About Orby Network

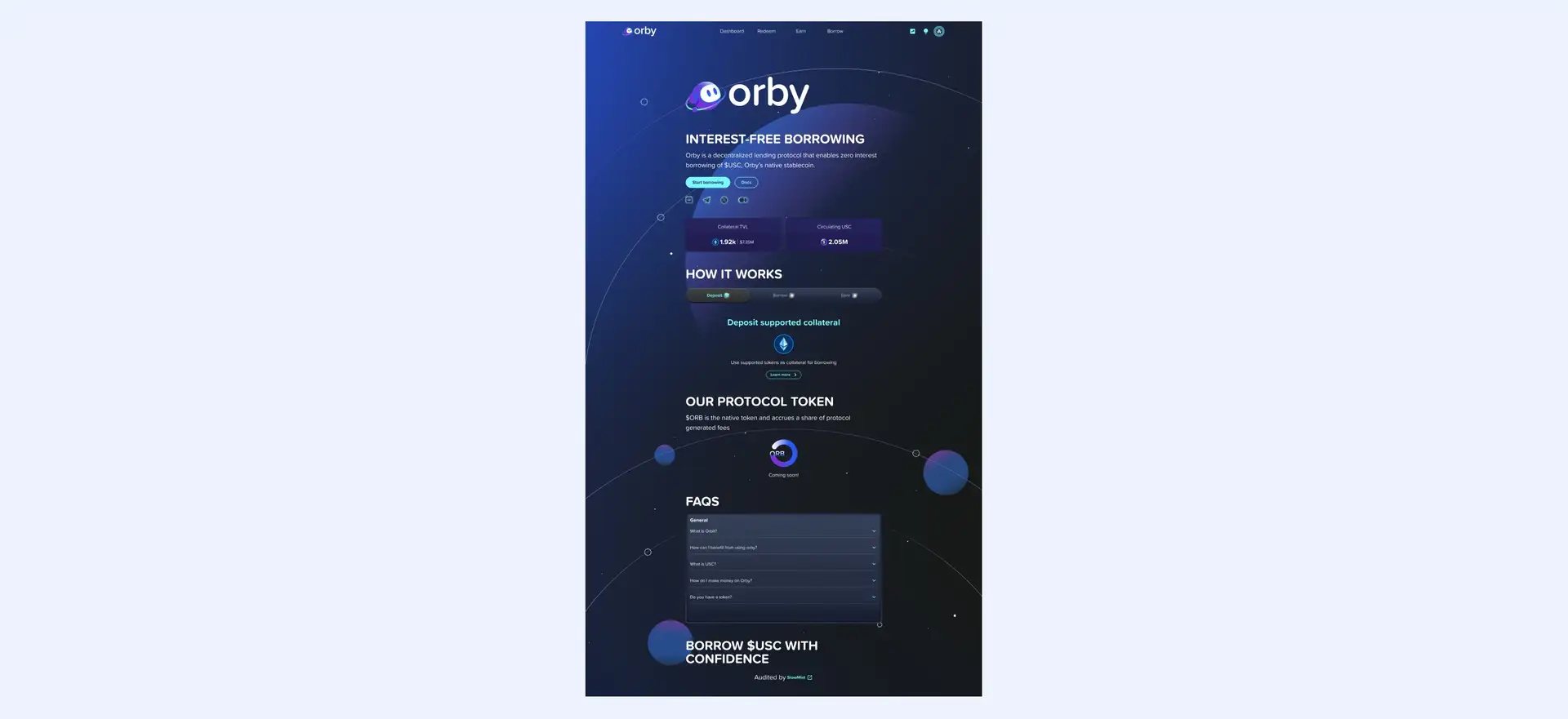

Orby Network is a decentralized lending protocol that offers interest-free loans using its native stablecoin, USC. The project aims to empower users by enabling them to unlock asset productivity without liquidating their holdings. Orby Network users can participate in liquidations and earn through various mechanisms within the ecosystem. The project focuses on security, transparency, and maintaining the stability of its stablecoin, making it a significant player in the decentralized finance (DeFi) space. By leveraging overcollateralization, Orby ensures that users can mint USC against their deposited assets while maintaining the value of their collateral.

