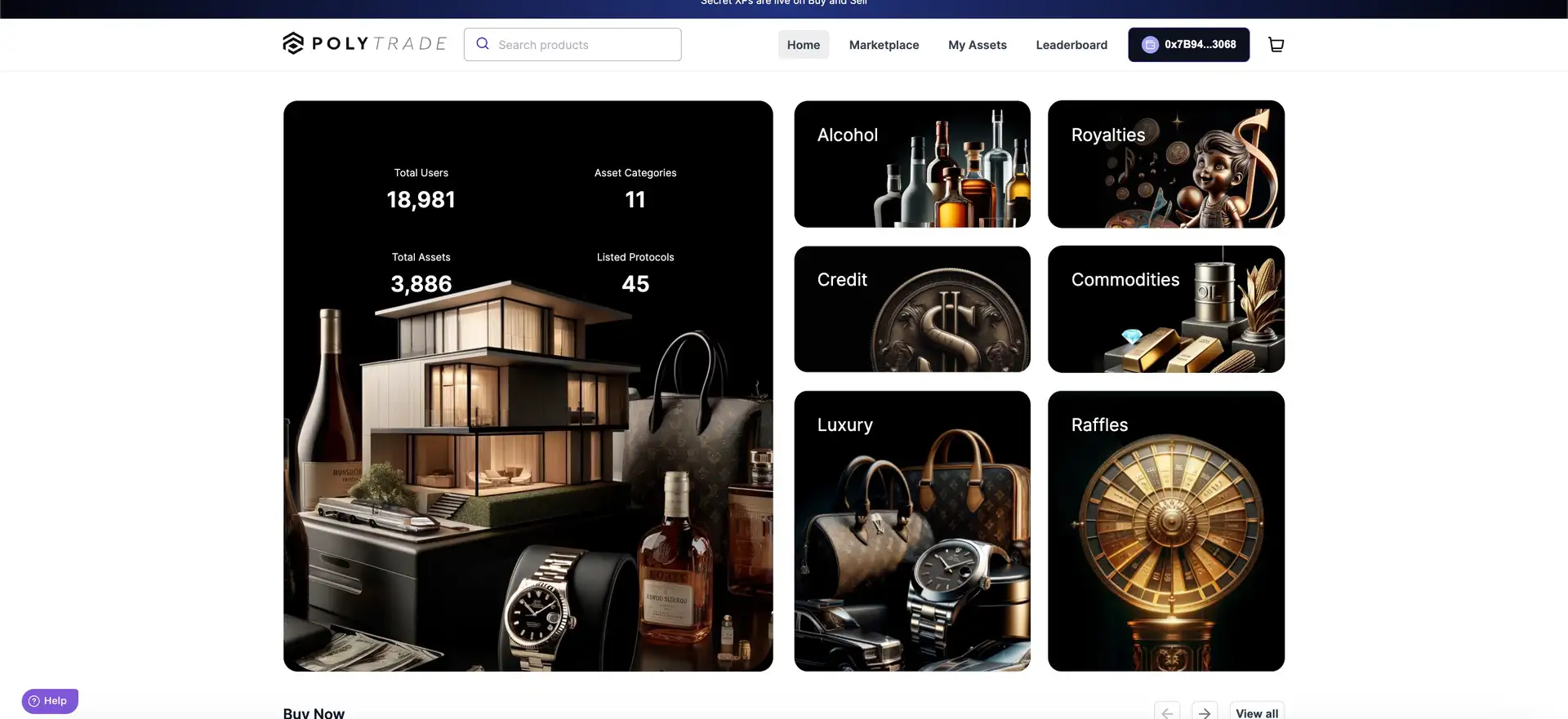

About PolytradeMarketplace

Polytrade is a groundbreaking platform operating at the intersection of blockchain and finance, providing real-world asset tokenization and decentralized finance (DeFi) solutions. The platform is designed to bridge traditional finance with decentralized ecosystems, enabling borrowers, lenders, and investors to interact seamlessly in a secure and transparent environment. Since its inception in 2022, Polytrade has made significant strides by launching the first tokenized invoice pool and developing the new ERC-6960 tokenization standard.

Through its RWA Marketplace, Polytrade aims to revolutionize finance by tokenizing real-world assets (RWAs), opening up opportunities for users to unlock liquidity and participate in a more efficient financial system. Polytrade’s mission is to bring RWAs on-chain, making them easily accessible while transforming the global trade finance ecosystem. With a vision rooted in blockchain innovation, the platform strives to provide value by combining the strengths of traditional finance with the opportunities presented by decentralized technologies.

The Polytrade Marketplace is a decentralized platform that revolutionizes how SMEs access trade finance. Traditionally, SMEs have struggled with slow, expensive processes to unlock funds tied up in unpaid invoices through banks or other intermediaries. Polytrade offers a blockchain-based alternative where businesses can submit invoices and receive liquidity quickly. Investors within the DeFi ecosystem provide the liquidity, turning invoice financing into a decentralized investment opportunity backed by real-world assets.

