About Opium

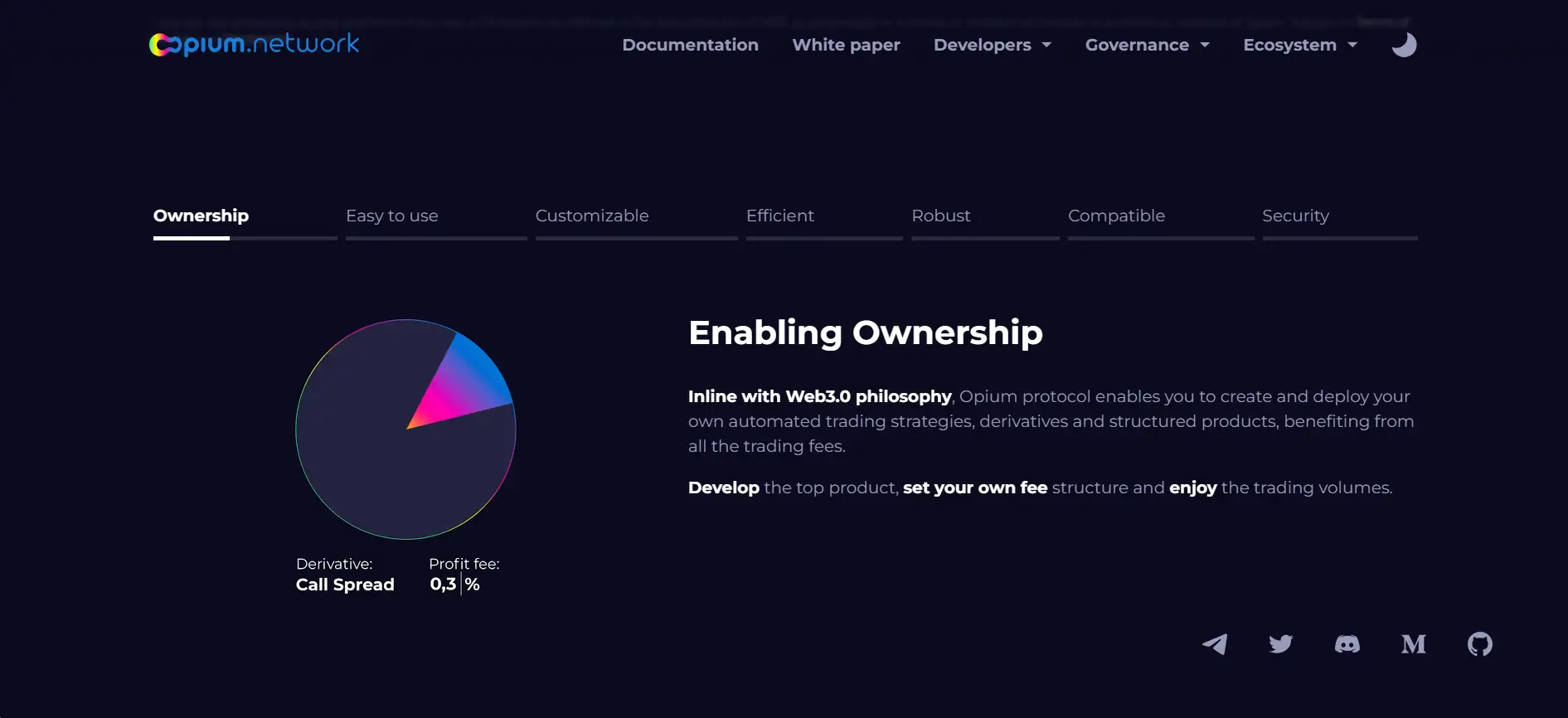

Opium is a powerful decentralized finance protocol designed for creating, settling, and trading decentralized derivatives. The platform provides the infrastructure for individuals and organizations to create complex financial products with ease, security, and ownership in mind. With a strong emphasis on aligning with Web3 values, Opium empowers users to construct their own smart financial contracts without relying on centralized intermediaries. This makes it a vital building block in the evolution of permissionless finance. Opium aims to decentralize not just trading, but the very process of product creation and management, unlocking new opportunities for DeFi professionals and developers alike.

The Opium protocol operates as a smart escrow system where two parties can securely engage in agreements without needing trust in each other. Its ability to lock and release assets based on oracle data enables highly customizable and composable financial contracts, applicable in everything from traditional-style derivatives to art-based futures. Governed by the community through the Opium DAO, the platform supports decentralized governance and open-source development, empowering users to shape its evolution and sustainability. Opium is tailored for professionals who understand financial mechanics and want to push DeFi boundaries with next-gen structured products.

