About ParaSwap

ParaSwap is a decentralized liquidity aggregator that enables users to swap tokens at the best possible rates across multiple decentralized exchanges (DEXs). By integrating with top liquidity providers, ParaSwap ensures that users get the most efficient and cost-effective trades without needing to manually compare prices across different platforms.

Unlike traditional DEXs, ParaSwap optimizes token swaps by splitting orders across multiple liquidity sources, reducing slippage and maximizing returns. The platform supports multiple blockchains, including Ethereum, BNB Chain, Polygon, Avalanche, Fantom, and Arbitrum. With a user-friendly interface, advanced routing algorithms, and seamless wallet integration, ParaSwap is a powerful tool for both retail traders and institutional investors looking to trade assets efficiently in the DeFi space.

ParaSwap is designed to solve key inefficiencies in the decentralized trading ecosystem by aggregating liquidity from various DEXs and automated market makers (AMMs). By leveraging its proprietary routing algorithm, the platform finds the best possible rates for token swaps while minimizing gas fees and slippage.

Traditional DEXs like Uniswap and SushiSwap rely on isolated liquidity pools, which can lead to price discrepancies and inefficiencies. ParaSwap eliminates this problem by combining liquidity from multiple sources, including Curve, Balancer, and Bancor. This ensures that users get the most competitive rates and reduced slippage compared to executing trades on a single DEX.

