About Polylastic

Polylastic is a platform designed to simplify crypto portfolio management through a set of digital asset indexes. Its mission is to democratize access to diversified crypto investments by providing a single token that gives exposure to various segments of the digital finance industry. The project aims to bridge the gap between novice and experienced investors by offering easy-to-understand and accessible investment options.

By utilizing indexes, Polylastic allows users to invest in a basket of assets, thereby spreading risk and reducing the impact of individual asset volatility. This approach is particularly beneficial in the highly volatile crypto market, as it provides a more stable and predictable investment option. The platform’s community-driven model ensures that the indexes remain relevant and up-to-date with the latest market trends and developments.

The POLX token plays a central role in this ecosystem, offering governance rights and staking rewards to incentivize participation and engagement. The project’s vision includes continuous innovation and expansion, with plans to integrate AI for optimized index performance, support multichain operations for enhanced interoperability, and introduce new investment products such as tokenized stocks.

Overall, Polylastic aims to be a leading platform in the crypto investment space, providing users with diversified and secure investment options through its innovative index-based approach.

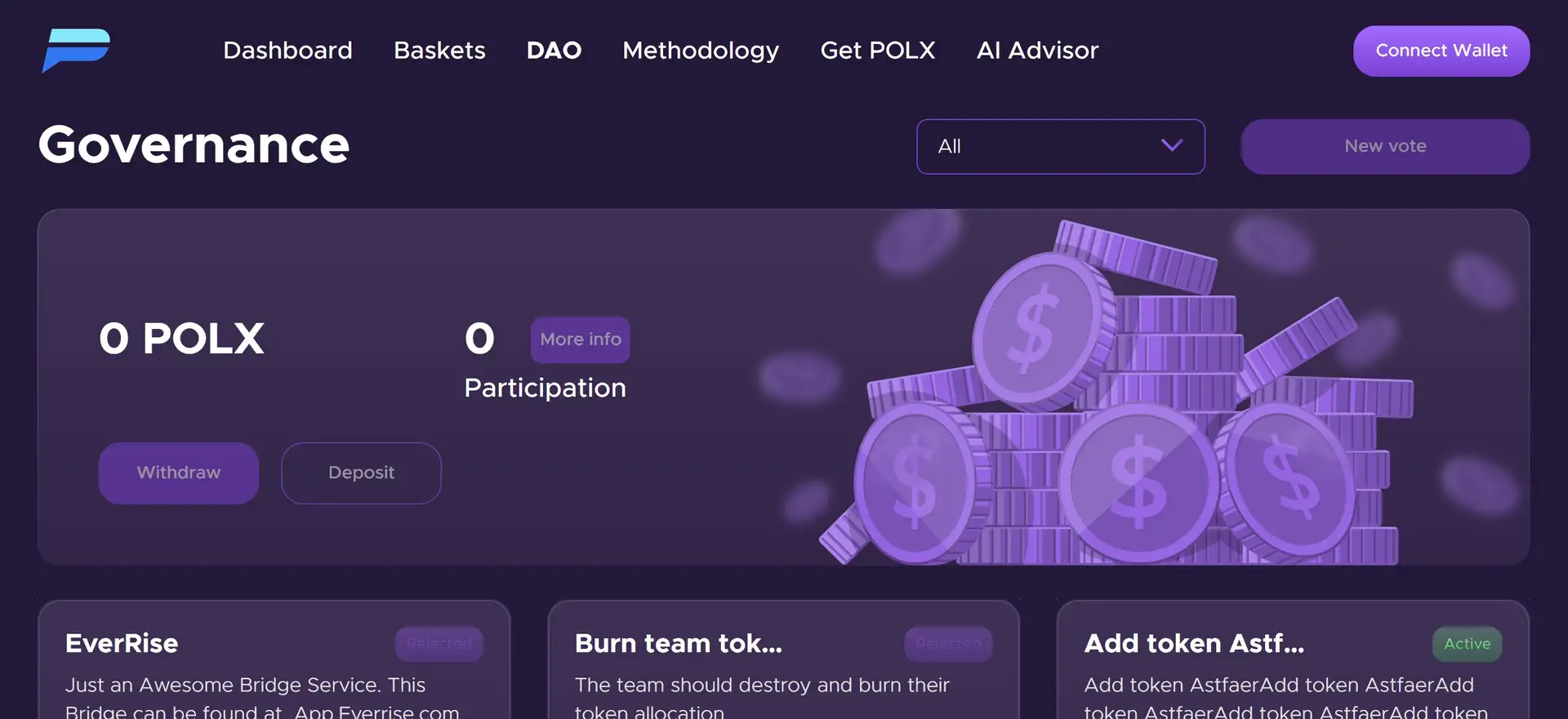

One of the key features of Polylastic is its community-driven approach. The platform allows its community to influence the composition and direction of its indexes, ensuring that they remain relevant and effective. This is achieved through a decentralized governance model, where POLX token holders can propose and vote on changes. This democratic process ensures that the platform evolves in line with the interests and needs of its users.

