About OpenLeverage

OpenLeverage is a cutting-edge decentralized margin trading protocol that empowers traders to long or short any trading pair available on decentralized exchanges (DEXs). The platform is designed to be permissionless, meaning that anyone can participate in margin trading without needing approval from a centralized authority. OpenLeverage aims to revolutionize the margin trading landscape by offering a secure, transparent, and decentralized alternative to traditional trading platforms.

The mission of OpenLeverage is to create a fully decentralized margin trading ecosystem that provides isolated risk controls and market-adjusted parameters. This approach ensures that each trading pair operates independently, reducing systemic risk and enhancing the security of the platform. OpenLeverage strives to be a comprehensive solution for both retail and institutional traders, offering a seamless and efficient trading experience.

OpenLeverage was conceptualized to address the growing demand for a decentralized, permissionless margin trading platform. Traditional margin trading platforms are often centralized, with high barriers to entry and limited transparency. OpenLeverage aims to disrupt this model by providing a fully decentralized alternative that leverages the liquidity of existing DEXs, such as Uniswap and PancakeSwap, to offer margin trading on a wide range of trading pairs.

The development of OpenLeverage began with the goal of creating a platform that combines the benefits of decentralized finance (DeFi) with the advanced features of traditional margin trading. Key milestones in the project's history include the launch of isolated risk lending pools, which allow users to lend and borrow assets with minimized risk. These pools operate independently, each with its own risk parameters and interest rates, providing a tailored experience for users based on their risk tolerance and investment strategy.