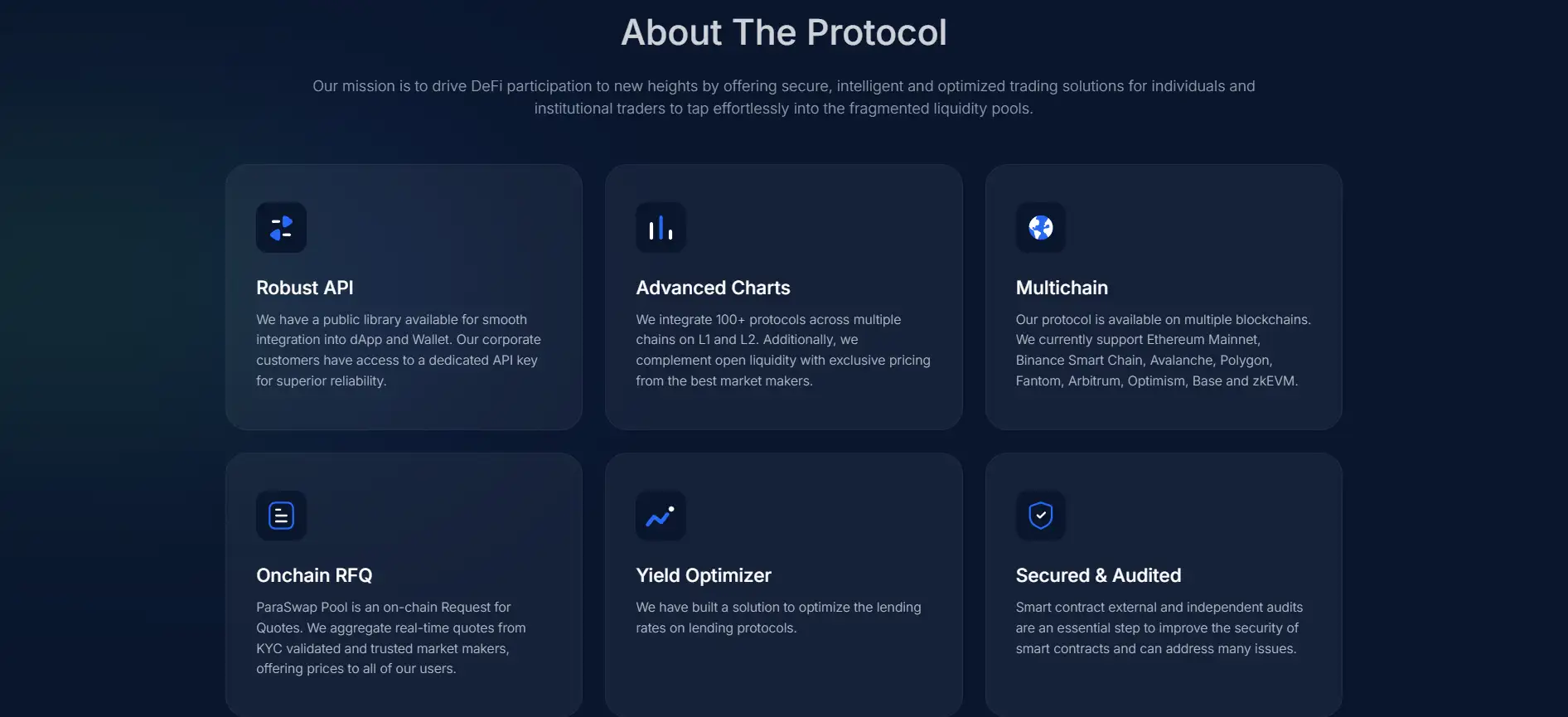

Another standout feature of ParaSwap is its ability to execute trades in a gas-efficient manner. The platform uses smart contract optimizations to lower transaction costs, making it a preferred choice for traders looking to maximize their profits. Additionally, ParaSwap offers an API that allows developers to integrate its powerful aggregation services into their own applications, enabling seamless DeFi interactions.

Security is a major focus for ParaSwap. Unlike centralized exchanges that require users to deposit funds, ParaSwap operates in a non-custodial manner, meaning users retain full control of their assets at all times. The platform has undergone extensive security audits to ensure that all transactions remain safe and transparent.

With increasing adoption of DeFi, ParaSwap continues to be a leader in the space by offering innovative solutions to liquidity fragmentation. Competing projects like Matcha and 1inch provide similar services, but ParaSwap distinguishes itself with its gas optimization, deep liquidity integrations, and developer-friendly API.

ParaSwap offers several key benefits that make it an essential tool for DeFi traders:

- Best Price Execution: ParaSwap scans multiple DEXs to ensure users receive the best possible rates for token swaps.

- Gas Optimization: The platform’s smart contract routing minimizes gas fees, making transactions more cost-effective.

- Multi-Chain Support: Users can swap tokens across major blockchains, including Ethereum, Polygon, BNB Chain, Avalanche, Arbitrum, and Fantom.

- Non-Custodial Trading: Unlike centralized exchanges, ParaSwap allows users to trade directly from their wallets without requiring deposits.

- Slippage Reduction: The platform splits large orders across multiple liquidity pools to minimize price impact.

- API & Developer Tools: Developers can integrate ParaSwap’s aggregation services into their own applications for seamless DeFi interactions.

Getting started with ParaSwap is easy and requires only a few steps:

- Visit the Platform: Go to ParaSwap and connect your wallet.

- Connect Your Wallet: Use MetaMask, WalletConnect, or another Web3-compatible wallet to start trading.

- Select Your Tokens: Choose the token you want to swap and select your desired output token.

- Review and Confirm: ParaSwap will automatically find the best route for your trade. Review the estimated price, gas fees, and slippage before confirming the transaction.

- Sign and Execute: Approve the transaction in your wallet and wait for the swap to be completed.

ParaSwap FAQ

ParaSwap uses a proprietary routing algorithm to scan multiple decentralized exchanges (DEXs) and liquidity providers in real-time. By analyzing price differences, slippage, and trading fees, the platform determines the most cost-efficient route for each token swap. Instead of manually checking different DEXs, users can rely on ParaSwap’s automated system to get the best price execution with minimal effort.

Yes, ParaSwap can split orders across multiple liquidity sources to optimize execution. If a single DEX doesn’t have enough liquidity for a large trade, the platform automatically distributes the swap across multiple pools, reducing slippage and ensuring better rates. This feature is particularly useful for high-volume traders who want to minimize price impact.

ParaSwap optimizes gas fees through smart contract batching and gas-efficient trade routing. Instead of executing multiple transactions separately, the platform consolidates them into a single, streamlined process, significantly reducing gas costs. Additionally, ParaSwap integrates with Layer 2 solutions like Arbitrum, Polygon, and Optimism to offer even cheaper transactions.

If a DEX has low liquidity, ParaSwap automatically finds alternative routes using higher liquidity pools from other exchanges. The platform prevents failed transactions by rerouting trades in real-time, ensuring that users receive the best possible execution. This eliminates the risk of placing orders on illiquid markets that could result in unfavorable pricing.

ParaSwap is a non-custodial platform, meaning it never holds user funds. Instead, transactions are executed directly from the user’s Web3 wallet, reducing the risk of hacks or mismanagement. Additionally, ParaSwap’s smart contracts have undergone extensive security audits to ensure safe and transparent trading. Users can verify transactions on-chain and maintain full control over their assets at all times.

You Might Also Like