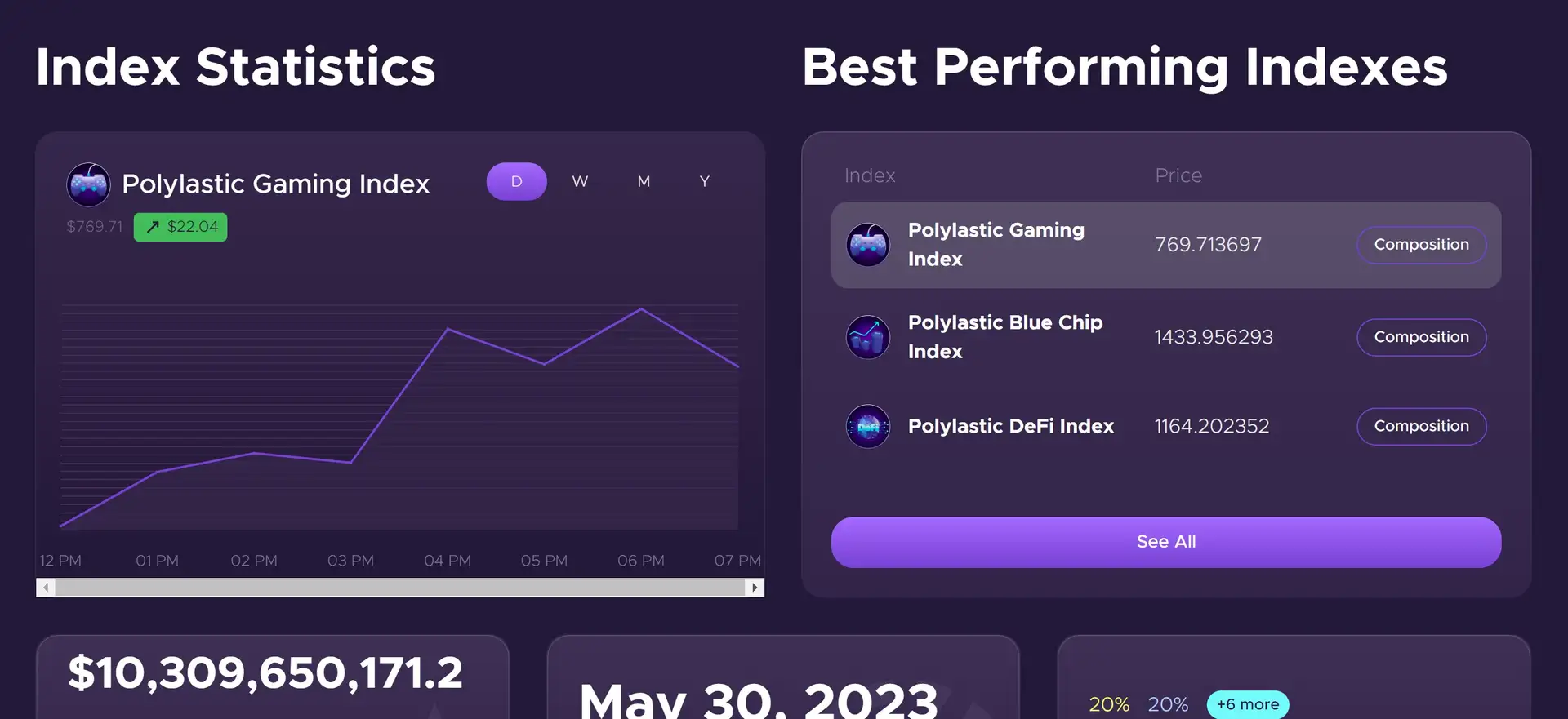

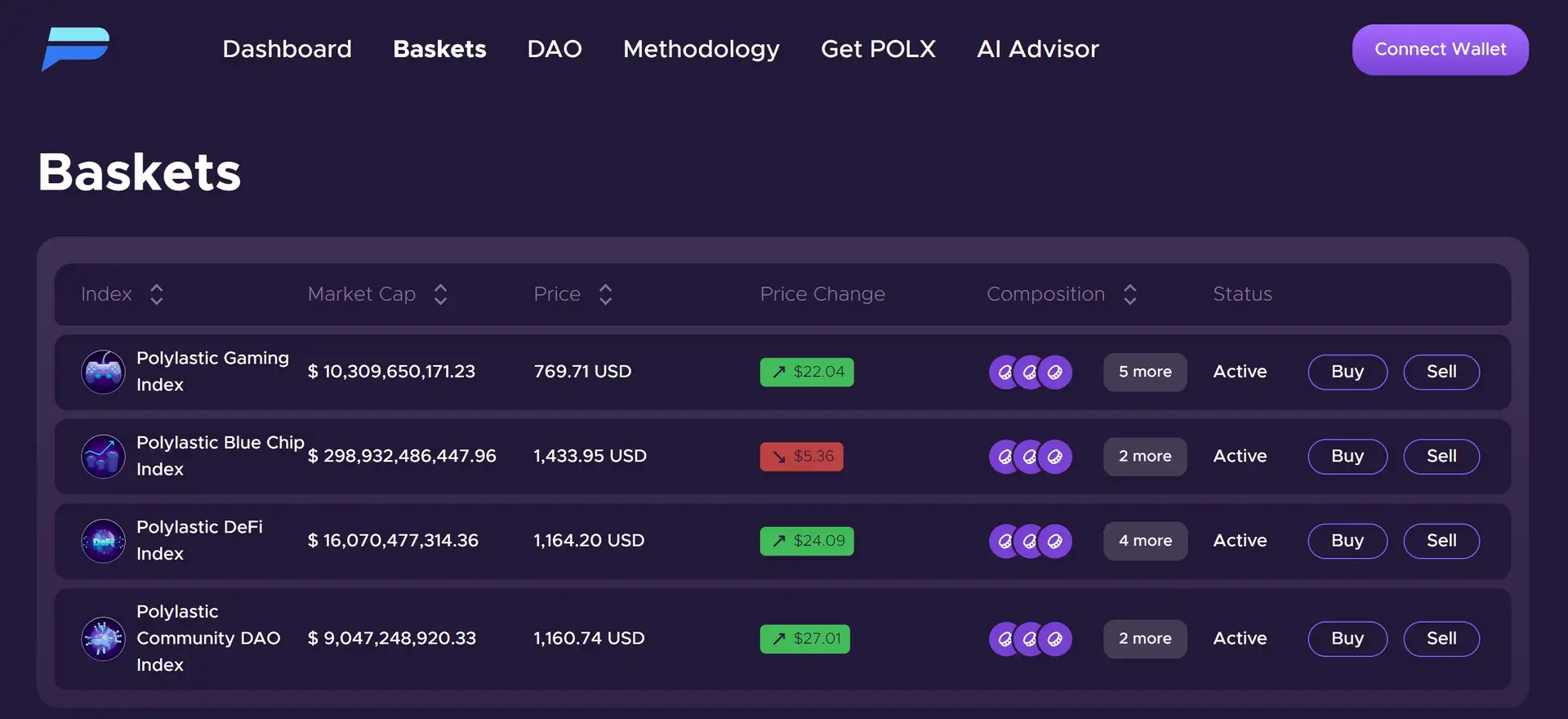

The project has achieved several key milestones since its inception. These include the launch of multiple index portfolios, implementation of DAO governance, and continuous updates to enhance platform functionality. The indexes provided by Polylastic are based on sophisticated risk models, designed to balance risk and reward effectively. This approach has made Polylastic a popular choice among investors seeking diversified exposure to the crypto market.

