About Polaris DEX

Polaris Finance is a decentralized financial platform that leverages innovative seigniorage mechanisms to create a suite of pegged synthetic assets. The project’s mission is to enhance the DeFi landscape by offering stable and reliable financial services that are governed by the community. Through its unique tokenomics and robust governance model, Polaris Finance aims to provide users with a decentralized, transparent, and efficient ecosystem for managing their digital assets.

Polaris Finance has developed a multi-phase project that focuses on the creation and maintenance of pegged synthetic assets through seigniorage mechanisms. The project began with the launch of several tokens, including POLAR, LUNAR, TRIPOLAR, ETHERNAL, ORBITAL, USP, and BINARIS, each serving a distinct role within the ecosystem. These tokens facilitate governance, liquidity provision, staking, and the stabilization of synthetic assets.

The development of Polaris Finance has been marked by several key milestones. Initially, the project focused on building a strong foundation by establishing liquidity pools and creating incentives for participation. This was followed by the introduction of the governance token, POLAR, which empowered the community to participate in decision-making processes. Subsequent phases included the launch of additional tokens designed to enhance the functionality and stability of the ecosystem.

Polaris Finance’s unique approach to synthetic assets sets it apart from other DeFi projects. Unlike traditional stablecoins, which are typically backed by fiat or other assets, Polaris Finance uses a seigniorage-based model to maintain the peg of its synthetic assets. This involves using multiple tokens in various pools and mechanisms to ensure stability and predictability.

