About Panoptic

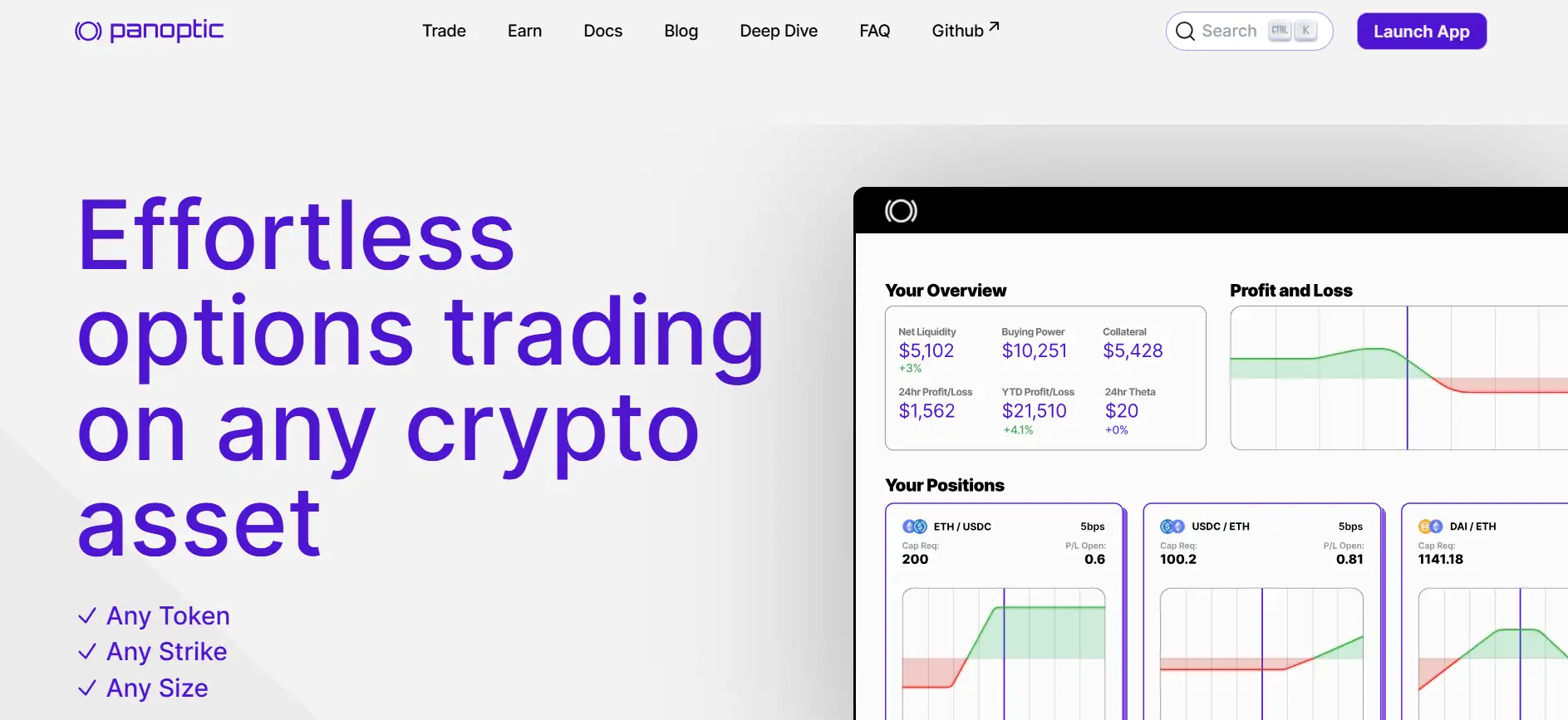

Panoptic is a revolutionary decentralized protocol enabling effortless, perpetual options trading on any ERC-20 asset. By eliminating oracles, expiries, and centralized intermediaries, Panoptic creates a fully permissionless and capital-efficient ecosystem for crypto options traders. Whether you're trading ETH, stablecoins, or long-tail DeFi tokens, Panoptic offers a groundbreaking way to manage risk, speculate, and earn yield.

The platform seamlessly integrates with Uniswap v3 and Uniswap v4 liquidity pools to allow unlimited trading possibilities. By bridging the gap between liquidity providers and options traders, Panoptic empowers DeFi participants with perpetual put and call options — redefining how decentralized derivatives markets work.

