About Perpetual Protocol

Perpetual Protocol is a decentralized perpetual futures trading platform designed to offer high-speed, trustless, and low-cost derivatives trading. Built on the Ethereum Layer 2 solution, Perpetual Protocol enables traders to open leveraged positions on a variety of assets without expiration dates, eliminating the need for rollovers.

By leveraging Automated Market Makers (AMMs) and a virtual liquidity model, Perpetual Protocol provides deep liquidity and low slippage trading. With a user-friendly interface and advanced trading tools, the platform is tailored for both experienced traders and newcomers looking to explore the world of decentralized derivatives.

Perpetual Protocol is a cutting-edge decentralized perpetual futures exchange that allows traders to take leveraged long or short positions on a wide range of assets, including cryptocurrencies, stocks, and commodities. Unlike traditional futures contracts, Perpetual Protocol eliminates expiry dates, allowing traders to maintain their positions indefinitely while benefiting from a highly efficient and liquid market.

At the core of Perpetual Protocol is its Automated Market Maker (AMM) model, which replaces traditional order books with a dynamic liquidity pool. This ensures that trades are executed with minimal slippage and at competitive prices, even during volatile market conditions. The platform operates on Layer 2 scaling solutions to significantly reduce gas fees while maintaining the security of the Ethereum network.

One of the standout features of Perpetual Protocol is its support for high-leverage trading, allowing users to amplify their positions with leverage up to 10x. This makes it an attractive platform for traders seeking to maximize profits while maintaining control over risk exposure through advanced features like stop-loss orders, take-profit targets, and liquidation alerts.

When compared to other decentralized derivatives platforms like dYdX, GMX, and Kwenta, Perpetual Protocol differentiates itself through its virtual AMM model, multi-asset support, and integration with Layer 2 scaling. The platform combines institutional-grade trading tools with decentralized security, making it a strong competitor in the growing DeFi derivatives market.