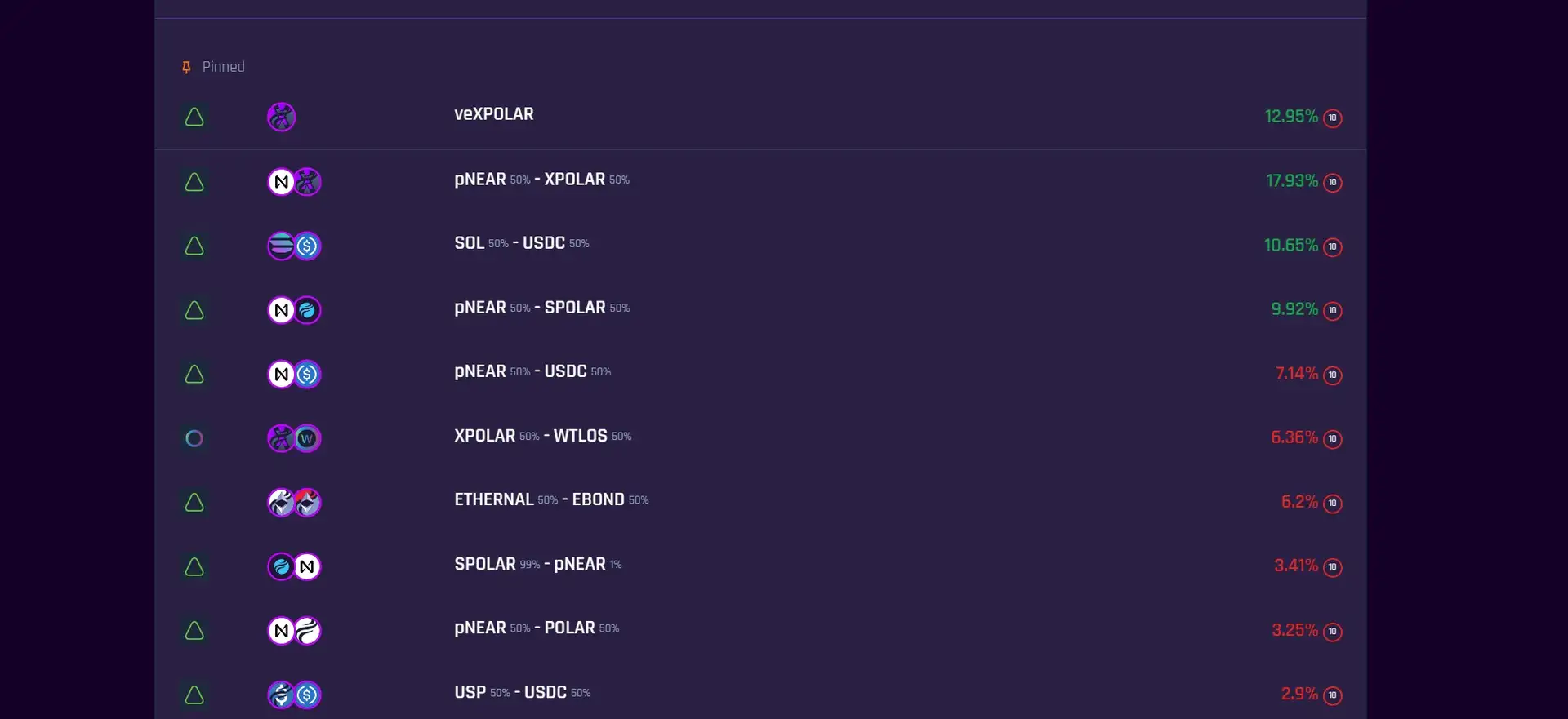

The project also places a strong emphasis on community governance. POLAR token holders can propose and vote on changes to the protocol, ensuring that the project remains decentralized and community-driven. This governance model not only enhances transparency but also ensures that the platform can adapt to the needs and preferences of its users.