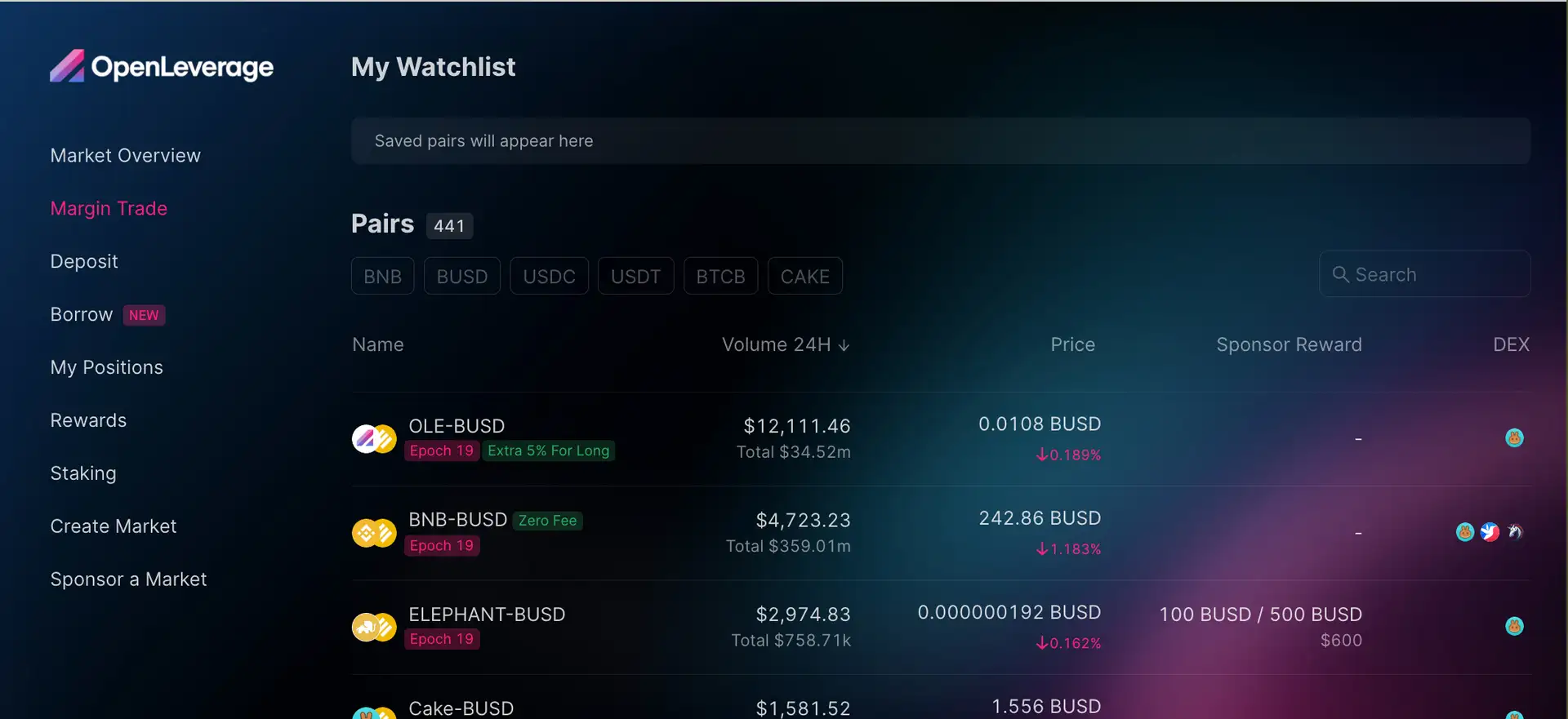

Integration with multiple DEXs is another significant milestone for OpenLeverage. By connecting with platforms like Uniswap and PancakeSwap, OpenLeverage ensures that traders have access to the deepest liquidity pools in the DeFi space. This integration not only enhances trading efficiency but also provides users with more opportunities to find profitable trading pairs and optimize their strategies.

The introduction of the OLE token marks a crucial development in the OpenLeverage ecosystem. The token serves multiple functions, including governance, staking, and rewards. Token holders can participate in the decision-making process by proposing and voting on protocol changes, ensuring that the platform remains decentralized and community-driven. Additionally, the staking and reward mechanisms incentivize users to contribute to the platform's liquidity and stability, aligning the interests of all participants.

OpenLeverage's innovative approach to risk management sets it apart from other margin trading platforms. The use of isolated risk lending pools ensures that potential losses in one pool do not affect the overall stability of the platform. This design minimizes systemic risk and protects users' assets, making OpenLeverage a secure and reliable choice for margin trading.

Competitors of OpenLeverage include other DeFi margin trading platforms like dYdX. However, OpenLeverage differentiates itself through its permissionless nature, allowing anyone to create lending pools for any trading pair, and its comprehensive risk management features. These aspects make OpenLeverage a unique and attractive option for traders seeking a decentralized and flexible margin trading solution.

In summary, OpenLeverage has established itself as a leading player in the DeFi margin trading space. Its focus on decentralization, security, and community governance, combined with its innovative features and integrations, positions it as a significant contender in the market. The platform continues to evolve, driven by a commitment to providing the best possible experience for its users and maintaining its position at the forefront of the DeFi revolution.

- Permissionless Margin Trading: OpenLeverage allows users to trade with leverage on any trading pair available on DEXs without needing approval or facing restrictions.