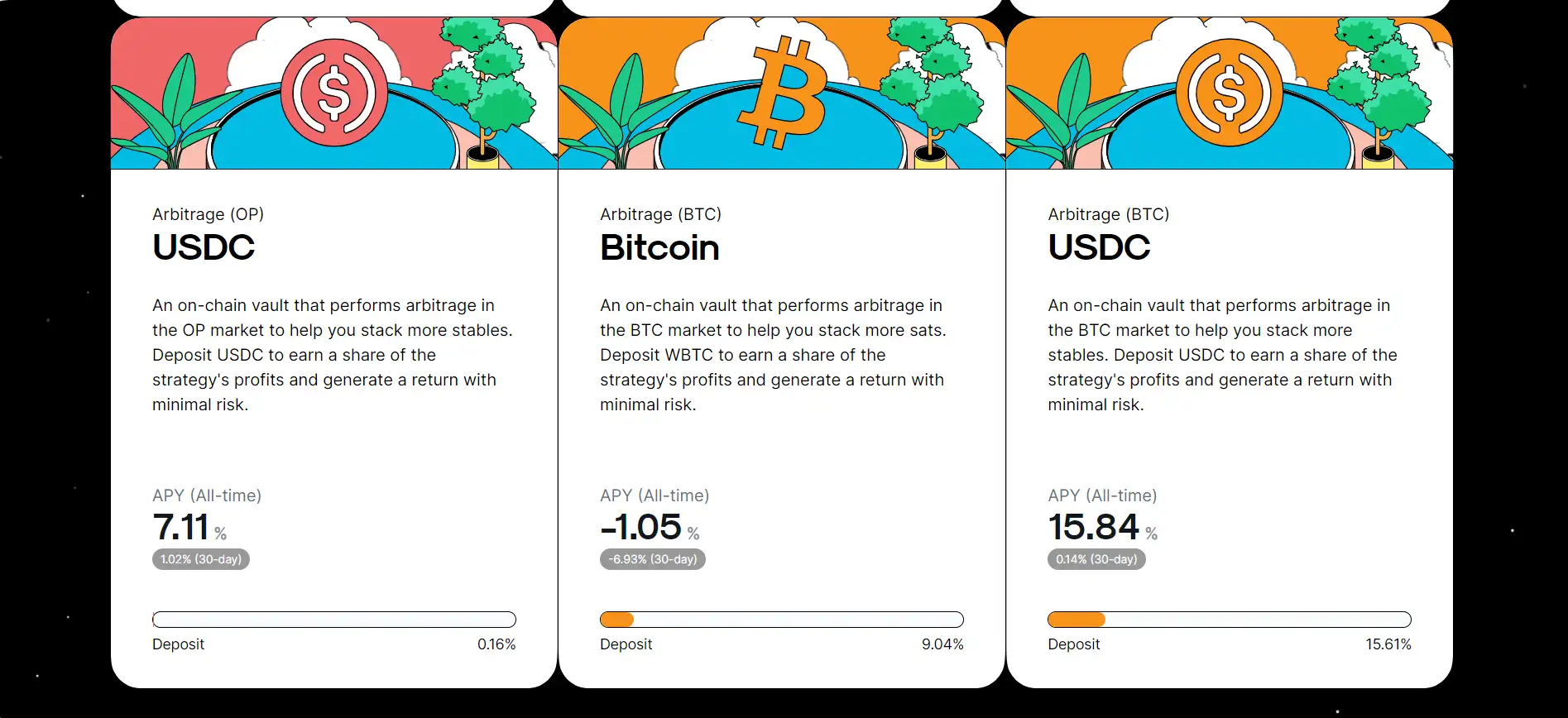

Perpetual Protocol offers a range of features and benefits that make it one of the most innovative decentralized derivatives exchanges:

- Perpetual Futures Trading: Trade assets with no expiration date, eliminating the need for contract rollovers.

- High Leverage: Amplify positions with up to 10x leverage while managing risk through advanced trading tools.

- Low Slippage & Deep Liquidity: The platform’s AMM-based liquidity model ensures smooth trading, even during high volatility.

- Layer 2 Scaling: Built on Optimistic Rollups for near-instant transactions with minimal gas fees.

- Cross-Asset Trading: Trade multiple asset classes, including cryptocurrencies, stocks, and commodities.

- Decentralized & Secure: Users retain full control over their funds, with smart contract execution ensuring transparent and fair trading.

