable rates and deploy into whitelisted yield strategies with institutional-level integrations like Convex and Aura. This lets users enhance returns while still controlling risk through automated position management and collateral-based protections, setting Notional apart from typical high-risk, high-slippage vaults. Explore vaults at notional.finance.

Yes, Notional's liquidity provision system allows users to earn interest, fees, and NOTE incentives by depositing into fixed rate pools. This passive strategy uses nTokens to automatically manage exposure across active maturities, making it ideal for users who want to support the protocol and earn returns without hands-on rebalancing. View liquidity options on notional.finance.

Notional Finance implements a robust risk management framework that includes oracle pricing validation, debt buffers, collateral haircuts, and slippage control mechanisms. These defenses mitigate risks from sudden price swings or oracle manipulation. The protocol is also backed by extensive audits and a $250K bug bounty via Immunefi. Learn more about risk measures in the Notional docs.

fCash tokens are the core innovation that powers fixed-rate DeFi on Notional. They function like zero-coupon bonds, representing a fixed amount of a currency payable or receivable at a future maturity date. By trading fCash in liquidity pools, Notional creates markets where users can lend or borrow at fixed rates—bringing predictability and capital efficiency to decentralized finance. Visit notional.finance to learn more.

You Might Also Like