Orby Network, built on the Cronos blockchain, introduces a novel approach to decentralized finance through its interest-free loan offerings. By leveraging overcollateralization, Orby ensures that users can mint USC against their deposited assets while maintaining the value of their collateral. The protocol's history includes the development of its native tokens, ORB and USC, and the establishment of a robust Stability Pool to manage liquidations. Orby's key milestones involve launching its native stablecoin and integrating with various parts of the Cronos ecosystem.

Orby Network was created to address the limitations of traditional financial systems and to provide more inclusive financial services. The protocol allows users to deposit accepted collateral and mint USC, a stablecoin pegged to the dollar. This stablecoin can then be used for borrowing, trading, and earning within the Orby ecosystem. The protocol's innovative mechanisms ensure that USC remains stable and secure, even in volatile market conditions.

Orby Network's approach to decentralized finance is based on three main pillars: security, stability, and accessibility. The protocol employs a unique liquidation mechanism that ensures undercollateralized loans are settled immediately, protecting the system's health and users' assets. Additionally, the Stability Pool plays a crucial role in maintaining the protocol's stability by providing immediate liquidity for liquidations.

One of the key features of Orby Network is its interest-free loans. Users can borrow USC against their collateral without incurring any interest, making it an attractive option for those looking to maximize their asset productivity. The protocol also offers various earning opportunities through the Stability Pool and Vault, where users can earn rewards and liquidation profits.

Orby Network's governance model is designed to be transparent and community-driven. ORB token holders have the power to vote on important protocol changes and decisions, ensuring that the community has a say in the protocol's future. This decentralized governance model helps maintain trust and engagement within the Orby ecosystem.

Orby Network competes with other decentralized lending and stablecoin platforms such as MakerDAO and Aave. MakerDAO offers a decentralized stablecoin called DAI, which is also minted through collateral deposits. Aave, on the other hand, provides a range of decentralized lending and borrowing services with its native token, AAVE. Both platforms are well-established in the DeFi space and offer similar services, but Orby Network differentiates itself through its interest-free loan model and unique liquidation mechanisms.