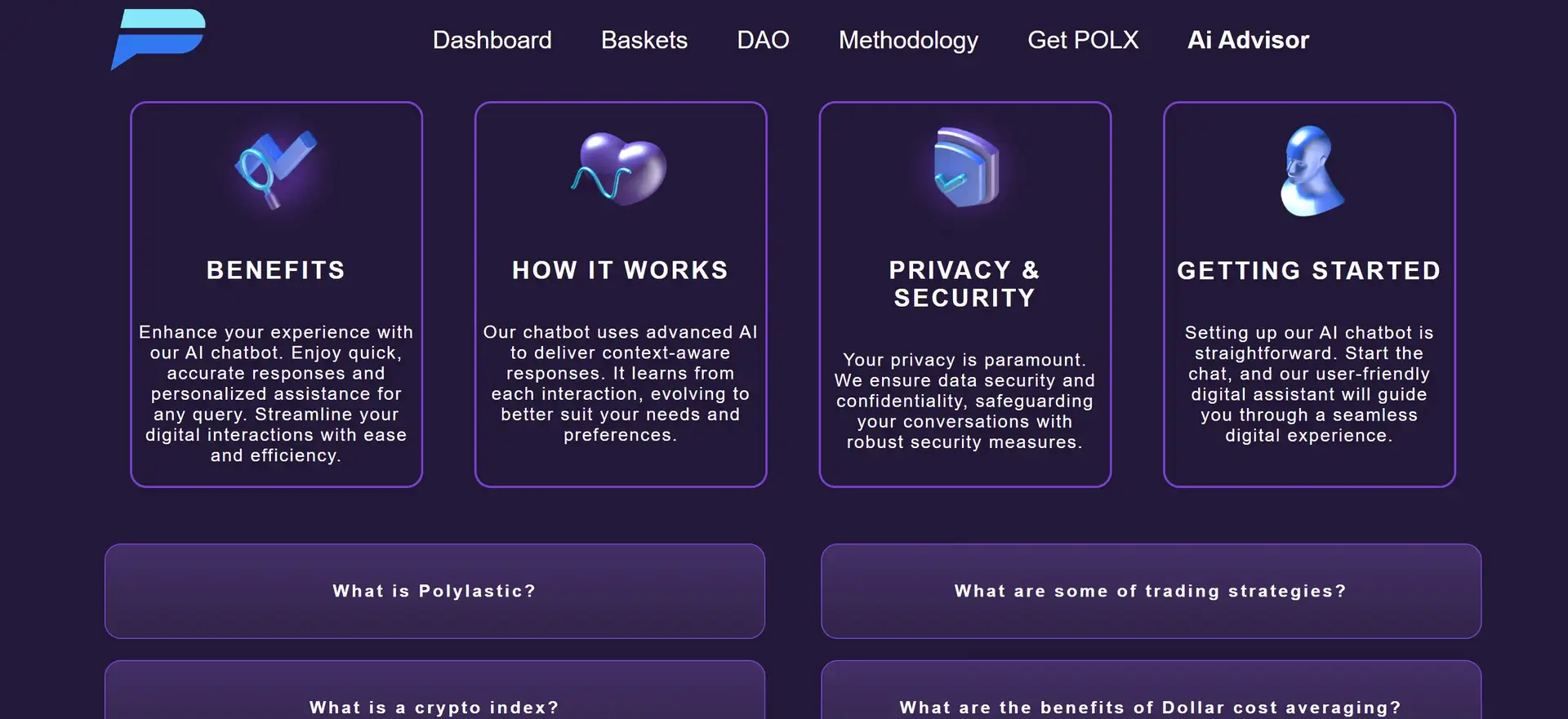

Looking ahead, Polylastic has ambitious plans for future development. The integration of AI is one such initiative, aimed at optimizing the performance of its indexes by leveraging advanced algorithms and machine learning techniques. This will help in predicting market trends and adjusting index compositions accordingly. The introduction of tokenized stocks is another significant development, providing users with even more diversified investment opportunities.