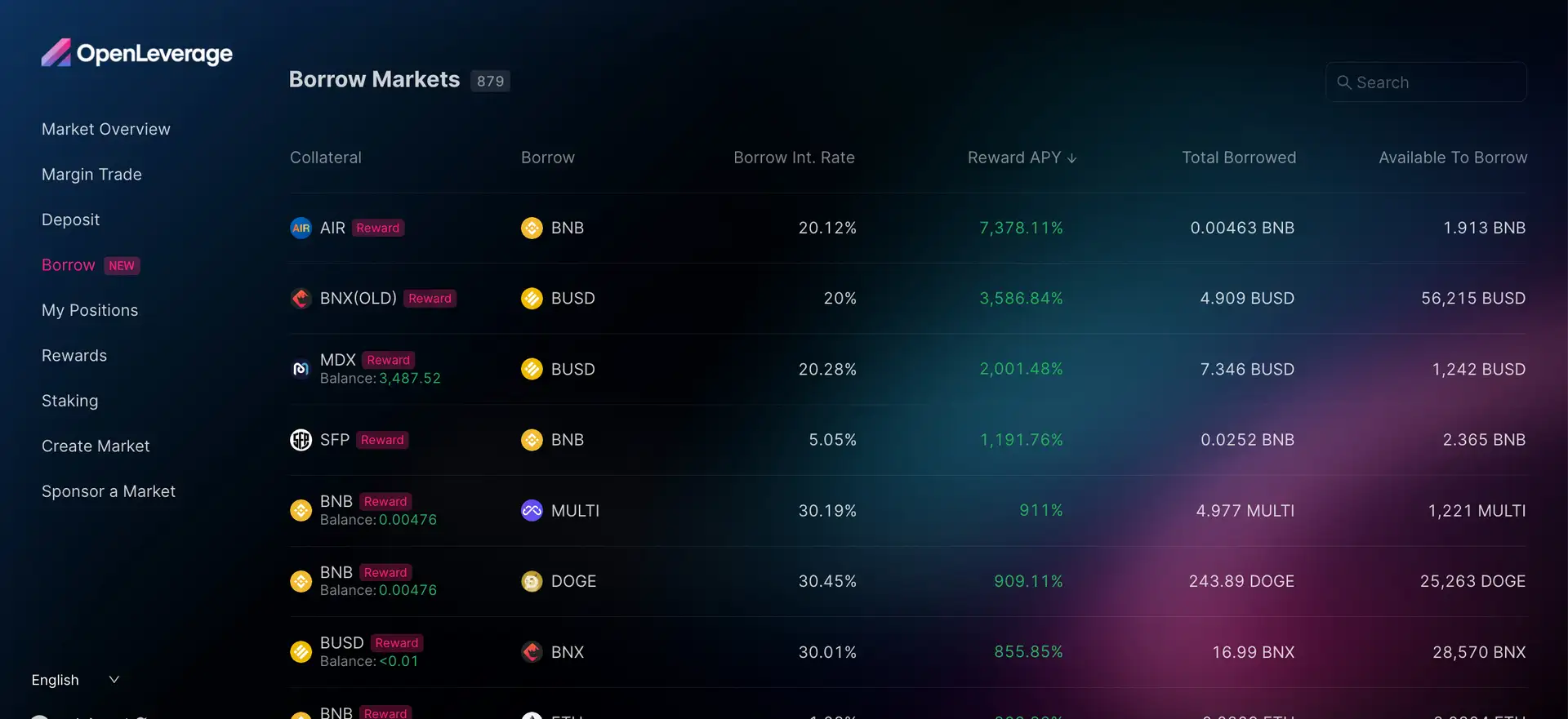

- Isolated Risk Lending Pools: Each lending pool operates independently with specific risk parameters, providing a tailored experience for lenders and borrowers and minimizing systemic risk.

- Real-Time Risk Calculation: The protocol uses real-time prices from DEXs to accurately calculate collateral ratios and trigger liquidations, ensuring transparency and fairness.

- OnDemand Oracle: OpenLeverage employs a time-weighted average price (TWAP) mechanism to ensure accurate pricing and prevent market manipulation.

- LToken Incentives: Users receive interest-bearing tokens (LTokens) when they lend assets to pools. These tokens can be staked to earn additional rewards, enhancing the return on investment.

- Comprehensive Governance: OLE token holders have the power to propose and vote on protocol changes, making the governance process fully decentralized and community-driven.

- Liquidity Mining and Staking: Users can earn OLE tokens by providing liquidity to lending pools or by staking their tokens, incentivizing participation and supporting the platform's growth.

- Integration with Major DEXs: By integrating with popular DEXs like Uniswap and PancakeSwap, OpenLeverage ensures access to deep liquidity pools and a wide range of trading pairs.

- Secure and Transparent: The platform emphasizes security and transparency, with robust risk management features and a commitment to open-source development.

- User-Friendly Interface: OpenLeverage provides a seamless and intuitive trading experience, making it easy for both novice and experienced traders to navigate the platform.

- Visit the Website: Go to OpenLeverage to explore the platform and familiarize yourself with its features.

- Create an Account: Connect your wallet to OpenLeverage using supported wallets like MetaMask. Ensure your wallet is funded with some ETH or BNB to cover transaction fees.

- Explore Markets: Browse the available trading pairs and lending pools on the platform. Use the search and filter options to find the best opportunities based on your trading strategy.

- Deposit Assets: Choose a lending pool and deposit your assets to start earning interest. You will receive LTokens representing your deposit, which can be staked for additional rewards.

- Start Trading: Navigate to the trading interface, select your desired trading pair, and set up your margin trade by specifying the amount and leverage. Execute the trade and monitor your position.

- Manage Your Portfolio: Use the portfolio management tools provided by OpenLeverage to track your positions, earnings, and overall performance.

- Participate in Governance: Stake your OLE tokens to participate in governance and vote on protocol changes. This allows you to have a say in the future development of the platform.

OpenLeverage Token

OpenLeverage Reviews by Real Users

OpenLeverage FAQ

OpenLeverage is a decentralized margin trading protocol that allows users to long or short any trading pair available on decentralized exchanges (DEXs) in a permissionless and secure manner.

You can earn OLE tokens by providing liquidity to lending pools, participating in staking programs, and contributing to governance proposals.

Isolated risk lending pools in OpenLeverage allow each pool to operate independently with its own risk parameters, minimizing systemic risk.

The OnDemand Oracle in OpenLeverage ensures accurate pricing and prevents market manipulation by using time-weighted average prices (TWAP) from DEXs.

OpenLeverage offers permissionless margin trading, isolated risk lending pools, real-time risk calculations, and comprehensive governance, making it a secure and efficient platform for traders.

You Might Also Like