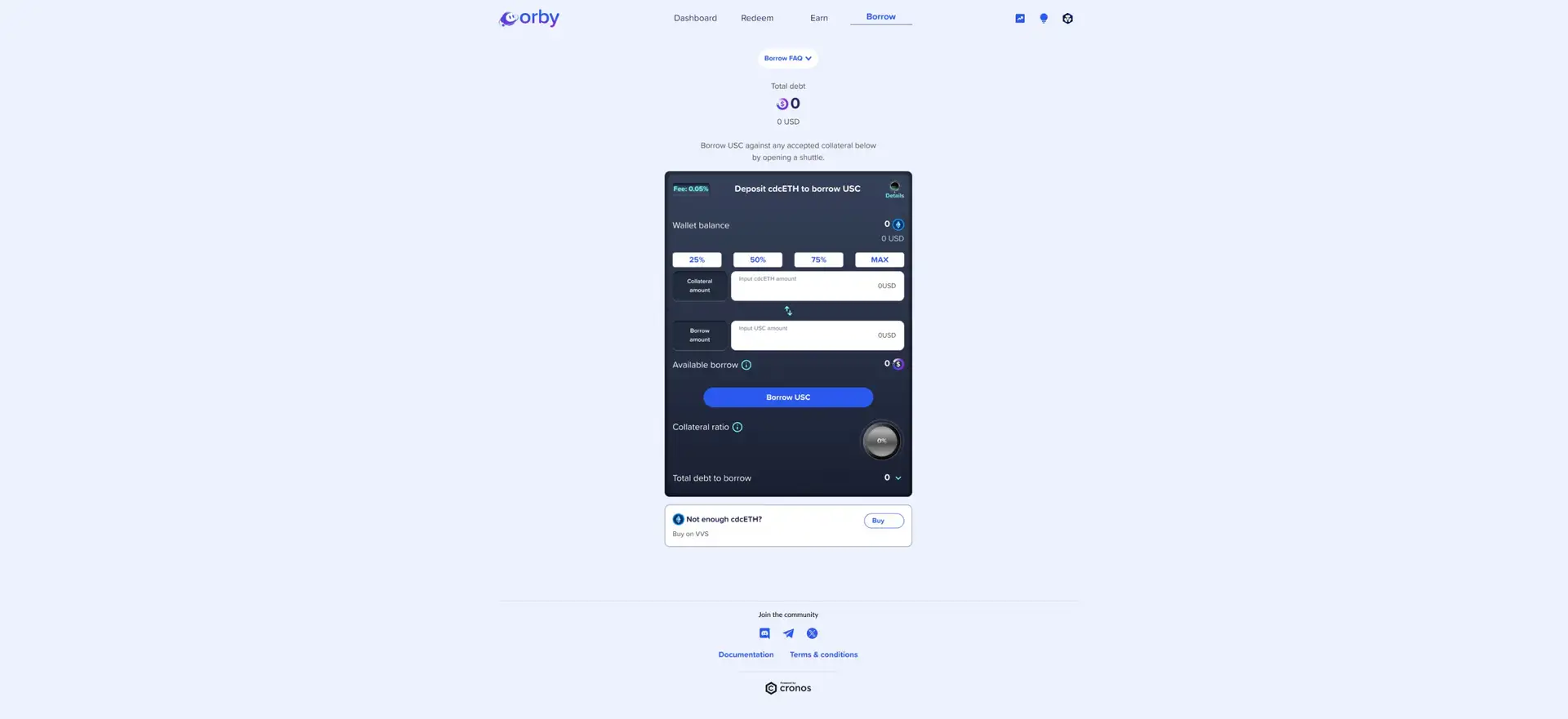

- Interest-Free Loans: Borrow USC without paying interest, using accepted collateral.