Opium is a robust, Ethereum-based protocol enabling users to create and manage decentralized derivative contracts. Since its inception, it has positioned itself as a pioneer in offering programmable, trustless escrows that mimic traditional financial contracts but with full transparency and decentralization. The Opium protocol simplifies the complexities of derivatives and smart contracts, letting users define contract parameters and automate execution via oracles, all without needing coding expertise. Opium effectively bridges the gap between traditional finance (CeFi) and decentralized infrastructure (DeFi).

The Opium ecosystem features components like RFQ systems for liquidity aggregation, auction-based settlements, and advanced analytics tools to compare DeFi and CeFi volumes. It integrates with major EVM-compatible chains like Ethereum, Polygon, Arbitrum, and BNB Chain, ensuring interoperability. The platform has settled over 2,000 contracts and facilitated more than $340 million in trading volume, supported by a vibrant and skilled user base. Projects such as 1inch, Aave, UMA, and RealT are among those utilizing or interoperating with Opium, showcasing its versatility and adoption.

What sets Opium apart is its ease of use — anyone can launch financial products using preset templates or build new markets by customizing long and short legs of derivatives. Its architecture allows for seamless integration of complex options, exotic derivatives, and collateral adjustments without compromising on user autonomy. Security is paramount, with each version of the protocol having passed multiple audits and supported by a continuous bug bounty program. Governance is fully community-driven, with proposals and voting powered by Opium token holders, using frameworks like Gnosis Safe, Snapshot, and Aragon DAO to ensure decentralized and resilient evolution.

Ultimately, Opium enables DeFi-native financial engineering through open infrastructure that promotes ownership, composability, and trustlessness. Whether you’re a developer, trader, or liquidity provider, Opium’s modular design and commitment to decentralization make it one of the most adaptable and community-focused protocols in the DeFi landscape.

Opium provides numerous benefits and features that make it a standout project in the DeFi derivatives landscape:

- Smart Escrow Protocol: Facilitates trustless contracts between users with assets locked and released based on oracle data.

- No Coding Required: Users can create custom derivative products via templates and one-click tools.

- Security-Focused: Audited by SmartDec and MixBytes, with an ongoing bug bounty program to ensure safety.

- Interoperability: Supports Ethereum, Polygon, Arbitrum, and BNB Chain for broad adoption and composability.

- Governance via DAO: The protocol is managed by Opium token holders through a decentralized voting system.

- Financial Flexibility: Create futures, options, hedging products, and market predictions, even on non-financial assets like art.

- RFQ System & Auction Settlement: Aggregates liquidity and improves price discovery and execution.

Getting started with Opium is straightforward, even for users with limited technical experience:

- Visit the Official Site: Head over to opium.network to explore protocol details and ecosystem.

- Create or Trade Derivatives: Use Opium Finance to access trading functionalities for decentralized derivatives. Note: access is restricted in certain jurisdictions.

- Provide Liquidity: Earn yield by contributing to liquidity pools supporting structured derivative products on Opium Finance.

- Utilize Derivative Constructor: Build your own financial products using intuitive tools—no coding required.

- Explore Documentation: Learn more about building, integrating, and contributing to the protocol via the official documentation and GitHub.

- Participate in Governance: Join discussions, vote on proposals, and help shape the protocol on the Opium governance forum.

- Join the Community: Share your expertise or ideas, apply for grants, or become a contributor to projects built on Opium Protocol.

Opium FAQ

Yes, Opium allows users to create custom derivatives tied to real-world events such as sports outcomes or weather metrics, by using oracle-fed data. These smart escrow contracts can be programmed to resolve based on the outcome of a soccer match, rainfall amount, or any measurable external event. This enables highly flexible and creative use cases within the Opium ecosystem.

Oracle risk is a known challenge in decentralized finance. Opium Protocol allows creators to choose from various oracles, including optimistic oracles, to feed their contracts. If an oracle fails, the contract could execute incorrectly, but users mitigate this by selecting verified oracle sources or customizing fallback logic. This makes Opium a flexible and resilient framework for DeFi professionals.

Opium features a no-code derivative constructor that empowers users to deploy advanced financial products without programming. Through modular building blocks, users can combine long and short legs, adjust collateral, and integrate oracles. Templates and preset strategies lower the entry barrier, making Opium accessible to financial engineers, not just developers.

Due to regulatory restrictions, certain products on Opium are not accessible to U.S. persons or residents of Canada and Japan. While the protocol is decentralized and censorship-resistant, front-end applications and hosted services may enforce geoblocking to remain compliant with applicable laws, particularly around financial derivatives.

Opium DAO plays a critical role in shaping the evolution of structured financial products by allowing token holders to vote on development proposals, fee structures, and oracle integrations. This governance model ensures the platform remains aligned with community priorities and opens the door for rapid innovation across diverse asset classes like commodities, NFTs, and real-world indexes. Visit the governance forum to participate.

You Might Also Like