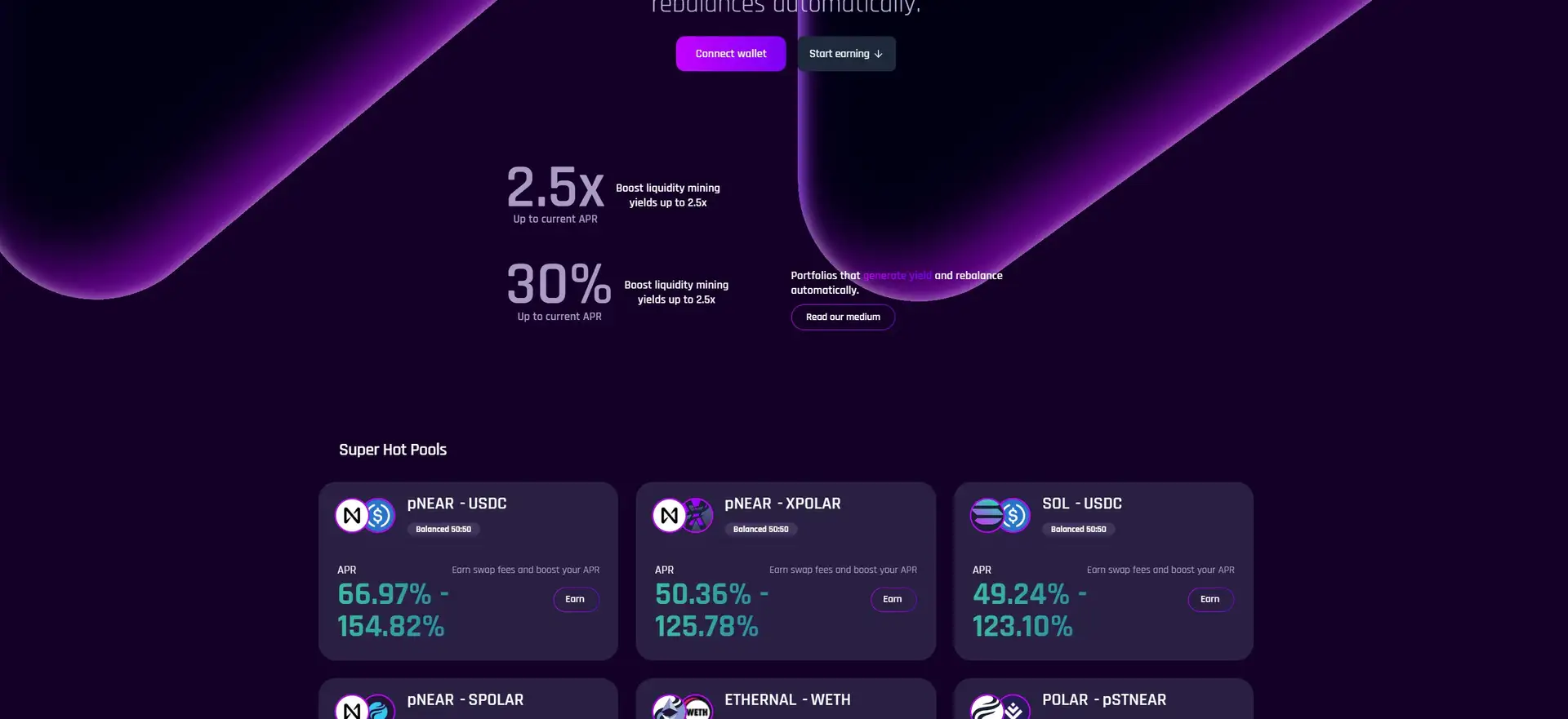

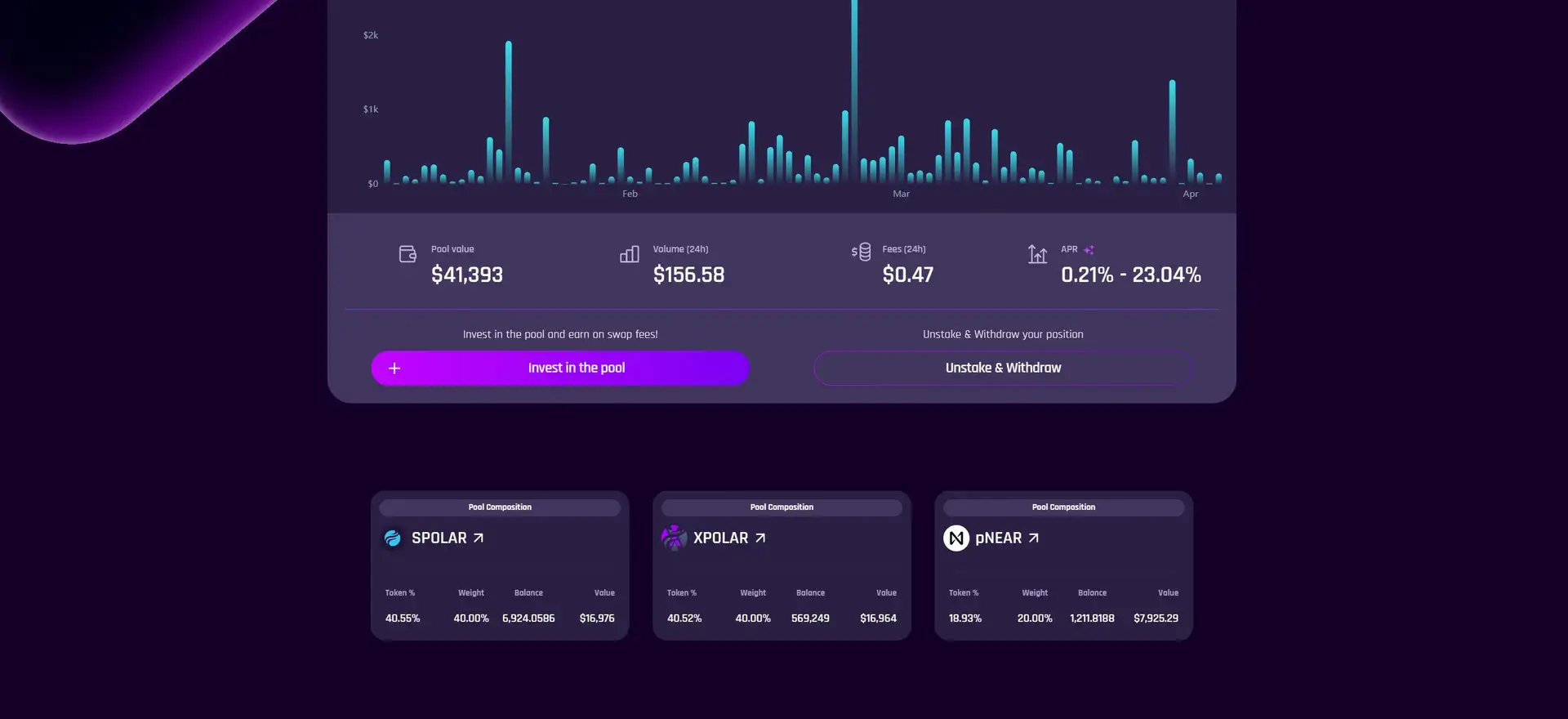

In addition to its innovative approach to synthetic assets and governance, Polaris Finance has also focused on providing robust economic incentives for liquidity providers and stakers. By offering attractive rewards, the project aims to maintain a high level of participation and engagement, which is crucial for the stability and growth of the ecosystem.

Competitors of Polaris Finance include other DeFi platforms like OlympusDAO, Terra, and MakerDAO. However, Polaris Finance differentiates itself with its unique seigniorage model and community-driven governance. Similar projects in the gaming sector might include blockchain-based games that utilize synthetic assets and community governance mechanisms, though direct comparisons are less common due to the specialized nature of Polaris Finance’s offerings.

For more detailed information on the project's history, development, and key milestones, refer to the Polaris Finance Documentation.

- Pegged Assets: Polaris Finance offers stability through pegged tokens, which are maintained using innovative seigniorage mechanisms.