Additionally, Polylastic plans to support multichain operations, enhancing interoperability and allowing users to access the platform from different blockchain networks. This will expand the platform’s reach and make it more accessible to a broader audience.

In terms of competition, Polylastic faces competition from other index-based platforms such as Synthetix and Index Coop. These platforms also offer diversified crypto investments through index tokens, catering to similar market segments. However, Polylastic differentiates itself through its community-driven approach, robust governance model, and continuous innovation in index offerings and platform functionalities.

Overall, Polylastic is well-positioned to become a leading player in the crypto investment space, offering users a comprehensive and user-friendly platform for diversified crypto investments.

- Broad Exposure: Access to diversified crypto portfolios through a single token, providing exposure to various market segments such as DeFi, blue chips, NFTs, and gaming.

- Community-Driven: The composition and direction of indexes are influenced by the community, ensuring that they remain relevant and aligned with user preferences.

- Staking Rewards: Opportunities to earn rewards by staking POLX tokens, either directly or as LP tokens, incentivizing active participation in the network.

- Risk Management: Indexes are based on sophisticated risk models, catering to different risk appetites and providing a balanced approach to risk and reward.

- Governance: POLX token holders have voting rights on key decisions, fostering a decentralized and democratic approach to platform development.

- Innovation: Continuous development and integration of new technologies, such as AI for index optimization and multichain support, ensure that the platform remains at the forefront of the industry.

- Future Plans: Introduction of new investment products, such as tokenized stocks, and expanded functionality to cater to evolving market needs and user preferences.

- Visit the Polylastic website and create an account by clicking on the "Sign Up" button and following the registration process.

- Purchase POLX tokens from supported exchanges such as Coingecko. Ensure you have a compatible wallet to store your tokens.

- Explore the available index portfolios on the Polylastic platform. Review the different indexes such as DeFi, blue chips, NFTs, and gaming to determine which align with your investment goals and risk appetite.

- Stake your POLX tokens to earn rewards. You can choose to stake directly or as LP tokens, depending on your preference. This not only provides you with rewards but also contributes to the security and governance of the platform.

- Participate in the community-driven governance by proposing and voting on key decisions. This can be done through the DAO mechanism, ensuring that you have a say in the platform's development and direction.

- Stay updated with the latest developments and announcements from Polylastic. Join their official communication channels such as Discord, Telegram, and Twitter for real-time updates and community engagement. You can find the links to these channels on the Polylastic website.

- Utilize the available resources and guides provided by Polylastic to deepen your understanding of the platform and maximize your investment strategy. This includes tutorials, FAQs, and support forums available on the website.

By following these steps, you can seamlessly integrate into the Polylastic ecosystem and take advantage of the diversified investment opportunities it offers.

Polylastic Token

Polylastic Reviews by Real Users

Polylastic FAQ

The main purpose of the Polylastic platform is to simplify crypto portfolio management by offering a set of digital asset indexes. These indexes provide diversified exposure to various segments of the digital finance industry, allowing users to invest in a broad spectrum of assets through a single token.

Polylastic ensures its indexes remain relevant by adopting a community-driven approach. The composition of the indexes is influenced by the community, who can propose and vote on changes. Additionally, the platform integrates advanced algorithms and AI to continuously optimize index performance based on market trends.

Polylastic offers a variety of indexes to cater to different investor profiles and market segments. These include DeFi, blue chip, NFT, and gaming indexes. Each index is designed to provide exposure to specific areas of the crypto market, allowing users to diversify their investments effectively.

Participation in the governance of the Polylastic platform is facilitated through its DAO. Holders of the POLX token can propose and vote on key decisions that shape the future of the platform. This democratic process ensures that the community has a significant influence on the development and direction of Polylastic.

Staking POLX tokens offers several benefits. Stakers earn rewards, which can be in the form of additional POLX tokens or LP tokens. Staking also contributes to the security and governance of the platform, making stakers an integral part of the Polylastic ecosystem.

You Might Also Like