About Polaris

Polaris is a cutting-edge DeFi derivatives trading platform that empowers users with access to the largest selection of cryptocurrency options and perpetual contracts. Designed for traders of all experience levels, Polaris offers deep liquidity, strategic tools, and an intuitive user experience, redefining what it means to trade options in the decentralized finance world.

Built by financial veterans from both crypto and TradFi sectors, Polaris gives you the tools to grow capital, protect assets, and generate yield using advanced trading strategies. Whether you’re a HODL’er looking for downside protection or a power user seeking high-frequency trading APIs and custom RFQ (Request for Quote) systems, Polaris has built a secure, scalable, and user-friendly solution.

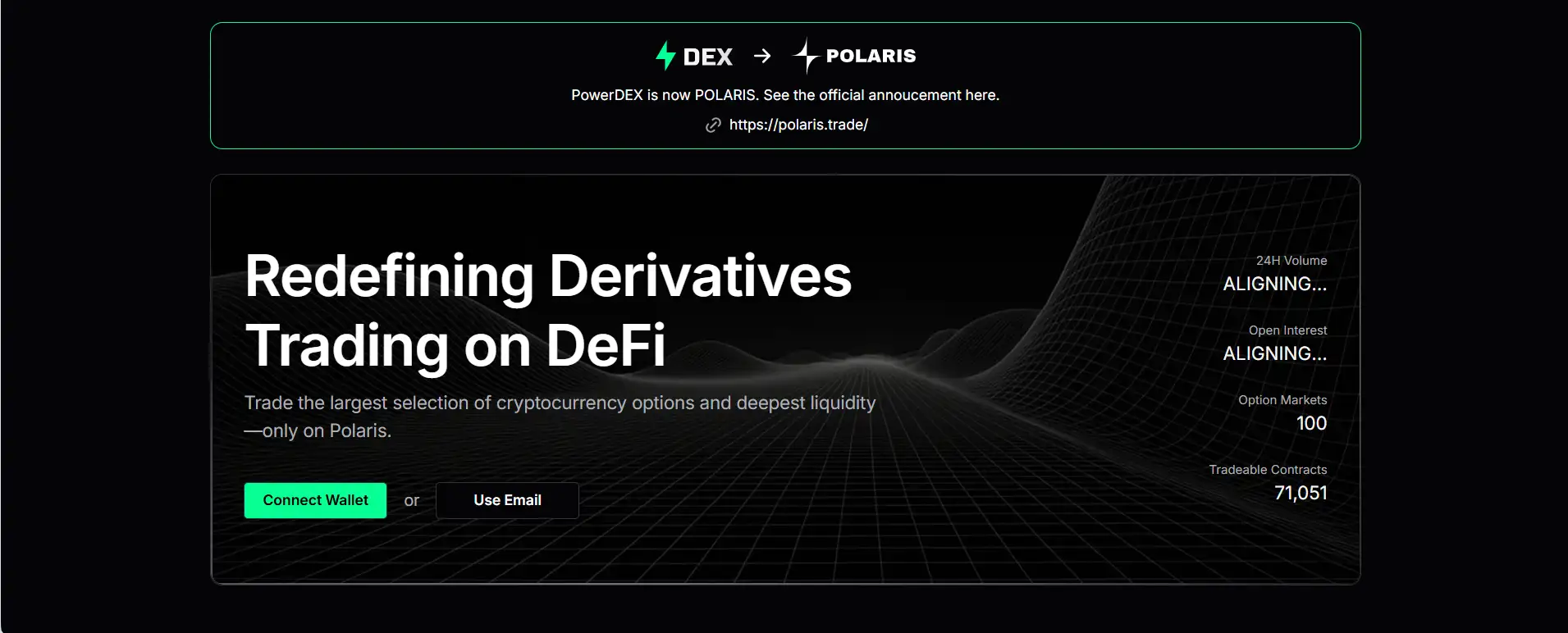

Polaris began its journey as PowerTrade and has evolved into one of the most innovative platforms in the DeFi derivatives space. The transition into Polaris marks a significant leap in capabilities and brand focus. With the growing need for sophisticated tools in decentralized finance, Polaris has emerged as a full-featured exchange where traders can access both perpetuals and crypto options with unparalleled ease.