By removing intermediaries, Polytrade drastically reduces operational costs and time for businesses while offering investors secure, collateralized returns. Every transaction is recorded on the blockchain, ensuring a transparent and traceable process. This setup addresses the core issues of inefficiency and inaccessibility faced by SMEs in traditional finance.

Since its launch, Polytrade has established partnerships with numerous DeFi liquidity providers and achieved significant user adoption. Key milestones include the expansion of its marketplace, increasing liquidity pools, and developing enhanced platform features. Competing projects in the DeFi space include Centrifuge, which focuses on bringing real-world assets to DeFi. However, Polytrade differentiates itself by focusing exclusively on trade finance.

Polytrade is continually evolving, aiming to grow its user base and offer innovative solutions that make trade finance more accessible globally. For more details, visit the official Polytrade website.

- Immediate Access to Liquidity for Businesses: SMEs can unlock liquidity tied up in unpaid invoices through the Polytrade platform, reducing the financial stress caused by long payment cycles.

- DeFi Investment Opportunities: Polytrade allows DeFi investors to diversify their portfolios by investing in trade finance, providing returns on real-world assets.

- Blockchain Transparency: Transactions on Polytrade are recorded on the blockchain, ensuring transparency and security.

- Cost and Time Efficiency: By eliminating intermediaries, Polytrade reduces the cost and time required for SMEs to access funds.

- Global Accessibility: Polytrade operates globally, offering businesses from around the world access to DeFi liquidity pools.

- Collateralized Investments: For DeFi investors, Polytrade offers lower-risk, collateralized investments backed by real-world assets like invoices.

- Create an Account: Visit the Polytrade Marketplace and register using your email or connect your crypto wallet such as MetaMask.

- Verify Your Business Information (For SMEs): Businesses need to submit documentation for verification, including unpaid invoices and financial records.

- Connect Your Wallet (For Investors): Investors need to link their wallet (such as MetaMask) to the Polytrade platform.

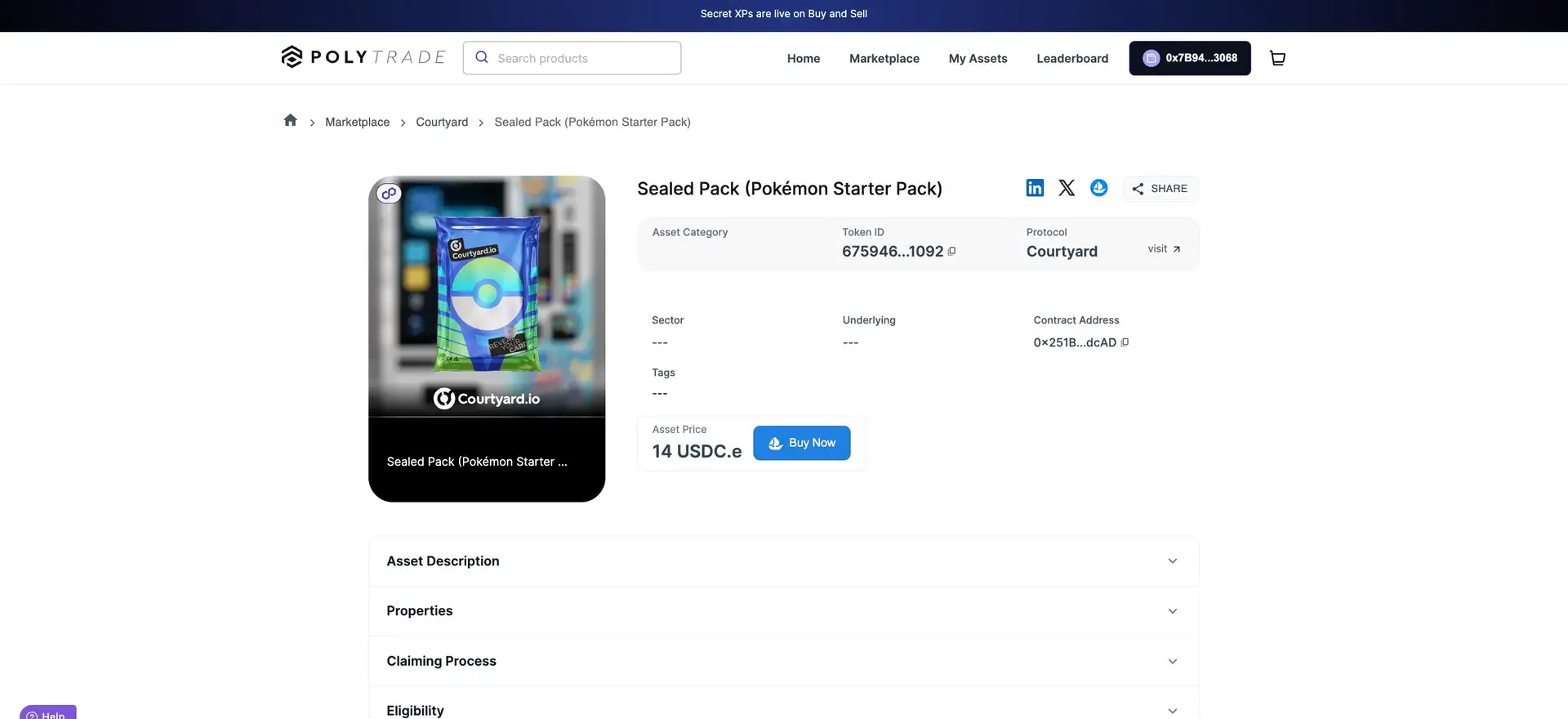

- Browse Opportunities (For Investors): Investors can browse available invoice financing opportunities and decide where to allocate funds.