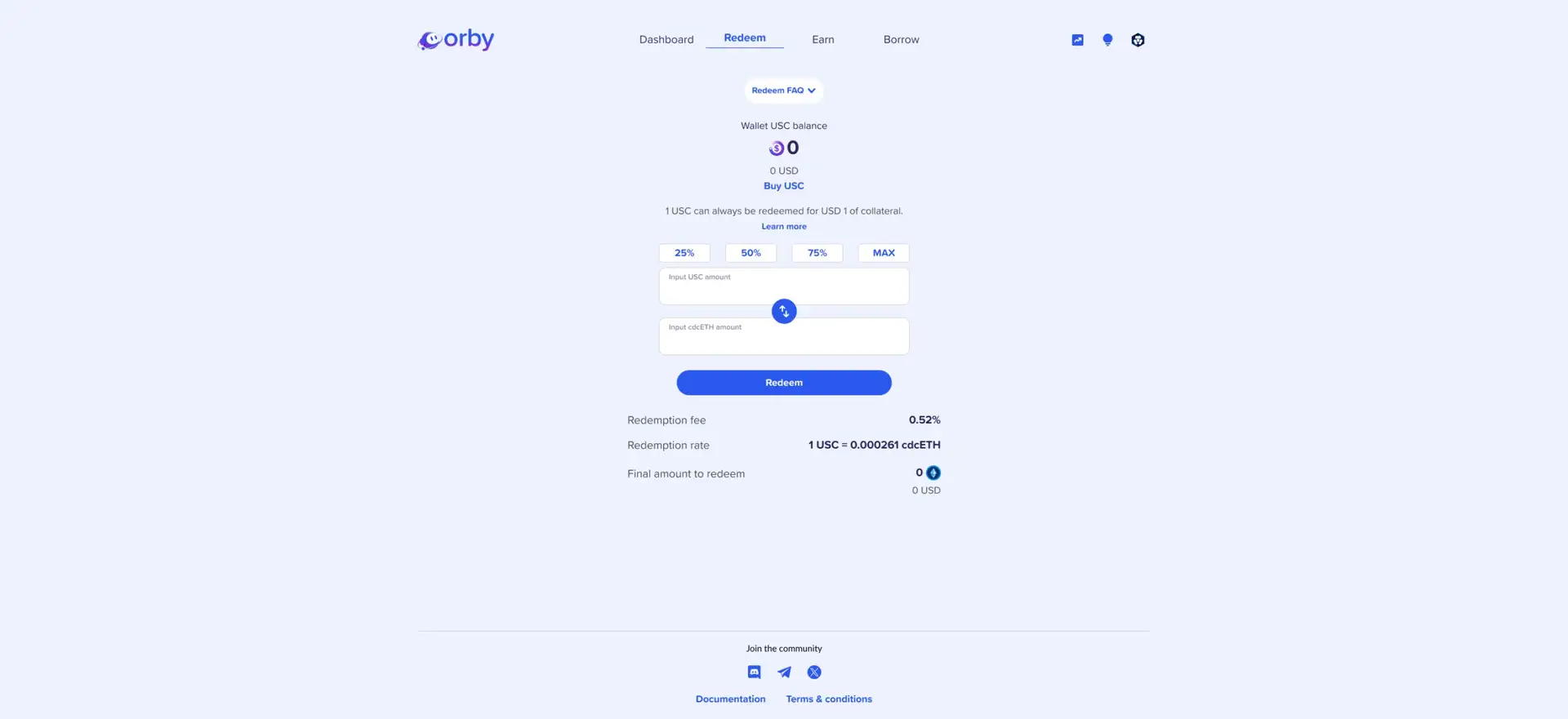

- Stablecoin Pegging: USC maintains its value close to USD 1 through overcollateralization and arbitrage incentives.