Panoptic has engineered the first-ever oracle-free, perpetual options protocol where users can mint, trade, and market-make options on any ERC-20 pair without intermediaries. Unlike traditional options, Panoptions never expire and offer flexibility unmatched by conventional DeFi platforms. Panoptic leverages Uniswap liquidity, allowing anyone to provide or borrow capital to facilitate seamless option creation and trading.

The protocol's innovative "streamia" pricing model replaces upfront premiums with continuous fee accrual, enabling more flexible and dynamic market engagement. It also removes dependency on off-chain oracles, minimizing attack surfaces and manipulation risks. Traders can create unlimited or limited downside strategies, use leverage up to 10x, and trade long-tail assets that otherwise lack robust derivatives markets.

Besides traders, passive liquidity providers (PLPs) play a key role by supplying fungible liquidity and earning commission fees. These roles create a two-sided market that solves the liquidity imbalance problem plaguing traditional Uniswap LP positions. Additionally, Panoptic introduces efficient liquidation and collateral management systems, taking inspiration from proven DeFi giants like Aave and Compound.

In the DeFi options landscape, Panoptic stands out against competitors like Ribbon Finance (RBN), and Derive, offering unique advantages such as perpetual trading, no expiry dates, oracle-free architecture, and permissionless market creation on any token.

Panoptic offers a range of unique benefits and features that revolutionize options trading in DeFi:

- Perpetual Options: Trade options that never expire, giving users infinite time horizons and flexible strategies.

- Oracle-Free Architecture: Removes external price feed risks, ensuring maximum security and decentralization.

- Any Asset, Any Strike: Trade options permissionlessly on any ERC-20 token pair at any custom strike price.

- Seamless Uniswap Integration: Built atop Uniswap v3 and v4 liquidity, benefiting from massive existing DeFi liquidity pools.

- Streamia Model: A new fee structure based on streaming premiums that improves flexibility and capital efficiency.

- Passive Yield: Become a PLP and earn commissions without active management or exposure to impermanent loss.

- Advanced Strategies: Supports dynamic payoff constructions like straddles, jade lizards, and customized spreads.

Getting started with Panoptic is easy and built for DeFi traders of all levels:

- Visit the Official Site: Head to panoptic.xyz to explore available features and the app interface.

- Launch the App: Click “Launch App” to access trading, LP provisioning, and passive yield opportunities.

- Connect Your Wallet: Use MetaMask or other supported Web3 wallets to connect securely to the Ethereum or Unichain networks.

- Start Trading or Earning: Trade Panoptions with leverage, or provide liquidity passively and collect fees.

- Test on Demo: Try the paper trading app on Sepolia to practice strategies risk-free before trading live.

- Learn More: Dive into resources like the Documentation and Blog to sharpen your knowledge and optimize your strategies.

- Join the Community: Stay updated and connected through Discord and Twitter.

Panoptic FAQ

Panoptic eliminates the need for oracles by utilizing Uniswap v3 and v4 liquidity pools to price and settle trades. Since Panoptions are based on real-time Uniswap liquidity positions, pricing is transparent, decentralized, and resistant to manipulation. No off-chain price feeds are necessary, keeping the protocol secure and permissionless. Learn more at panoptic.xyz.

Streamia is Panoptic’s innovative fee mechanism where option buyers pay a streaming premium over time instead of a full upfront payment. This model gives traders more capital efficiency and flexibility while creating a sustainable earnings stream for liquidity providers. Panoptic is the first protocol to introduce this novel approach to perpetual options.

Yes. Panoptic allows users to buy and sell options at any strike price and build complex strategies like straddles, jade lizards, and spreads. There are no restrictions on strikes or tokens, empowering traders to fully customize their risk and payoff profiles using any ERC-20 asset. Try it at panoptic.xyz.

Passive Liquidity Providers (PLPs) supply liquidity to the Panoptic pool and earn commission fees from option sellers and buyers. Unlike Uniswap LPs, PLPs do not actively manage price ranges or suffer impermanent loss. Their funds help power the options ecosystem, earning predictable returns without continuous rebalancing. Become a PLP at panoptic.xyz.

Perpetual options offer features not available with perps, like limited downside risk, no liquidations from price wicks, and flexible volatility plays. With Panoptic, traders can craft market-neutral strategies or volatility bets with customized leverage, unlike perps that expose users to abrupt liquidations and rigid payout structures.

You Might Also Like