- Submit Invoices (For SMEs): Businesses can submit invoices to request liquidity from DeFi liquidity providers.

- Manage Investments or Repayments: Both businesses and investors can manage and track their activities via the platform's dashboard.

If you need further assistance, visit the Polytrade Marketplace for more tutorials and guides.

Polytrade envisions a future where real-world assets are seamlessly integrated with blockchain technology, creating an ecosystem where finance is both more accessible and more transparent. The platform’s core philosophy is centered on enabling the tokenization of RWAs such as invoices and accounts receivable, helping businesses and investors unlock liquidity that would otherwise be difficult to access. The focus on tokenization ensures that assets can be traded globally with the security and trust of decentralized ledgers.

The inspiration behind Polytrade stems from the growing demand for more flexible and decentralized financial products. Traditional finance systems are often slow, expensive, and lack transparency, which Polytrade seeks to address by providing on-chain solutions. By tapping into the immense potential of blockchain technology, the platform seeks to disrupt established financial structures and deliver superior benefits such as faster settlement times, reduced costs, and greater inclusivity.

The team at Polytrade is committed to creating a future-proof system for global trade finance, where both investors and borrowers benefit from greater efficiency and new liquidity streams. Through strategic partnerships and continuous innovation, Polytrade is on a mission to drive a paradigm shift in how financial transactions involving RWAs are handled, aiming to dominate the DeFi space while staying aligned with regulatory standards.

Polytrade’s roadmap focuses on the expansion of its RWA marketplace and the development of innovative blockchain protocols like the ERC-6960 standard. The platform has already completed significant milestones, including launching its tokenized invoice pool. Future goals include onboarding more assets, integrating with decentralized lending platforms, and enhancing user experiences through product upgrades.

The team is actively working on expanding the marketplace by bringing more real-world assets on-chain and increasing liquidity for businesses. Additionally, Polytrade plans to introduce new financial products that cater to a broader range of industries, further diversifying its offerings.

Polytrade is led by a seasoned team of professionals with diverse expertise in blockchain, finance, and technology. The platform was founded by Piyush Gupta, who serves as the CEO, driving the vision and strategic direction of the company. Key team members include Ashish Sood (Chief Product Officer), Milind Bansia (Head of Strategy), and Rishi Sharma (Principal Engineer), each contributing their specialized knowledge to ensure the platform’s success.

The advisory council features notable figures such as Sandeep Nailwal, co-founder of Polygon, and Zeneca, founder of Zen Academy, among others, who help shape the future of Polytrade and the broader real-world asset sector.

Polytrade is currently in the Beta phase of its RWA marketplace, with ongoing testing and feedback shaping its evolution. The platform recently completed Batch-1 of private testing, which involved feedback from a group called The Vanguard, consisting of experts and advocates in the field of real-world asset tokenization. These participants have provided crucial insights, which Polytrade has used to implement several upgrades, including refined asset filtering, a redesigned user interface, and enhanced usability features for asset management.

The marketplace remains in Beta Phase 2, where users can interact with tokenized assets such as commodities, collectibles, and more. Early access features allow participants to provide feedback that directly impacts the platform’s development, aligning with Polytrade’s vision of creating a seamless and efficient RWA trading environment. For those interested in exploring this evolving ecosystem, early access to the marketplace is available through a controlled roll-out.

Further updates regarding Beta testing, including performance statistics and future plans, can be tracked via Polytrade’s official blog. As the platform progresses, continuous testing and marketplace improvements will pave the way for a full public release. For more information, visit the official Polytrade blog.

PolytradeMarketplace Token

PolytradeMarketplace Reviews by Real Users

PolytradeMarketplace FAQ

Polytrade addresses liquidity issues by allowing fractional ownership of tokenized RWAs, making assets more accessible to a broader range of investors. This innovation increases liquidity and reduces barriers to entry. Learn more on the Polytrade 2.0 Overview.

Polytrade tokenizes invoices on-chain, providing global liquidity without intermediaries, lowering costs, and increasing transparency. Learn more on the official Polytrade site.

Polytrade integrates cross-chain technology, allowing tokenized real-world assets to be traded across multiple blockchains, enhancing liquidity. Learn more on the Polytrade 2.0 Overview.

Polytrade ensures secure tokenization through blockchain technology, KYC, and AML compliance. Explore more on the official site.

Both retail and institutional investors can access real-world assets through fractionalized ownership. Learn more at the Polytrade marketplace.

You Might Also Like