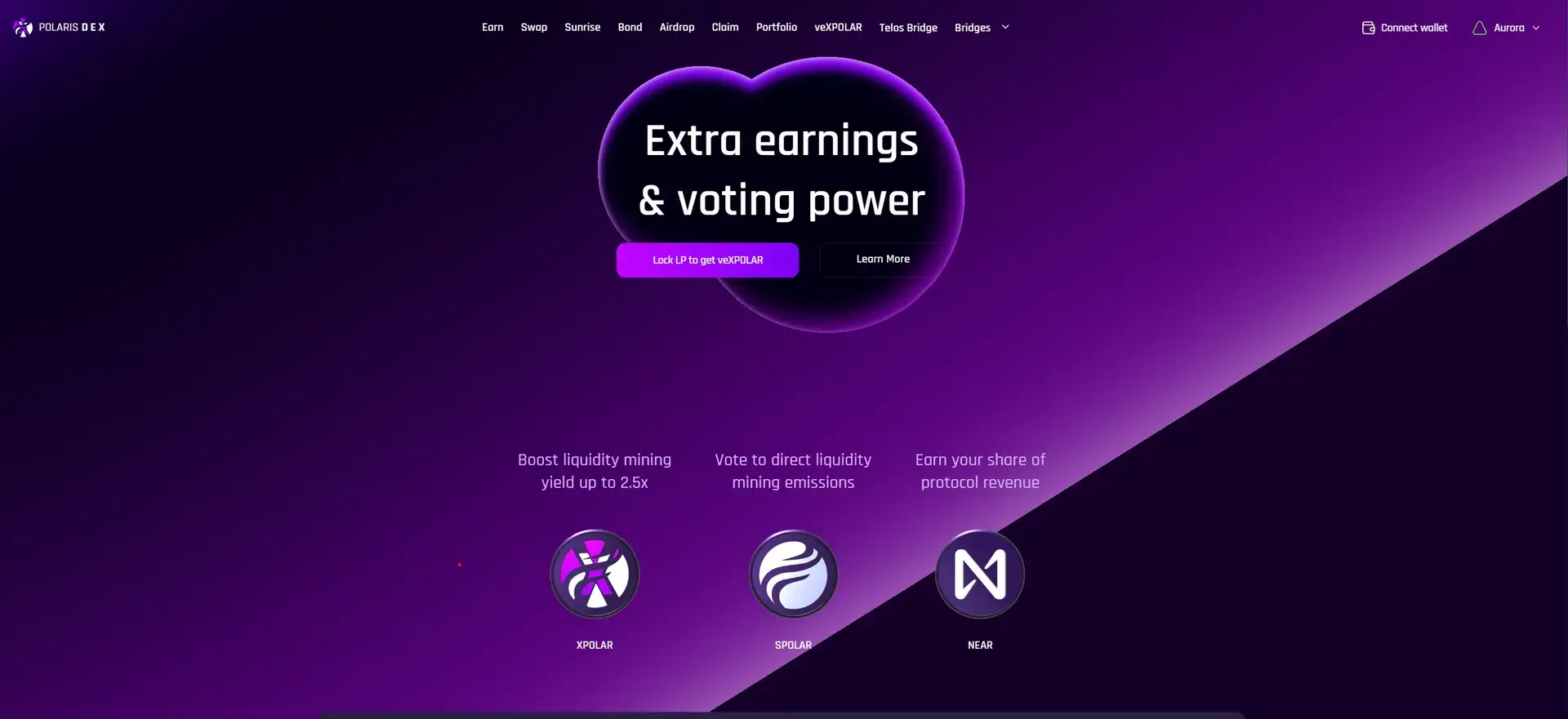

- Governance: The POLAR token enables holders to participate in governance, making decisions about the platform’s future direction.

- Incentives: The platform provides attractive rewards for stakers and liquidity providers, encouraging active participation.

- Decentralization: A robust ecosystem with a community-driven governance model ensures transparency and adaptability.

- Synthetic Assets: Unlike traditional stablecoins, Polaris Finance’s synthetic assets are maintained through a unique seigniorage model, offering a different approach to stability.

- Multi-Token Ecosystem: Each token within the ecosystem has a specific role, contributing to the overall functionality and stability of the platform.

- Create an Account: Visit Polaris Finance and connect your wallet. Ensure your wallet is compatible with the Binance Smart Chain (BSC).

- Acquire Tokens: Purchase POLAR and other tokens on supported exchanges. You can find POLAR on popular exchanges like PancakeSwap.

- Stake and Provide Liquidity: Follow guides on Polaris Finance Documentation to stake tokens and provide liquidity. This involves selecting the appropriate pools and depositing your tokens.

- Participate in Governance: Use POLAR tokens to vote on proposals. Governance participation involves staying updated on active proposals and casting your vote through the platform’s governance portal.

- Explore Features: Engage with various features of the platform, such as yield farming, staking, and liquidity provision. Detailed tutorials and guides are available in the documentation to help you navigate these processes.

For detailed steps and guides, refer to their documentation. This will ensure you have all the necessary information to effectively participate and benefit from the Polaris Finance ecosystem.

Polaris DEX Token

Polaris DEX Reviews by Real Users

Polaris DEX FAQ

The POLAR token serves as the governance token in the Polaris Finance ecosystem, allowing holders to vote on proposals and make decisions regarding the future direction of the platform. It also plays a crucial role in maintaining the stability of the synthetic assets through seigniorage mechanisms.

Polaris Finance uses a seigniorage-based model, involving multiple tokens and liquidity pools to ensure the stability of its synthetic assets. This model adjusts the supply of tokens based on market demand to maintain their peg.

Unlike traditional stablecoins, Polaris Finance’s synthetic assets are maintained through a unique seigniorage model that uses a combination of multiple tokens and liquidity pools to achieve stability and predictability.

To participate in governance, you need to hold POLAR tokens. These tokens allow you to propose and vote on changes to the protocol through the platform’s governance portal.

Polaris Finance offers attractive rewards for liquidity providers, including staking rewards and a share of transaction fees, to encourage active participation and ensure the stability of the ecosystem.

You Might Also Like