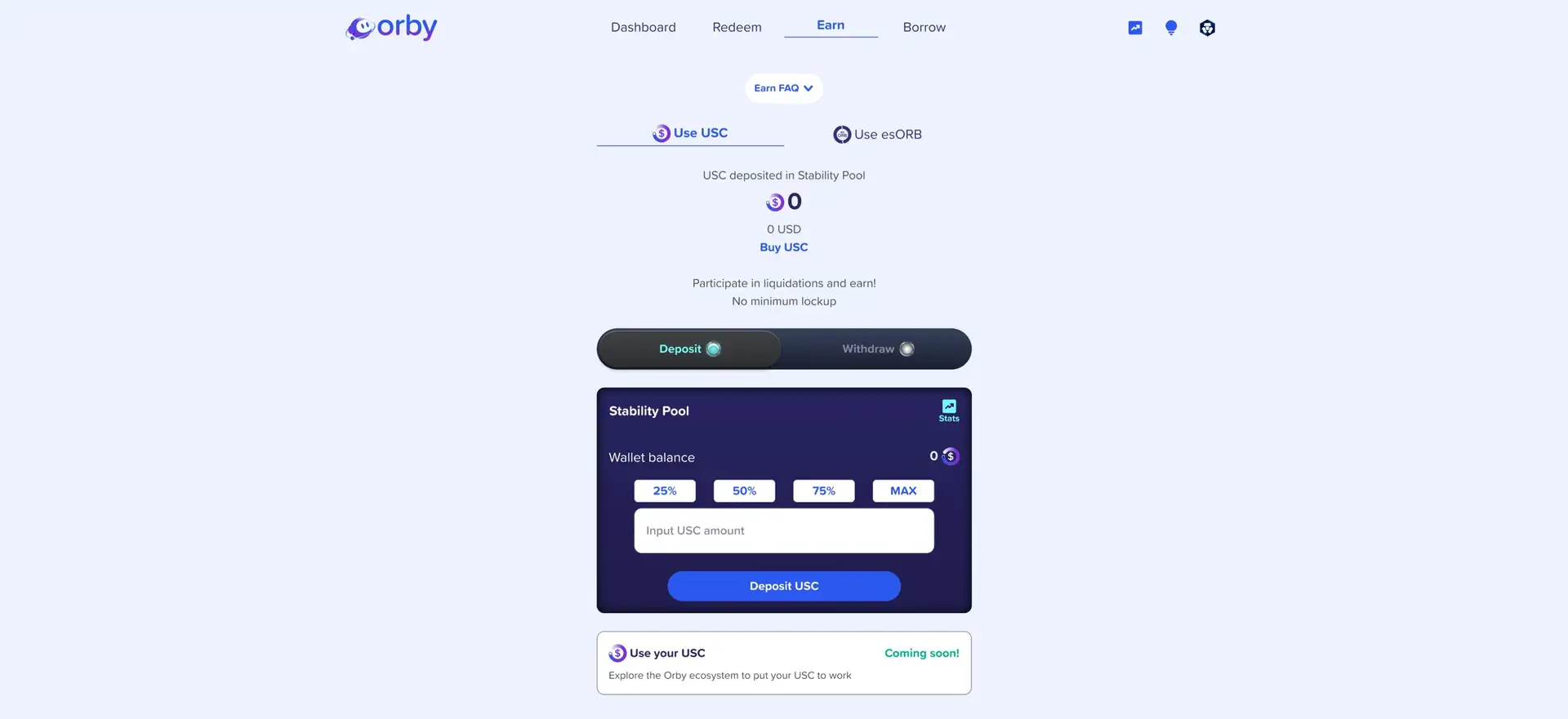

- Earnings Opportunities: Earn through the Stability Pool and Vault, gaining liquidation profits and protocol rewards.

- Security and Stability: Orby's mechanisms ensure robust collateral backing and instant liquidations for undercollateralized loans.

- Token Utility: ORB tokens accrue protocol fees and provide additional utilities when deposited in the Vault.

- Decentralized Governance: ORB token holders can vote on protocol changes and decisions, promoting a community-driven approach.

- Innovative Liquidation Mechanisms: Immediate settlements of undercollateralized loans protect the protocol's health and users' assets.

- Accessibility: Easy-to-use platform with detailed guides and documentation for new users.

- Community Engagement: Active community involvement in governance and protocol improvements.

- Cross-Chain Compatibility: Integration with various blockchain networks for enhanced interoperability.

- Continuous Development: Regular updates and feature enhancements based on community feedback and technological advancements.

To get started with Orby Network:

- Visit the Orby Network website.

- Connect your wallet by clicking on the "Connect Wallet" button. Supported wallets include MetaMask, Trust Wallet, and others compatible with the Cronos blockchain.

- Deposit supported collateral by navigating to the "Deposit" section. Accepted collateral types will be listed, and you can choose the amount to deposit.

- Mint $USC by borrowing against your deposited collateral. The interface will guide you through the process, showing the amount of $USC you can mint based on your collateral.

- Utilize $USC for various ecosystem activities or deposit it in the Stability Pool to earn rewards. By doing so, you can maximize the productivity of your assets.

- To participate in governance and earn additional benefits, consider acquiring and staking $ORB tokens in the Vault.

- Stay updated with the latest developments and community discussions by joining the Orby Network on social media platforms such as Twitter and Telegram.

Orby Network Token

Orby Network Reviews by Real Users

Orby Network FAQ

The primary benefit of using the Orby Network for borrowing is its unique offering of interest-free loans. This allows users to access liquidity without incurring additional costs, enabling them to leverage their assets more efficiently while preserving their value.

The Orby Network differentiates itself from other DeFi lending platforms with its interest-free loans, participation in the Stability Pool for yield generation, and the use of overcollateralized stablecoins. Additionally, its governance model involving $ORB token holders ensures community-driven development and management.

Yes, you can earn rewards by participating in the Orby Network. Users can deposit $USC into the Stability Pool to earn liquidation profits and other incentives. Additionally, by staking $ORB tokens, users can participate in governance and receive a share of protocol-generated fees.

The Orby Network accepts a variety of collateral types, which are overcollateralized to ensure the stability and security of the $USC stablecoin. Specific accepted collateral types will be listed on the platform, offering users flexibility in leveraging their assets.

The Orby Network ensures the stability of its $USC token by overcollateralizing each issued token. This means that every $USC is backed by more than a dollar’s worth of collateral, maintaining its peg to the US dollar and ensuring a stable and reliable value.

You Might Also Like