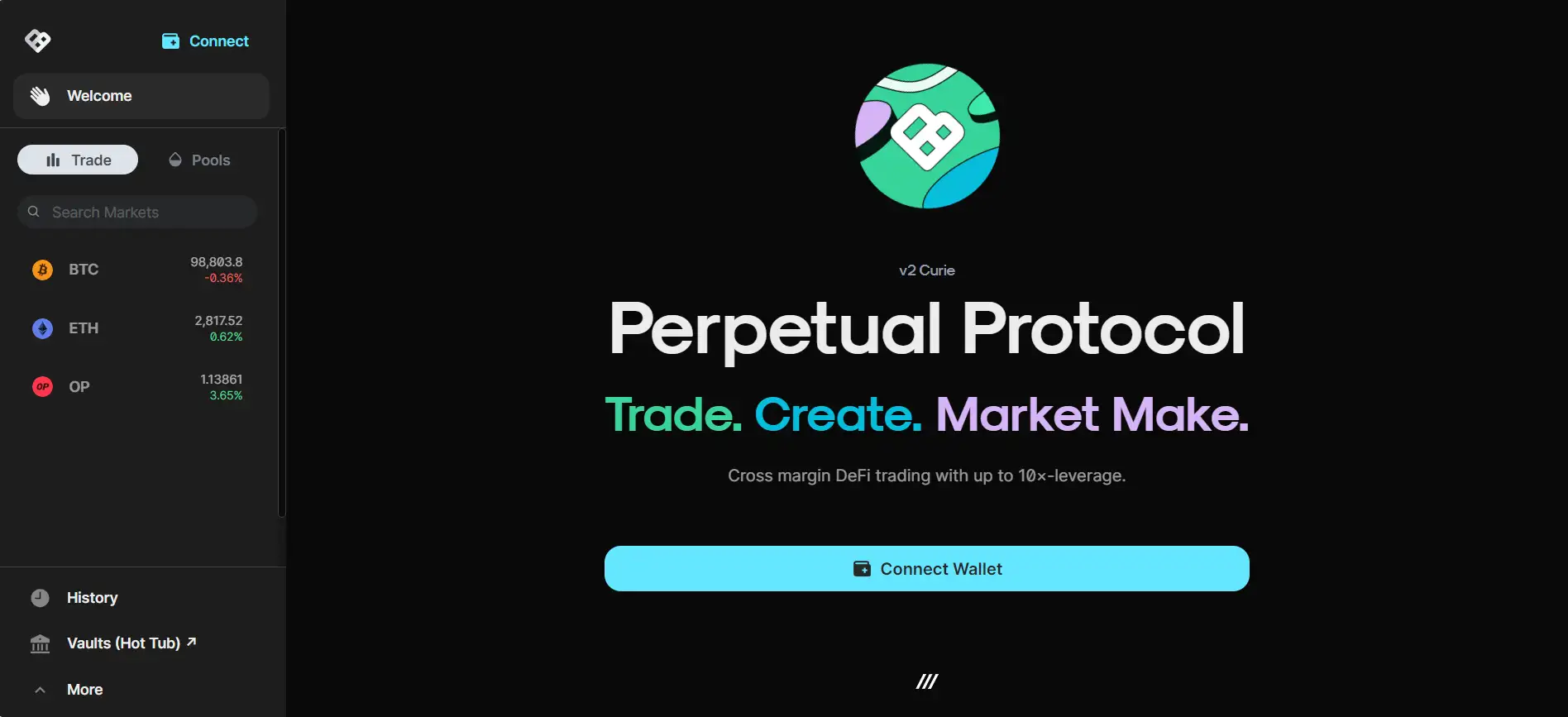

Getting started with Perpetual Protocol is simple. Follow these steps to begin trading securely:

- Visit the Official Website: Go to Perpetual Protocol and explore the platform’s features.

- Connect Your Wallet: Click on the wallet connection button and link a supported cryptocurrency wallet like MetaMask or WalletConnect.

- Deposit Funds: Add USDC or other supported assets to your account for margin trading.

- Select a Trading Pair: Choose an asset and adjust leverage according to your risk preference.

- Open & Manage Positions: Execute buy or sell orders, set stop-loss limits, and monitor live market trends.

- Withdraw Profits: Once satisfied with your trade, close your position and withdraw funds directly to your wallet.

Perpetual Protocol FAQ

Perpetual Protocol uses a Virtual Automated Market Maker (vAMM) instead of relying on centralized liquidity providers. This system allows traders to enter and exit positions at any time, with liquidity dynamically adjusted based on market activity. The vAMM maintains a balanced pricing model, ensuring that all trades execute efficiently. Additionally, Perpetual Protocol integrates with external liquidity sources to further optimize order execution.

No, all trades on Perpetual Protocol require collateral to manage risk and ensure that leveraged positions remain solvent. Users must deposit USDC as margin before opening a trade. However, Perpetual Protocol allows traders to adjust their leverage and margin requirements, enabling flexible risk management strategies.

Perpetual Protocol has an automated liquidation engine that manages high-volatility events. If a trader’s margin falls below the maintenance level, the system liquidates a portion of their position to prevent full loss. To protect against cascading liquidations, Perpetual Protocol employs a dynamic margin adjustment mechanism and a risk mitigation fund that helps stabilize market fluctuations.

Perpetual Protocol uses decentralized oracles from providers such as Chainlink and Band Protocol to ensure accurate, real-time price data. These oracles aggregate pricing from multiple exchanges, reducing the risk of manipulation. Additionally, Perpetual Protocol implements safeguards like time-weighted average price (TWAP) to prevent sudden price spikes or inaccuracies.

Yes! Perpetual Protocol provides smart contract APIs that allow developers and traders to automate their strategies. Users can integrate trading bots, algorithmic execution, and custom risk management tools through Perpetual Protocol’s permissionless infrastructure. This enables high-frequency trading and advanced strategy execution without manual intervention.

You Might Also Like