The platform enables users to leverage their holdings without risking liquidation, unlike traditional perpetuals. Through structured options strategies such as covered calls and puts, traders can generate income or hedge their portfolios based on their market outlook. Unique features like "Options Lite" offer a visual, interactive introduction to option trading, making it easy for newcomers to understand and execute high-ROI strategies with a single click.

The technology stack is built for speed and flexibility. With FIX, WebSockets, and REST APIs, Polaris supports high-frequency trading, while its integration with Copper’s secure MPC custody provides decentralized security without compromising usability. Advanced users can benefit from professional-grade SPAN portfolio margining and multi-collateral support, enhancing capital efficiency.

Polaris also offers live leaderboards, 1-on-1 trading sessions, and a fully featured testnet for experimentation. Their community-centric approach encourages feedback and customization. As the DeFi market continues to mature, Polaris is positioning itself as the go-to platform for serious traders looking for more than just basic swap features.

While other DeFi trading protocols such as dYdX, Perpetual Protocol, and Ribbon Finance offer pieces of the puzzle, Polaris stands out with its integrated experience, user-centric interface, and institutional-grade infrastructure.

Polaris offers advanced DeFi trading solutions designed to meet the needs of both retail and institutional users:

- Deep Options & Perpetual Markets: Access the widest range of crypto options and perps with high liquidity.

- No Liquidation Risk: Options trading on Polaris allows for leveraged exposure without the fear of liquidation.

- Yield Generation Tools: Implement covered call strategies to earn passive yield on your crypto holdings.

- Advanced Portfolio Margin: Use SPAN margining for efficient capital allocation across positions.

- Interactive Options Lite Interface: New traders can visually select and execute option strategies for optimal ROI.

- API & Institutional Support: Trade with FIX/WebSocket/REST APIs or RFQ features for block-sized trades.

- Secure Custody: Keep your funds safe with Copper's MPC custody while enjoying full trading freedom.

- Community Leaderboards & Insights: Learn from top-performing traders via public dashboards.

Getting started with Polaris is seamless, whether you're a casual trader or a power user:

- Step 1 – Visit the Website: Head over to polaris.trade and click "Connect Wallet" or sign in using your email.

- Step 2 – Explore the Interface: Choose from "Options Lite" for visual trading or jump into live markets for BTC options and perpetuals.

- Step 3 – Practice on Testnet: Try out trading strategies safely on Polaris’s dedicated Testnet.

- Step 4 – Fund Your Account: Use PTF or supported crypto assets to fund your trading portfolio directly from your connected wallet.

- Step 5 – Start Trading: Choose from ready-made strategies like "Covered Call" or "Put Protection" and execute them with a click.

- Step 6 – Track Your Positions: Use the built-in analytics and leaderboard to monitor your trades and compare performance.

Polaris FAQ

Polaris stands out by offering a dedicated options and perpetuals trading platform with a focus on user experience, automation, and capital efficiency. Unlike other platforms that rely heavily on basic swaps or spot trading, Polaris introduces pre-packaged strategies, visual tools like "Options Lite", and customizable APIs for pro traders. It’s also designed with decentralized custody via MPC solutions to provide a secure, non-custodial trading experience.

Polaris offers one-click trading strategies tailored to various market conditions—bullish, bearish, and sideways. Users can easily implement high-return strategies like covered calls, puts for protection, and custom spreads without needing advanced knowledge of options. These strategies are automated and simplified for ease of use, making advanced derivatives trading accessible to all. Learn more at polaris.trade.

Yes, Polaris integrates with Copper’s secure MPC custody to ensure that users maintain control over their assets during trading. Your funds never leave your custody unless required for settlement, making it one of the safest derivatives platforms in DeFi. The platform also uses rigorous smart contract audits and enterprise-grade security protocols. Visit polaris.trade for details on their security model.

Absolutely. Polaris was built for both beginners and experienced traders. The Options Lite interface visually guides users to the highest ROI trades by allowing them to click directly on a chart to set price targets. The platform automatically suggests optimal options contracts, making complex trading strategies approachable without a steep learning curve. Get started at polaris.trade.

Yes. Polaris offers robust support for high-frequency trading (HFT) through FIX, WebSockets, and REST APIs. This allows institutional traders and developers to build custom strategies, RFQs, and integrate with their own front-end or trading bots. API documentation is publicly available and tailored for pro-level implementation. You can explore API tools via the official site at polaris.trade.

You Might Also Like